Position in Rating | Overall Rating | Trading Terminals |

239th  | 2.0 Overall Rating |  |

One Royal Review

Forex brokers play a significant role in the trading journey. They provide access to global currency markets. Choosing the right one ensures security, competitive trading conditions, and reliable support-all essentials for successful trading. It can make a huge difference between being profitable and profitable.

One Royal, part of the Royal Group conglomerate, which includes Royal Financial Trading Pty, stands out with a strong emphasis on transparency, competitive trading conditions, and diverse account options. This broker caters to traders of all experience levels, offering robust tools and features designed to enhance trading efficiency. One Royal provides a demo account for beginners to become familiar with the practical application of trading with virtual money before moving forward to a live account. Services are provided to all sorts of traders, from the novice to the experienced ones.

This review aims to provide a comprehensive analysis of One Royal, pointing out its strengths and possible weaknesses. It will focus on the most important aspects: account types, deposit and withdrawal methods, commission structure, and other important information. By combining expert insights with trader feedback, this review gives you the necessary information to make a decision about whether One Royal is the right brokerage for your trading needs.

What is One Royal?

One Royal is an online trading platform that has gained international recognition since its inception in 2006. It offers access to various financial markets, including forex, cryptocurrencies, commodities, shares, and indices. With more than 17 years of experience, the broker is licensed by multiple regulators, such as ASIC, VFSC, and FSA, which ensures a secure and transparent trading environment. Royal Financial Trading Pty offers the support of the Royal Group conglomerate, highlighting this company’s compliance and reliability. Thus, it becomes a very safe trading option for all novice traders. The advanced platforms and sophisticated tools provided by this brokerage firm make it possible to satisfy traders of any skill level, such as offering MetaTrader 4 (MT4), MT4 Accelerator, and AI Trading Tools.

