OneUp Trader Review

Proprietary trading firms provide financial backing to traders, allowing them to trade with the firm’s capital. OneUp Trader is one such prop trading firm. It offers a one-step evaluation and funded accounts from $25,000 to $250,000 for successful candidates.

I’ll share my expert views on OneUp Trader in this article, combining my trading experience and customer reviews. We’ll explore the pros and cons, trading platforms, and the evaluation process. This review aims to give you the information you need to decide if OneUp Trader fits you.

What is OneUp Trader?

OneUp Trader is a proprietary trading firm based in Wilmington, Delaware. The company specializes in offering funded trading accounts to individuals. If you’re a skilled trader, OneUp Trader can pair you with reliable funding partners after a successful evaluation.

To qualify, traders must meet a profit target within a set of rules and trade for at least 15 days. Once you pass the evaluation, you can trade with an account funded up to $250,000. Note that there is a fee for this service.

Advantages and Disadvantages of Trading with OneUp Trader

Benefits of Trading with OneUp Trader

After trading with OneUp Trader, I can attest to some significant benefits that set this prop firm apart. One of the first things to note is their robust analytics. This feature gives traders a deep insight into their trading patterns, a crucial factor for improving performance.

Another highlight is their support for multiple trading platforms. You’re not locked into using just one interface, offering your trade flexibility. Unlike many prop firms, OneUp Trader doesn’t charge data fees, which can add up quickly in this line of work.

In terms of profits, OneUp Trader is generous. Partners can keep between 90 and 100% of what they earn. This high-profit share is a significant advantage for traders looking to maximize their earnings.

On the financial side, the firm offers a range of deposit and withdrawal options, making transactions straightforward. Plus, you can initiate withdrawals anytime if your account balance is above $1,000. This offers excellent liquidity and financial freedom for traders.

OneUp Trader Pros and Cons

Pros:

- No data fees for funded traders

- Free 7-day trial

- Accounts range from $25,000 to $250,000

- Free NinjaTrader license for evaluations and funded accounts

- 24/7 real-time customer support

Cons:

- 15-day minimum trading requirement

- Only credit & debit cards are accepted for payment

Difficulties Met by the Traders Who Participated in the Brokers Challenge

Meeting the Profit Target

Meeting a profit target is a task fraught with challenges. The psychological strain of achieving a specific goal within a set time can impact decision-making. Traders may resort to risky strategies, hoping for more significant returns but exposing themselves to more enormous losses.

How to Overcome the Difficulty

A well-defined, tested trading strategy is crucial. Stick to your plan and manage risks carefully. It’s also essential to be aware of the market conditions and adapt your approach accordingly—lastly, factor in any trading costs when calculating potential profits.

Following the Rules

Prop trading firms have rules to mitigate risks and ensure that traders are informed about the capital provided. However, the sheer number of regulations can be overwhelming, covering everything from which assets are tradable to the maximum allowable position size. Some rules may contradict a trader’s strategies or habits, requiring a significant adjustment.

How to Overcome the Difficulty

Take the time to thoroughly read and understand the rule set provided by the prop firm. Create a checklist or a summary sheet you can refer to while trading. Stick to these guidelines rigorously to avoid any slip-ups that could disqualify you.

Minimum 15 Trading Days

The requirement to trade on a minimum of 15 different days might seem straightforward but can pose challenges. Part-time traders or those with other commitments may need help to allocate this much time. Moreover, spreading your trading over at least 15 days exposes you to a broader range of market conditions, making consistency more difficult.

How to Overcome the Difficulty

Planning is key. Set a schedule to meet the 15-day requirement without affecting your other commitments. Consistency is vital, so focus on trading strategies that are adaptable to a range of market conditions.

