Noor CM Review

A proprietary trading company called Noor CM gives users access to large money and advantageous profit-sharing schemes. Their ability to access a wide range of tradable assets, such as equities, and FX, attracts clients using a variety of methods.

The company’s risk management guidelines are transparent, giving users a controlled setting in which to develop their abilities and efficiently manage risk.

For its funded accounts, the company offers reasonable pricing that is suitable for both new and seasoned users. Transparency is another key component of Noor CM, as it enables customers to monitor their performance through real-time analytics.

For customers looking for a dependable funded trading account platform, Noor CM is a great option because of its numerous financing options and Kuwait stock exchange.

Apart from its extensive funding programs, Noor CM is distinguished by its easy-to-use platform and effective customer service. The site is simple to use, allowing users to place trades and access learning materials to improve their trading expertise.

Because of the company’s dedication to ongoing development, users are given the resources they need to remain competitive in the quick-paced trading industry.

What is Noor CM?

Noor CM is a proprietary trading company that lets customers trade without putting their own money at risk by giving them funded assets. This makes it a good choice for users who want to try new things. Noor CM has competitive profit-sharing plans that help both new and experienced clients grow their Noor CM account and make the most money possible.

The company is dedicated to openness and easy-to-use services, giving clients the chance to track success in real time and use powerful risk management tools. Because Noor CM offers funding, help, and flexibility, it is a popular choice among clients who want to trust their proprietary trading partner.

Noor CM Regulation and Safety

Noor CM puts safety and following the rules first so that traders can trade in a safe atmosphere. The company follows strict rules set by regulators to make sure that all of its operations are clear and in line with best practices in the business.

Noor CM not only follows the rules, but also puts in place strong security steps to keep client data and central bank transactions safe. Advanced encryption technologies are used to keep private data safe, so users don’t have to worry about data breaches while they work on their plans.

Noor CM also stresses clear risk management to keep buyers from losing money they don’t need to. The company makes sure that buyers stay within safe limits by setting clear rules and guidelines. This lowers the chance of big financial losses.

Noor CM Pros and Cons

Pros:

- Competitive funding

- Diverse assets

- Profit-sharing

- User-friendly platform

Cons:

- Limited regulation

- High fees

- Strict rules

- No demo accounts

Benefits of Trading with Noor CM

There are a lot of good things about trading with Noor CM, especially for traders who want to get access to bigger capital without losing their own money. The company’s funded accounts are a great way to trade with a lot of money and take advantage of a flexible profit-sharing plan. This lets traders make the most money possible without taking on the usual financial risk that comes with self-funded asset.

Traders can use a variety of trading strategies with Noor CM because it covers many types of assets, such as forex and stocks. Clients can better study markets and make trades with the help of the platform’s advanced tools and resources. This variety, along with the ability to track performance in real time, gives dealers everything they need to be successful.

The company also puts a lot of stress on risk management and gives traders clear guidelines to help them avoid losses. Clients can improve their skills and grow in a safe environment with this structured method and Noor CM’s educational materials. Noor CM gives users a tool that they can trust and that will help them, as well as funding, flexibility, and expert support.