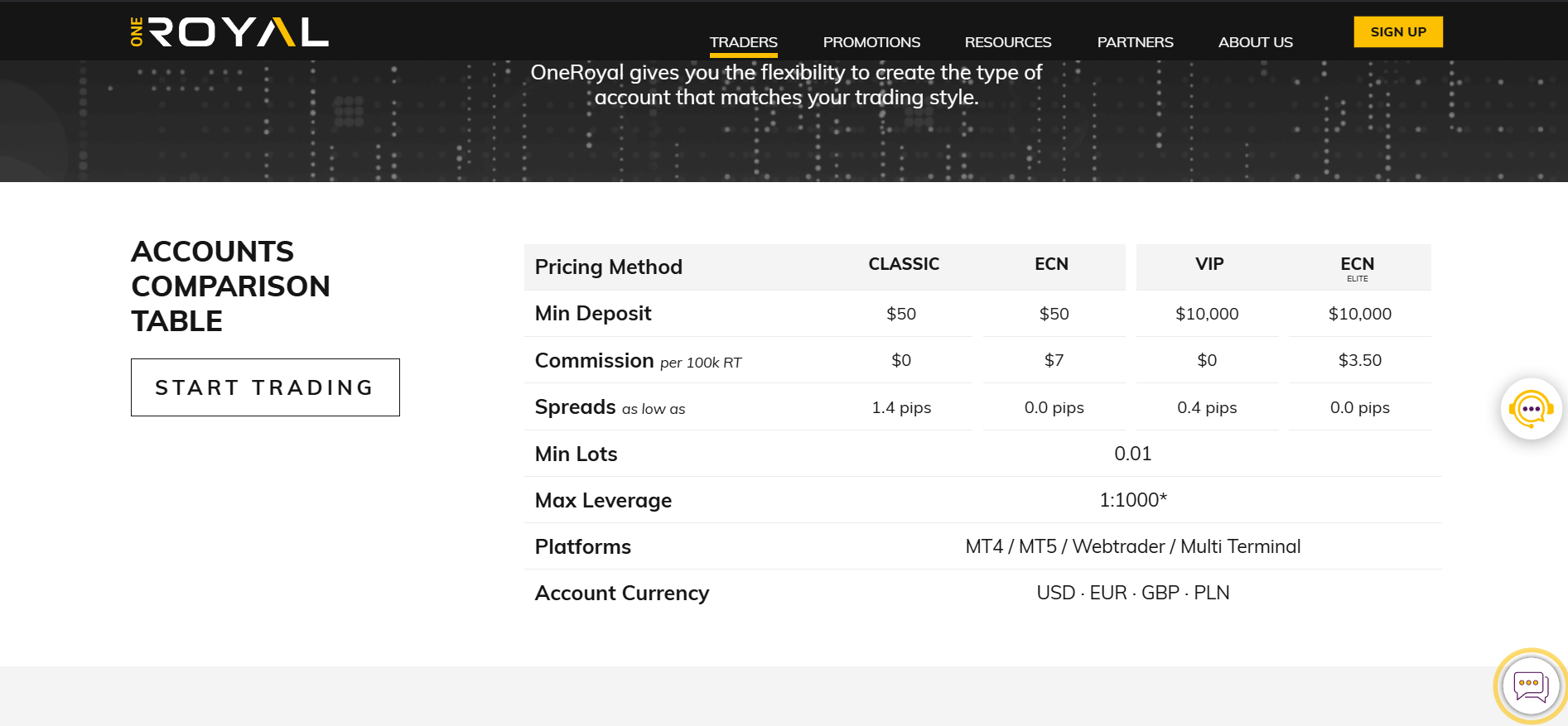

The platform offers flexible leverage up to 1:1000, trade sizes starting from 0.01 lots, and multiple account types, including Classic, ECN, VIP, and ECN Elite. One Royal focuses on client security through fund segregation and provides high-speed trading powered by LD4 and NY4 data centers. With 24/5 multilingual support, demo accounts for beginners, and seamless deposit/withdrawal options, One Royal is a trusted choice for navigating complex financial markets confidently.

One Royal Regulation and Safety

One Royal operates under several regulatory licenses to ensure a secure trading environment, emphasizing the need for trust in the financial industry. They are licensed by the Australian Securities & Investments Commission, the Cyprus Securities and Exchange Commission, the Vanuatu Financial Services Commission, and they have registration in Saint Vincent and the Grenadines.

Client funds are held in segregated accounts with top-tier banks, thus not commingled with One Royal’s operational funds. This ensures that the Anti-Money Laundering policies in place are strictly followed and that clients are protected from regulatory violations.

One Royal is dedicated to transparency and prompt processing of withdrawal requests, giving clients confidence in the safety and accessibility of their funds.

One Royal Pros and Cons

Pros

- Low spreads

- High leverage

- Multiple platforms

- Diverse instruments

Cons

- Limited support

- Withdrawal fees

- Regional restrictions

- Premium deposits

Benefits of Trading with One Royal

OneRoyal is a multi-licensed broker that gives access to the world’s financial markets under favorable trading terms. Royal Financial Trading Pty, a major division of the Royal Group, has gained recognition for its solidity and variety of offerings that entice traders.

Variety of Trading Instruments

One Royal allows one to access more than 1,900 financial instruments, including CFDs on forex, cryptocurrencies, metals, oil, indices, and shares. This breadth allows the diversification of portfolios and access to multiple market opportunities.

Flexible account options

A spread-based account can be selected, along with ECN or zero-commission choices. This ensures that clients can use a type of account that best serves their trading strategies and financial objectives. One Royal also automatically sets up demo accounts following registration. Users can use these without financial risk to practice trading.

Advanced Trading Platforms

One Royal supports MetaTrader 4, or MT4, which is a trading platform that provides the best interface and offers the most advanced trade functionalities. MT4 comes as a desktop application, WebTrader, and mobile app, giving users the ability to administer their accounts using any device.

