Noble Trading Review

In this Noble Trading review, the article will help traders decide whether Noble Trading fits their trading style, this review will look at its salient features—including fees, platform choices, and customer service—in order.

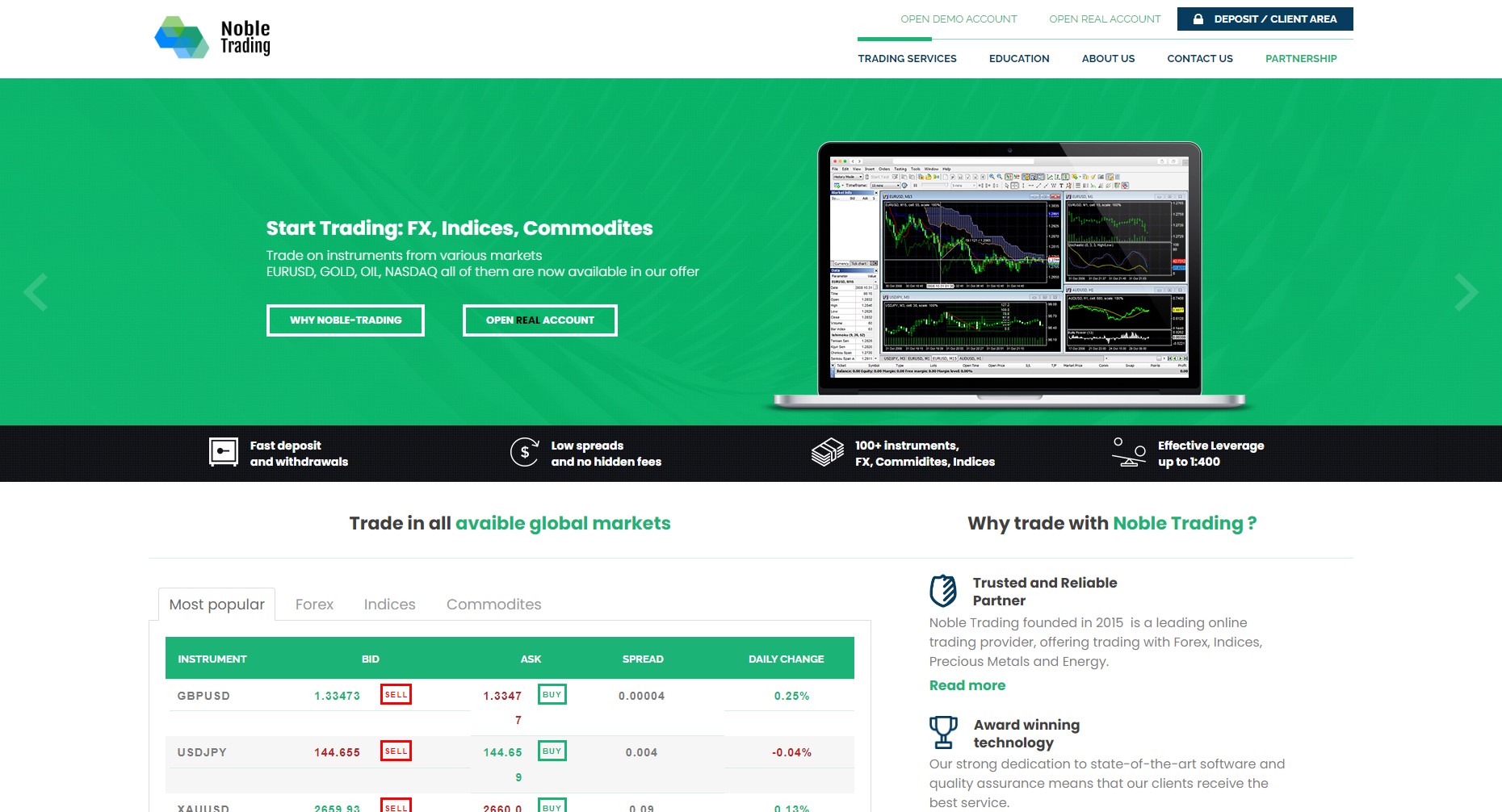

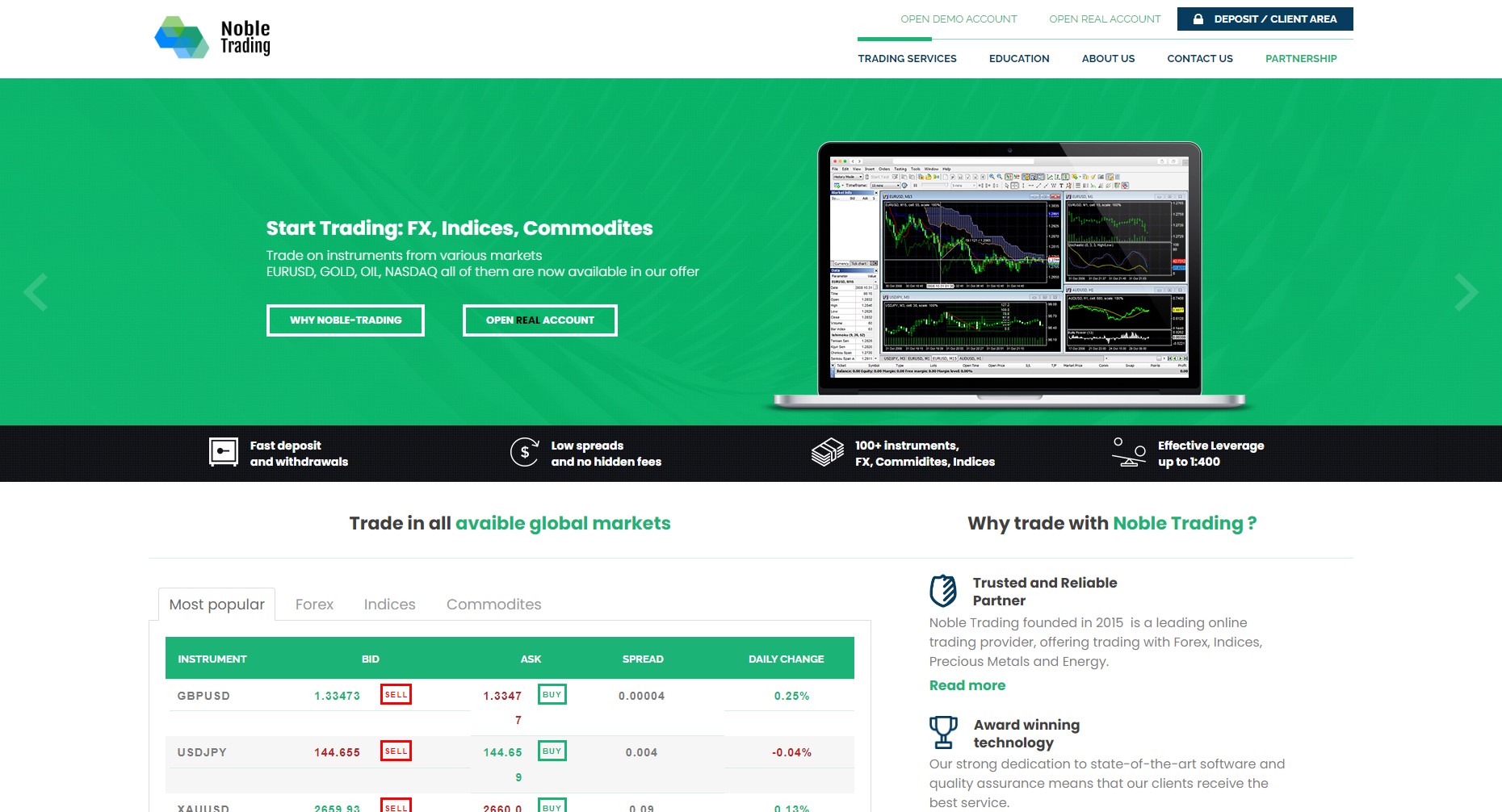

Well-known forex trading and CFD broker Noble Trading provides traders access to a range of products including equities, commodities, and FX pairs. Both novice and expert traders looking for a simple trading environment find the forex broker intriguing because of its competitive spreads and support of MetaTrader 4.