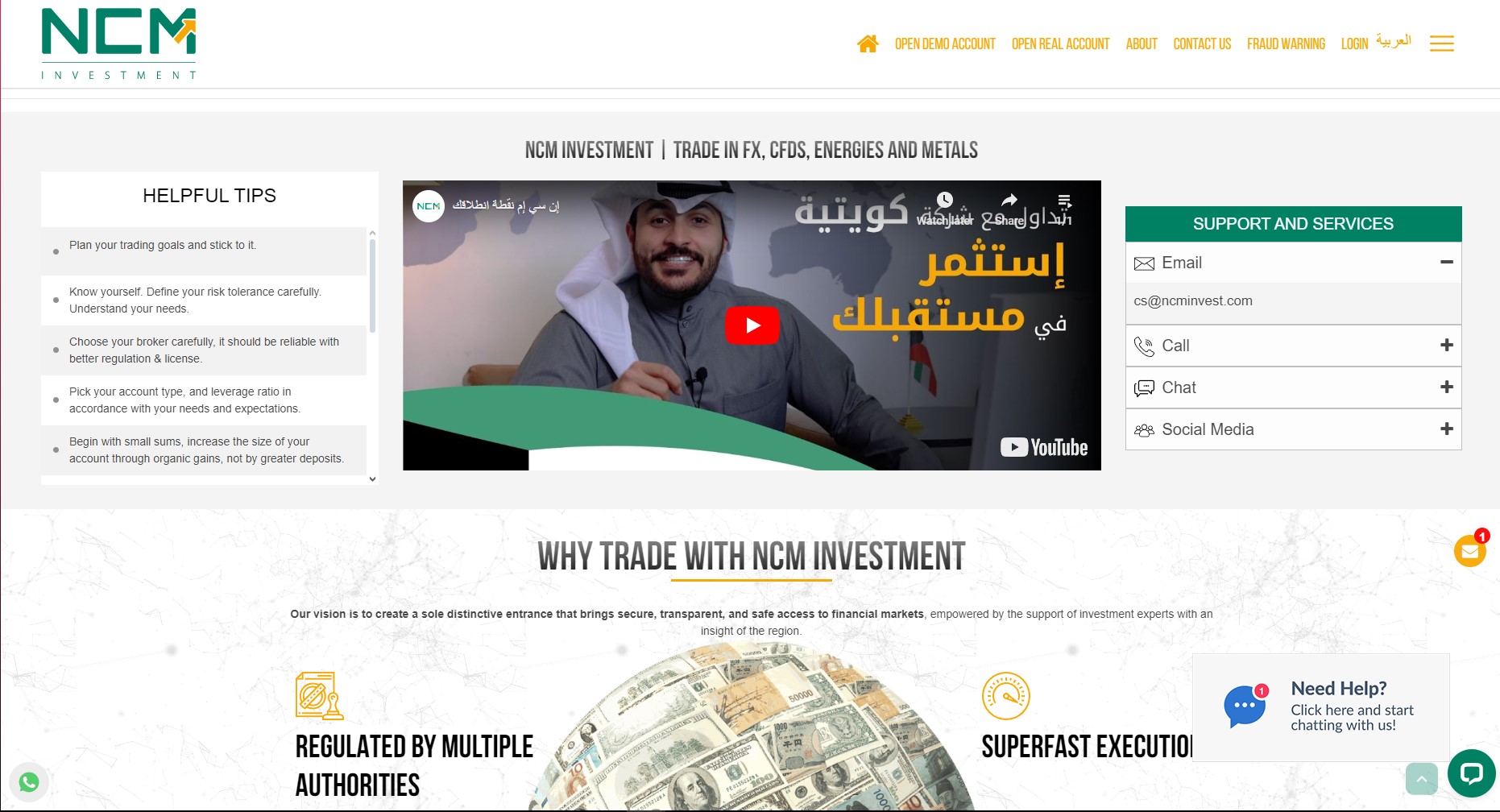

Noor CM Customer Reviews

Customers have said good things about Noor CM, especially about its wide range of funding options, expert advisors, and easy-to-use website. This has helped many traders advance in their jobs. People often say that the company’s profit-sharing plan and wide range of assets, such as forex and commodities, give customers more freedom and opportunities to make money.

Users really like Noor CM’s customer service and educational materials, as well as its funding choices. Many buyers praise how quickly the support team responds and how helpful their advice is. Noor CM is becoming known as a trustworthy proprietary trading company thanks to its platform’s focus on openness, real-time performance tracking, and risk management tools.

Noor CM Spreads, Fees, and Commissions

Spreads at Noor CM are reasonable, which makes it a good choice for traders who want to keep their trading costs as low as possible. The company gives traders access to tight spreads on important forex pairs, and stocks, which means they can make trades for less money. This can be especially helpful for busy users who depend on small changes in prices to make money.

Noor CM keeps its spreads low, but buyers should be aware of other fees, like costs to keep a trading account open and get money out of it. The company also has a profit-sharing plan where traders keep some of their profits and give some back to the company. Even though Noor CM has fees, its clear fee structure and low spreads make it a good choice for customers who want to find a mix between costs and earning potential.