Premium Trading Tools

Clients get free access to highly powerful trading tools, which include One Royal’s improved version of MT4 with 12 advanced features, copy trading services through HokoCloud, and Virtual Private Servers to enable faster execution speeds and ultra-low latency.

Regulated and Trustworthy

One Royal has been in business since 2006 and is regulated by several authorities, namely ASIC, VFSC, and FSA. Regulation by these authorities ensures that financial standards are strictly followed, ensuring a safe trading environment for clients.

One Royal Customer Reviews

One Royal has received mixed reviews from its users, reflecting both positive and negative experiences. Some traders commend the platform for its user-friendly design, efficient withdrawal process, and competitive spreads, which make it suitable for traders seeking reliability. However, others have expressed dissatisfaction, citing a lack of transparency in account updates and inadequate communication, which raises concerns about trustworthiness. While the support team appears responsive, consistent improvements in clarity and service are needed to meet the expectations of a broader range of traders.

One Royal Spreads, Fees, and Commissions

One Royal provides competitive spreads and transparent fee structures to suit various trading preferences. Spreads differ based on the tier, where the VIP tier provides a more competitive rate from 0.4 pips. Commissions are applied on some account configurations, like ECN-style trading, where fees start from $3.50 per 100k round turn.

The platform supports multiple deposit and withdrawal methods, such as credit/debit cards, bank wires, eWallets, and cryptocurrencies. One Royal normally covers deposit fees for cards and eWallets; bank wire deposits incur up to $30 reimbursement fees for amounts over $500; and cryptocurrency transactions have some network fees, thus flexible according to the funding preference of an individual.

Account Types

OneRoyal offers several types of trading accounts in order to meet the various needs and experience levels of traders. Below is an overview of each account type:

Classic Account

The Classic Account is well-suited for novice traders and those who are familiar with the field. A $50 minimum deposit is expected, with two types of pricing plans: Zero Commission with a starting spread from 1.4 pips, and ECN with a raw spread from 0.0 pips together with a $7 commission per 100k round turn.

VIP Account

The VIP Account is designed for high-volume traders, offering premium trading conditions. It requires a minimum deposit of $10,000 and offers Zero Commission with spreads starting from 0.4 pips, as well as ECN Elite with raw spreads from 0.0 pips plus a $3.50 commission per 100k round turn.

Cent Account

The Cent Account is designed for a beginner in forex trading; it allows trading with a smaller volume. The account allows the trader to gain experience and hone his skills with minimal financial risk.

Swap-Free Account

For clients who follow Islamic finance principles, the Swap-Free Account has no interest charges. Its execution speed and trading conditions are the same as in other accounts, with spreads starting from 0.0 pips and leverage of up to 1:1000.

