TOGETHER WITH

Today’s edition is brought to you by by AvaTrade. If you’re looking to take your stock trading to the next level, AvaTrade has everything you need for success.

Hey traders! Ezekiel here with fresh market insights (and more 🔥). Here’s what’s making waves today:

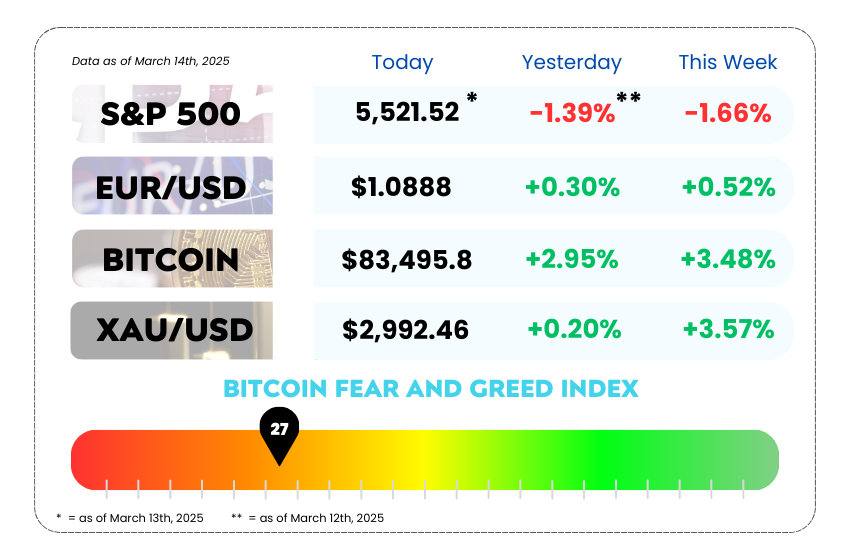

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• Gold hits $3,000 for the first time amid U.S. trade policies and inflation concerns

• Rising costs and trade tensions trigger S&P 500 correction

• Oil prices rise above $70 as US sanctions on Iran and Russia tighten

• Learn the 4 key indicators to identify when a trend is about to reverse with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

💰 Gold Hits $3,000 – Trump’s Trade Wars & Central Banks Keep It Shining 💰

Gold has officially breezed past the $3,000 mark per ounce for the very first time in history. What’s behind this explosive rally? You guessed it, central banks buying up gold like there’s no tomorrow, global economic fragility, and of course, President Trump’s game-changing tariffs.

On Friday, gold hit $3,001.20, marking a 0.4% surge. This milestone is a reflection of gold’s timeless role as the ultimate safe haven in uncertain times. Over the last 25 years, gold has increased by 10x, leaving even the S&P 500 in the dust (which only quadrupled).

💣 What’s Driving the Surge?

• Tariffs & Trade Wars: Trump’s aggressive trade policy is rattling global markets. With tariffs imposed on allies and rivals alike, traders are flocking to gold as a hedge against the fallout. And guess what? Gold prices in the U.S. are shooting up faster than other markets. Between Election Day and March 12, 23 million ounces of gold—worth about $70 billion—have poured into New York’s Comex futures exchange. That’s a whole lot of bullion!

• Central Banks Going All In: Countries are diversifying away from the U.S. dollar. After Russia’s invasion of Ukraine, central banks got a wake-up call that the dollar could be weaponized, and gold was the perfect backup plan. The result? Central bank gold buying has doubled since 2022, and this trend shows no signs of slowing down. 🔥

🌍 Why Now?

While gold typically suffers when the U.S. dollar strengthens, this time, the situation’s different. The yuan has tanked against the dollar, sending Chinese investors scrambling for gold. Plus, persistent global inflation is pushing gold’s status as a store of value through the roof. And let’s face it, nobody wants to miss out on $3,000 now that it’s happening.

📉 The Trump Factor: The real kicker is Trump’s unpredictable trade moves. He’s imposed tariffs on steel, aluminum, and Chinese goods while shaking up relations with Europe. The markets? Nervous. And when markets get nervous, gold gets shiny.

