TOGETHER WITH

Today’s edition is brought to you by AvaTrade. Wanna start trading without dropping a whole paycheck? With AvaTrade, you can kick off your trading journey with as little as $50.

Start trading with just $50 at AvaTrade!

Hey traders! Ezekiel here with fresh market insights (and more 🔥). Here’s what’s making waves today:

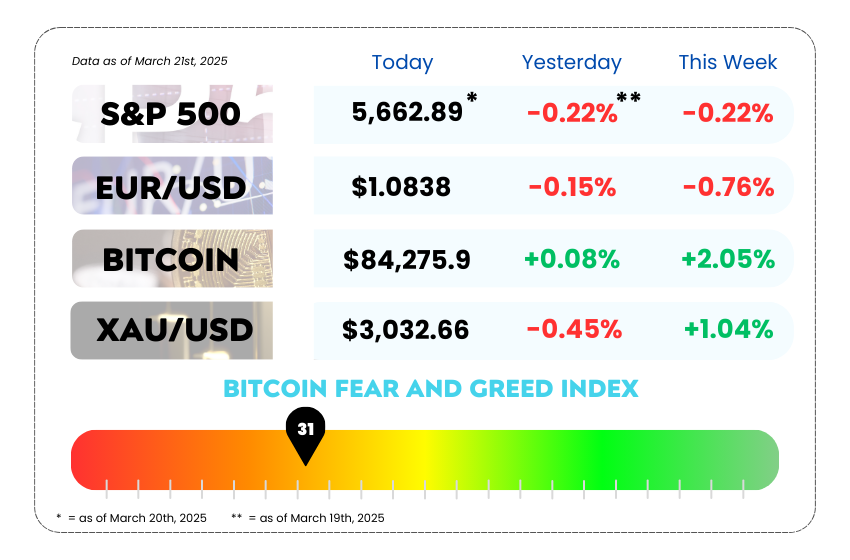

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Mexican sugar stalls, and high-tier imports steal the spotlight

• How one RV company fits perfectly in a lazy portfolio

• Bitcoin volatility hits 6-month high amid U.S. economic uncertainty

• Avoid common MACD mistakes with these expert tips with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🍭 US-Mexico Sugar Trade Just Got a Whole Lot Stickier 🍭

The sugar trade between the US and Mexico is officially in meltdown mode.

First, Mexico got slammed by back-to-back droughts, seriously cutting into its sugar production. Then, just to turn up the heat, the US is eyeing 25% tariffs on Mexican goods (sugar included), set to hit on April 2. Not exactly the kind of April surprise traders like.

This trade relationship was once rock solid. Thanks to the US-Mexico-Canada trade agreement, Mexico had a free pass to ship sugar to the US, and became its top foreign supplier. But a 2014 policy shift introduced strict export caps and price floors, and the sugar flow started drying up… literally and figuratively.

With Mexico’s supply shrinking and prices rising, US importers started looking elsewhere. It actually became cheaper to pay higher taxes to bring sugar in from places like Brazil than to stick with Mexican supply. That alone tells you how upside down things have gotten 🍬

Earlier this year, importers scrambled to buy up Mexican sugar before tariffs kick in, creating a flurry of shipping activity. But now, that flow has essentially stalled. Importers are shifting focus to “high-tier” sugar imports, the kind that comes with heavier duties, and for the first time ever, those imports outpaced Mexican sugar in the last fiscal year.

Despite all this, US officials insist there’s no major threat to supply. Domestic production is strong, and supply-demand ratios look stable for now. But the market’s clearly in transition — with rising sugar futures and new sourcing strategies becoming the norm.

Meanwhile, sugar users in the US and producers in Mexico aren’t thrilled. They see the system as broken, originally designed to create a fair, dependable flow of sugar, it’s now doing the opposite: strangling trade, inflating costs, and penalizing Mexican suppliers who were supposed to benefit from the agreement in the first place.

Even larger sugar producers that operate in Mexico are sounding alarms. Many had built their business models around exporting to North America, and now they’re being hit with unexpected fees that could force major strategic shifts.

