OneRoyal Review

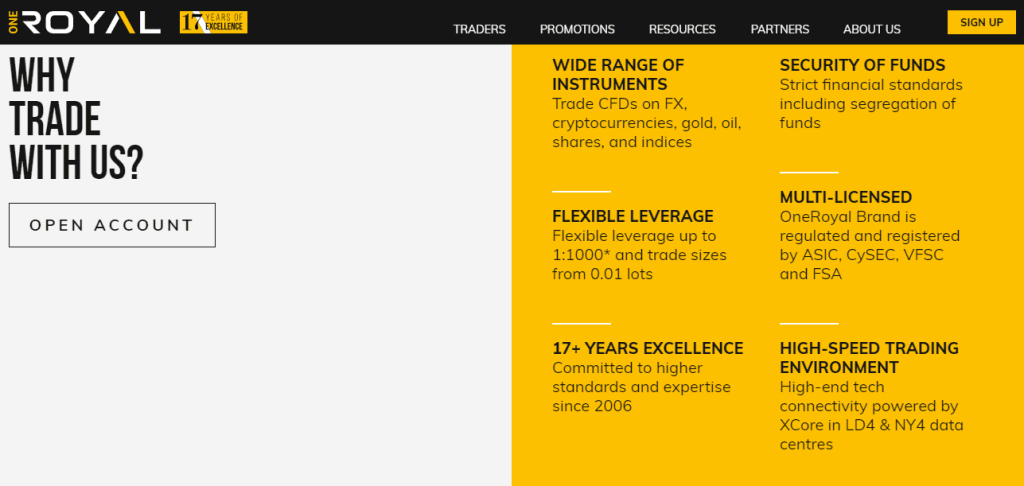

OneRoyal is an all-encompassing online trading broker that offers a plethora of trading instruments, including Contracts for Difference (CFDs) on over 180 major, minor, and exotic currency pairs in the Forex market. Additionally, it extends its offering to other diverse markets such as Indices, Metals, Oil, Stocks, Cryptocurrencies, Exchange-Traded Funds (ETFs), and more.

This comprehensive review will delve deep into OneRoyal’s trading ecosystem, highlighting its strengths, weaknesses, and all the nuances in between. It provides an in-depth evaluation of its features, pricing structure, account types, and transaction procedures, among other aspects, amalgamating expert assessments and real trader experiences to assist you in your decision-making process.

What is OneRoyal?

OneRoyal is an established online trading brokerage that has set a high bar in the realm of Forex trading. Founded in 2006, OneRoyal started its journey with a robust and honest commitment to providing exemplary trading services. The firm quickly gained recognition and acclaim in the trading sector, leading to its successful expansion to the Middle East in 2008, followed by Australia in 2014.

OneRoyal obtained a critical milestone in its journey by receiving its license from the Cyprus Securities and Exchange Commission (CySEC) in 2016. This licensing is a testament to OneRoyal’s strict adherence to regulations, transparency, and its unwavering commitment to providing clients with a secure trading environment.

Despite its global footprint, OneRoyal adheres to the law of the land and does not offer its services in countries like the USA, North Korea, Iran, Japan, and some others due to regulatory restrictions. This level of responsibility demonstrates OneRoyal’s commitment to legal compliance, highlighting its reputation as a trusted and reliable broker in the trading industry.

Advantages and Disadvantages of Trading with OneRoyal?

Benefits of Trading with OneRoyal

OneRoyal provides traders with a globally renowned MT4 trading platform, enabling them to execute trades efficiently and effectively. Their website hosts a comprehensive resource section laden with valuable materials, including educational resources, technical insights, trading tools, and trading central, offering valuable insights to both novice and experienced traders.

OneRoyal also offers a vast array of trading instruments at competitive rates and spreads, making it an attractive choice for traders. The broker upholds stringent measures to secure clients’ funds by maintaining segregated accounts and implementing negative balance protection mechanisms.

OneRoyal Pros and Cons

Every trading platform has its share of pros and cons, and OneRoyal is no different. Let’s delve into the pros and cons to understand better what OneRoyal brings to the table for its clientele.

