TOGETHER WITH

Today’s edition is brought to you by FP Markets, delivering ultra-tight spreads and fast execution for serious traders. With raw spreads from 0.0 pips on MT4 & MT5, FP Markets provides the low-cost, high-speed trading environment that professionals demand.

Check out FP Markets here.

Hey traders! Ezekiel here with fresh market insights (and more 🔥). Here’s what’s making waves today:

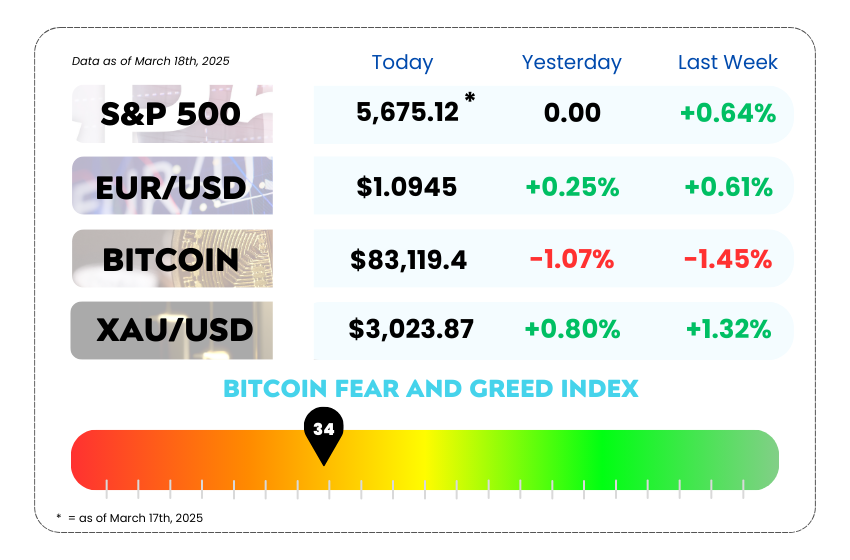

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Rate cut expectations keep pressure on dollar, but risks of a rebound remain

• Why investors turn to Vanguard ETFs for financial growth

• Gold surges past $3,017 as markets react to global instability

• How to use moving averages for better trade timing and exits with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚀 Dollar Stuck in Limbo: Growth Worries Keep It in Check 🚀

The U.S. dollar is like that one friend who says they’re “fine” but is actually going through it. After chilling near a five-month low, the greenback managed to steady itself on Tuesday, but it’s still struggling to shake off fears about slowing global growth.

The Fed is up next. Investors are on standby for the latest economic projections from the Federal Reserve. Markets want answers: How bad is the slowdown? Will the Fed blink and shift policy?

Euro’s still flexing. The euro is holding just below last week’s high of $1.0947, waiting on Germany to push through a massive stimulus package. Meanwhile, the Japanese yen, the OG safe-haven currency, gave up some of its recent gains.

What’s weighing down the dollar? 💰

Blame it on tariff tensions and a sluggish U.S. economy. Investors are uneasy about whether Trump’s aggressive trade policies will lead to a bigger economic downturn. Recent data suggests sentiment is shaky, making it harder for the dollar to gain ground.

Dollar index check:

The dollar index has taken a 6% hit since its January peak of 110.17. It clawed up 0.13% to 103.59, but it’s still hovering near last week’s five-month low of 103.21.

Central banks in the hot seat 🏦

It’s not just the Fed – the Bank of Japan and Bank of England are also meeting this week, with markets looking for any clues on where rates are headed. The Fed will publish fresh economic projections, giving us a better idea of how policymakers see inflation, growth, and job numbers shaping up.

Rate cuts ahead?

Markets are betting on two more rate cuts from the Fed this year, pricing in about 60 basis points of easing. But Citi’s FX strategists think the Fed will lean dovish—they’d rather cushion the economy than fight inflation too aggressively.

📌 Other currency action:

- Euro: A bit softer at $1.0907, still feeling bullish after Germany’s court cleared the way for a new borrowing plan.

