NS Broker Review

Forex brokers are essential for anyone looking to trade in the foreign exchange market. They act as intermediaries, providing traders with access to a platform where they can buy and sell foreign currencies. The importance of choosing the right Forex broker cannot be overstated. A suitable broker not only offers a secure trading environment, but also enhances the overall trading experience through user-friendly platforms, a range of trading instruments, and competitive fees.

NS Broker, an ECN broker incorporated in Malta, distinguishes itself in the crowded Forex market. This company is notable for offering comprehensive access to online trading of CFDs on a wide variety of assets. These include currencies, stocks, indices, cryptocurrencies, energies, and precious metals. What makes NS Broker stand out is its commitment to providing traders with a robust trading platform, coupled with a diverse range of trading options. This versatility is key for traders who seek to diversify their trading portfolio in a dynamic market.

What is NS Broker?

NS Broker is a renowned ECN broker based in Malta, known for its reliable trading services since 2011. Operating under the strict supervision of the Malta Financial Services Authority (MFSA), it upholds high standards of financial integrity and customer protection. This broker is a part of NSFX Ltd., a respected investment firm regulated by five European commissions, ensuring a secure and trustworthy trading environment.

Offering a wide range of trading instruments, NS Broker caters to diverse trading needs. Clients can trade Contract for Differences (CFDs) on various assets such as currencies, stocks, indices, cryptocurrencies, energies, and precious metals. This versatility makes it an attractive option for traders looking to explore different markets. The platform is designed for both new and experienced traders, focusing on ease of use without compromising on advanced features.

Benefits of Trading with NS Broker

After trading with NS Broker, I’ve identified several benefits that stand out. Firstly, their regulation by six different authorities brings a significant level of trust and security to my trading activities. Knowing that they adhere to strict regulatory standards gives me peace of mind about the safety of my investments.

Another notable benefit is the absence of deposit and withdrawal fees. This feature of NS Broker makes managing my trading funds more efficient, as I don’t lose a portion of my capital to transaction fees. Additionally, the availability of a diverse range of trading instruments, including CFDs on various asset classes like currencies, stocks, and cryptocurrencies, offers me the flexibility to diversify my trading portfolio.

Lastly, the ECN network trade execution provided by NS Broker ensures that my trades are processed swiftly and efficiently. This is particularly important in the fast-paced world of Forex trading, where even a small delay can impact the outcome of a trade. The combination of these benefits makes NS Broker a compelling option for traders seeking a reliable and versatile trading platform.

NS Broker Regulation and Safety

As a seasoned Forex trader, I’ve found that understanding a broker’s regulation and safety is crucial. NS Broker, managed by NSFX Ltd., is strictly regulated by the Malta Financial Services Authority (MFSA). This regulation is important because the MFSA rigorously oversees the broker’s operations, ensuring transparency in financial and accounting reporting. Trading with a broker under such stringent oversight gives me confidence in the security of my investments.

Another key aspect of NS Broker’s commitment to trader safety is the segregation of funds. This means that all trader funds are kept separate from the company’s own funds, stored in independent bank accounts. This segregation is vital for protecting traders’ capital, especially in the unlikely event of the company facing financial difficulties. Additionally, NS Broker offers negative balance protection, which is a significant safety feature. It ensures that as a trader, I won’t lose more money than what’s in my trading account, which is a crucial safeguard in the volatile world of Forex trading.

Compliance with the Markets in Financial Instruments Directive (MiFID) is another assurance of NS Broker’s safety standards. The MiFID sets high standards for financial instruments and investor protection within the European Union. Knowing that NS Broker adheres to these standards adds an extra layer of trust and security for me as a trader. This information, gathered from my own trading experience with the broker, highlights why every trader should consider a broker’s regulatory and safety measures before investing.

