As Nvidia prepares to report its second-quarter 2024 earnings, investors are eager to see if the star of U.S. chip stocks can recover its recent losses.

LSEG Data & Analytics indicates a consensus ‘buy' rating for Nvidia, with 19 strong buys, 33 buys, and 5 holds as of August 15, 2024.

Anticipated Revenue Drivers

As Nvidia approaches its Q2 earnings announcement, the market has set high expectations due to its leadership in several critical growth sectors.

Over the past year, Nvidia has experienced significant demand across multiple markets, particularly in data centers and gaming. The rise in adoption of AI and machine learning has driven strong sales of Nvidia's specialized GPUs and networking products in data centers. Additionally, as more companies transition workloads to the cloud, Nvidia continues to benefit. The gaming segment remains robust, fueled by the popularity of eSports, game streaming services, and new blockbuster game releases optimized for Nvidia hardware.

Nvidia's data center segment, which includes GPUs, networking equipment, and AI software, is expected to see further growth. This is largely due to major hyperscale customers like Amazon AWS, Microsoft Azure, and Alphabet GCP increasingly adopting Nvidia chips for AI workloads.

Continued demand for Nvidia's latest GPUs for both gaming and creative applications is anticipated to be a significant revenue driver.

Nvidia's automotive computing platforms are gaining traction among electric and autonomous vehicle manufacturers, further increasing the demand for Nvidia's technology. The company's Omniverse 3D simulation platform has also seen triple-digit customer growth over the past year, pointing to potential future growth in enterprise software.

Potential Obstacles

Nvidia faces several challenges that could impact its upcoming earnings, including supply chain constraints that may limit its potential upside. While these constraints are improving, ongoing shortages in foundry capacity and components could prevent Nvidia from fully meeting the heightened demand. Any signs that these supply issues persist could lead to investor disappointment.

A slowdown in the PC market due to challenging macroeconomic conditions could negatively affect Nvidia's graphics segment, potentially reducing overall earnings growth.

Macroeconomic uncertainty could also lead to reduced business spending if economic conditions worsen, disproportionately affecting Nvidia's data center and enterprise segments.

The company also faces increasing competition from rivals like AMD and Intel, who are heavily investing in AI-focused chips. Additionally, major tech and automotive companies are developing their own AI chips, which could decrease demand for Nvidia's products.

Despite these risks, Wall Street remains largely bullish on Nvidia, with investors focusing on the company's long-term potential in AI, high-performance computing, autonomous vehicles, and the metaverse. Nvidia's ability to capitalize on these opportunities is likely to drive share price momentum after the earnings report.