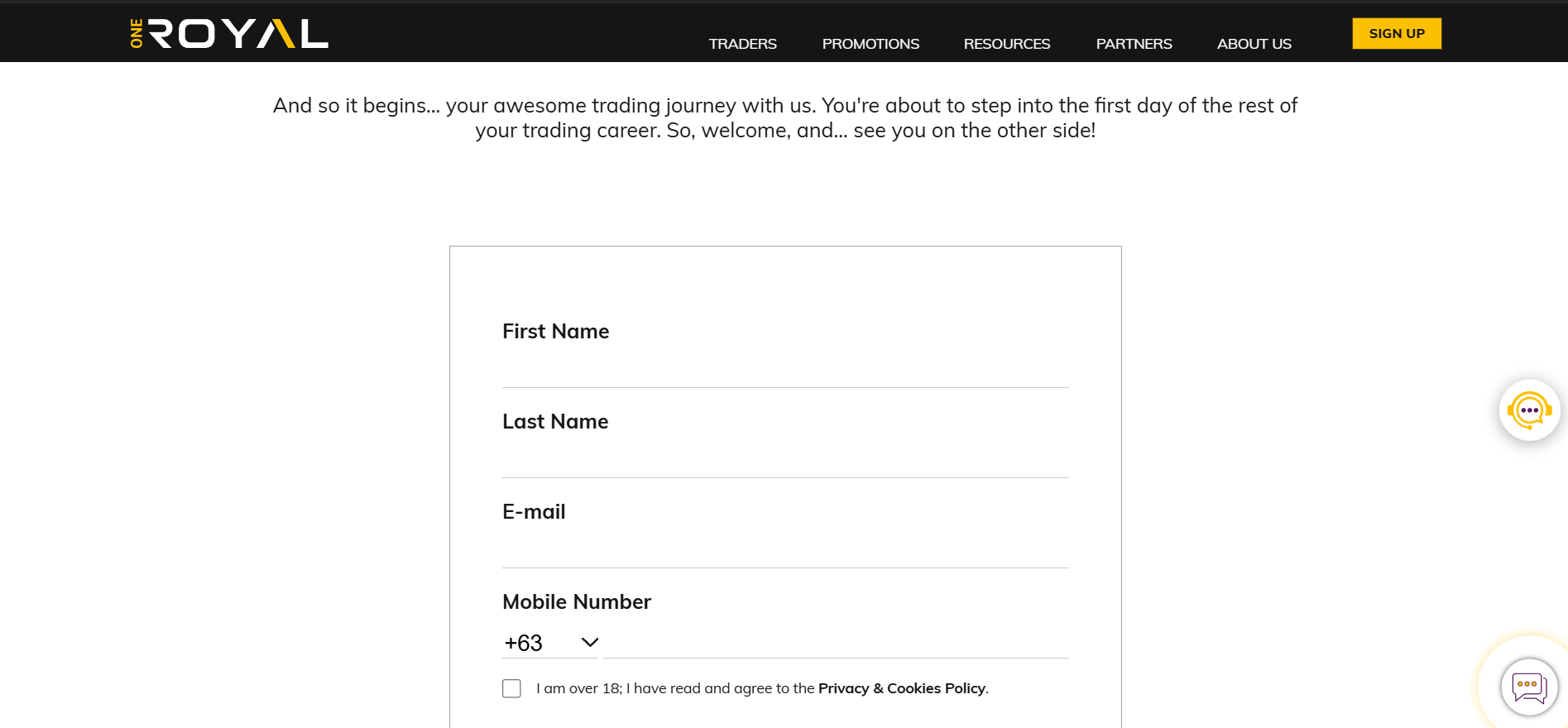

How to Open Your Account

Opening an account with One Royal is a straightforward process that ensures a smooth trading experience. Follow these steps to get started:

Step 1: Visit the One Royal Website

Go to the official One Royal website by entering oneroyal.com in your browser. Click on the “Sign Up” button at the top right corner to begin the registration process.

Step 2: Fill Out Your Personal Information

Enter your first and last name, email address, and mobile number in the provided fields. Ensure all details are accurate to avoid delays in account verification.

Step 3: Agree to Terms and Privacy Policy

Tick the box confirming that you are over 18 and agree to the Privacy & Cookies Policy. This step is mandatory to proceed with the registration.

Step 4: Submit Your Registration

Click on the “Open Account” button to finalize your application. A confirmation email will be sent to your registered email with further instructions.

Step 5: Complete Verification

Follow the instructions in the email to upload the required identification documents. Verification ensures compliance with regulatory standards and account security.

By completing these steps, you can begin your trading journey with One Royal and explore global market opportunities.

One Royal Trading Platforms

One Royal offers a variety of trading platforms to suit the diverse preferences and trading styles of its clients. Designed to be adaptable, these platforms provide sophisticated tools that cater to both novice and experienced traders.

The MT4 Mobile platform empowers traders to manage accounts and execute trades directly from smartphones or tablets. With real-time quotes, interactive charts, and a full range of trading orders, it is an excellent choice for those who trade on the go.