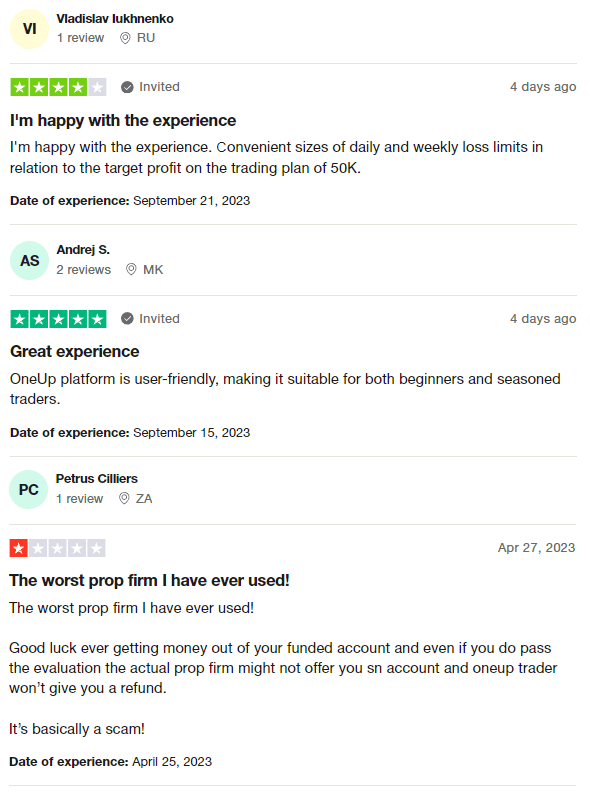

OneUp Trader Customer Reviews

OneUp Trader has garnered mixed reviews from its user base, currently holding a 4.7-star rating on Trustpilot. Many users find the platform’s trading plans and loss limits well-calibrated, particularly praising the user-friendly interface that caters to novice and experienced traders.

However, there are also critical reviews pointing out difficulties in withdrawing profits and questioning the credibility of the prop firm’s evaluation process. The opinions vary significantly, making it crucial for prospective traders to conduct thorough research before committing to OneUp Trader.

OneUp Trader Fees and Commissions

Regarding fees and commissions, OneUp Trader operates differently than typical brokers. The firm doesn’t charge trading fees and doesn’t provide direct access to financial markets. Instead, that’s handled by liquidity providers, which may have their fees or spreads.

You need to focus on the monthly fee with OneUp Trader, which ranges between $125 and $650, depending on the plan you choose. Remember, a more extensive account balance means a higher monthly fee. It’s worth noting that the first seven days are free, giving you a chance to test the waters. While OneUp Trader doesn’t slap you with withdrawal fees, third parties like your bank might, so watch for those.

Account Types

Having tested the different account types offered by OneUp Trader, here’s a straightforward rundown of the options:

