Hey traders, Ezekiel here with fresh market insights and a few extra tips to take your trading to the next level. Here’s what you need to know:

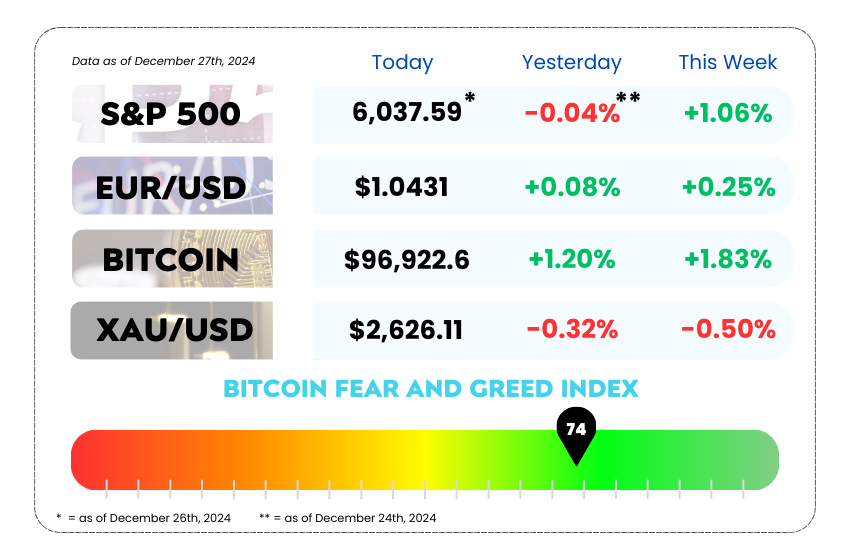

• Today’s market mayhem. S&P, EUR/USD, Bitcoin, and XAU/USD today

• The U.S. dollar is set for a 7% annual gain, while Japan’s yen faces its fourth year of losses

• Investors poured $31.67 billion into large-cap funds, reversing last week’s sell-off

• Learn how to spot the Drop Base Rally Pattern and use it to identify bullish momentum

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

💵 The Dollar Dominance Rolls On: A 7% Annual Gain in Sight 🚀

The U.S. dollar is strutting its stuff, heading towards a 7% annual gain for 2024 as of Friday, while Japan’s yen braces for its fourth straight year of losses. Why? Traders are betting big on robust U.S. economic growth, which might keep the Federal Reserve cautious about rate cuts all the way into 2025.

Here’s how it all played out this week:

- The Dollar Index (which tracks the greenback against major currencies) ticked up 0.08% to 108.16, capping off a 2.2% monthly rise and putting it on track to end the year up by 6.6%.

- The dollar surged 5.5% against the yen this month and a staggering 11.8% for 2024 against the weakening Japanese currency. Meanwhile, the euro remains stuck near two-year lows.

Fed, ECB, and BoJ—Oh My!

Earlier this month, Fed Chair Jerome Powell reiterated the U.S. central bank’s cautious stance on further rate cuts, after delivering a much-expected quarter-point reduction. Meanwhile:

- The European Central Bank (ECB) is eyeing more rate cuts as the eurozone economy cools.

- The Bank of Japan (BoJ) is holding steady with loose monetary policy, waiting for clarity on global trade shifts and U.S. policies under President-elect Donald Trump.

The yen is wobbling around 157.76 per dollar, levels not seen since July. Meanwhile, the euro is trading just above $1.04, close to its December 18 low.

USD/JPY Daily Chart as of December 27th, 2024 (Source: TradingView)

Markets React: Stocks and Yields

Despite higher U.S. rates, global equities managed to hold their ground:

- The MSCI global share index stayed flat on Friday but remained 1.6% higher for the week.

- Wall Street’s S&P 500 gained 1.8% this week, while Tokyo’s Nikkei climbed 2%.

- European stocks, however, lagged behind, with the Stoxx 600 inching up 0.3% for the week.

In the bond market, U.S. 10-year Treasury yields hit 4.607%, their highest since May, while eurozone yields followed suit. Germany’s 10-year bund yield rose to 2.372% on Friday.

Gold and Oil: A Mixed Bag of Moves

- Gold prices dipped 0.2% to $2,628 per ounce, but it’s still up an eye-popping 28% for the year, its best annual performance since 2011.

- Oil markets stayed mostly flat, with Brent crude inching up 0.1% to $72.52 per barrel as investors keep an eye on potential economic stimulus from China.

The U.S. dollar’s dominance this year highlights its resilience, driven by economic strength and the Fed’s hawkish stance. While global equities showed surprising stability, the long-term risks of inflation under the incoming Trump administration could make things volatile in 2025.

Our Take: Keep an eye on the yen and euro as central bank policies diverge. With U.S. yields pushing higher, there could be opportunities for traders looking to hedge or speculate on rate differentials.

Stay sharp, stay informed. 💡 AFM’s got your back!

🎅 US Equity Funds Get a “Santa Claus” Gift: $20.56 Billion Inflows 🎄

U.S. equity funds just got a major holiday boost, raking in $20.56 billion in the week leading up to Dec. 25, thanks to a trifecta of good news: cooler inflation, a stopgap funding bill to dodge a government shutdown, and the always-cheerful “Santa Claus Rally.” 🎁

The latest Commerce Department report showed that November’s PCE price index rose by just 0.1%, beating analyst expectations and fueling hopes for Fed rate cuts next year.

That optimism sent U.S. stocks soaring as investors loaded up on large-cap funds, which saw a whopping $31.67 billion in inflows—their best showing since October. 🚀

But it wasn’t all holiday cheer:

- Small-, mid-, and multi-cap funds saw combined outflows of nearly $5 billion.

- Sectoral equity funds bled $2.14 billion, with healthcare and consumer discretionary leading the losses.

Bond Funds: The Grinch of the Week 😬

U.S. bond funds faced their second straight week of outflows, losing $5.42 billion. Popular categories like emerging markets debt and investment-grade bonds struggled, while government & treasury funds bucked the trend, pulling in $957 million.

Meanwhile…

Investors stashed a jaw-dropping $41.72 billion into money market funds, flipping the script from last week’s $27.31 billion in outflows. Safe havens FTW. 💰

The surge in equity inflows signals renewed investor confidence, but fund flows tell a two-sided story: optimism in large caps and caution in bonds.

The “Santa Claus Rally” may bring some holiday magic, but with inflation and rate cuts still on the radar, expect early 2025 to test these gains.

Position yourself wisely. Look to diversify across equities and safe havens like money markets to ride out any turbulence ahead.

MEMES OF THE DAY

Discipline is key… but that breakout is looking so juicy! 🍏📈

I thought I was trading the news, but the news traded me. 🤯