TOGETHER WITH

Today’s edition is sponsored by Plus500 . When it comes to trading CFDs, Plus500 is a name trusted by traders worldwide. With a sleek platform, real-time market data, and access to a wide range of instruments.

Check them out and see why millions of traders choose Plus500 as their go-to platform.

Hey traders, it’s Ezekiel! I’m back with your market update to help you stay sharp and ahead of the game. Let’s check out what’s shaking up the markets today:

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Tarrifs hit, dollar dips, is the bear market here to say?

• China hits back: Tarrifs, bans, and rare earth revenge

• Learn how to use OBV to confirm trends and catch reversals with our video

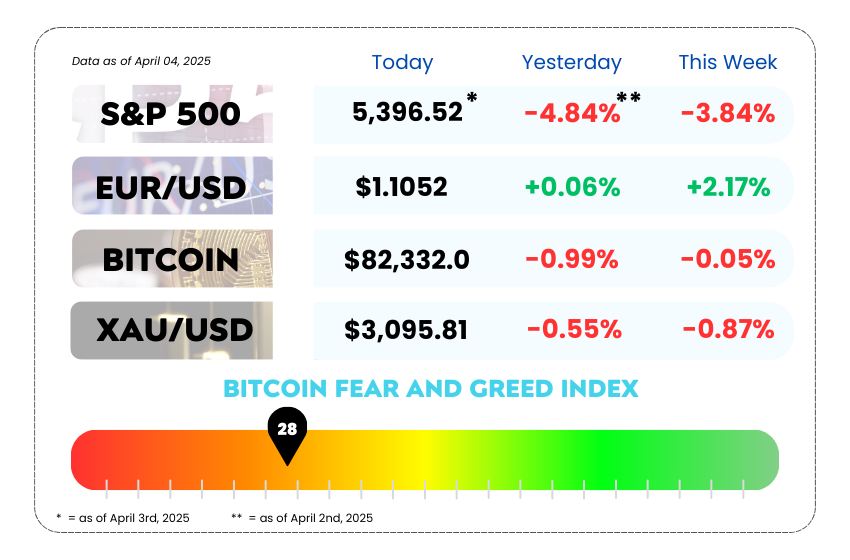

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

📉 The Dollar Just Lost 8 Years of Gains Faster Than You Can Say “Trade War” 📉

The greenback just did a full 180. Everything it gained since Trump won in 2016? Poof — gone. Like your gains after revenge-trading. 💸

On Friday, the Bloomberg Dollar Spot Index dropped to levels not seen since just before the 2016 U.S. election. Translation: the dollar just erased an 8-year victory lap. All thanks to… tariffs.

Trump’s trade war came back with a chair shot to the economy.

US bond yields dropped, equities slid, and traders dove head-first into safe havens like the yen and Swiss franc 🏃♂️💨

📉 “The Dollar Bear Market Has Arrived” – And It’s Loud

Paresh Upadhyaya from Amundi said it best: “The dollar bear market is roaring.” He thinks the dollar could fall another 10% this year as the U.S. flirts with recession vibes.

And yeah, traders saw this coming. The market was already holding its breath before Trump’s big April 2 tariff announcement. When it dropped, so did the dollar — like a mic with no stand. 🎤🪦

Wait, Weren’t Tariffs Supposed to Help the Dollar?

Funny you should ask. Earlier this year, people thought Trump’s “America First” policy cocktail (tax cuts + tariffs) would lift the dollar like a protein shake lifts gym bros. 🏋️♂️

Even Treasury Secretary Scott Bessent swore the administration was sticking with a strong dollar policy. But now?

The dollar has dropped 4% in 2025, including a 1.5% nosedive on Thursday and another 0.4% dip in Asia on Friday.

US Dollar Index Daily Chart as of April 1st, 2025 (Source: TradingView)

🤕 “USD Smile” Has Turned Into a Grimace

Richard Franulovich from Westpac called the last 24 hours a “profound structural moment” for FX markets. Translation: the market’s relationship with the dollar is getting a full-on therapy session.

His quote? Absolute gold:

“The famed ‘USD smile’ no longer exists – it’s more of a ‘USD sneer.’”

Ouch. That’s not even shade — that’s a full eclipse. 🌑

🔮 What’s Next?

Right now, the US economy is giving off “cooling down” signals — slower growth, softer job data, and labor markets losing some steam. Traders are officially turning bearish on the buck for the first time since pre-Trump era.

All eyes now are on the March jobs report — if job growth cooled even more, expect more pressure on the dollar. ING’s Chris Turner put it bluntly:

“The dollar is naked — and until we get some surprisingly good news, don’t expect it to find support.”

The dollar’s getting hit from all sides, geopolitics, economic slowdown, policy shifts. For forex traders, this isn’t a time to panic, it’s a time to adapt.

- Expect more volatility in USD pairs as the market tries to reprice expectations.