What is Noble Trading?

Forex trading and CFD broker Noble Trading lets users trade several financial assets like equities, commodities, and currencies. Accessible for both beginner and seasoned traders, the platform provides competitive spreads and includes well-known tools like MetaTrader 4.

To assist consumers with their forex trading experience, the forex broker providing manual and also offers customer service and instructional tools. Traders should be advised, though, of various fees for withdrawals and account inactivity.

Noble Trading Regulation and Safety

Under the direction of acknowledged financial authorities, Noble Trading makes sure it complies with industry standards to safeguard its consumers. The forex broker provides traders with a safe atmosphere for their transactions by means of encryption technology, therefore safeguarding personal and financial data.

Although the broker looks at user safety, traders should always confirm the particular regulatory status of the broker in their own nation. To guarantee further protection, keep updated about any trading hazards and make sure money is maintained in separate accounts.

Noble Trading Pros and Cons

Pros:

- Low spreads

- MetaTrader 4 support

- Educational resources

- 24/7 customer service

Cons:

- Withdrawal fees

- Inactivity fees

- Limited assets

- No U.S. clients

Benefits of Trading with Noble Trading

Low spreads offered by the broker let traders enter and leave transactions more economically in forex trading. Appropriate for both new and experienced traders, the Noble Trading offers MetaTrader 4, a generally-used program renowned for dependability and user-friendly features.

Furthermore, Noble Trading provides trading instruments to enable customers to raise their trading ability. By use of 24/7 customer support, traders can conveniently receive assistance anytime they require it.

Noble Trading Customer Reviews

It has cheap spreads and user-friendly trading instruments systems—like MetaTrader 4—usually appeal to customers. Particularly beginners, many traders find the instructional materials useful in sharpening their trade techniques.

Some consumers have expressed worries about the broker's inactivity and withdrawal fees, though. The broker's 24/7 customer service is rated as overall good since it offers quick help when needed.

Noble Trading Spreads, Fees, and Commissions

Noble Trading has low spreads, which can help buyers keep their costs as low as possible. The spreads aren't the same for every product, but they are generally competitive with some brokers in the market.

There are, however, fees for withdrawals and inactivity that traders should be aware of. These can add to the total cost of trading. Noble Trading doesn't charge fees for most trades, which makes it a good choice for sellers who do a lot of business.