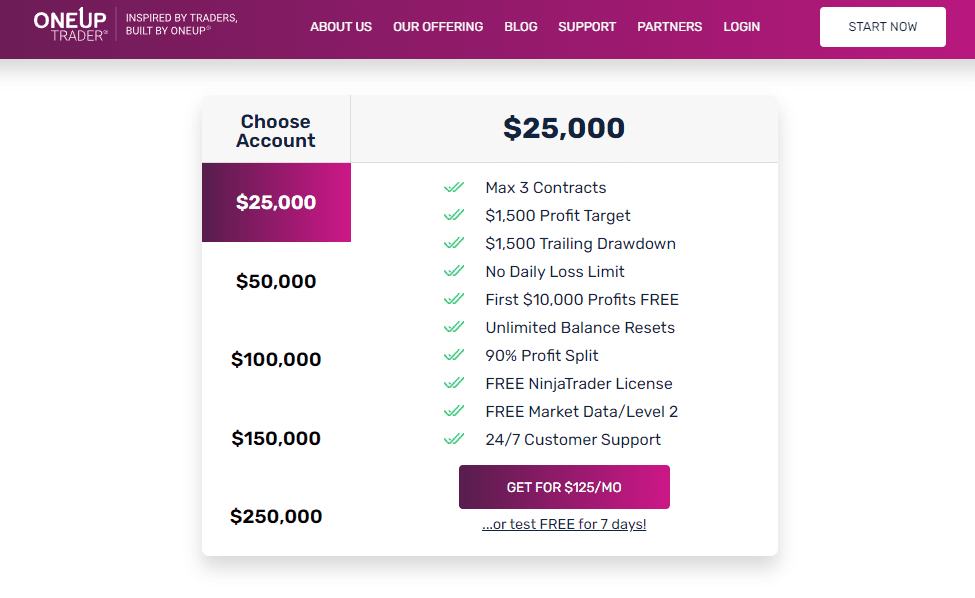

$25,000 Account

- Max 3 Contracts

- $1,500 Profit Target and Trailing Drawdown

- No Daily Loss Limit

- First $10,000 Profits Free

- 90% Profit Split

- $125/Mo

$50,000 Account

- Max 6 Contracts

- $3,000 Profit Target, $2,500 Trailing Drawdown

- No Daily Loss Limit

- First $10,000 Profits Free

- 90% Profit Split

- $150/Mo

$100,000 Account

- Max 12 Contracts

- $6,000 Profit Target, $3,500 Trailing Drawdown

- No Daily Loss Limit

- First $10,000 Profits Free

- 90% Profit Split

- $300/Mo

$150,000 Account

- Max 15 Contracts

- $9,000 Profit Target, $5,000 Trailing Drawdown

- No Daily Loss Limit

- First $10,000 Profits Free

- 90% Profit Split

- $350/Mo

$250,000 Account

- Max 25 Contracts

- $15,000 Profit Target, $5,500 Trailing Drawdown

- No Daily Loss Limit

- First $10,000 Profits Free

- 90% Profit Split

- $650/Mo

All accounts come with free NinjaTrader licenses, free market data, Level 2 access, and 24/7 customer support. Unlimited balance resets are also a common feature across all account types. Choose the one that aligns best with your trading goals and budget.

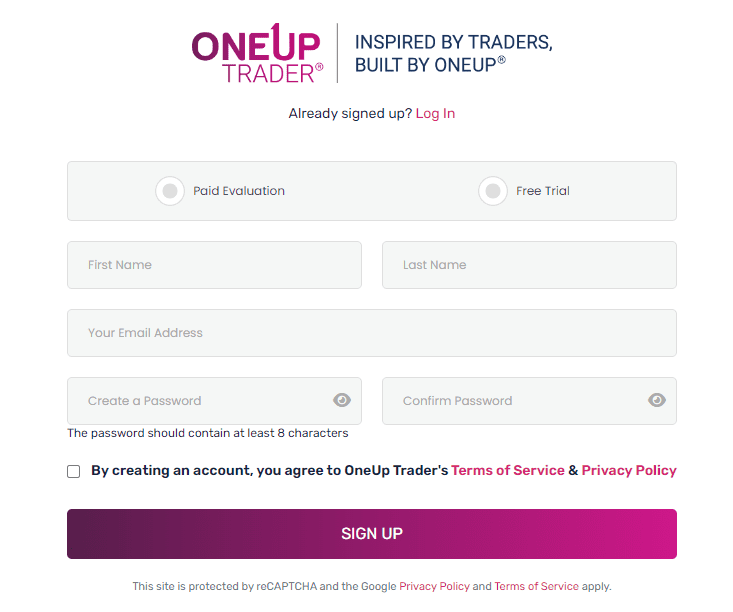

How to Open Your Account

- Visit OneUp Trader’s official website and click “Start Now” or a similar button like “Get Funded” or “Start Free Trial Period.”

- Browse the section that displays various plans and their conditions. Select a plan that fits your needs and click the “Get for $…/MO” button.

- Choose between a paid or free version. Fill in your name email, and create a password. Accept the terms of service and click “Sign Up.”

- Input additional details such as your username, date of birth, and place of residence, including the zip code. Click “Next.”

- Provide your phone number and re-enter your email for verification. Confirm these details using a verification code and follow the on-screen instructions.

- Gain access to your user account. Proceed to the next steps for account verification.

- Complete the verification process by confirming your personal information.

- Set up your preferred payment method for monthly fees and fund withdrawals. Contact tech support for assistance if needed.