- Safe havens like JPY and CHF are gaining favor fast. Watch those flows. 🕵️♀️

- If you’re a technical trader, keep an eye on key support levels — we’re heading into “what goes down might go lower” territory.

And remember: markets don’t move in straight lines — they move in wavy, meme-worthy chaos. Surf it right. 🏄♂️

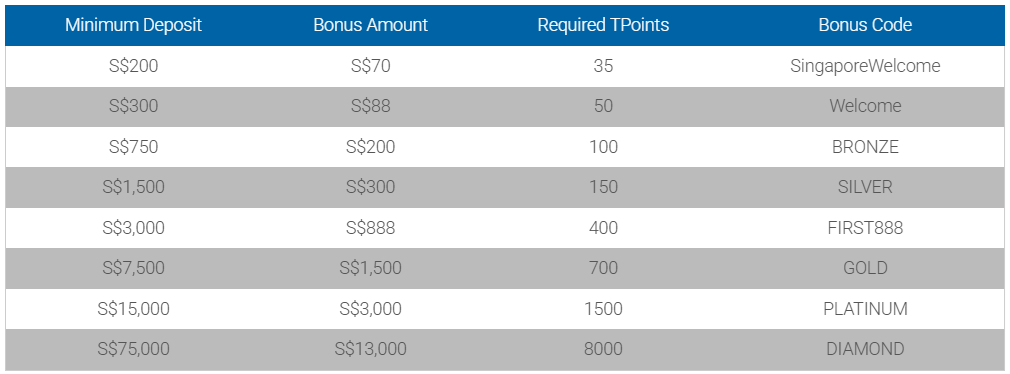

🎁 Singapore Traders, This One’s for You! 🎁

We’ve teamed up with Plus500 to bring an exclusive deal to all our Singapore-based traders. Whether you’re just getting started or already deep in the game, this offer’s got something for everyone 👇

💰 First Deposit Bonus + Weekly Rebates

Yep, you read that right. Make your first deposit, enter a bonus code, and get rewarded instantly — plus enjoy automatic weekly rebates to sweeten your trades even more.

Here’s how to claim it:

👉 Click here to access the deposit screen

💳 Pick your deposit method

🏷️ Enter the bonus code (you’ll find it below)

📈 Start trading and watch your bonus kick in

It’s simple, fast, and made to give your trading journey a boost from day one.

📌 Bonus Details Below:

🥊 China Claps Back, Hits U.S. with Tariffs, Export Curbs, and a Side of Spicy Payback 🥊

And just like that, the trade war scoreboard got a new update — and it’s 🔥.

After Trump went full “Tariff Titan” with a 34% levy on Chinese goods (on top of an earlier 20%), China hit back with a matching 34% tariff on all U.S. imports, kicking off what’s looking like a high-stakes trade chess match.

Starting April 10, the tariffs go live. And that’s just the beginning.

🎯 Target Locked: Rare Earths, Food & Tech

China also slammed the brakes on rare earth exports to the U.S. — not your everyday materials, but strategic elements used in EVs, defense, and electronics. Names like dysprosium and lutetium may not roll off the tongue, but without them, your drone, missile, or MRI machine won’t get very far.

Then came the agricultural gut punch:

China suspended imports of U.S. sorghum, poultry, and bonemeal from specific American suppliers, a move that directly hits U.S. farmers and food exporters.

🧨 Blacklist Just Got Bigger

China didn’t stop at products. They expanded their export control list, targeting 16 U.S. companies involved with dual-use goods (think civilian tech that can double as military).

On top of that, 11 American firms were added to the “Unreliable Entities” list, tightening the noose around any foreign business seen as crossing Beijing’s red lines, particularly those involved in arms sales or activity related to Taiwan.

The consequences? No new investments, no importing, no exporting, and a lot of boardroom panic.

🏥 Even Medical Tech Got Pulled In

To round out the response, Beijing launched an anti-dumping investigation into medical CT scanner tubes coming from the U.S. and India. Oh, and a broader probe into the competitive landscape in that industry too.

So now, even healthcare equipment is part of the trade war casualty list. 🩻

Let’s break this down for traders:

- The yuan’s under pressure: This level of escalation raises questions about capital flow and currency management. Volatility’s coming.

- JPY & CHF looking good: Safe havens are back on the menu as risk sentiment dips.

- Rare earths are the silent nuke: China just reminded the world that it still holds the keys to a chunk of the global supply chain.

- Watch U.S. tech & agri sectors: Export bans and import curbs mean more downside risk for affected industries.

- The FX market loves drama, and this is peak drama.

This is a multi-front power move, and if you’re trading currencies or commodities, the next few weeks are gonna be spicy. 🌶️

MEMES OF THE DAY

Interest rate hikes be like: “Whose portfolio am I ruining today?” 👀

Why pay for horror movies when my MT4 account balance exists? 🎬💀