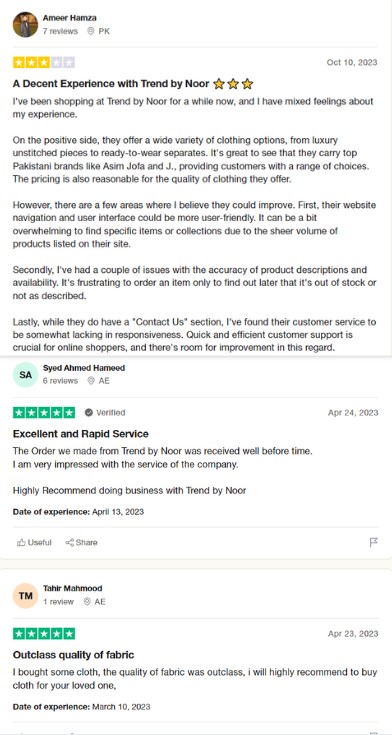

Account Types

Noor CM offers a variety of instrument types designed to cater to different levels of traders.

- Standard Account: Competitive spreads, flexible profit-sharing, ideal for beginner and intermediate traders.

- Pro Account: Tighter spreads, advanced trading tools, suited for experienced traders.

- Funded Account: Access to significant capital with profit-sharing model, no personal fund risk.

- Demo Account: Practice trading with virtual funds, ideal for testing strategies before live trading.

These types give traders the opportunity to grow their capital without risking personal funds.

