TOGETHER WITH

Hey traders! Ezekiel here with fresh market insights (and more 🔍). Here’s what’s on the radar today:

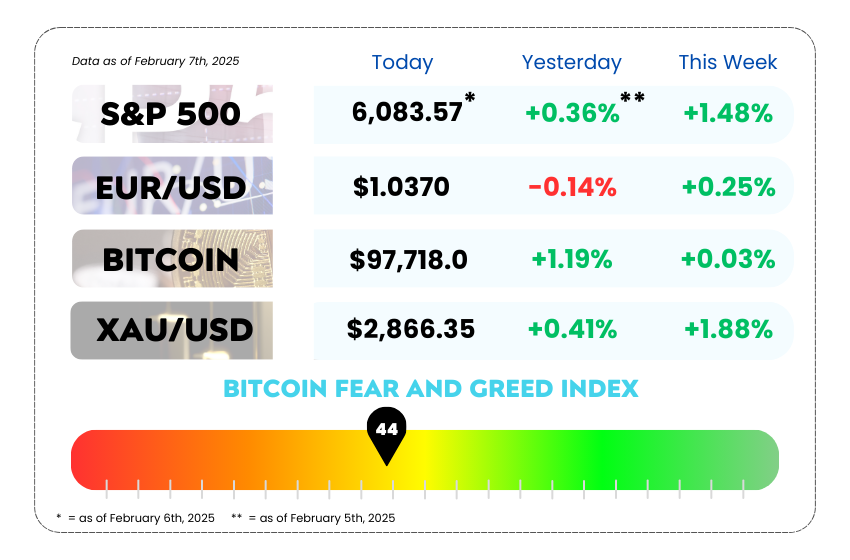

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• China’s AI boom is turning doubters into believers, and its tech stocks are reaping the rewards

• Trump’s tariffs fuel extreme market volatility, forcing traders into rapid-fire strategies

• Learn the right way to use the Stochastic Indicator and avoid costly mistakes with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚀 DeepSeek Shock Ignites Bullish Fire in China’s Tech Stocks 🚀

China’s AI game is leveling up, and investors are starting to take notice. The Hang Seng Tech Index just hit bull market territory, soaring over 20% from its January low. Leading the charge? Xiaomi and Alibaba, both up nearly 30%—all thanks to China’s latest AI sensation, DeepSeek.

DeepSeek’s AI model is being hailed as a game-changer, showing off China’s growing dominance in the AI space. It’s not just about flashy tech—this breakthrough is making investors rethink China’s beaten-down stocks, just as trade war fears heat up with Trump back in the picture.

Even Wall Street is catching the hype. Deutsche Bank just dropped a report titled “China Eats The World”, predicting 2025 as the year when China outcompetes everyone. The report went viral in China, with investors seeing a major shift in sentiment.

The Private Sector Strikes Back

For years, government regulations and policy uncertainty kept China’s market in the dumps. Now, AI-driven growth is making foreign investors rethink their China strategy. HSBC sees the valuation gap between China and other emerging markets narrowing as money starts flowing back in.

🔎 Alibaba’s AI flex: It claims its new model outperformed Meta’s Llama and DeepSeek’s V3 in multiple tests. That’s big considering Alibaba was struggling under regulatory pressure not long ago.

💰 Favorable valuations: The Hang Seng Tech Index trades at 17x forward earnings, while the Nasdaq 100 sits at 27x. Translation? China’s tech stocks are looking cheap.

But Not Everyone’s Sold… Yet

Morgan Stanley is still cautious on China’s semiconductor and hardware stocks, warning that the US could expand its chip curbs. Even with the rally, the Hang Seng Tech Index is still down 50% from its 2021 peak. And while foreign funds are trickling back, $2.4B still left China’s market in January.

China’s AI boom is lighting up its tech stocks, but risks remain. With cheap valuations, rising innovation, and policy support, the short-term trade looks solid.

Long-term? That depends on whether China can turn all this AI hype into real profits. Keep your eyes on the foreign capital flows—if the money keeps rolling in, the bull case gets stronger. 🚀

Boost Your Trading Game with AvaTrade’s 20% Bonus

Boost Your Trading Game with AvaTrade’s 20% Bonus

Looking to amplify your trading potential? AvaTrade is giving you an exclusive 20% deposit bonus, giving you the extra capital to seize more opportunities and maximize your potential profits! 📈💰

✅ Instant capital boost to supercharge your trades

✅ Trade forex, CFDs, or gold with more firepower

✅ Access top-tier trading tools on AvaTrade’s advanced platform

✅ Easy sign-up, easy bonus claim—no hassle!

Why wait? Grab your bonus now, dive into the markets, and trade with more confidence than ever! Your next winning move starts TODAY! 🔥

🚨Traders Caught in Market Whiplash as Trump’s Policies Trigger Wild Swings 🚨

Donald Trump’s tariff rollercoaster is sending traders into survival mode, forcing them to ditch long-term bets in favor of lightning-fast trades. With markets moving in hours instead of weeks, even seasoned investors are struggling to stay ahead.

Adapt or Get Left Behind 💨

The days of holding positions for a week are over. Traders now flip positions in less than 24 hours, adjusting to the constant policy shifts. Forex options trading has exploded, with volumes on Canadian dollar options hitting their second-highest level ever on January 31.

After Trump’s 25% tariff on Canada, the loonie plunged to its lowest level since 2003, only to bounce back when the tariffs were delayed.

Hedging Costs Are Rising

Funds that used to short volatility are now buying it aggressively, realizing that market stability is a myth. Investors in US bonds are also scrambling.

Treasury futures positions in two-year contracts just fell to 4.1 million, the lowest since June, while government bond investors cut their holdings after building up the biggest net long position in 15 years.

Speed and adaptability are the new edge. Traders who cling to old strategies will struggle in a market where positions that once lasted weeks now barely survive a day.

With forex options volumes surging and volatility spiking, the smartest investors are shifting to:

• Shorter holding periods – trades are now measured in hours, not days

• More hedging through options – rising costs signal higher demand for protection

• Volatility-driven strategies – directional bets are riskier than ever

This market isn’t for the slow or indecisive. If you’re not reacting fast, you’re already losing.

MEMES OF THE DAY

Buff Doge studies One Core Program, Cheems studies green candles. 📊🤦♂️

One minute it’s peaceful, next minute it’s financial disaster 🌪️💸