Position in Rating | Overall Rating | Trading Terminals |

270th  | 2. Overall Rating |  |

One Financial Markets Review

Traders who have used One Financial Markets often highlight its straightforward trading platform and reliable execution speeds. Many appreciate the variety of account types, which cater to both beginners and advanced traders. The broker’s transparent fee structure and competitive spreads are frequently mentioned as positives, making it an appealing choice for those seeking cost-effective trading.

However, some traders have noted areas for improvement with One Financial Markets, particularly regarding customer support response times. While the platform itself is user-friendly, a few users have reported delays in resolving issues or answering inquiries. Despite this, most traders find the broker’s services efficient and conducive to active trading strategies.

Overall, One Financial Markets has received favorable feedback from its user base for delivering a solid trading experience. Its range of features and commitment to providing a seamless platform have earned the trust of many traders, though addressing minor service concerns could further enhance its reputation.

What is One Financial Markets ?

One Financial Markets is a brokerage platform that offers trading services across various financial markets, including forex, stocks, and commodities. Traders have described it as a reliable choice for both beginners and experienced investors due to its user-friendly interface and competitive pricing. Many appreciate its straightforward tools, which make analyzing markets and executing trades efficient.

Traders and borrowers have shared their experiences with One Financial Markets , emphasizing the convenience of accessing onemain financial personal loans. Many appreciate the flexibility offered through both unsecured and secured loans, making it easier to meet diverse financial needs. Users often highlight the quick loan approval process, which accommodates individuals with varying credit history and credit score levels.

Feedback indicates that onemain financial provides a seamless application experience, particularly for those seeking personal loans. Borrowers value the option to choose between unsecured loans for flexibility or secured loans for potentially better terms. The integration of funds with a bank issued debit card after loan closing has been praised for its convenience and efficiency.

Overall, users of onemain financial have noted that maintaining a responsible credit history improves loan terms and approval rates. The combination of accessible products and user-centric services makes it a preferred choice for personal financing needs.

One Financial Markets Regulation and Safety

Traders often praise One Financial Markets for maintaining high regulatory standards, which is a common expectation among top forex brokers. Feedback indicates that the broker’s compliance with industry norms reassures clients about the safety of their funds and trades. Many appreciate its clear policies and secure handling of Kuwait financial instruments forex, ensuring a reliable trading environment.

In various markets reviews, traders have highlighted the broker’s wide range of financial markets symbols, catering to diverse trading preferences. The platform also supports comprehensive investment strategies by offering multiple trading accounts tailored to different levels of expertise. This flexibility has been positively received by traders looking for tools that align with their trading strategies.

Reviews further mention that One Financial Markets integrates advanced trading tools into its platforms, enhancing analytical capabilities. The broker also provides a detailed trading glossary to assist traders in understanding complex terms, making it accessible for beginners. Its overall financial markets offer is regarded as robust, though some traders suggest further enhancements to meet advanced expectations.

One Financial Markets Pros and Cons

Pros

- Low Spreads

- Fast Execution

- Diverse Assets

- Reliable Support

Cons

- Limited Promotions

- High Deposit

- No Cryptos

- Regional Restrictions

Benefits of Trading with One Financial

Traders frequently praise the benefits of trading with One Financial, particularly its competitive spreads and transparent fee structure. These features make it a cost-effective option for those looking to maximize their returns. Additionally, the broker offers diverse account types, ensuring flexibility to match varying skill levels and trading strategies.

Another advantage highlighted by users is the efficient trade execution provided by One Financial, which minimizes delays and slippage. The platform’s user-friendly design and access to a wide range of markets, including forex, stocks, and commodities, have been well-received by traders. This accessibility allows users to diversify their portfolios with ease.

One Financial Markets Customer Reviews

Customer reviews for One Financial Markets often highlight its efficient platform and user-friendly tools. Many traders appreciate the broker’s competitive spreads and transparent pricing, which are seen as ideal for cost-conscious trading. Positive feedback frequently mentions the platform’s stable performance and the wide variety of tradable assets available.