Pros:

- Award-winning company: OneRoyal is a recognized and respected entity in the trading industry, having garnered numerous awards for its exceptional services and robust trading platform.

- Award-winning platforms: The firm provides the acclaimed MetaTrader 4 platform, known for its intuitive interface and array of advanced trading tools.

- Wide selection of account choices: OneRoyal offers a variety of account types tailored to suit diverse trading needs and financial capabilities.

- Transparency regarding fees: The firm maintains a clear and upfront policy on its fee structure, eliminating any hidden charges.

- Tight Spreads: OneRoyal offers highly competitive spreads, an aspect that is much appreciated by traders aiming for higher profitability.

Cons:

- Geographical restrictions: Due to certain legal limitations, OneRoyal’s services are not available in some countries, which restricts its global reach.

- Limited trading platform selection: While the MetaTrader 4 platform is reliable and feature-rich, the absence of alternative trading platforms limits the choice for traders who prefer different platforms.

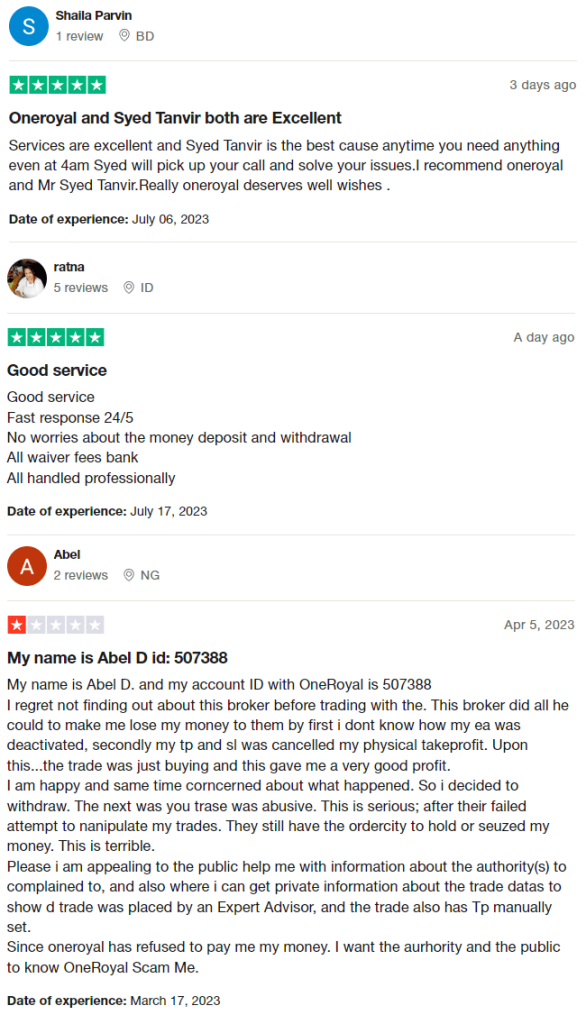

OneRoyal Customer Reviews

The overall customer sentiment towards OneRoyal seems to be largely positive. Many clients praise the company’s services as excellent, highlighting the impressive dedication of their staff, such as Syed Tanvir, who reportedly goes above and beyond in addressing client concerns, even during unconventional hours. Clients also appreciate the fast response times provided by the customer service team, and the seamless, worry-free process for money deposits and withdrawals.

However, there is a negative review expressing concerns about trade manipulation and difficulties in withdrawing profits. This particular client felt that their trades were manipulated and seeks help from the public regarding regulatory authorities to report their grievances. This review, albeit in contrast with the others, highlights the importance of customer vigilance in monitoring their trading activity.

OneRoyal Spreads, Fees, and Commissions

OneRoyal offers tight, floating spreads, with an average spread of just 0.2 pips for the widely-traded EUR/USD currency pair in the Forex market. This rate is considerably attractive, especially considering the industry average is 1.2 pips. Moreover, OneRoyal offers competitive spreads for all major currency pairs and other popular trading instruments.

OneRoyal stands out for its transparent and competitive pricing on trading instruments and does not impose any hidden fees. There are no charges for opening, closing, or inactivity of accounts. However, certain charges may apply to deposits and withdrawals depending on the chosen funding method and the country of registration. Therefore, thorough research is advisable.

