Nvidia Now Valued at $2.8 Trillion

Nvidia's stock surged by 7% overnight as the AI chip giant continues its relentless post-earnings rally. This rally has pushed Nvidia to a market capitalization of just over $2.8 trillion, making it the third-largest company globally by market cap. The AI titan is now closing in on tech mega-stocks Apple ($2.9 trillion) and Microsoft ($3.2 trillion).

Nvidia's chips are indispensable for powering cutting-edge artificial intelligence applications, fueling insatiable demand, and driving the company's stratospheric ascent. The chip giant's rally has been nothing short of spectacular since breaching the $500 level at the start of 2024. The late-March/early-April sell-off was quickly retraced as the stock continues defying gravity.

Nvidia has a 7.2% weighting in the Nasdaq 100, and last night’s rally helped the tech index hit a fresh closing high.

US Dollar Awaits Core PCE Release

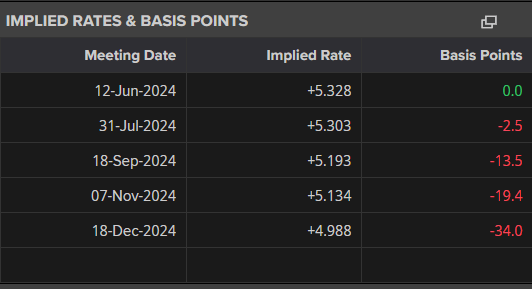

The US dollar is treading water, with traders hesitant to take new positions ahead of Friday's pivotal US Core PCE inflation release. Persistent stickiness in US inflation has forced financial markets to drastically recalibrate rate cut expectations for 2024. Now, only a single 25 basis point cut is fully priced in, a stark contrast to the six cuts anticipated at the end of last year.

Minneapolis Fed Reserve President Neel Kashkari stated that the US central bank should wait for ‘many months of positive inflation data’ before considering rate cuts. He added that if inflation remains elevated, rate hikes cannot be ruled out. Kashkari’s comments underscore the Federal Reserve's unwavering commitment to reducing inflation, even at the potential cost of short-term economic pain. With price pressures proving more persistent than initially anticipated, policymakers appear determined to restore price stability, regardless of the implications for financial markets.

The US Dollar Index is flat in early trading with a slight downside bias. Initial support is seen at 104.44 (200-dsma) ahead of 104.37 (38.2% Fibonacci Retracement).