TOGETHER WITH

Today’s edition is sponsored by Tickmill, your trusted gateway to CME & Eurex futures trading. With institutional-grade access, ultra-low latency execution on the CQG platform, and full FCA regulation, Tickmill gives serious traders the tools to go big.

Ready to trade futures like a pro? 🚀 Start with Tickmill today

Hey traders, it’s Ezekiel here with your latest market scoop. Let’s dive into what’s moving the markets and keep you one step ahead.

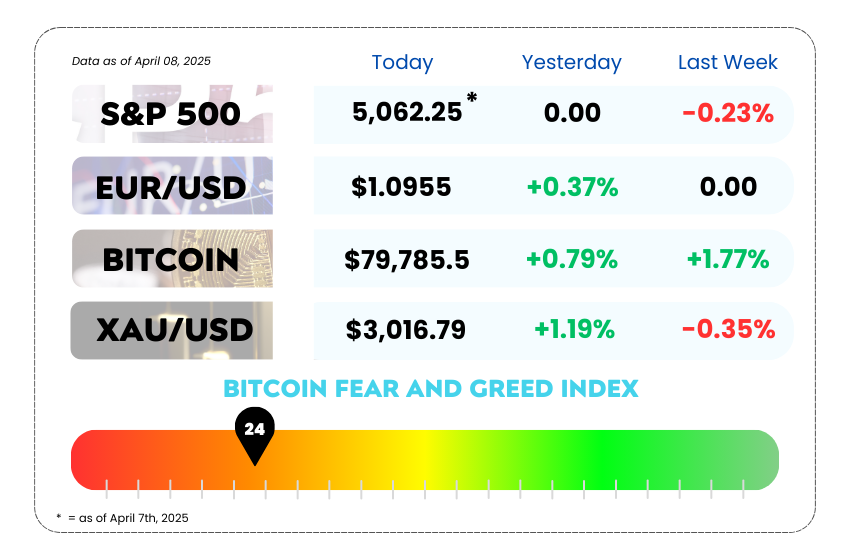

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Dow futures fly after Monday Meltdown, but don’t get too cozy yet

• Gold shakes off a 3-day beating, thanks to Trump’s tariff tantrum

• Discover the price action strategy behind these six-figure trades with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🧨 Wall Street’s Wild Ride: Dow, S&P 500, and Nasdaq Set to Bounce Back 🧨

Markets are looking to shake off a hangover after a chaotic Monday on Wall Street — and early signs say we’re in for a rebound. 📈💥

US stock futures are popping off this morning:

- Dow futures: +2% 🚀

- S&P 500: +1.6%

- Nasdaq 100: +1.4%

Why the optimism after such a rocky start to the week?

Well… investors are doing the financial equivalent of waking up, chugging water, and trying to forget yesterday even happened. 🍾➡️💧

The chaos came after a heated escalation in the US-China trade war, with China throwing down the gauntlet, saying it would “fight to the end” if the US keeps ramping things up. That clapback followed Trump’s threat to hit China with 50% more tariffs if they didn’t back off their own retaliatory moves. 🔥🇺🇸🇨🇳🔥

Monday Recap (aka: What Just Happened?)

- The Dow tanked 350 points 🕳️

- The S&P 500 extended a losing streak that’s starting to look a little too familiar, with comparisons being thrown around to the COVID crash and even 2008. 😬

- The Nasdaq? Yeah… it’s already slipped into bear market territory. 🐻

Dow Jones Industrial Average Index Daily Chart as of April 7th, 2025 (Source: TradingView)

Meanwhile, the White House is tossing out mixed messages like confetti 🎉:

- Treasury Secretary says, “Yay, talks with Japan!” 🇯🇵

- Trump’s trade guy says, “Tariffs aren’t a negotiation tool.”

- Trump himself? “Both can be true.” 🙃

Translation: Nobody really knows what’s going on, but tariffs are coming — and they’re not being paused.

Even the Wall Street big dogs are getting nervous. Jamie Dimon (JPMorgan) and Larry Fink (BlackRock) are waving the red flags 🚩, and even Elon Musk is throwing soft shade at his buddy Trump.

This market whiplash is a trader’s dream (or nightmare 😅), depending on how you play it. Volatility = opportunity, but you have to know your levels and stay sharp. Keep your eye on how Asia reacts overnight, especially if China decides to up the ante. This is macro madness in real-time.