However, some traders have expressed concerns about One Financial’s customer support, noting occasional delays in response times. While most users find the platform reliable for their trading needs, a few suggest that improving customer service could enhance their overall experience. Despite these concerns, the broker maintains a generally favorable reputation among its clients.

One Financial Markets Spreads, Fees, and Commissions

Traders often commend One Financial Markets for its competitive spreads and transparent fee structure. The broker is known for offering tight spreads on major currency pairs and other popular instruments, making it an attractive choice for cost-conscious traders. Many users also appreciate the absence of hidden fees, which allows for clearer cost management.

Feedback indicates that One Financial Markets applies reasonable commissions on certain account types, catering to traders who prioritize low spreads or commission-based models. Additionally, the broker provides detailed information about its fees, earning praise for its transparency. However, some traders suggest further reductions in withdrawal fees to enhance overall cost efficiency.

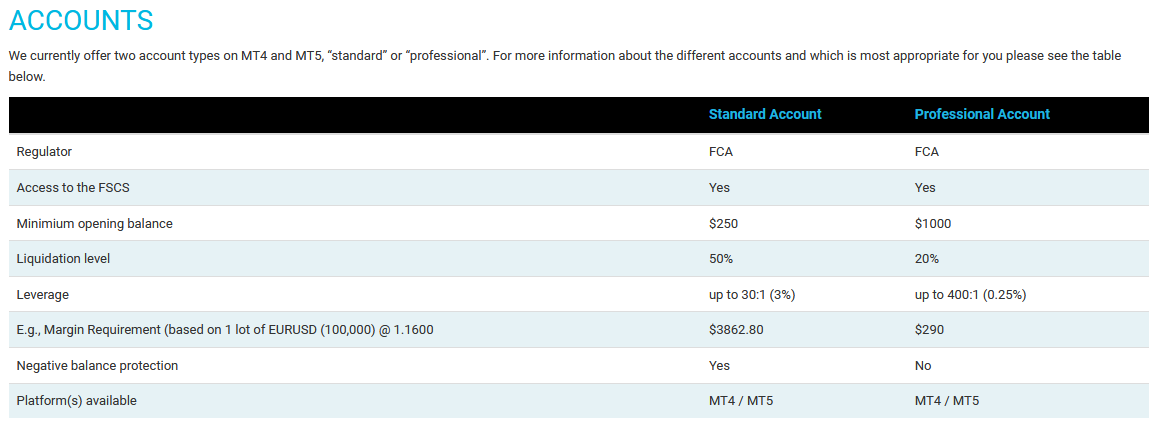

Account Types

One Financial Markets provides traders with various account types tailored to suit different trading preferences and experience levels. Each account is designed to offer unique features, enabling traders to find the best fit for their financial goals.

Standard Account

The Standard Account at One Financial Markets is ideal for beginner traders, offering low minimum deposit requirements and basic trading tools. It provides access to a broad range of assets with competitive spreads.

Premium Account

The Premium Account caters to experienced traders looking for enhanced features. It offers tighter spreads, access to advanced trading tools, and priority customer support to ensure seamless trading experiences.

VIP Account

The VIP Account is designed for professional traders or high-net-worth individuals. One Financial Markets provides this account with exclusive perks, including the lowest spreads, a personal account manager, and premium analytics tools.

Demo Account

The Demo Account is a risk-free way to explore the trading platform of One Financial. It allows traders to practice strategies and understand the platform’s functionalities using virtual funds.

How to Open Your Account

Opening an account with One Financial Markets is a straightforward process designed for both new and experienced traders. The platform ensures a seamless setup experience by providing clear instructions and user-friendly tools. Follow the steps below to get started with your trading journey.

Step 1: Visit the One Financial Markets Website

Go to the official One Financial Markets website and locate the “Open Account” button on the homepage. Click on it to access the registration form and begin the process.