The takeaway? This sugar saga is a reminder that policy and climate can collide fast, leaving markets scrambling to adapt.

This sugar drama might seem niche, but it has ripple effects. Rising commodity prices, shifting supply chains, and geopolitical trade tensions are all macro themes traders should keep an eye on.

✅ Tariffs often create artificial price dislocations — which = opportunity for traders in futures and commodities.

✅ Supply chain shifts can impact related sectors: logistics, agriculture, and even consumer goods.

✅ And when a trade partner like Mexico loses leverage? Expect rebalancing in forex exposure and broader LATAM trade flows.

Sugar may be sweet, but in the markets, we’re always trading what’s underneath the frosting 🍰

🟢 Start Trading with Just $50? AvaTrade Says Yes 🟢

Looking to dip your toes into the markets without going full whale? 🐳 AvaTrade lets you start trading with just $50, that’s like skipping two overpriced lattes and getting access to the world of forex, stocks, crypto, and more. ☕💸

Whether you’re a beginner or just ballin’ on a budget, AvaTrade gives you the tools, leverage, and platforms to trade smart without needing a small fortune to get started.

💤 Want Lazy Profits? These Stocks Do the Heavy Lifting for You 💤

Not all smart investments require constant attention. Some just… work quietly in the background.

There’s one company, hidden in plain sight, that turns RVs into reliable revenue — and it might be one of the most overlooked plays for long-term investors. With just the right mix of stability, cash flow, and passive growth, it fits perfectly in what we call a “lazy portfolio.”

But that’s only the beginning. We’ve uncovered a few more that reward patience over hustle, and they could be doing the heavy lifting in your portfolio right now.

🔍 Read the full story here.

🚨 Bitcoin’s Bouncing Harder Than Your Rent Payment 🚨

Bitcoin just flipped the volatility switch — and it’s getting spicy again 🔥

The world’s favorite crypto hit a 6-month high in price volatility, with its 30-day volatility jumping to 3.6%, up from just 1.6% a month ago. That’s more than double in just a few weeks. The culprit? Good ol’ U.S. economic chaos.

Between trade war chatter, inflation fears, and Powell basically shrugging at the uncertainty, markets are jittery — and Bitcoin’s riding the waves 🌊

Even though it’s still under the 4.3% peak from last year, this surge in volatility means one thing: Buckle up, because Bitcoin’s price swings aren’t slowing down just yet.

Oh, and BTC’s not just volatile — it’s also been dropping.

📉 In the last month alone, it’s down 10%, and over 20% off its January all-time high of $108K. Yeah, feels rough. But here’s the twist…

BTC/USD 6-Month Chart as of March 21st, 2025 (Source: TradingView)

Macro madness is leading the charge 💼

The VIX (Volatility Index), Wall Street’s fear gauge, just shot up to nearly 30, the highest since August. And the S&P 500? It gave back every gain it made since the 2024 elections. Ouch.

Meanwhile, the Fed is keeping rates steady, but Powell admitted there’s still “unusually high uncertainty” out there. With Trump-era tariffs potentially heating up inflation again, the Fed might have to keep rates higher for longer, which isn’t exactly what risk assets like BTC love.

So, what now? 🧊

Even though Bitcoin’s price is cooling, some see it as a setup, not a setback. Grayscale is still bullish, calling this a potential entry point for new investors. Their view? Bitcoin is still a long-term hedge against inflation, just caught in the crossfire of short-term policy chaos.

Here’s what traders should really be watching:

🔹 Volatility = opportunity, but only if you’ve got the risk management to match. The swings are juicy, but they’ll eat undisciplined traders alive.

🔹 Macro matters more than ever. BTC’s price action is no longer just about halving cycles and memes, it’s deeply tied to rates, inflation, and political drama. Your edge comes from understanding both charts and headlines.

🔹 Long-term thesis is intact, but the short-term noise is LOUD. That means traders need to be agile, and investors need to stay calm.

Bitcoin may be shaking, but sometimes the best setups are born in volatility.

MEMES OF THE DAY

Just me and my unconfirmed setup… watching the money fly away 💸

Congrats. You just turned one L into a full-blown account funeral. ☠️