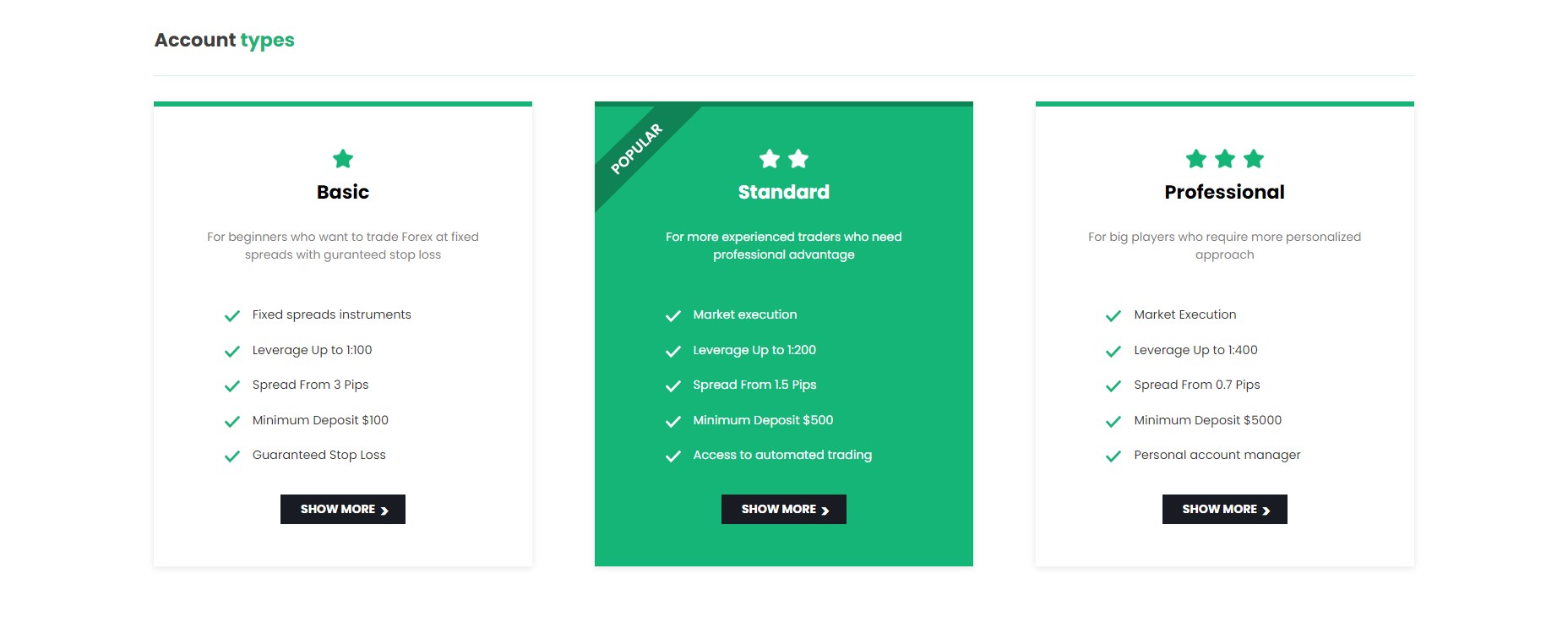

Account Types

Here are the trading accounts that Noble Trading offers:

Basic Account: This basic account is for people who are just starting out in trading. It comes with minimum deposit low spreads, trading tools, and basic training materials. This is a great way for basic account holders to start with a small deposit. Basic accounts offer leverage than is enough for traders who's starting.

Standard Account: The Standard account gives you access to a bigger range of trading instruments and better spreads than basic account, among other advanced trading platforms and features. It works well for traders with some experience who want more freedom with minimum deposit.

Professional Account: Traders with more experience can use this trading account type, which has even lower spreads, personalized help, and special trading tools. The minimum deposit for professional account holders is bigger than for the Basic and Standard accounts.

Demo Account: Noble Trading also lets new buyers practice trading with fake money by giving them a Demo Account. It lets users practice dealing with fake money, which helps them feel more confident before they open a real account without any minimum deposit.

All of these Noble Trading accounts are in the same trading platforms so the users and customers shouldn't worry about the market. Professional account is recommended for expert traders in the market. The accounts has its own personal account manager.

How to Open Your Account

Here are the steps for account opening process:

Visit the Website: Go to the official Noble Trading website and click on the “Open an Account” button.

Complete Registration: Fill out the online registration form with personal details such as your name, email, and phone number.

Verify Identity: Upload the required identification documents like a government-issued ID and proof of address for account verification.

Choose Account Types: Select the account type that suits your trading needs, whether it's Basic, Standard, Premium, or VIP.

Fund Your Account: Make an minimum deposit using your preferred payment method to fund your trading account.

Start Trading: Once you open an account is verified and funded, you can start online trading on the Noble Trading platform.

Noble Trading Trading Platforms

Noble Trading gives users access to the MetaTrader 4 (MT4) platform, which is a popular choice because it is easy to use and has a lot of advanced trading tools. MT4 is good for both new and experienced traders because it has features like real-time market data, charts that can be customized, and automated trading through expert advisers.

Noble Trading may offer a web-based tool in addition to MT4 and also a mobile platform for mobile traders. This would let traders access their accounts from any device without having to download software. These platforms give traders the freedom and trust they need to make smart trading choices.

What Can You Trade on Noble Trading

Noble Trading has many different kinds of financial tools, such as forex pairs, which let traders buy and sell different currencies. Stocks, which let traders buy in well-known companies, and commodities like gold, oil, and silver are also available to traders.

It also gives buyers access to indices and cryptocurrencies, which helps them spread out their holdings. Because of this, it's a useful tool for traders who are interested in a range of markets.