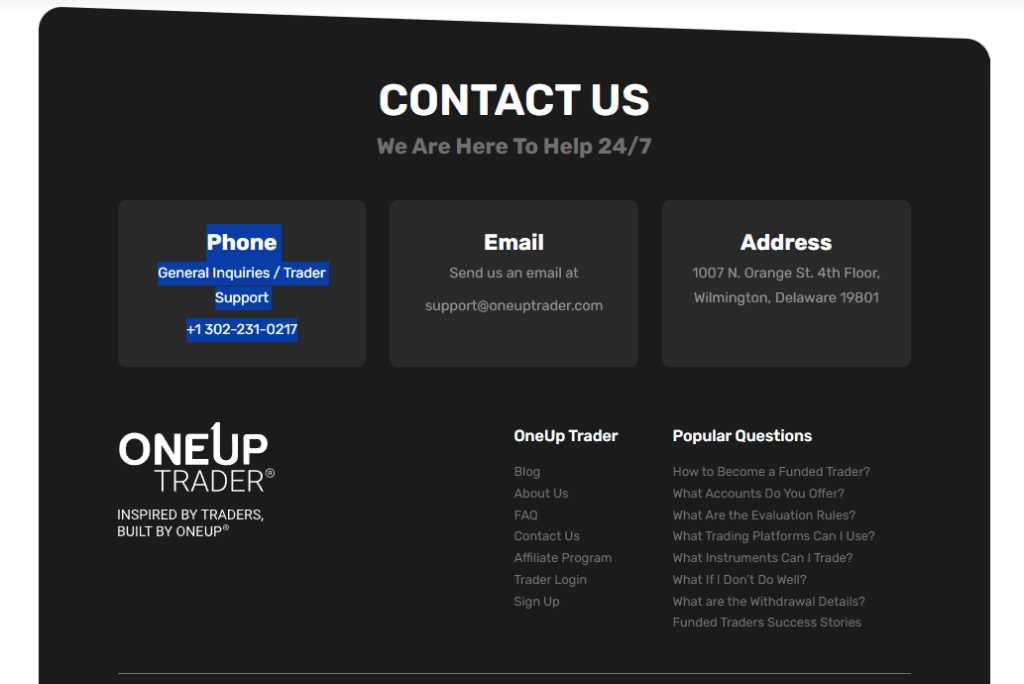

OneUp Trader Customer Support

Based on my experience, OneUp Trader offers reliable customer support through various channels. You can contact them via phone, email, or the live chat feature on their website. What sets them apart is their 24/7 availability. Unlike many other firms, OneUp Trader’s tech support is at your service even when the markets are closed, including nights and holidays. This feature is excellent for traders with urgent queries outside regular trading hours.

Advantages and Disadvantages of OneUp Trader Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

With OneUp Trader, you can keep all your profits until you hit the $10,000 mark. After that, you’ll receive a 90% share of your profits. All the money you earn is accumulated in your primary account, including any bonuses from their referral program.

You can withdraw your earnings from day one of trading, but there’s a minimum withdrawal limit of $1,000. Submitting a withdrawal request is simple and quick; contact tech support, and they’ll process it in minimal time.

Various options are available for fund withdrawals, including bank cards, bank transfers, and electronic wallets. This offers you the convenience to choose the method that’s best for you.

What Makes OneUp Trader Different from Other Prop Firms

One of the standout features of OneUp Trader is its flexible account options. Unlike many prop firms offering limited account types, OneUp Trader provides multiple plans with different funding amounts and profit targets. This allows traders to pick a plan that suits their trading style and goals.

Another distinguishing factor is the company’s generous profit-sharing arrangement. Traders get to keep up to 100% of their initial $10,000 profits and 90% after that. This is a higher percentage than what’s commonly offered in the industry, making OneUp Trader more lucrative for traders.

The firm also excels in customer service with its 24/7 support, something not all prop firms provide. Whether it’s a weekend or a holiday, OneUp Trader ensures that traders have assistance when needed. This level of support can be invaluable, especially for those trading in different time zones.

Lastly, OneUp Trader’s initial seven-day free trial sets it apart. You can try their services and get a feel for the platform without any upfront fees. This level of transparency and risk-free exploration is not commonly found in other proprietary trading firms.