Step 2: Complete the Registration Form

Fill out the registration form with your personal details, such as your name, email address, and phone number. Ensure that the information is accurate to avoid any delays in verification.

Step 3: Verify Your Identity

Upload the required documents, including a government-issued ID and proof of address. One Financial Markets uses these documents to comply with regulatory standards and secure your account.

Step 4: Fund Your Account

Log in to your newly created account and navigate to the funding section. Choose your preferred payment method and deposit the minimum amount required by One Financial Markets to activate your account.

Step 5: Start Trading

Once your account is funded, access the trading platform and explore the available assets. One Financial Markets offers a variety of tools and resources to help you make informed trading decisions.

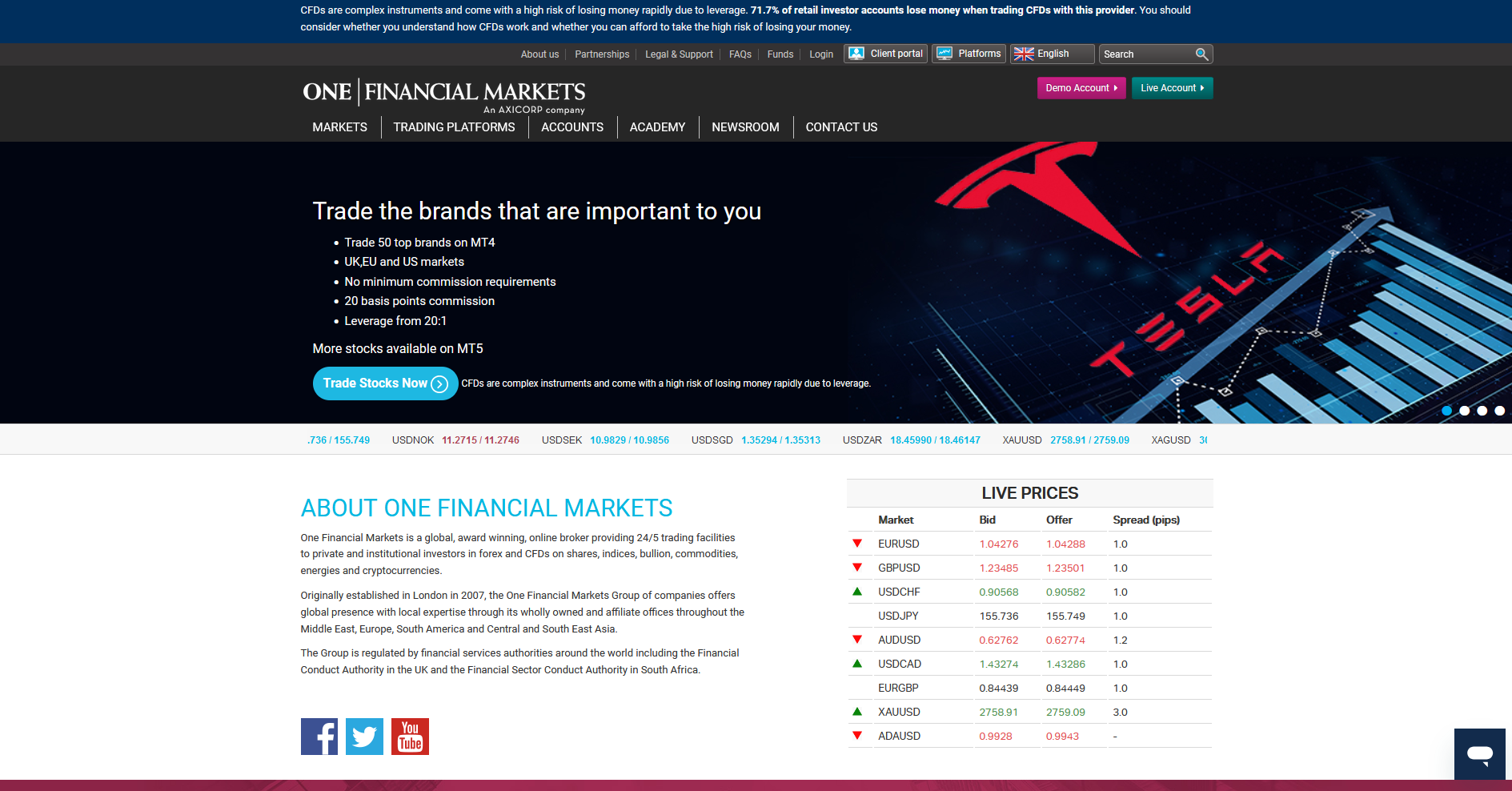

One Financial Markets Trading Platforms

Traders utilizing One Financial Markets have access to several trading platforms, notably MetaTrader 4 (MT4) and MetaTrader 5 (MT5). MT4 is renowned for its user-friendly interface and comprehensive charting tools, supporting various trading strategies. MT5 offers enhanced features, including more time frames and an integrated economic calendar, catering to traders seeking advanced analytical capabilities.

Additionally, One Financial Markets provides the ONE | Web Trader, a browser-based platform that mirrors the functionality of MT4 without requiring any downloads. This flexibility allows traders to access their accounts from any desktop with an internet connection. For those who prefer trading on the go, mobile versions of MT4 and MT5 are available for both iOS and Android devices, ensuring a seamless trading experience across various devices.

What Can You Trade on One Financial

One Financial Markets offers a wide variety of trading instruments designed to cater to both novice and experienced traders. From forex to commodities, their platform provides access to global markets, allowing users to diversify their portfolios with ease. Traders can choose from various asset classes based on their trading strategies and preferences.

Forex Trading

Forex trading on One Financial Markets includes a range of currency pairs, from major pairs like EUR/USD to exotic ones. This allows traders to capitalize on global market movements and currency fluctuations. The platform provides competitive spreads and advanced tools for effective forex trading.

