TOGETHER WITH

Today’s edition is brought to you by Markets4you. Markets4you gives you the key to one of the world’s most powerful platforms, MetaTrader 4.

Ready to upgrade your trading setup? 👉 Start with Markets4you

Hey traders! Ezekiel here with your dose of market action (and even more 🔥). Let’s check out what’s stirring things up today:

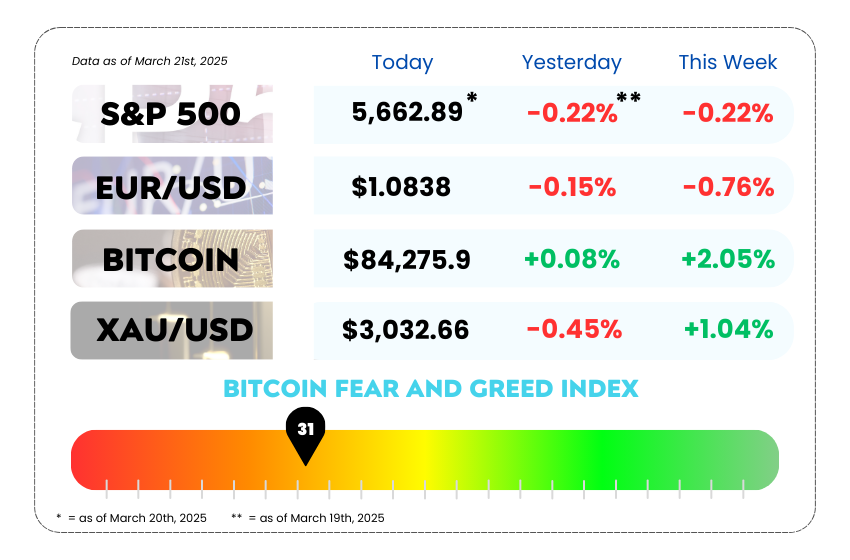

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Wall Street starts cutting jobs as deal drought drags on

• GameStop jumps on Bitcoin news while Dollar Tree stumbles

• How to spot and trade the 3 types of Doji like a pro with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚨 Wall Street’s Got a Case of the Chopping Block Blues 🚨

Things are gettin’ spicy on Wall Street… and not in a good way.

If you’re in investment banking, now might be a really good time to update that LinkedIn profile. 🫣

The TLDR? Layoffs are coming — and not the usual “clean out your desk, Kevin” kind. We’re talkin’ mass cuts if the market doesn’t pick up the pace soon.

Here’s the tea:

- Market chaos (👋 thanks, tariffs and global uncertainty) = 📉 fewer deals

- Fewer deals = 📉 less revenue

- Less revenue = ✂️ layoffs and smaller bonus pools

Major players like JPMorgan and Bank of America have already started trimming the fat, and Goldman Sachs and Morgan Stanley are cueing up the next round of “sorry, it’s not you, it’s our profit margins.”

💬 One analyst said the deal drought isn’t dead, just delayed — but if things don’t bounce back by summer, the axe swings harder.

Meanwhile, boutique banks are holding on like a guy who YOLO’d into Dogecoin in 2021. If the pipeline doesn’t show signs of life, they’re next on the chopping block.

By the Numbers:

- 💸 Investment banking fees dropped 6.3% YoY (ouch)

- 📉 U.S. equity offerings also slid to $57B, down from $69B last year

- 📉 Smaller banks like Evercore and Jefferies are down 22% and 21% YTD

- 😬 Big dogs like JPM and GS are holding steadier (barely)

Even though 2024 bonuses were up (Goldman’s CEO cashed in a cool $39M — not bad for a guy doing layoffs), 2025 might be a whole different story. If revenues don’t rebound, say goodbye to fat bonuses and hello to lean times.

💡 Recruiters say banks are now asking:

“Do we wanna grow… or just survive 2025 without bleeding cash?”

There is still some light: sectors like private credit and tech are holding up. But others — like consumer, industrials, and construction — are on thin ice.

While Wall Street braces for impact, smart traders know that volatility = opportunity. 📊

Whether markets are pumping or dumping, the key is knowing how to ride the waves. Learn to read the signs before the layoffs hit, because while bankers get cut, you could be cashing in.

🟢 Upgrade Your Trading Game with MT4 + Markets4you 🟢

If you’re still out here trading on clunky platforms in 2025… we gotta talk 😅

Markets4you + MetaTrader 4 = chef’s kiss for traders.

Whether you’re just learning the ropes or already flexin’ chart patterns in your sleep, MT4 gives you everything you need to trade smarter:

- 💻 Super clean interface (no more getting lost in tabs)

- 📈 Advanced charting & technical analysis tools

- 🤖 Expert Advisors (aka robots that can trade while you nap)

- 🔒 Secure, fast, and ultra-reliable execution

And with Markets4you, you’re not just using MT4, you’re getting the VIP version. Fast executions, tight spreads, and real-deal support.

👉 Ready to level up your trading game? Markets4you’s MT4 has your back.