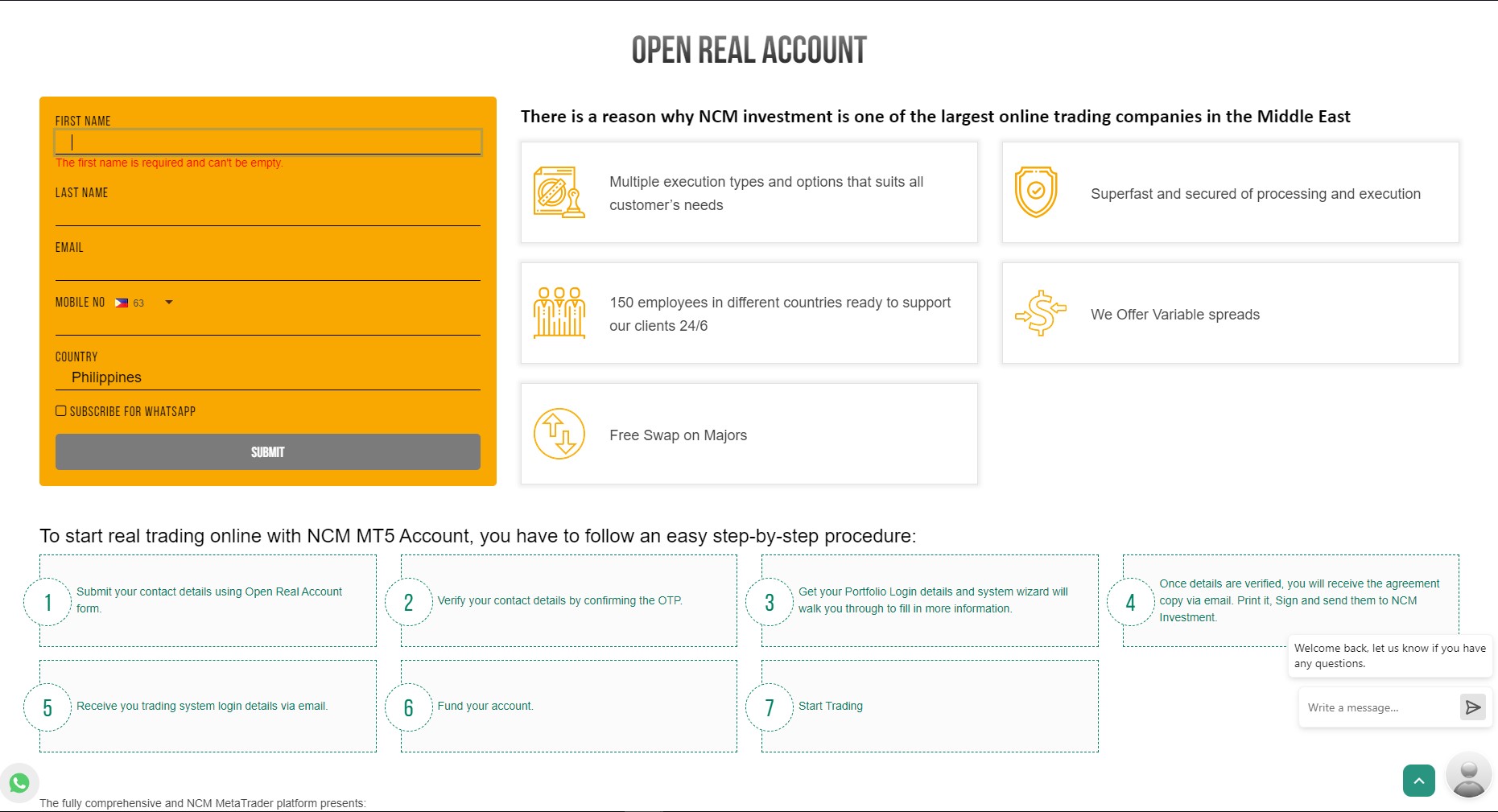

How to Open Your Account

To start trading in Noor Cm and become investors, the users must follow these instructions by:

1. Go to the website for Noor CM: Go to the official Noor CM website and look for the area where you can register an account.

2. Sign Up: Click the “Sign Up” button and enter name, email address, and phone number, among other information asked for.

3. Click “Choose Account Type.” Pick the type that works best, like the Standard Account or the Pro Account.

4. Complete Verification: To meet the rules, upload the name verification documents that are needed, like a valid ID and proof of address.

5. Investing money —either deposit the minimum amount or connect with a funded program to start dealing with Noor CM’s money.

6. Start Trading: Use the trading platform and start making transactions in a number of different asset classes once the account invest.

Noor CM Trading Platforms

Noor CM gives its access to advanced trading tools that are also easy to use. This makes sure that trading goes smoothly. Traders can use the platforms’ real-time data, charts that can be changed, and many basic analysis tools to help them make smart choices.

Noor CM is now using MetaTrader 4 going to Metatrader 5 since January 2023. Traders can easily find their way around the platform and make trades quickly, whether they are dealing forex, or stocks.

Furthermore, Noor CM’s platforms can be accessed from a variety of devices, such as desktop, web, and mobile, so users can handle their accounts and deals from anywhere. Adding more advanced features, such as automated trading and tools for managing risk, makes trade even better.

Noor CM has PC and mobile platform, both new and expert users can use these platforms because they are flexible and have a lot of features.

What Can You Trade on Noor CM

Noor CM lets users choose from many different products to trade, which allows them to diversify their portfolios. Users can get into the forex market and major, minor, and exotic currency pairs at market rates that are competitive based on the market analysis.

Clients can also buy stocks from foreign and financial markets, which lets them bet on some of the most well-known companies in the world.

Noor CM gives clients access to gold, oil, and agricultural goods, in addition to forex and stocks. This lets traders protect their positions or spread out their bets. The platform also has indices, which let users bet on the success of whole financial markets instead of just one stock.

Noor CM is a great choice for buyers who want to find a wide range of opportunities because it offers a wide range of assets.

Noor CM Customer Support

Noor CM has quick and dependable customer service provider to make sure buyers can get help whenever they need it. The customer service team can be reached by phone, email, and live chat, so buyers can quickly get any problems or questions solved. Clients like how quickly they respond and how informed the staff is. They can answer questions about both technical issues and their accounts.

Noor CM offers real-time support as well as an extensive Frequently Asked Questions (FAQ) section and educational materials to help users get around the site on their own. The company is dedicated to providing excellent customer service so that all users , no matter how skilled they are, feel supported at all times. Noor CM has a good reputation as a reliable proprietary trading company in part because it cares about its customers.

Advantages and Disadvantages of Noor CM Customer Support

Withdrawal Options and Fees

Noor CM gives clients a number of withdrawal choices to make things easy and flexible. Customers can get their money out of the account in a number of different ways, including through bank transfers, e-wallets, and credit or debit cards. Withdrawals are easy to make, and most requests are handled within a few working days.