NS Broker Pros and Cons

Pros

- Low spreads starting from 0.3 pips

- Diverse CFD trading options

- No fees for deposit or withdrawal

- Regulated by six authorities

- Up to 100 multi-currency accounts

- Quotes from top liquidity providers

- ECN network trade execution

Cons

- Restricted to MetaTrader 5 platform

- Limited to only ECN accounts

- Absence of investment programs

NS Broker Customer Reviews

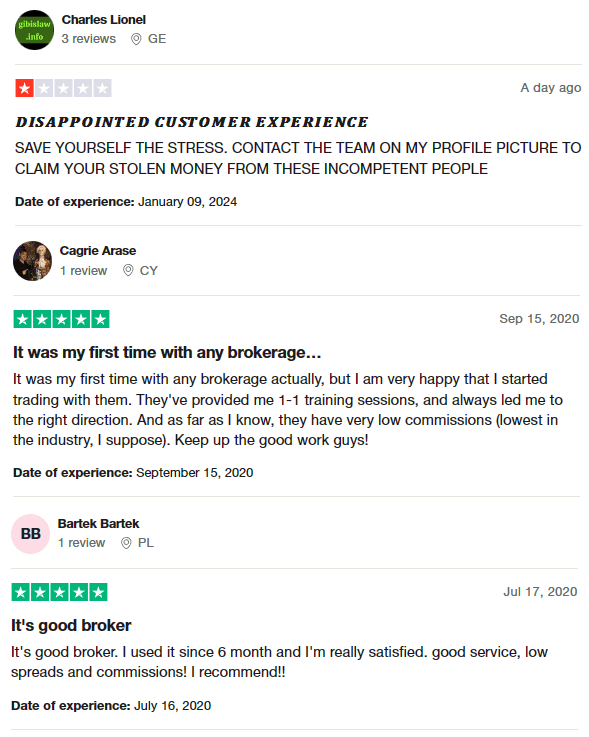

NS Broker, with its current 2.5-star rating on Trustpilot, elicits mixed reactions from customers. Some users express significant dissatisfaction, citing issues related to fund management and urging others to seek assistance for recovering what they perceive as lost funds. In contrast, other customers share positive experiences, particularly newcomers to brokerage. They appreciate the 1-on-1 training sessions and guidance provided by NS Broker, alongside commendation for low commissions, which some believe to be the lowest in the industry. Long-term users also express satisfaction, highlighting good service, low spreads, and commissions, and even recommend NS Broker based on their half-year experience. This range of reviews reflects a diverse spectrum of user experiences with the broker.

NS Broker Spreads, Fees, and Commissions

Trading with NS Broker, I’ve noticed their straightforward approach to spreads, fees, and commissions, which is quite user-friendly. Firstly, it’s a relief that they don’t charge any fees for depositing or withdrawing funds. This is a significant advantage, as it allows me to manage my funds more effectively without worrying about additional charges.

When it comes to trading commissions, NS Broker primarily uses a spread-based system. The spreads are floating, which means they vary depending on the asset and the current market conditions. This flexibility in spread values reflects the real-time dynamics of the market, offering a transparent trading experience.

Additionally, there are specific trading fees to consider. For currency pairs, metals, and energies, NS Broker charges an $8 commission per lot, which is a standard practice in the industry. For index and stock CFDs, the fee structure includes a commission of 0.05% of the trade value in addition to the spread. Trading cryptocurrencies incurs a commission of 0.5% of the trade value. These fees are relatively competitive and are an important factor to consider when calculating potential profits.

Lastly, NS Broker implements swaps, which are commissions charged for rolling over a position to the following day. This is a common practice in Forex trading and something to keep in mind for traders who hold positions overnight.

Account Types

Having tested the account types offered by NS Broker, I found their structure straightforward and accommodating for different trading styles. Here’s a breakdown of what they offer:

Real Account:

- Type: Single ECN account for both retail and professional trading.

- Currency Options: Accounts can be opened in three currencies – USD, EUR, GBP.

- Number of Accounts: Each client can open up to 100 trading accounts.

- Minimum Deposit: $250.

- Spreads: Floating, starting from 0.3 pips for EUR/USD.

- Commission: $4 for opening a position and $4 for closing it, applicable to currencies, metals, and energies.

- Leverage:

- Currency Pairs: Up to 1:30 for retail traders and up to 1:100 for professional traders.

- Gold, Silver, Oil, and Indices: Maximum leverage of 1:20.

- Stocks: Maximum leverage of 1:5.

- Cryptocurrencies: Maximum leverage of 1:2.

This single real account approach by NS Broker is quite efficient. It simplifies the process for traders who want to manage multiple trading activities under one account type. The flexibility to open up to 100 accounts in different currencies also caters to diverse trading needs and strategies.

