Hey, traders! Ezekiel here, ready to share the latest market insights (and more

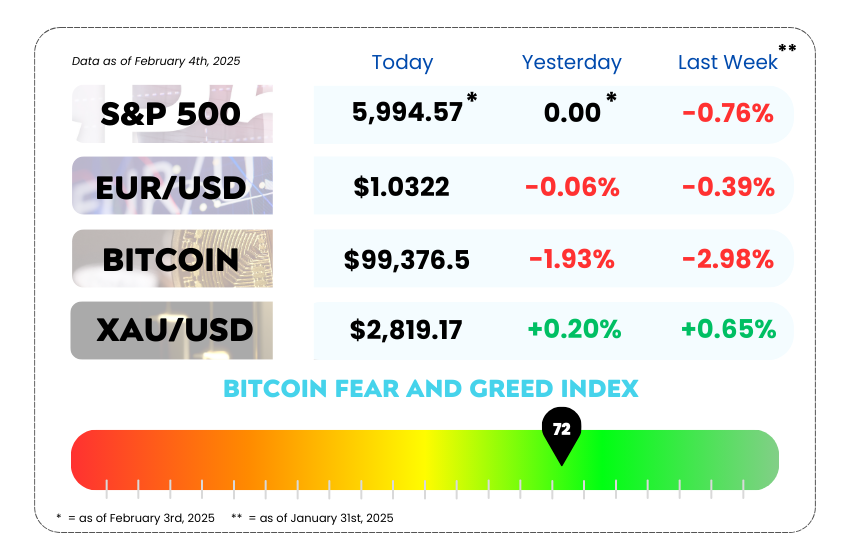

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Trump’s tariffs are spooking the Fed, slowing down rate cuts

• Tech giants face new tariffs, and chip stocks could be the next to tumble

• Unlock 3 hidden strategies to master the Head & Shoulders pattern with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚨 Goolsbee Says Trump’s Policies Could Put the Brakes on Fed Rate Cuts 🚨

Looks like the Fed’s got a new speed bump on its road to rate cuts—and it’s spelled T-R-U-M-P. 😬

Here’s the scoop:

Chicago Fed President Austan Goolsbee says the central bank needs to pump the brakes on cutting interest rates. Why? Because Trump’s latest moves are stirring up economic uncertainty like a toddler with a bowl of cereal. 🥣

Goolsbee’s vibe:

“We’ve gotta be more careful now. Inflation risks are creeping back, and we don’t want to get blindsided.”

What’s shaking things up?

• Tariffs, baby. Just two weeks into his new term, Trump slapped tariffs on Mexico, Canada, and China—three of America’s biggest trading buddies. (Though he hit the snooze button on Mexico and Canada for now, after last-minute deals.)

• This means more volatility, and the Fed hates surprises. 🎢

Goolsbee’s not the only one waving the caution flag. Fed officials in Boston and Atlanta also chimed in, saying:

“No rush, folks. Let’s see how the economy handles the cuts we’ve already made.”

Translation? They’re basically staring at the economy like, “You good, bro? 👀”

• Expect slower rate cuts ahead.

• Tariffs = turbulence. Keep an eye on forex pairs tied to USD, especially with Mexico, Canada, and China in the mix.

• Data is king. The Fed’s watching every economic report like it’s the final season of a hit show.

Stay sharp out there. 📈

💥 Trump’s Tariffs Are Coming for Tech—And Chip Giants Could Be Next 💥

Looks like Trump’s trade war 2.0 has entered the chat—and this time, it’s gunning straight for tech. 🎯

Starting Tuesday, a fresh wave of 10% tariffs on Chinese-made goods kicks in. What’s in the crosshairs?Everything from PCs to smartphones—yep, your precious iPhone isn’t safe. 📱💻

But wait, it gets spicier… 🌶️Trump’s also hinting at slapping tariffs on chips (yes, the tiny brains inside all your devices). That could send shockwaves through the tech industry, driving prices higher just when consumers are still recovering from inflation whiplash. 💸

Who’s feeling the heat?

• Apple (AAPL): With most of its products made in China, every iPhone, iPad, and MacBook is now 10% pricier—unless Apple decides to eat the costs (and dent profits) or pass the bill to you.

• Chip giants like Nvidia (NVDA), AMD (AMD), and Intel (INTC): Stocks already took a hit, and if tariffs expand to chips, expect more red on the charts. 📉

NVDA Daily Chart as of February 3rd, 2025 (Source: TradingView)

And if Trump ramps tariffs up to 60% (which he’s definitely teased), it’s gonna be a whole new ballgame. That’s not just a dent—it’s a sledgehammer to profit margins.

While companies like Apple are scrambling to shift production to places like India, that’s not a quick fix. And for chipmakers? Building new factories takes years, not months.

• USD volatility incoming as tariffs ripple through tech-heavy sectors.

• Keep an eye on tech stocks—especially chipmakers and companies heavily reliant on Chinese manufacturing.

• Watch for safe-haven plays in forex as market uncertainty grows. When tariffs hit, so does market anxiety.

Trade wars are back, and the stakes? Higher than ever. 🚀

MEMES OF THE DAY

No real money = no real stress

My head can’t just keep up with all the happenings 😂