Stocks and Indices

One Financial Markets provides access to popular stocks and indices from major markets around the world. Traders can speculate on the price movements of companies or indices without owning the underlying asset. This asset class suits those looking to diversify their trading strategies with equities.

Commodities

Commodity trading on One Financial Markets includes metals like gold and silver, as well as energy resources such as oil and natural gas. These instruments are popular for hedging against inflation and diversifying portfolios. The platform ensures competitive conditions for trading in these markets.

Cryptocurrencies

One Financial Markets also supports trading in cryptocurrencies, including Bitcoin, Ethereum, and other altcoins. This market offers high volatility, making it appealing for traders seeking substantial returns. The platform ensures secure and efficient transactions for digital assets.

Bonds and ETFs

With One Financial, traders can explore bonds and ETFs, offering steady and diversified investment options. These instruments are ideal for long-term investors looking for lower-risk trading opportunities. The platform simplifies access to these markets, making them easily manageable.

One Financial Markets Customer Support

Traders have shared mixed feedback about One Financial’s customer support services. Many appreciate the availability of multiple communication channels, such as live chat, email, and phone support, which make it easy to seek assistance. Some users have highlighted the professionalism and helpfulness of the support team when addressing queries or issues.

However, a few traders have noted delays in response times, especially during peak trading hours. While the overall quality of assistance is deemed satisfactory, some suggest that enhancing availability and speed could improve the customer experience.

Advantages and Disadvantages of One Financial Markets Customer Support

Withdrawal Options and Fees

Understanding withdrawal options and fees is essential for traders to efficiently access their funds. One Markets Financial offers a range of withdrawal methods designed to meet the needs of diverse clients, each with varying fees and processing times.

Bank Transfers

Bank transfers are a reliable option for withdrawing funds directly to a personal or business bank account. One Financial Markets ensures secure transactions, though these may incur higher fees and take 2-5 business days to process.