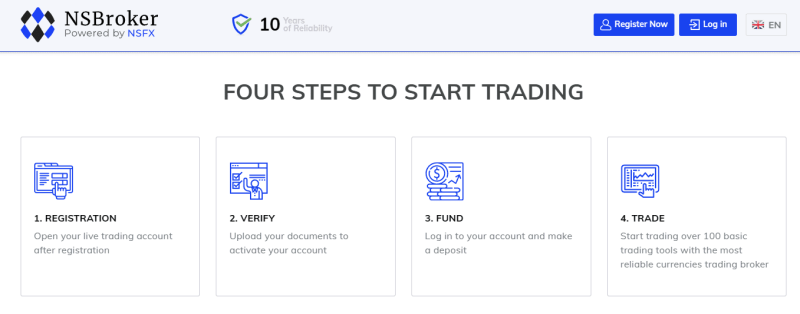

How to Open Your Account

- To open an account with NS Broker, start by visiting their official website.

- On any page of the website, find and click the ‘Open an Account’ button located in the upper right part.

- A registration form will appear; fill it out with your first name, last name, country, phone number, and email.

- Create a reliable password and choose your account currency from USD, EUR, or GBP.

- Tick the box to confirm you have reviewed and accept the official conditions.

- Click on the ‘Register’ button to complete the registration process.

- After registering, log in to your Personal Account using your email and the password you created.

- Within your Personal Account, the first step is to upload the necessary verification documents.

- Next, you can open a new trading account.

- Once your account is set up, you can proceed to make a deposit.

- Follow these steps systematically to ensure a smooth account setup with NS Broker.

NS Broker Trading Platforms

Based on my experience, NS Broker provides a singular but versatile trading platform, MetaTrader 5 (MT5). This platform is available in various formats including desktop, mobile, and web versions, catering to different trading preferences and styles. The accessibility of MT5 across multiple devices ensures that traders can monitor and execute trades from anywhere at any time.

MetaTrader 5 stands out due to its advanced technical capabilities. It supports 21 different timeframes for charts, offering detailed analysis options for traders. Additionally, the platform boasts over 50 adjustable indicators and 40 drawing tools, making it highly customizable for technical analysis. These features are particularly beneficial for traders who rely on in-depth charting and analysis for their trading decisions.

What Can You Trade on NS Broker

Based on my personal experience, NS Broker offers a diverse range of trading instruments, catering to various interests and strategies. One of the primary offerings is the Contract for Differences (CFDs) on currencies. This allows traders to speculate on the price movements of different currency pairs, which is ideal for those interested in the dynamic forex market.

In addition to currencies, NS Broker provides the opportunity to trade CFDs on stocks. This is perfect for traders looking to tap into the stock market without owning the actual shares. They also offer CFDs on precious metals, appealing to those who wish to trade on gold, silver, and other metals as a hedge or investment.

Furthermore, NS Broker includes CFDs on indices and energies, enabling traders to speculate on broader market trends and energy commodities like oil and gas. Lastly, the platform caters to the growing interest in digital assets by offering CFDs on various cryptocurrencies. This variety of trading instruments makes NS Broker a versatile platform, suitable for traders with diverse interests in the financial markets.

NS Broker Customer Support

Based on my experience, NS Broker’s customer support system is both efficient and user-friendly, catering to different preferences for assistance. One of the most direct ways to get support is through the phone numbers provided in the ‘Contact Us’ section. This option is particularly helpful for addressing immediate and complex queries, allowing for a detailed and personal interaction with their support team.

For those seeking quicker responses, the online chat feature on NS Broker’s website and within the Personal Account is incredibly convenient. I found this method especially useful for urgent issues that needed prompt attention. The chat service is responsive, providing real-time assistance without the need to navigate away from the trading platform.

Additionally, for less urgent matters, NS Broker offers a feedback form on their website. This option is suitable for inquiries that don’t require immediate attention, allowing clients to submit their questions or concerns at their convenience.

Advantages and Disadvantages of NS Broker Customer Support

Withdrawal Options and Fees

In my experience with NS Broker, their withdrawal process is both efficient and user-friendly. The financial department processes withdrawal requests within one working day, which is quite prompt compared to some other brokers. This speed in processing ensures that I can access my funds without unnecessary delays.