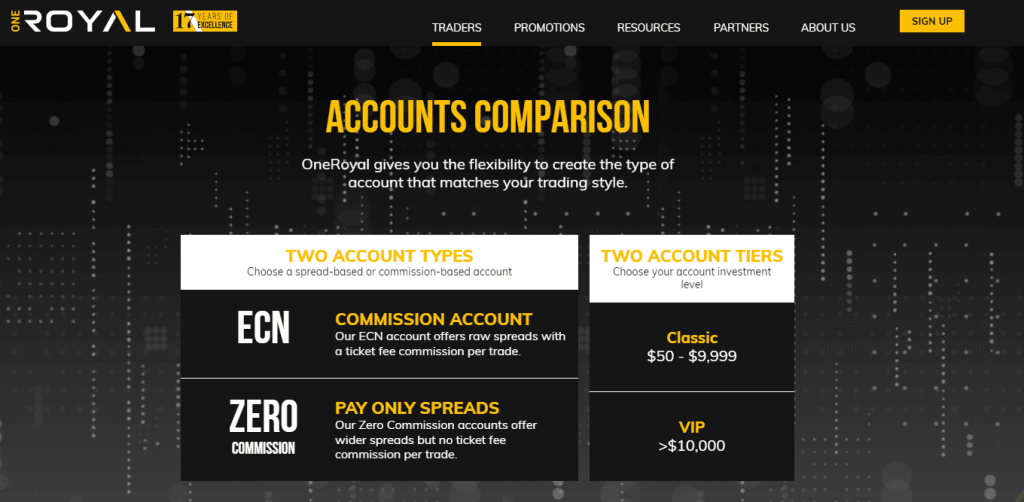

Account Types

OneRoyal offers two primary account types – an ECN account and a Zero Commission account, which are further subdivided into six different account types. Each of these subaccounts has distinct conditions for commissions, fees, margin calls, leverage, and minimum deposits.

Zero Classic Account

With a minimum deposit ranging from $50 to $19,999, the Zero Classic Account provides commission-free trading with spreads starting from 1.4 pips. This account offers access to MetaTrader 4, WebTrader, and Multi-Terminal, and allows account opening in multiple currencies. It also provides access to live market news and social competitions.

Zero Premium Account

The Zero Premium Account requires a minimum deposit between $20,000 and $99,999 and offers commission-free trading with spreads starting from 1.0 pips. Besides offering all the benefits of the Zero Classic Account, this account provides access to an Account Manager and Trading Central, along with MetaTrader 4 Tools and Plugins.

Zero VIP Account

The Zero VIP Account requires a minimum deposit of over $100,000 and offers commission-free trading with spreads starting from 0.6 pips. It includes all the benefits of the Zero Premium Account and provides access to the Dow Jones Newswire.

Core Classic Account

The Core Classic Account requires a minimum deposit between $50 and $19,999, offering trading with spreads starting from 0.0 pips and commissions charged at $7.

Core Premium Account

The Core Premium Account requires a minimum deposit between $20,000 and $99,999, offering trading with spreads starting from 0.0 pips and commissions charged at $5.

Core VIP Account

The Core VIP Account requires a minimum deposit of over $100,000, offering trading with spreads starting from 0.0 pips and commissions charged at $3.5.