Credit/Debit Cards

Withdrawals via credit or debit cards offer a quick and convenient method. With One Financial, this option typically has minimal fees and processing times of 1-3 business days.

E-Wallets

E-wallets like PayPal or Skrill provide fast and flexible withdrawal options. One Financial Markets supports e-wallet transactions with low fees and same-day processing in most cases.

Cryptocurrency

For traders using digital currencies, One Financial Markets offers cryptocurrency withdrawals. This method is fee-efficient and ideal for those seeking rapid and secure transactions.

One Financial Markets Vs Other Brokers

#1. One Financial Markets vs AvaTrade

One Financial Markets offers traders a range of account types with competitive spreads and a strong focus on forex and CFD trading. It emphasizes personalized support and a user-friendly interface tailored to intermediate and advanced traders. On the other hand, AvaTrade stands out for its extensive regulatory compliance and broader asset offerings, including cryptocurrencies and social trading features like AvaSocial. While One Financial Markets caters to those seeking a more traditional trading experience, AvaTrade appeals to traders looking for diversified tools and global accessibility.

Verdict: One Financial is ideal for traders seeking a focused and simplified trading approach with direct support. AvaTrade suits those who value extensive asset diversity and advanced trading features.

#2. One Financial Markets vs RoboForex

One Financial Markets offers a tailored experience for traders, emphasizing personalized account management and transparent pricing. It provides a diverse range of account types with competitive spreads, suitable for various trading strategies. In contrast, RoboForex stands out for its advanced automated trading tools and robust copy trading features, appealing to tech-savvy traders. While One Financial focuses on personalized service and reliability, RoboForex prioritizes technological innovation and flexibility in trading platforms. Both brokers cater to a broad audience, but their priorities differ in terms of service delivery and trading tools.

Verdict: One Financial Markets is ideal for traders seeking hands-on support and simplicity, while RoboForex suits those who prioritize automation and advanced trading options. The choice depends on whether personal attention or technological innovation is the trader’s priority.

#3. One Financial Markets vs Exness

One Financial is known for catering to experienced traders with competitive spreads and advanced trading tools, while Exness emphasizes accessibility with its user-friendly interface and low deposit requirements. One Financial offers extensive educational resources for traders looking to enhance their skills, whereas Exness excels in providing quick and efficient withdrawals, along with a broader range of account types. Both brokers feature robust trading platforms, but One Financial focuses on institutional-grade solutions, whereas Exness is better suited for retail traders seeking flexibility and ease of use.

Verdict: One Financial is ideal for traders prioritizing professional-grade tools and resources. Exness stands out for its simplicity and convenience, making it a strong choice for beginners or those looking for flexible trading options.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH MY ONE FINANCIAL MARKETS

Conclusion: One Financial Markets Review

One Financial Markets has garnered generally positive feedback from traders for its user-friendly platforms, competitive pricing, and reliable trade execution. Its transparent fee structure and diverse account options make it suitable for traders with varying experience levels. The broker’s emphasis on security and regulatory compliance adds to its credibility in the trading community.

While traders value the efficiency and features offered by One Financial, some have pointed out areas for improvement, particularly in customer support and advanced trading tools. Despite these minor concerns, the broker remains a trusted choice for many, offering a well-rounded trading experience. Overall, One Financial Markets is a dependable platform for traders seeking affordability, reliability, and accessibility.

One Financial Markets Review: FAQs

Is One Financial Markets a regulated broker?

Yes, One Financial Markets is regulated by reputable financial authorities, ensuring compliance with industry standards and the protection of traders’ funds.

What trading platforms does One Financial Markets offer?

One Financial provides access to MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a web-based platform called ONE | Web Trader, along with mobile apps for trading on the go.

Are the fees and commissions competitive with One Financial?

Traders have noted that One Financial offers tight spreads and transparent fees, making it a cost-effective choice for various trading strategies.

OPEN AN ACCOUNT NOW WITH ONE FINANCIAL MARKETS AND GET YOUR BONUS