Let the trend be your friend, but don’t forget to check who else is at the party. 🎉📊

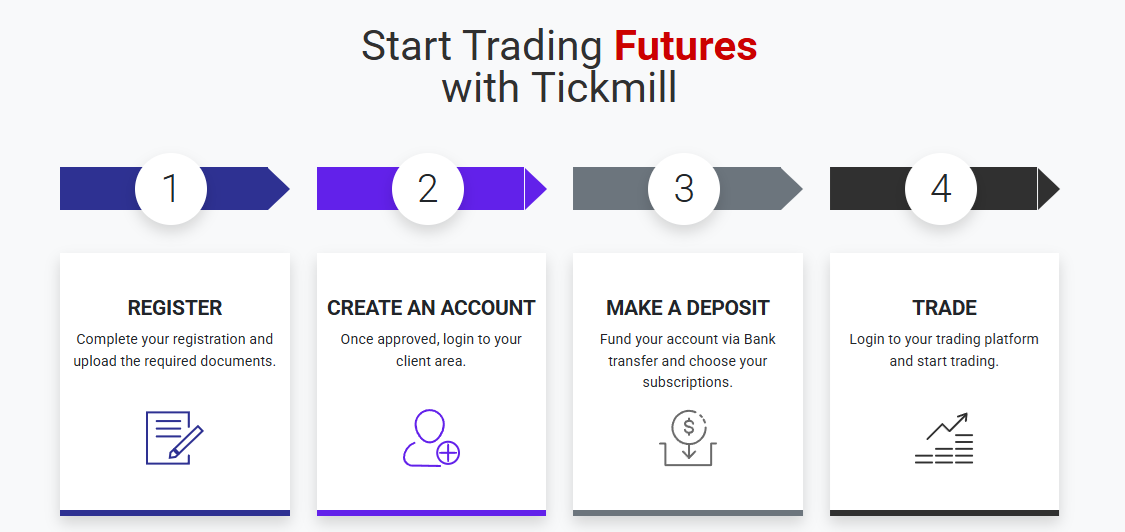

🚀 Trade CME & Eurex Futures Like a Pro with Tickmill 🚀

Looking to level up your futures game? Tickmill gives you direct access to CME and Eurex futures with the tools and conditions serious traders demand.

✅ Regulated by the UK’s FCA — trade with confidence

✅ Institutional-grade market access — deep liquidity, sharp pricing

✅ CQG platform — lightning-fast execution & pro-level tools

✅ Low-cost, transparent trading — no hidden fees, no fluff

✅ Expert support & education — because smart traders never stop learning

Whether you’re hedging, speculating, or just looking to diversify, Tickmill delivers the futures edge you need.

🪙 Gold’s Got Its Groove Back (Kinda) 🪙

Gold just pulled a classic comeback move — like a boxer taking a few hits, then standing back up yelling “You thought I was done?!” 🥊💥

After a rough 3-day slump (we’re talking nearly 5% down — its worst drop since 2021 😵), gold bounced back above $3,000/oz on Tuesday. Why? Because the US-China trade war just escalated again, and investors are once again reaching for the ultimate safe haven: shiny metal. ✨

Here’s the drama fueling the gold train:

- Trump’s heating things up, threatening a 50% tariff hike on Chinese imports 😬

- China clapped back with a “we’ll fight to the end” flex

- Global markets are spooked — like full-on horror movie scream spooked 📉😱

XAU/USD Daily Chart as of April 8th, 2025 (Source: TradingView)

While gold usually thrives during chaos, even it got caught up in the recent market mess. Investors were too busy panic-selling everything to even remember their favorite hedge. But now, with the dust starting to settle (kind of), gold’s finding its footing again.

At 9:00 p.m. in Singapore:

- Gold: +0.76% to $3,004.78 🏆

- Silver: Meh, flat

- Palladium & Platinum: Both up over 1%

- Dollar Index: Dipping a bit 👀

This move is your classic “flight to safety” in action. When trade wars start swinging, smart money starts sprinting, straight into gold. But don’t forget: when the broader market goes haywire, even gold can get sold off temporarily as investors scramble for liquidity.

Key takeaway? Gold still has its swagger, but if you’re trading it, don’t expect a straight line to the moon. Keep an eye on macro news, especially anything involving tariffs, inflation, or dollar strength. That’s where the gold story gets written. 📝📊

MEMES OF THE DAY

Trading psychology: hanging by a thread 🪢🧠

Belief is great. But maybe… risk management is better? 🙃📊