Building on MT4, MT5 Mobile adds advanced charting tools, multiple timeframes, and an integrated economic calendar. Such a platform would be of use to more sophisticated traders seeking greater functionality.

The MT4 Accelerator is a suite of tools that enhances the functionality of the MT4 platform. Features such as the Alarm Manager and Sentiment Trader improve efficiency and decision-making, making it an excellent addition for traders looking to optimize their MT4 experience.

MetaFX is a multi-account management solution designed for professional traders and money managers. It is easily integrated with the MT4 platform, providing real-time monitoring, group order execution, and customizable allocation parameters, making the management of multiple client accounts much easier.

Designed for traders that operate multiple accounts, the MT4 MultiTerminal supports up to 128 live accounts in parallel. It is ideal for the streamlining of complex trading operations because of one-click execution and several volume distribution methods plus detailed reporting.

Every platform is designed to specifically target specific trading needs, arming One Royal’s clients with the right tools to effectively and efficiently trade. Whether a novice or an experienced professional, One Royal has a platform that will make your trading journey even better.

What Can You Trade on One Royal

One Royal offers an array of trading instruments for different market preferences. Here are the details of each:

Forex Trading

One Royal offers access to a range of currency pairs: major, minor, and exotics. Traders benefit from competitive spreads and reliable platforms designed to enhance forex trading efficiency.

Commodities

Trading in precious metals such as gold and silver and energy products like oil. One Royal offers transparent pricing for commodity trading enthusiasts.

Indices

Experience global markets and discover market opportunities through One Royal’s indices. Trade popular indices representing key economies, with flexible trading conditions.

Cryptocurrencies

Diversify your portfolio by trading cryptocurrencies, including Bitcoin and Ethereum. One Royal supports crypto trading with secure and seamless access.

Shares and ETFs

Trade stock CFDs and ETFs from global markets. One Royal offers the ability to invest in leading companies as well as diversified funds, accessible for long-term and short-term strategies.

One Royal Customer Support

One Royal provides traders with multiple channels of customer support to ensure an easy experience. You can reach their team through live chat, WhatsApp, Telegram, Messenger, or by requesting a callback on their website. For local assistance, One Royal has offices in Australia, Lebanon, Vanuatu, St. Vincent & the Grenadines, Cyprus, and Nigeria, which provide direct phone numbers and email addresses for easy communication.

To further help customers, One Royal has a very detailed Help Center and FAQ on their website. These sections include topics like account setup, trading platforms, deposits, and withdrawals. Their support team is available 24/5, ensuring that any question or issue would be promptly and efficiently addressed, so the trader can continue with their goals with confidence.

Advantages and Disadvantages of One Royal Customer Support

Withdrawal Options and Fees

One Royal provides multiple withdrawal options to meet the different needs of its clients. Clients can withdraw money through credit/debit cards, bank wire transfers, eWallets, and cryptocurrencies. Each method supports a range of currencies, including AUD, CAD, CHF, EUR, GBP, HKD, NZD, SGD, and USD.

One Royal covers all fees in case of withdrawals through a credit/debit card as well as eWallet. In the case of Bank Wire Transfer, although One Royal does not charge any withdrawal fee, and there might be fees incurred by the sending and corresponding bank, which will be deducted on the final amount received. Also, cryptocurrency withdrawals incur network charges, such as 0.0005 BTC for Bitcoin or 0.0035 ETH for Ethereum.

The accounts and credit cards need to bear the same name as that of the trading account holder at One Royal in order for any withdrawal from it to take place. Therefore, transfers into accounts other than that of the individual making a withdrawal are not allowed, and withdrawal request in currencies other than those in the base account attracts a 3% fee on top of conversion.

Additionally, customers are expected to note that, while transferring funds in or out of international financial institutions might involve transfer fees as well as intermediary bank fees independent of One Royal and subject to client account, the latest withdrawal options and fees can only be accessed through One Royal’s official resources or via the support team.

