TOGETHER WITH

Today’s edition is brought to you by Titan FX – the trading platform built for pros and beginners alike. Whether you’re diving into forex, commodities, or indices, Titan FX has the tools and spreads to keep you ahead of the game.

Hey, traders! Ezekiel here, ready to share the latest market insights (and more

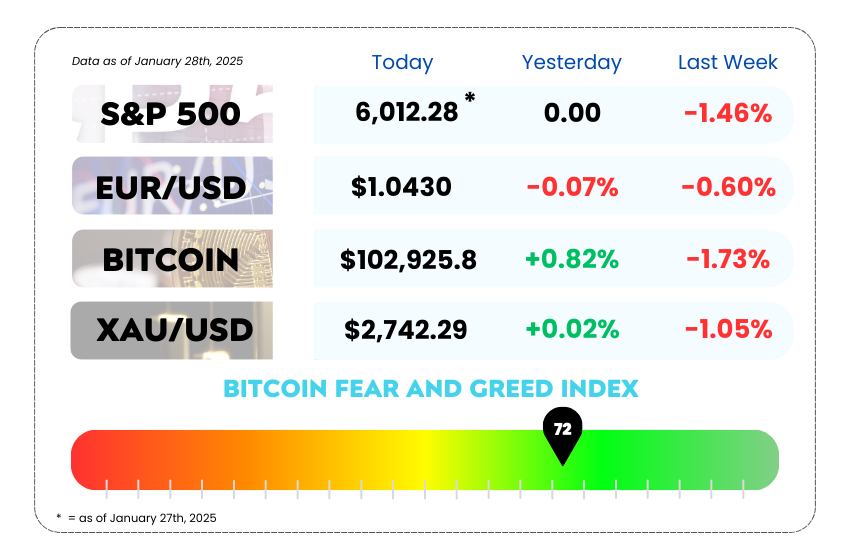

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Trump’s tariff threats boost the dollar, sparking global market jitters

• Wall Street bets on Musk’s future to recover losses from his $13B X debt

• Master the Three Drives Pattern to spot trend reversals and bullish breakouts

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🎯 Dollar Rallies as Tariff Talk Shakes the Markets 💵

The dollar flexed its muscles on Tuesday, hitting new highs as global markets braced for another round of “Trump Tariff Roulette.” 🎰

President Donald Trump hinted at sweeping tariffs on everything from steel to semiconductors, sending the greenback surging while global currencies stumbled. The euro dropped 0.7%, and the yen wasn’t feeling great either, falling nearly 1%.

But wait, there’s more! This isn’t just talk—Trump’s Treasury Secretary, Scott Bessent, seems to be all in on a gradual universal tariff strategy. Rumors suggest he’s starting at a modest 2.5%, but Trump has bigger plans: “Why stop there?” The President hinted at automobile tariffs on Canada and Mexico and suggested tariffs could rise as high as 25%. (Yikes. 🚗🔥)

📉 Global Markets Feel the Heat

The tariff chatter wasn’t just a dollar booster; it shook the bond market too. US Treasuries tumbled, pushing the 10-year yield up to 4.56% after Monday’s rally had briefly sent yields to their lowest point this year.

Adding fuel to the fire was a separate drama in the tech world: a breakthrough in Chinese AI caused a $589 billion selloff in Nvidia stock, raising concerns about US tech dominance. The result? More volatility, less confidence, and a clear runway for the dollar to keep climbing. ✈️

US Dollar Index Daily Chart as of January 28th, 2025 (Source: TradingView)

🔥 Why Tariffs Equal Dollar Strength

Markets see tariffs as a double-edged sword for global trade but a big boost for the dollar. Nick Rees of Monex Europe explained it best: “This raises the prospect of tariffs sticking around and reinforces the credibility of Trump’s trade threats. The dollar thrives in this uncertainty.”

Investors are hedging their bets on Trump keeping US rates high, but there’s some caution in the air. Speculators have started pulling back on their most bullish bets on the greenback, suggesting that some think this dollar rally might not have legs. After all, selling the dollar has been a painful trade lately, with the greenback up over 7% in Q4 of 2024. 📈💸

So, what’s the takeaway here? Trump’s tariff talk is shaking up markets, fueling demand for the dollar, and keeping other currencies in check. For traders, this means opportunity—but also volatility. Watch how these tariffs develop and keep an eye on US tech stocks for clues about the dollar’s next move.

In short: Trade smart, stay sharp, and don’t sleep on the power of market drama. 😏

💥 Wall Street Tries to Flip the Script on a Costly Elon Musk Bet 💵

It’s been over a year since Elon Musk bought Twitter (now X) for a jaw-dropping $44 billion, but the real pain? That’s still sitting on Wall Street’s books. 😅 Big banks like Morgan Stanley and Bank of America are now hustling to sell off chunks of the $13 billion in debt they financed for Musk’s takeover. Why? Because holding onto it has been a financial headache.

The plan? Offload the “senior portions” of the debt at 90-95 cents on the dollar to investors. Sure, it’s a slight loss, but compared to the value they’ve already seen sink? It’s practically a win. 🏆 And they’re throwing in a bonus to sweeten the deal: a claim on X’s stake in xAI Corp., Musk’s AI startup.

🤑 Why Banks Are Betting on Musk (Again)

Wall Street banks aren’t exactly thrilled about these losses, but they’re playing the long game. Musk isn’t just the guy running X—he’s also the mastermind behind SpaceX, Tesla, and xAI. Translation? Banks want to stay on his good side for potential IPOs and other big-ticket deals in the future. 🚀

Plus, there’s a glimmer of hope that X could turn things around. Musk’s alliance with Donald Trump (and a friendly wink during Trump’s inauguration speech about going to Mars 🌌) is giving banks a little extra confidence in X’s future profitability. Combine that with xAI’s valuation boost, and maybe—just maybe—there’s light at the end of this tunnel.

US Dollar Index Daily Chart as of January 15th, 2024 (Source: TradingView)

📈 Why This Move Matters for Wall Street

This isn’t just about Musk or X. It’s about the bigger picture: Wall Street banks are on the rebound. Fourth-quarter profits in 2024 soared at Morgan Stanley, Goldman Sachs, and others, fueled by strong investment banking and trading results. Banks are optimistic that Trump’s administration could loosen regulations and pave the way for more dealmaking in 2025. 🤝

Morgan Stanley CEO Ted Pick is already hyped, predicting a return to “classic corporate finance”—think 1990s-style Wall Street action. And while this Musk debt cleanup might sting, banks see it as a step toward clearing the slate for bigger wins ahead.

For traders, the lesson here is clear: watch how market conditions evolve when power players like Musk and Wall Street intersect. Tariff talks, tech moves, and Musk’s ventures are all creating ripples that impact currencies and market sentiment globally.

Whether you’re bullish or bearish on Musk’s moves, one thing’s for sure—his impact on the financial world is always a story worth following. 🌟

MEMES OF THE DAY

Market dips? Just another Tuesday for the OGs 😏

Bought the top, living the dream 🐶