📊 Gold’s Journey: Past, Present, and Future

Gold’s price has always surged during economic stress. It broke past $1,000 an ounce after the 2008 financial crisis and hit $2,000 during the Covid pandemic. After a dip, it began rising again in 2023. So, what’s next? Some analysts are eyeing $3,500 per ounce if demand continues to rise.

🔥 So, What Does This Mean for You?

Gold’s recent rally isn’t just a blip; it’s a sign of bigger shifts in global finance. Central banks are holding gold as a hedge against dollar instability, and with Trump’s trade wars keeping markets on edge, gold is on track to keep its shine well into 2025.

Gold’s recent breakout above $3,000 signals a strong bullish trend, but traders should be prepared for potential consolidation or pullbacks. Key levels to watch are the $2,900–$2,850 support zone, which could offer favorable entry points if the price retraces.

With the U.S. dollar showing weakness and central banks continuing their gold accumulation, the path to $3,200 is likely. However, overbought conditions on momentum indicators suggest that caution is needed. Stay focused on central bank moves and U.S. policy shifts, and use stop loss strategies to manage risk during retracements. Happy trading! 📈

🚀 AvaTrade: Your Ultimate Platform for Stock Trading 🚀

Ready to trade stocks? AvaTrade offers a user-friendly platform with access to global stock markets, powerful trading tools, and real-time data. Whether you’re new to trading or an experienced investor, AvaTrade helps you make informed decisions with ease.

And here’s the best part: Register now and get a 20% bonus to boost your trading capital!

Don’t miss this exclusive offer – start trading stocks today with AvaTrade!

📉S&P 500 Enters Correction as Inflation and Interest Rates Hit Hard 📉

The S&P 500 has dropped more than 10% from its peak, with inflation, rising interest rates, and trade tensions causing heightened volatility. While Trump’s tariffs are in the spotlight, broader economic concerns are fueling the sell-off. 🤔

📉 Is it time to buy the dip, or should you stay cautious?

🔍 Read the full story here.

🚨 Oil Prices Rise as US Sanctions on Iran & Russia Offset Weak Demand Outlook 🚨

Oil prices are making a comeback! 📈 Despite a gloomy demand forecast from the International Energy Agency (IEA), US sanctions on Iran and Russia have helped push oil prices back above $70 per barrel.

Brent crude is showing some resilience, climbing as high as $70, thanks to tightened sanctions targeting Iran’s oil minister, several Iranian companies, and vessels. The US is also ramping up restrictions on Russian energy payments. Meanwhile, US equity markets saw a bit of a rebound, which helped oil regain some ground after a rough week.

CFDs on Brent Crude Oil Daily Chart as of March 14th, 2025 (Source: TradingView)

But here’s the thing: While the sanctions are giving oil a boost, the IEA’s outlook is far from optimistic. They’ve warned that a supply surplus could grow, driven by trade wars and OPEC+ boosting output. This put pressure on oil earlier in the week, and it seemed like West Texas Intermediate (WTI) might suffer its eighth consecutive weekly decline—the longest losing streak since August.

Still, the forecast isn’t all doom and gloom. Analysts from ANZ Group Holdings see a short-term bullishness as tariffs on Canadian crude and disruptions from places like Iran and Venezuela keep supply tighter. According to their note, Brent crude could push back toward $70 by the end of the year, as supply balances loosen up in the second half of 2024.

Oil prices have rebounded above the $70 per barrel mark, but the market is far from stable. Technically, Brent Crude has found temporary support around the $70 level, which aligns with recent sanction-driven price action. Traders should be watching for a bullish continuation pattern if prices can hold above this key level. A close above $71.50 could indicate a push towards $74, with potential to test the 200-day moving average at $75 by the end of the year.

However, volatility remains high due to conflicting signals. The IEA’s supply surplus forecast means any break below $69 could open up the potential for a retest of recent lows, possibly pushing WTI back toward $66. Watch for key geopolitical events, particularly the response from OPEC+ and US sanctions, as these will be pivotal in dictating whether Brent can maintain its recent gains. Timing your trades around key levels of $70 and $71.50 could provide solid risk/reward opportunities as oil continues its back-and-forth with demand uncertainty and supply disruptions.

MEMES OF THE DAY

Patience > FOMO always 📉📈

The only thing ‘rich’ here is the dust on this book 😆