One Royal Vs Other Brokers

#1. One Royal vs XM

One Royal and XM offer competitive trading services but cater to slightly different preferences. One Royal offers a customized trading experience that focuses on professional tools and personalized support, which appeals to more advanced traders. XM, however, is famous for its extensive educational resources and low entry barriers, which makes it ideal for beginners. Both brokers offer more than one account type, highly competitive spreads, and also access to the popular platforms like MetaTrader 4 and 5. XM seems to have a broader audience outreach due to its global presence and special offers, which could better appeal to a more broad audience compared to One Royal’s niched approach.

Verdict: One Royal is better for seasoned traders who look for customization, while XM would work best for newcomers who prioritize educational resources.

#2. One Royal vs RoboForex

One Royal and RoboForex have different types of traders that are attracted by the respective strengths. One Royal is a transparent, straightforward fees trading service for traders who are interested in clarity over the cost. RoboForex excels with the range of trading instruments and account types to cater for traders’ interests in flexibility. Both of the brokers offer competitive spreads and leverage options, but the edge of RoboForex is in its proprietary trading platforms and extensive educational resources, while One Royal puts a lot of emphasis on strong customer support and regulatory compliance.

Verdict: RoboForex is perfect for traders looking for diversified tools and account options, while One Royal suits those who prefer a transparent trading environment. The choice depends on whether flexibility or simplicity is better aligned with individual trading goals.

#3. One Royal vs Exness

One Royal is pretty simple and easy to use with a user-friendly interface, and it has fewer assets but effective ones, making it suitable for new traders. On the other hand, Exness provides a broader range of assets, advanced tools, and flexibility in leverage, making it suitable for both beginners and experienced traders. One Royal’s simplicity appeals to those seeking less complexity, while Exness excels in customization and scalability, accommodating a wider trading audience. Pricing structures also differ, with Exness offering competitive spreads compared to One Royal’s relatively higher costs for premium features.

Verdict: Exness stands out for its advanced features and broad appeal, making it a better choice for experienced traders. However, One Royal remains a solid option for beginners who prefer simplicity and ease of use, and a platform supported by moderate royal web traffic.

Also Read: XM Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH ONE ROYAL

Conclusion: One Royal Review

One Royal equips traders with the necessary tools to make it through these complex financial markets, thereby requiring robust technical and business strategy to navigate. A comprehensive resource suite is available to facilitate traders in taking informed decisions. From advanced charting tools to real-time market analysis, One Royal is there for traders to ensure them of up-to-date information and latest technology.

One of the major benefits of One Royal is customer support. The support team is available 24/5, ready to address any question or concern a trader may have. With prompt and efficient solutions, they ensure that traders are on their feet to tackle the fast-paced world of online trading.

For those who are keen on improving their trading without risking their money, demo accounts from One Royal would be of great benefit. These accounts allow one to test strategies in a risk-free environment, increasing one’s confidence and developing their trading techniques. The usage of a demo account by either a novice or experienced trader will give an enormous insight into how things are done, making one ready for live trading.

In summary, One Royal is good at offering powerful tools, efficient customer support, and risk-free practice environments to make it an excellent choice for traders looking to successfully navigate complex financial markets.

Also Read: CMS Prime Review 2024 – Expert Trader Insights

One Royal Review: FAQs

Is One Royal regulated?

Yes, One Royal operates under multiple regulatory authorities, including ASIC, VFSC, and FSA, ensuring compliance and client fund security.

What trading platforms does One Royal offer?

One Royal supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), and specialized tools like MT4 Accelerator and MetaFX, catering to various trading preferences.

Are there fees for withdrawals?

One Royal covers fees for most withdrawal methods, but network or intermediary bank charges may apply for some transactions, such as cryptocurrency or international transfers.

OPEN AN ACCOUNT NOW WITH ONE ROYAL AND GET YOUR BONUS