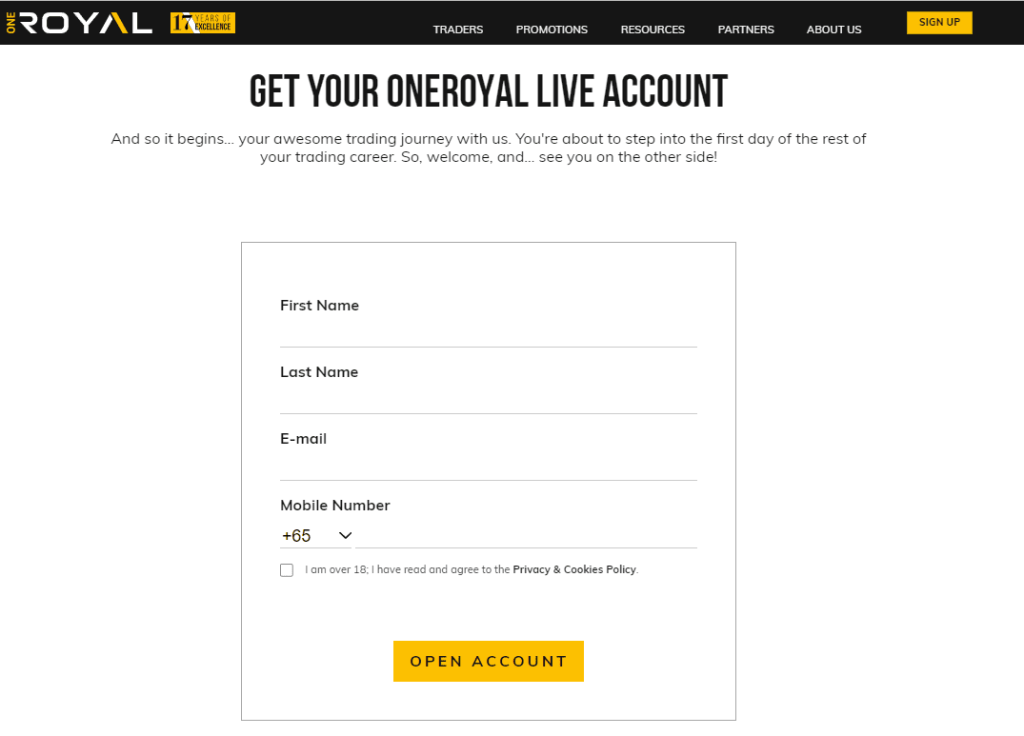

How to Open Your Account

The process of opening an account with OneRoyal is simple and streamlined. Here’s a step-by-step guide to getting started:

- Begin the Process: Visit the official OneRoyal website and locate the “Sign Up” button situated in the upper right corner of the home page. Clicking this will initiate the account creation process.

- Fill out the Information: You’ll be prompted to fill out a form requiring personal details. Ensure all the information is accurate before proceeding. This information will be crucial for the later stages of account verification.

- Verify Your Account: Upon successful registration, you’ll receive an account verification email in your registered email inbox. Follow the instructions within the email to verify your account. Once the verification process is complete, you can log in to your account and commence your trading journey with OneRoyal.

What Can You Trade on OneRoyal

OneRoyal offers its clientele access to a diverse selection of trading markets, providing ample opportunities for traders to diversify their portfolios. The platform supports over 180 currency pairs in the Forex market, including major, minor, and exotic pairs, allowing Forex traders a wide variety to choose from.

Aside from Forex, OneRoyal also provides access to other markets including Indices, Metals, Oil, Stocks, Cryptocurrencies, ETFs, and shares. These markets cater to the varying preferences and risk appetites of traders. However, the availability of certain trading instruments may be subject to regulatory stipulations depending on your jurisdiction. Therefore, it is prudent to review the range of trading options available for your location.

OneRoyal Customer Support

OneRoyal prides itself on its top-tier customer service. The platform offers 24/5 support to its clients via Live Chat, Social Media, Email, and Phone. The customer support team is comprised of experienced trading professionals equipped to handle a wide array of issues. Whether you’re facing technical difficulties, require market analysis advice, have general inquiries, or have operational concerns, the OneRoyal support team is prepared to assist.

Advantages and Disadvantages of OneRoyal Customer Support

Security for Investors

Withdrawal Options and Fees

OneRoyal is committed to providing a seamless and flexible transaction experience for its clients. The broker offers multiple funding options for depositing into and withdrawing from your trading account. These options include traditional methods such as bank wire transfers and credit/debit card transactions, as well as popular online payment systems like Skrill and Neteller.

OneRoyal maintains transparency regarding its fee structure and does not impose any hidden fees on transactions. However, it’s important to bear in mind that specific requirements, limits, and potential fees may vary depending on the chosen funding method, your financial institution, and your country of residence. It’s advisable to thoroughly review the details pertaining to your selected method of transaction to avoid any unexpected charges or limitations.