Noor CM makes sure that withdrawals go smoothly, but buyers should be aware of the fees that come with them. Transaction fees or currency conversion fees may be charged for some withdrawal methods, based on where the trader is located and the payment method used. Even with these fees, Noor CM is still open about its costs and tells buyers exactly what fees they need to pay.

Noor CM Vs Other Brokers

#1. Noor CM vs AvaTrade

There are a lot of good trading platforms out there, but Noor CM and AvaTrade are for different types of buyers. Noor CM focuses on private trading and gives clients access to a lot of money through funded accounts and a model where they share profits. If you’re looking for a traditional broker, AvaTrade is not one of them. It deals in a bigger range of assets, such as cryptocurrencies, and has a lot of educational materials for both new and experienced users.

Noor CM’s user-friendly interface focuses on simplicity and speed when it comes to trading platforms. AvaTrade, on the other hand, offers a number of platforms, including MetaTrader 4, MetaTrader 5, and its own platform, AvaTradeGO. While Noor CM is great for users who want paid accounts, AvaTrade is better because it has more trading tools and assets, making it a better choice for clients with different trading strategies.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

#2. Noor CM vs RoboForex

RoboForex and Noor CM are two different trading platforms. Noor CM focuses on proprietary trading and gives customers access to funded accounts through a plan where users share profits. Because of this, Noor CM is perfect for customers who want to trade more without putting their own money at risk. RoboForex, on the other hand, is a traditional forex that is known for its low-cost dealing. It has tight spreads and different account types, so it can be used by both new and experienced clients.

Through its sponsored programs, Noor CM focuses on risk management and capital growth. RoboForex, on the other hand, offers more trading platforms, such as MetaTrader 4, MetaTrader 5, and cTrader, as well as extra tools like copy trading. RoboForex is interesting to users who want to trade in a lot of different markets because it offers a wide range of assets, such as cryptocurrencies. But Noor CM’s funded account structure is great for clients who want to improve their skills and get access to outside cash.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. Noor CM vs Exness

Noor CM and Exness are two different ways to trade. Noor CM focuses on proprietary trading and gives users funded accounts so they can trade without risking their own money. Because of this, Noor CM is a great choice for users who want to grow their business using a profit-sharing plan. A standard broker like Exness gives clients more account types and flexible leverage options, which makes it a popular choice for small users who want to make their trading conditions fit their needs.

Noor CM works on making things easy and helping businesses grow through capital funding. Exness, on the other hand, offers a wider range of assets, such as forex, cryptocurrencies, and commodities. The company is also known for having low trading fees and a quick payout process, which makes it appealing to high-frequency customers. Noor CM might be better for users looking for funded opportunities, while Exness might be better for those who want a standard broker with a lot of flexible features.

Also Read: Exness Review 2024 – Expert Trader Insights

Conclusion: Noor CM Review

To sum up, Noor CM is a great option for broker who want to get access to a lot of capital through its own trading plan. The firm’s profit-sharing system lets dealer grow their accounts without putting their own money at risk. This makes it perfect for users of all levels, from beginners to experts. Noor CM’s attention on risk management and wide range of assets, such as forex and commodities, make it even more appealing.

Noor CM may have some problems with regulation and trading fees, but its platform is easy to use and offers a lot of help, which makes it a good choice for dealer who want to grow their businesses. Noor CM is a one-of-a-kind chance for people who want to do well in the tough world of trading because it offers funded accounts and a helpful environment.

Noor CM Review: FAQs

Is the Noor CM subject to regulation?

In comparison to certain traditional brokers, Noor CM is subject to a lower level of regulation, despite the fact that it works in a transparent manner and follows the best practices in the business. When looking for additional information, clients should look over the policies and terms of the company.

What assets can I trade on Noor CM?

Noor CM offers a variety of assets, including forex, stocks, commodities, and indices, allowing users to diversify their strategies.

Which payments are related to using the Noor CM service?

In addition to its profit-sharing model, Noor CM takes a number of costs into consideration, such as fees for withdrawals and fees for account maintenance. The precise fees change depending on the type of account and the services that are utilized.

OPEN AN ACCOUNT NOW WITH NOOR CM AND GET YOUR BONUS