For withdrawals, NS Broker offers several options. I can choose to withdraw my funds to either Visa or Mastercard debit/credit cards, directly to a bank account, or to electronic wallets like Neteller and Skrill. This range of options provides flexibility depending on my preference or the urgency of the withdrawal.

Regarding the timeframe for crediting funds, it varies by method. Wire transfers can take up to two working days, while withdrawals to cards and electronic payment systems (EPS) like Neteller and Skrill are usually completed within one working day. One significant advantage is that NS Broker does not charge any withdrawal fee. However, it’s important to note that Skrill and Neteller impose a 2.9% fee. The fees for wire transfers and card withdrawals depend on the respective financial institutions. Moreover, I can withdraw money in three major currencies: US dollars, Euros, and British pounds, which adds to the convenience.

NS Broker Vs Other Brokers

#1. NS Broker vs AvaTrade

NS Broker and AvaTrade both offer comprehensive Forex and CFD trading services, but they cater to different trader needs. AvaTrade, established in 2006, boasts a larger customer base with over 300,000 registered clients and offers a wider range of financial instruments (over 1,250). It’s heavily regulated and has a global presence with multiple offices. NS Broker, on the other hand, focuses on providing a streamlined trading experience with its ECN account model and is regulated by six authorities.

Verdict: AvaTrade may be more suitable for traders seeking a broader range of instruments and global market access. NS Broker is better for those who prefer a more focused and regulated ECN trading environment.

#2. NS Broker vs RoboForex

RoboForex, operating since 2009, offers a diverse range of trading platforms and more than 12,000 trading options. It caters to a wide array of traders, regardless of their experience or investment level, and is known for its advanced technologies and personalized terms. NS Broker, with its singular focus on MetaTrader 5 and emphasis on ECN trading, provides a more specialized trading environment.

Verdict: RoboForex is preferable for traders seeking variety in trading platforms and a vast array of trading options. NS Broker is more suited for traders who value a streamlined, MetaTrader 5-based ECN trading experience.

#3. NS Broker vs Exness

Exness, started in 2008, offers a high trading volume and a wide array of CFDs including over 120 currency pairings. Known for its low commissions, immediate order execution, and infinite leverage for small deposits, Exness caters to both new and experienced traders with its varied account options. NS Broker, with its focus on no deposit/withdrawal fees and a secure ECN trading environment, offers a more specialized service.

Verdict: Exness is ideal for traders who value a wide range of currency options and flexible leverage. NS Broker is better suited for traders looking for a reliable ECN trading environment without deposit and withdrawal fees.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH NS BROKER

Conclusion: NS Broker Review

Based on my insights and user feedback, NS Broker emerges as a competent choice in the Forex and CFD trading landscape, particularly for those who prioritize a streamlined and regulated trading environment. The broker’s adherence to strict regulatory standards and its offering of a diverse range of trading instruments, including currencies, stocks, and cryptocurrencies, are significant advantages. Additionally, its commitment to providing a secure ECN trading platform, along with the flexibility of up to 100 multi-currency accounts, enhances its appeal to a broad spectrum of traders.

However, potential clients should be aware of certain limitations. NS Broker’s focus on a single platform, MetaTrader 5, might restrict traders who prefer platform diversity. Also, the absence of investment programs and social media engagement are notable drawbacks. While NS Broker offers many benefits, such as no deposit/withdrawal fees and competitive spreads, these advantages should be weighed against the constraints.

Also Read: RoboForex Review 2024 – Expert Trader Insights

NS Broker Review: FAQs

Does NS Broker charge deposit or withdrawal fees?

No, NS Broker does not charge any fees for deposits or withdrawals, which is a significant advantage for traders looking to manage their funds efficiently.

What types of trading instruments are available with NS Broker?

NS Broker offers a wide range of trading instruments, including CFDs on currencies, stocks, precious metals, indices, energies, and cryptocurrencies, catering to a diverse set of trading interests.

Is NS Broker regulated?

Yes, NS Broker is regulated by six authorities, ensuring a high standard of financial integrity and customer protection in its trading environment.

OPEN AN ACCOUNT NOW WITH NS BROKER AND GET YOUR BONUS