- Japanese yen: Slipped to 149.79 per dollar, after hitting a high of 146.545 last Tuesday. Traders are eyeing the Bank of Japan’s meeting—if they sound too dovish, the yen could weaken further.

- British pound: Holding at $1.29755, just shy of Monday’s high of $1.2999—its strongest level since November.

- Aussie dollar: Consolidating at $0.63695, after touching its highest level in a month. The Reserve Bank of Australia is keeping markets guessing after cutting rates for the first time in four years last month.

Right now, the Fed is caught between rising inflation expectations and weakening economic sentiment. That’s a dangerous mix because if the Fed signals fewer cuts than expected, the dollar could see a short-term rebound. But if they lean dovish, expect further dollar weakness as traders rotate into higher-yielding or riskier assets.

The real risk? Market mispricing. Traders are currently pricing in about two Fed cuts this year, but if economic data turns south, the Fed might be forced to move faster than markets expect. That’s where the real opportunities lie—watch for shifts in rate cut probabilities in the coming days.

For currency traders:

- A dovish Fed could push EUR/USD higher, breaking resistance near 1.0950-1.10.

- The JPY trade is all about BOJ risk, if Japan signals a shift, USD/JPY could drop hard.

- The Australian dollar is in a strong consolidation zone—watch for a break above 0.6400 if risk sentiment improves.

🚀 Broker Spotlight: FP Markets – Ultra-Tight Spreads, Pro Execution 🚀

FP Markets is a go-to for traders who demand tight spreads and fast execution. With raw spreads from 0.0 pips on MT4 and MT5, this broker delivers some of the best trading conditions in the market.

✅ Spreads from 0.0 pips – Ideal for scalpers and day traders

✅ Ultra-fast execution – No dealing desk, no re-quotes

✅ Deep liquidity – Institutional-grade pricing for better fills

If you’re serious about trading low-cost, high-speed markets, FP Markets is built for you. Tight spreads, deep liquidity, and raw ECN execution make it a top choice.

📉Are Vanguard ETFs a Smart Play for Passive Income 📉

Generating passive income isn’t just about picking stocks, but also about choosing the right strategy. Vanguard’s ETFs offer exposure to dividend-paying stocks, bonds, and real estate, balancing risk and reward for long-term investors.

From Vanguard High Dividend Yield ETF (VYM), which prioritizes high dividend payouts, to Vanguard Real Estate ETF (VNQ), giving access to income-generating properties, these funds are built for steady cash flow and compounding growth. But how do they compare, and which ones stand out in today’s market?

🔍 Read the full story here.