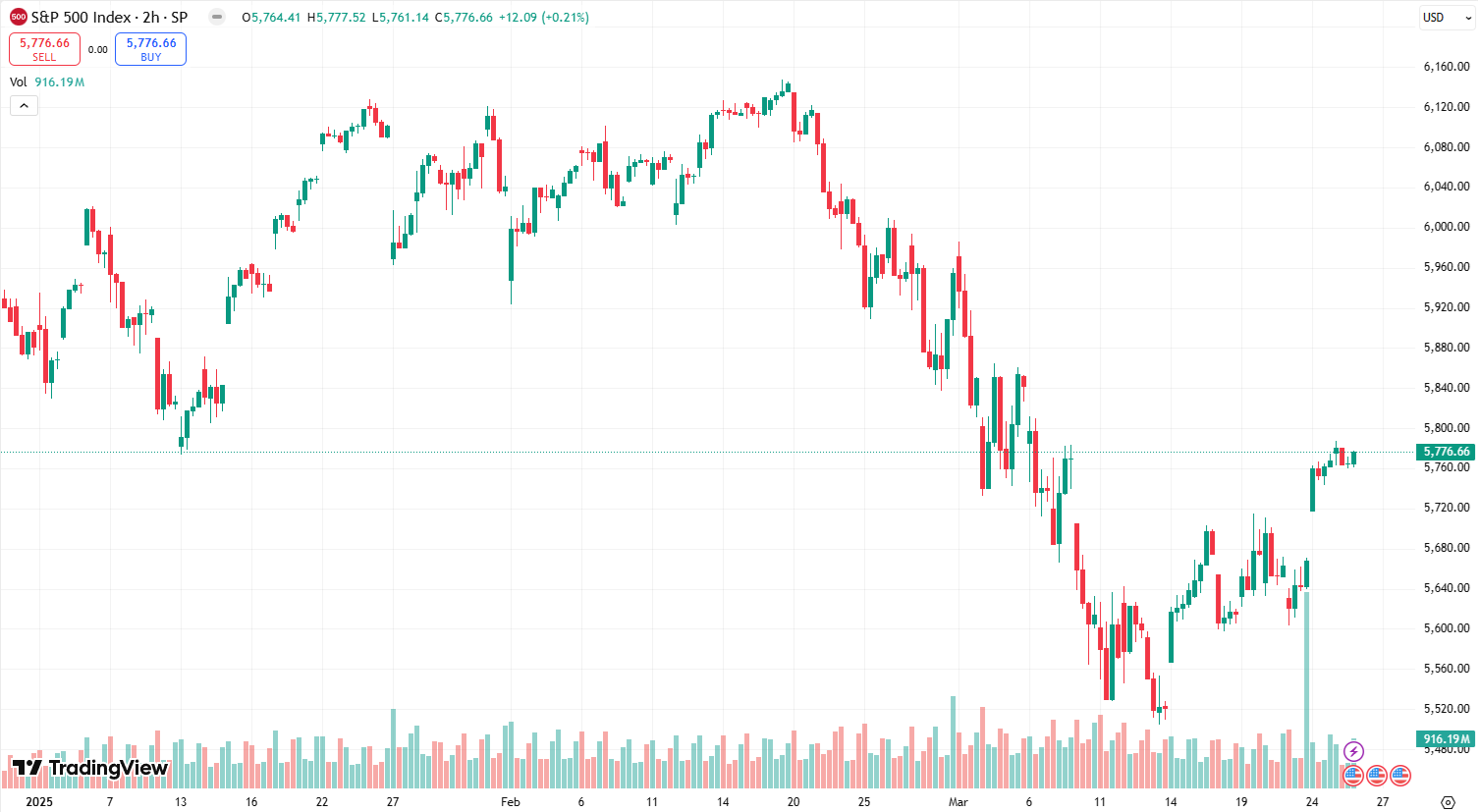

🧊 Markets Hit Pause As Trump Keeps Wall Street Guessing 🧊

Wall Street futures are hitting the brakes — not crashing, not rallying, just… chilling. The Dow, S&P 500, and Nasdaq all held steady Wednesday as investors tried to decode the latest signals out of Washington.

The drama? Once again, it’s all about tariffs.

Markets had been on a bit of a heater, riding a three-day win streak after President Trump seemed to open the door to easing up on tariff threats. That spark of optimism gave stocks a nice little boost.

But things shifted fast. Just a day later, the tone out of D.C. turned colder. The market’s read? The flexibility may be fading, and the hardline stance could be back on the table.

Translation: Investors don’t really know what the play is yet — and that uncertainty is keeping futures in limbo

S&P 500 Daily Chart as of March 26th, 2025 (Source: TradingView)

Copper Prices Spike As Tariff Timeline Speeds Up

While stocks were steady, copper went wild. Word on the street is that the White House might roll out tariffs on copper imports way earlier than expected. The result? A surge in copper prices to record levels.

Traders love a surprise, but only when they’re holding the right bags. And copper holders? They’re definitely vibing right now. 🔥

GameStop Buys Bitcoin, Dollar Tree Dips

Over in corporate land, we’ve got two moves worth watching:

GameStop popped nearly 15% in premarket after announcing it’s getting into Bitcoin. Yup, the OG meme stock just added crypto buyer to its resume. Meme magic is alive and well.

Dollar Tree, on the other hand, saw a short-lived rally after reports it might sell off its Family Dollar business for a cool $1B. But a weak earnings report quickly knocked those gains back down.

The markets are caught in a holding pattern, but that’s exactly where smart traders thrive. Uncertainty = opportunity — if you know how to read between the lines.

At Asia Forex Mentor, we teach traders how to spot what’s really moving the market, not just react to the noise. Tariff tension? Copper chaos? Meme stock madness? It’s all part of the game, and we help you stay two steps ahead.

Now’s the time to sharpen the edge. Let’s trade smart. 💹

MEMES OF THE DAY

Leverage level: 💀

1 pip… just 1 pip 😭📉