OneRoyal Vs Other Brokers

#1. OneRoyal vs AvaTrade

OneRoyal and AvaTrade are both reputable brokers in the trading industry. While OneRoyal offers its clients an impressive variety of over 180 Forex pairs, AvaTrade also provides a substantial selection of trading instruments, though not as extensive. Additionally, OneRoyal leverages the MT4 trading platform and offers competitively low spreads starting from 0 pips. In contrast, AvaTrade supports both MT4 and MT5 and has slightly higher spreads.

OneRoyal’s transparent fee structure, including its lack of hidden charges and fees for opening, closing, or account inactivity, is a plus. AvaTrade also emphasizes transparency but charges an inactivity fee after a certain period.

Verdict: While both brokers have their strengths, OneRoyal edges out with its wider variety of Forex pairs, low spreads, and no inactivity fee. Therefore, OneRoyal is better suited for traders seeking a diverse Forex portfolio and lower trading costs.

#2. OneRoyal vs RoboForex

RoboForex is a well-known broker offering an extensive range of trading instruments, similar to OneRoyal. RoboForex, however, stands out with its offer of multiple trading platforms, including MT4, MT5, and cTrader, while OneRoyal focuses on the MT4 platform.

On the flip side, OneRoyal offers an impressive selection of account types tailored to different traders’ needs and preferences, giving it an edge over RoboForex, which has fewer account types. Additionally, OneRoyal’s customer support has been consistently praised by users, while RoboForex’s customer service is occasionally reported to be slower in response times.

Verdict: If a wide range of trading platforms is a priority, RoboForex may be the better option. However, considering the variety of account types, overall user experience, and strong customer support, OneRoyal would be a better choice for most traders.

#3. OneRoyal vs Exness

Both OneRoyal and Exness are recognized for their tight spreads and range of trading instruments. Exness stands out with its superior leverage offering, which can reach up to 1:Unlimited for certain accounts, compared to OneRoyal’s more conservative leverage limits.

OneRoyal, however, shines with its rich educational resources and technical insights that assist traders in making informed decisions. It also offers a wide array of account types to suit different trading styles. While Exness does provide educational resources, they are not as comprehensive as OneRoyal’s.

Verdict: For traders seeking high leverage, Exness could be the more suitable option. But for those who value educational resources, customer service, and a wide range of account types, OneRoyal emerges as the preferable choice.

Also Read: Exness Review 2023

Conclusion: OneRoyal Review

In conclusion, OneRoyal has distinguished itself as a strong contender in the trading industry since its inception in 2006. By offering a comprehensive range of over 180 Forex pairs, competitive spreads, a variety of account types, and high-quality educational resources, it provides a solid trading platform for both new and experienced traders.

OneRoyal’s commitment to transparency, as evidenced by its clear fee structure and strict regulatory adherence, builds trust and confidence among its clients. The firm’s priority in client safety through segregated accounts, negative balance protection, and regulatory compliance further enhance its credibility.

Although OneRoyal is not available to residents of certain countries due to legal restrictions, and only provides the MT4 platform, the platform’s popularity and robustness counterbalance these minor limitations. Overall, the strengths of OneRoyal make it a broker that traders of different backgrounds and preferences can seriously consider in their decision-making process.

OneRoyal Review: FAQs

Is OneRoyal safe for trading?

Yes, OneRoyal is considered safe for trading. It operates under the regulation of reputable authorities such as the Australian ASIC and the European CySEC. Additionally, the broker ensures the safety of client funds by keeping them in segregated accounts and implementing a Negative Balance Protection policy.

What type of trading instruments does OneRoyal offer?

OneRoyal offers a wide range of trading instruments, including over 180 pairs in the Forex market, Indices, Metals, Oil, Stocks, Cryptocurrencies, ETFs, and shares. This wide array of options allows traders to diversify their portfolios according to their trading preferences and strategies.

What kind of customer support does OneRoyal provide?

OneRoyal’s customer support is available 24/5. It is provided through various channels including Live Chat, Email, and Phone. The team comprises experienced trading experts who can assist clients with a range of issues, from technical problems to market analysis advice.