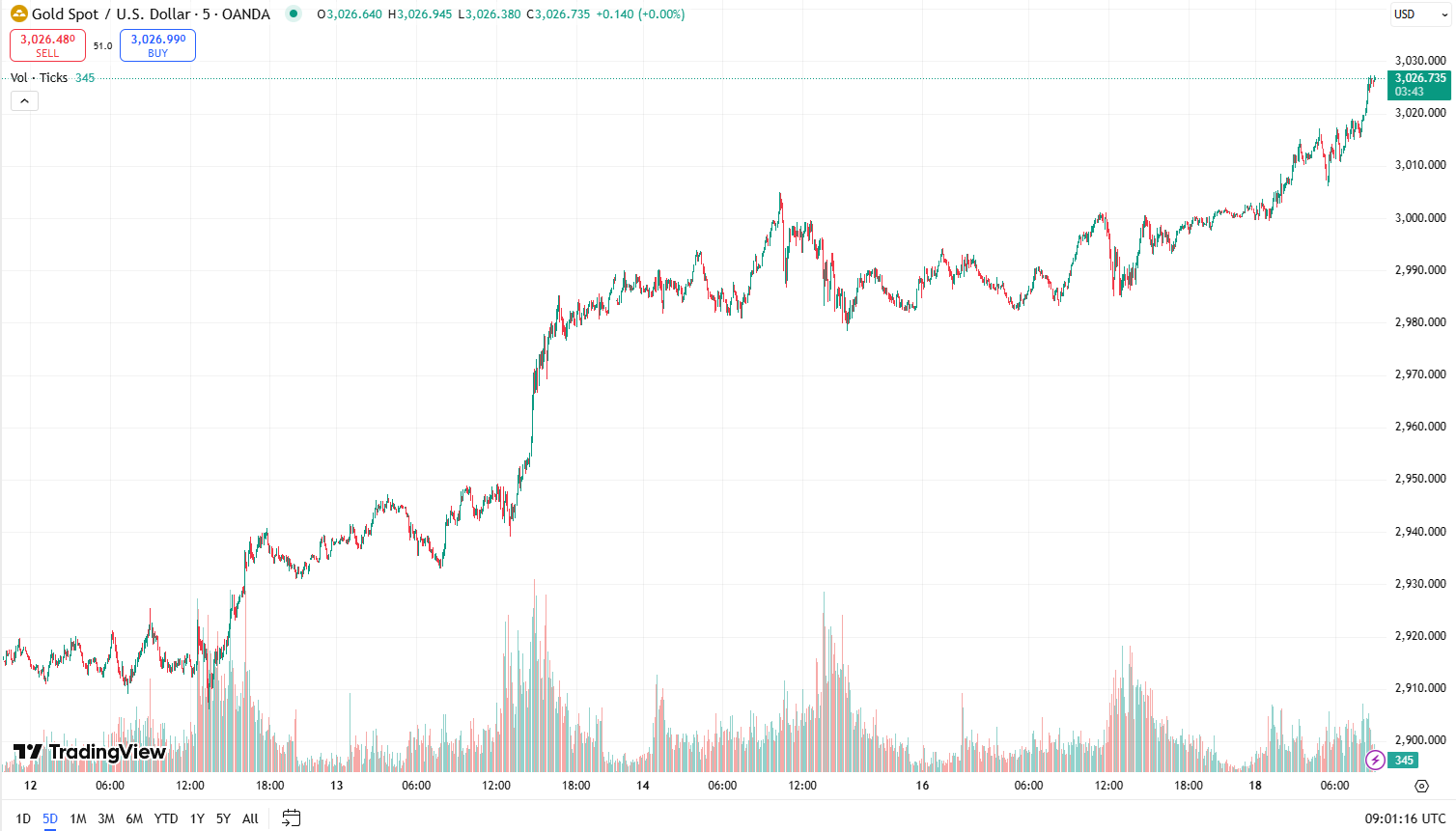

🚨Investors Rush to Gold as Fed Rate Cut Bets and Uncertainty Grow 🚨

Gold just blasted past $3,017 an ounce, hitting a new all-time high as investors rushed toward safe-haven assets amid escalating tensions in the Middle East and fresh concerns about the US economy slowing down.

🛑 What’s driving the gold rush?

- Geopolitical uncertainty: Israel launched military strikes on Hamas targets in Gaza, adding more instability to an already fragile situation.

- Weak US economic data: Retail sales for February came in lower than expected, raising questions about consumer spending and economic momentum.

- Fed rate cut bets: While the retail data wasn’t bad enough to force the Fed’s hand, investors are still pricing in multiple rate cuts this year.

XAU-USD 5-Day Chart as of March 18th, 2025 (Source: TradingView)

So far in 2024, gold is up more than 14%, proving once again why it’s the go-to asset when uncertainty rises. Several major banks have already raised their price targets, betting that the rally isn’t over yet.

💡 But is this just the beginning?

According to Vasu Menon, Managing Director at OCBC, the $3,000 mark was a strong resistance level—meaning gold could face some short-term pullbacks before making its next move. He sees $3,100 as the next key level in the coming months.

Gold’s breakout above $3,000 isn’t just about geopolitics—it’s about market positioning. As long as rate cuts remain on the table, gold has a tailwind. But the real test? Whether inflation expectations shift, forcing traders to rethink the Fed’s timeline.

For now, gold bulls are in control, but watch how the dollar and bond yields react in the coming days. If risk-off sentiment strengthens, this rally could have more room to run.

MEMES OF THE DAY

A rare moment in trading history 🤝📈

If I never withdraw, I never really lost… right? 🤔🏦