Nvidia’s Technical Outlook

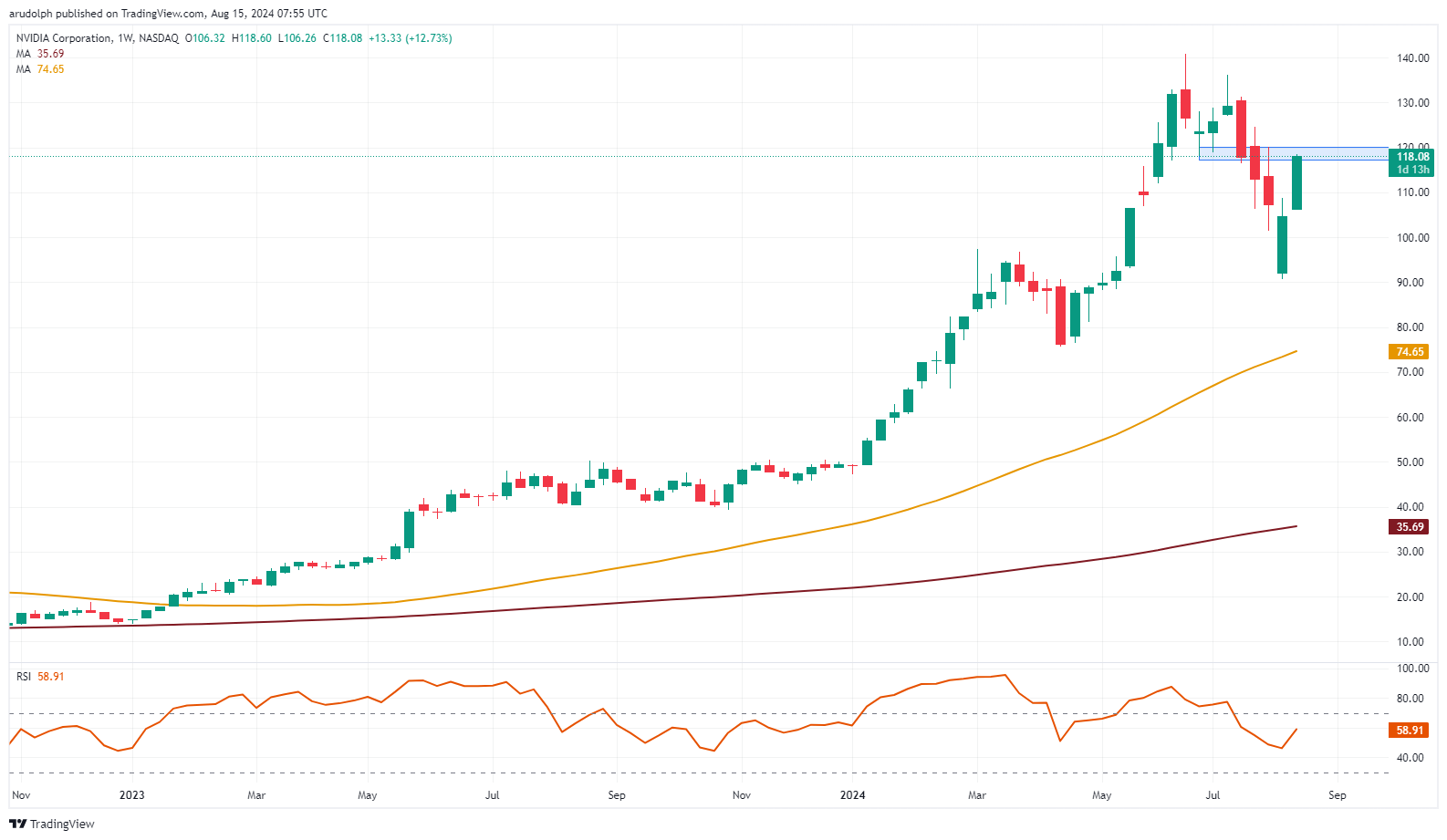

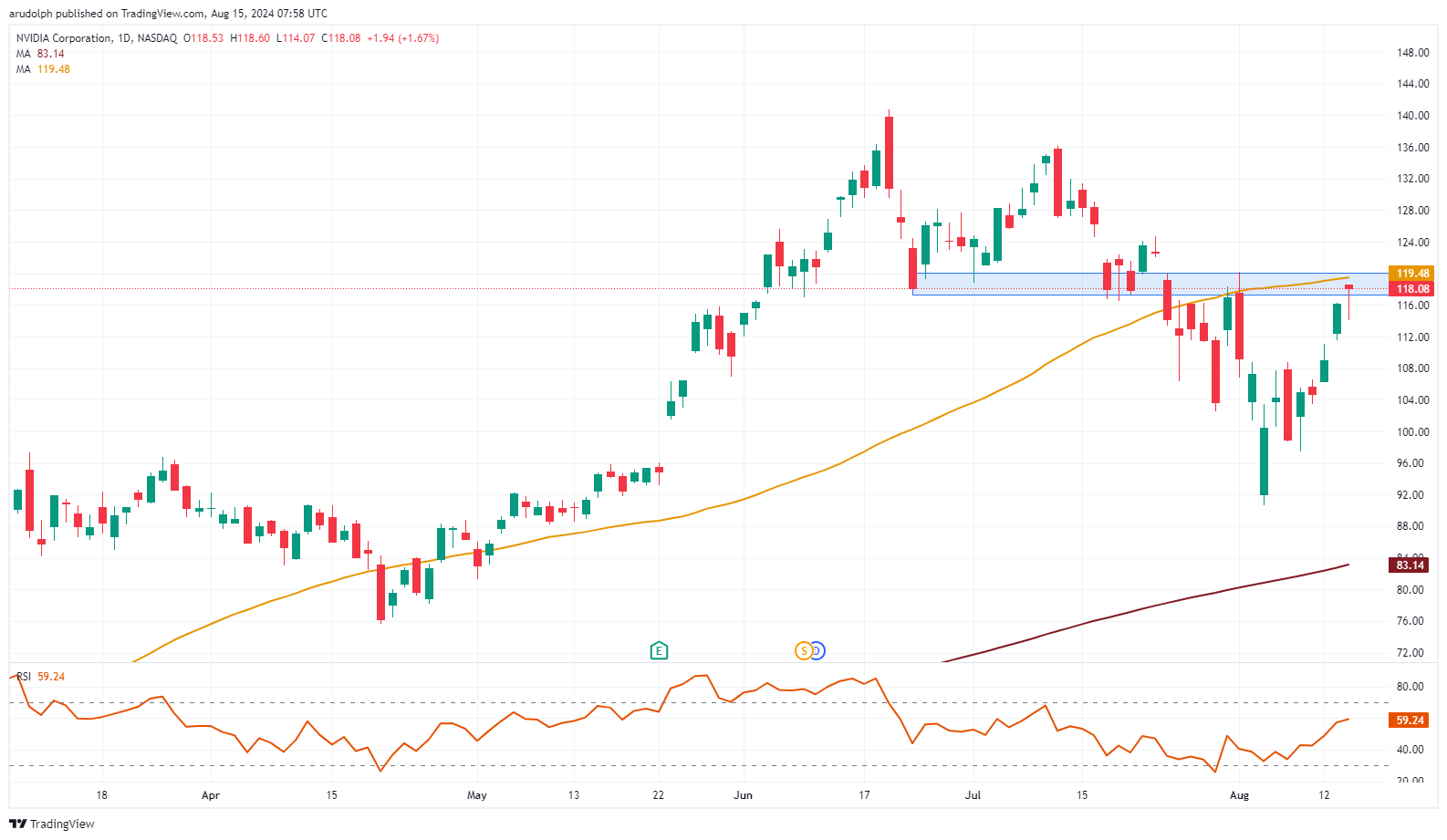

Nvidia's share price has increased by over 145% year-to-date, despite a 35% decline from June to August. The stock is currently testing the $118.04-$120.16 resistance zone, marked by the late June low and early August high.

If Nvidia's share price surpasses this zone on a weekly closing basis by Friday, it could potentially move back towards its June record high of $140.76.

This bullish trend is expected to continue as long as the early August low of $90.69 holds on a weekly closing basis.

However, if the share price falls below this level, a further decline toward the 200-day simple moving average (SMA) at $83.14 and the April low of $75.61 could be possible.