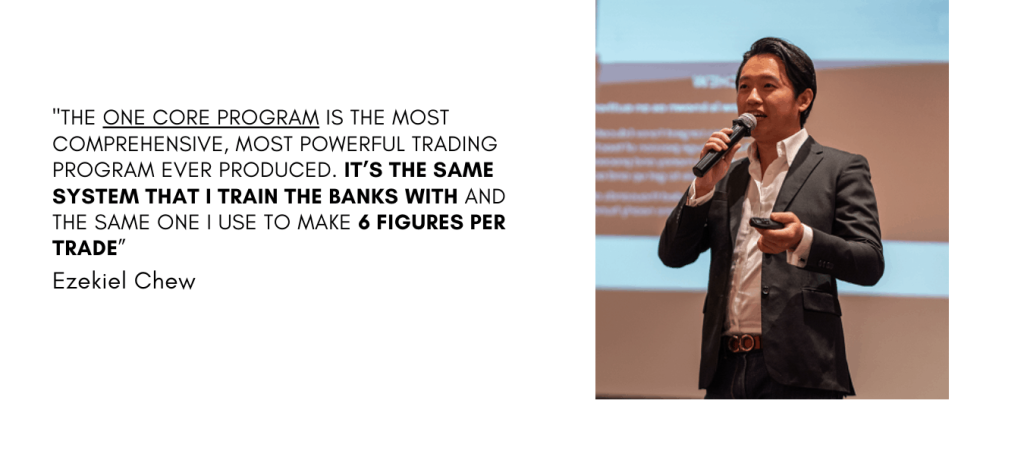

How Can Asia Forex Mentor Help You Pass OneUp Trader’s Evaluation?

I founded Asia Forex Mentor in 2008, starting small by teaching a handful of friends the basics of forex trading. Over time, this small circle grew into a thriving community, leading me to refine my teaching methods. Eventually, I even began conducting live, in-person lessons, catching the attention of trading companies and banks who sought my expertise for their teams.

To streamline the learning experience, I’ve consolidated my teachings into a comprehensive program called the AFM Proprietary One Core Program. This program is designed to equip you with the skills to construct a robust trading system, perform precise market analysis, and manage your trading account with stability. With 26 full lessons and over 60 subtopics, each accompanied by high-quality video content, this program offers an exhaustive guide to forex trading and other financial instruments. I’ve curated examples and insights for each lesson to ensure clarity and effectiveness.

If you aim to pass OneUp Trader’s evaluation process, the One Core Program can be a powerful asset. This program provides a deep understanding of the trading landscape and offers hands-on skills directly applicable to real-world trading scenarios. It’s among the best low-risk, beginner-friendly programs you can find to fast-track your trading career.

Our Journey at Asia Forex Mentor

During my time at Asia Forex Mentor, I’ve had the incredible opportunity to mentor many traders—from retail and bank traders to professionals working in investment firms. I’ve watched many transition from beginners to full-time forex traders; some have even moved up to become respected fund managers.

In the One Core Program, I’ve distilled years of experience and insight into a comprehensive training regimen. This program covers the technical aspects of trading and delves into often-overlooked areas like trading psychology and the value of maintaining a trading diary. Specific topics like bar-by-bar backtesting, large vs. small stop-loss levels, and our unique ‘set-and-forget’ strategy are discussed in depth. We also offer exclusive tools such as an auto stop-loss feature and explore the concept of free trading.

The One Core Program comes with a seven-day free trial for those interested in joining this transformative journey. The course is available for a one-time fee of $997. However, if you’re already convinced of its value and are eager to get started, I’m offering a special rate of $940, allowing you to bypass the trial period and dive right in.

Conclusion: OneUp Trader Review

In conclusion, OneUp Trader has garnered attention for its user-friendly platform and multiple account types tailored to meet different trading needs. With a current 4.7-star rating on Trustpilot, it is evident that many users have a positive experience with the service.

OneUp Trader offers a range of fee structures, starting from a monthly payment of $125, scaling up based on the account size. The first seven days are free, allowing you to explore the platform without initial costs. However, while they don’t charge withdrawal fees, third-party fees may apply, so be cautious.

Also Read: FundedNext Review 2023

OneUp Trader Review FAQs

What is the starting monthly fee for OneUp Trader?

Starting at $125 per month.

Is there a free trial period?

Yes, a 7-day free trial is available.

Is OneUp Trader regulated?

It’s a registered entity but doesn’t provide any licensing or regulatory data.