Noble Trading Customer Support

Noble Trading has customer service available 24 hours a day, seven days a week. Traders can get help through live chat, email, or the phone. Traders who need help quickly and are in different time zones will find this service very useful.

The customer support team is there to help, but they also have a help center with Frequently Asked Questions (FAQs) and tips to help users fix common problems on their own. This helps traders get back to work right away by making it easy for them to find solutions.

Advantages and Disadvantages of Noble Trading Customer Support

Withdrawal Options and Fees

There are a number of ways to receive money, such as bank transfers if the users has bank account, credit/debit cards, and e-wallets. This gives traders a choice in how they want to get their money, can also be used in minimum deposit processes. The time it takes to process each way is different, but is usually between 1 and 5 business days.

Noble Trading offers a number of ways to withdraw money, but buyers should be aware of the fees that may be charged. These fees change depending on how you pay and can change how much the whole thing costs.

Traders should look over Noble Trading's website's transaction terms to make sure they don't get hit with fees or delays when they try to get their money. These costs can be kept to a minimum with good planning.

Noble Trading Vs Other Brokers

#1. Noble Trading vs AvaTrade

You can trade a lot of different financial products with Noble Trading and AvaTrade. These include forex, stocks, and commodities. AvaTrade, on the other hand, stands out because it lets you trade cryptocurrencies, while Noble Trading is more focused on offering competitive spreads and an easy-to-use platform for dealing traditional assets.

Both brokers offer MetaTrader 4 (MT4) as a trading tool, but AvaTrade also has other platforms, such as AvaOptions, for more experienced traders. Noble Trading, on the other hand, makes MT4 easy to use, which makes it perfect for people who are just starting out.

Traders should be aware that Noble Trading charges fees for withdrawals and fees for accounts that are not used for a certain amount of time. AvaTrade does charge some fees, but its price is known for being clear, which helps traders know what their costs are right away.

#2. Noble Trading vs RoboForex

Noble Trading and RoboForex both let you trade in different things, like forex, stocks, and commodities. More experienced traders may like RoboForex's bigger range of account types and copy trading options. Noble Trading, on the other hand, focuses on low spreads and easy access to popular trading platforms like MetaTrader 4.

Platform-wise, both banks offer MetaTrader 4, but RoboForex also has cTrader, which is known for having more advanced features and faster execution times. However, Noble Trading is still better for users who like a simple platform experience.

As for fees, Noble Trading charges fees for both withdrawals and inaction, which traders should think about. RoboForex also charges fees, but it also has cashback programs and perks that could save traders money.

#3. Noble Trading vs Exness

Many traders are interested in Noble Trading and Exness because they both let you trade forex, stocks, and commodities. Noble Trading focuses on low spreads and an easy-to-use platform. Exness, on the other hand, stands out because it offers unlimited leverage, which may draw traders who are willing to take on more risk.

Both of the brokers offer MetaTrader 4, but Exness also offers MetaTrader 5, which has more powerful trading tools and features. Noble Trading keeps MetaTrader 4 simple, which makes it better for people who are just starting to trade or who like things to be simple.

Noble Trading charges fees for leaving the account and for not using it for a while, which can raise the cost. Exness, on the other hand, lets you trade without paying any fees and has no fees for withdrawals, so it's a good choice for traders who do it often.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Noble Trading Review

This broker is a trustworthy broker for users who want low spreads and access to well-known platforms like MetaTrader 4. It has a lot of different financial instruments, so both new and expert traders can use it.

But sellers should be aware that fees for withdrawals and not using an account can make their costs go up. Overall, Noble Trading is a good place to trade. They have helpful customer service and learning tools to help people get better.

Noble Trading Review: FAQs

Is Noble Trading regulated?

Yes, it operates under recognized financial regulators to ensure the safety of traders' funds and compliance with industry standards.

What platforms does Noble Trading offer?

It supports MetaTrader 4 (MT4), a widely-used platform known for its user-friendly features and advanced trading tools.

Does Noble Trading offer a demo account?

Yes, it provides a demo account that allows traders to practice with virtual funds before trading with real money.

OPEN AN ACCOUNT NOW WITH NOBLE TRADING AND GET YOUR BONUS