TOGETHER WITH

Today’s edition is brought to you by AvaTrade. AvaTrade gives you access to the world’s top stocks, fast execution, and powerful tools to make smarter moves in the market.

Hey traders! Ezekiel here, bringing you today’s market heat. Let’s dive into what’s shaking things up right now:

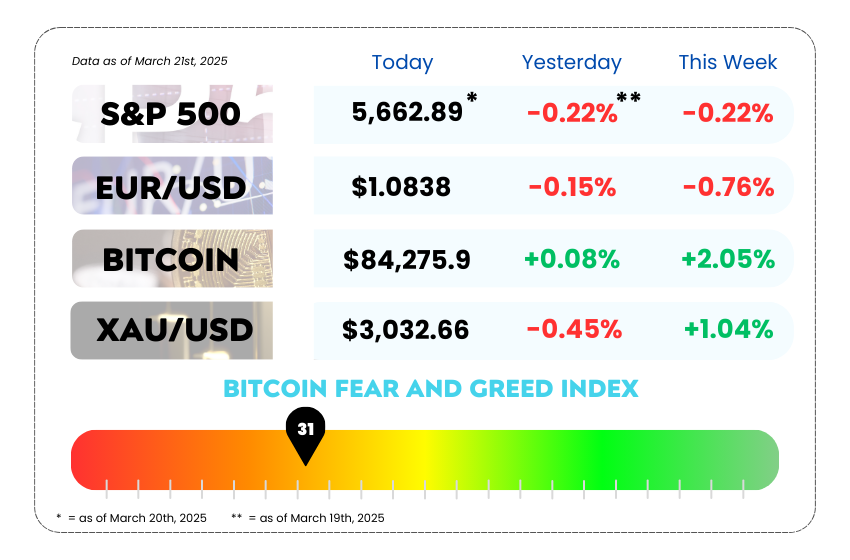

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• EUR/USD slides to 1.0775 as Eurozone braces for auto tariff showdown

• Stocks were riding high until the White House pulled the plug

• Learn why the descending triangle pattern could wreck your trades with our video

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🚗 Trade War Rumblings Put the Brakes on EUR/USD 🚗

The EUR/USD pair hit the brakes on Friday, slipping down to 1.0775 during the European session. But don’t call it a full breakdown just yet, it’s still chillin’ above its 20-day EMA (1.0760) like it’s got cruise control on. 😎

So what’s spooking the Euro? One word: tariffs, and not the fun kind.

💥 U.S. vs. Eurozone: The Auto Showdown

The U.S. just dropped a 25% blanket tariff on foreign autos, and the European Commission isn’t exactly sending flowers in response.

Retaliatory tariffs are on deck. The EC says it’s coming in “timely, robust, well-calibrated,” basically, a fancy way of saying “we got you back.”

German carmakers are sweating harder than a used car salesman — they send 13% of their exports to the U.S., and those new tariffs are gonna hit harder than a pothole at 80 mph.

Even German Chancellor Olaf Scholz weighed in, saying the U.S. is headed down a road “where only losers wait at the end.” Not exactly a glowing review.

📉 ECB: Tariffs = Bad News Bears for Growth

The European Central Bank isn’t loving this trade war drama either.

Vice Prez Luis de Guindos says tariffs will be a short-term inflation booster but a long-term growth killer.

He also said that it’s very difficult to say what the ECB will do in April, which is trader-speak for ¯\(ツ)/¯

🧊 Inflation Cools in France & Spain

Meanwhile, over in macroeconomic land:

- France’s CPI rose just 0.9% in March — slower than the expected 1.1%.

- Spain’s HICP came in at 2.2%, also cooling off from the prior 2.9%.

- Translation? Inflation’s catching its breath, but traders are still holding their breath.

Despite the dip to 1.0775, EUR/USD is still above the 20-day EMA (1.0760) — a bullish technical sign. But…

- The 14-day RSI dipped below 60, which means momentum’s cooling, even if bulls still have the steering wheel.

- If this turns into a full slide, 1.0630 (Dec 6 high) is your next key support zone.

- If the bulls hit the gas again, watch for resistance at the psychological 1.1000 level, that’s where things could get spicy.

📈 Trade Stocks with AvaTrade — Get a 50% Welcome Bonus! 📈

Looking to dive into the world of stock trading? AvaTrade has you covered with access to top global stocks, fast execution, and powerful trading tools — all in one platform.

AvaTrade gives you everything you need to start strong:

✅ Access to top global stocks (Apple, Tesla, Amazon & more)

✅ Fast, reliable trade execution

✅ Advanced trading tools and real-time market data

✅ Regulated and trusted broker with years of experience

✅ User-friendly platform for web and mobile

✅ 50% welcome bonus when you sign up using the button below 💰

Sign up today using the button below and score a 50% welcome bonus to kickstart your trading journey! 💰📊

📉 Stocks Were Vibing… Then the White House Hit “Undo” 📉

Just when it looked like the stock market was ready to shake off the drama and get its groove back — BOOM — the White House reminded everyone who’s really in charge of the mood swings.

The week started with a nice lil’ rally. Traders were feeling hopeful after President Trump hinted that the upcoming April 2 tariffs might not be as heavy-handed as feared. The S&P 500 climbed back into the 5,700s and even flirted with 5,800. Bulls were back, baby.

Then came Thursday. 💀

Another surprise round of auto tariffs rolled in, and the party came to a screeching halt. The index spent most of the day chilling at 5,700… before quietly dipping below it. That “two steps forward, one Trump tweet back” vibe is becoming all too familiar.

🚗 All Roads Lead to… Tariffs

Let’s be honest: this isn’t just part of the market narrative — tariffs are the narrative now.

The headlines bounce between:

🥳 “Yay! Tariffs might be lighter!”

😰 “Wait. More auto tariffs?!”

🔁 “Never mind, maybe it’s targeted?”

It’s economic whiplash, and the market is stuck in a loop of tariff optimism and tariff dread, with very little clarity on where this rollercoaster ends.

Investors are basically playing a game of “guess the next White House move,” while watching their portfolios do the cha-cha.

S&P 500 Index 5-Day Chart as of March 27th, 2025 (Source: TradingView)

🔍 A New “Targeted” Tariff Strategy?

The latest twist: reports say the administration might be shifting to a more surgical approach with tariffs — like using them to shield industries tied to national security (hello, autos), while easing up elsewhere.

But don’t get it twisted — “targeted tariffs” still = more tariffs. And the upcoming “Liberation Day” (aka when the EU claps back) could light another fire under this already-cooked market.

Basically, President Trump is saying: play by our rules, or we keep dropping tariff bombs.

Markets started the week with bullish vibes, but sentiment cracked fast once fresh tariffs came into play. The S&P 500 failing to hold 5,700 suggests investor confidence is still shaky, and clarity is king right now.

If the White House continues swinging between “tariff lite” and “tariff tsunami,” expect:

- More intraday volatility 🚨

- Risk-on trades to get sketchy real quick

- Safe havens (like the USD or JPY) looking a lot more attractive

Until markets get a solid read on what the administration’s actual strategy is, this yo-yo movement isn’t going anywhere.

MEMES OF THE DAY

When you realize Wall Street was just letting you think you had control… 🚀

When fundamentals fail, memes prevail 🪙😂