TOGETHER WITH

Today’s newsletter is powered by Consensus Hong Kong 2025 presented by CoinDesk Event! The crypto event of the year is coming to the Hong Kong Convention and Exhibition Centre on Feb 18-20, 2025. Don’t miss out on epic panels, top speakers, and the latest in blockchain. Get 15% off your ticket here!

Hey, traders! Ezekiel here, ready to share the latest market insights (and more

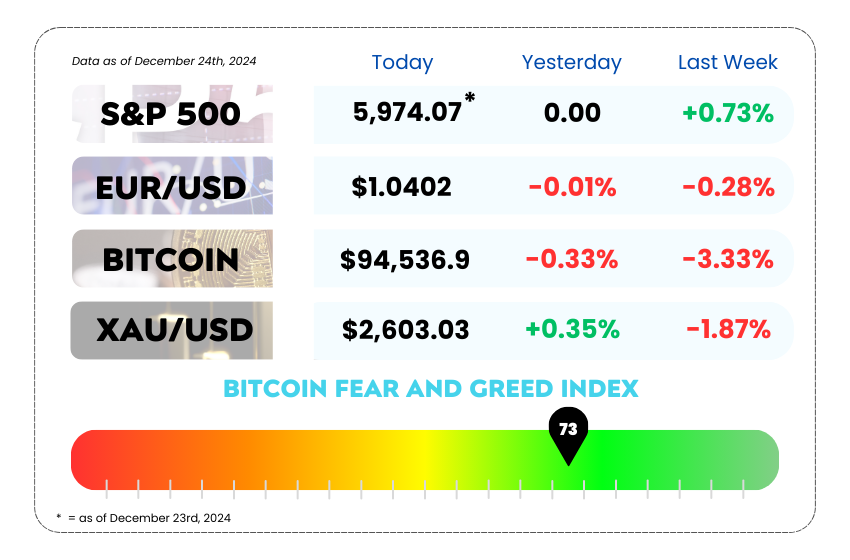

• Dollar steady, yen shaky as the Fed signals slower rate cuts and inflation cools only slightly

• Consensus Hong Kong 2025 brings crypto’s best to Hong Kong this February

• Bitcoin drops 7%, its first weekly loss since Trump’s win

• Spot the Bearish Hikkake Trap and avoid false breakouts like a pro

WEEKLY MARKET MAYHEM

For this week’s market mayhem, here’s what we got for you today:

🎯 Fed’s Rate Cuts Keep Traders Guessing, While Yen Slides Into Danger Zone 🎢

The dollar decided to play it cool on Monday after U.S. inflation data revealed just a modest rise last month. This kinda eased concerns about how fast the Fed might slash rates in 2024.

Meanwhile, the yen was hanging around the 156 per dollar mark, flirting dangerously with levels that might trigger Tokyo’s intervention hotline. 📞🇯🇵

Investor vibes? Lifted. Congress narrowly avoided a government shutdown over the weekend (phew!), thanks to some last-minute budget magic. 🪄

But with the holidays coming in hot, trading volumes are expected to chill as the year-end looms. 🎄

The Fed’s Curveball

Last week, the Federal Reserve gave markets a good ol’ reality check, predicting a “measured pace” of rate cuts. Translation: Don’t expect fireworks anytime soon. This sent Treasury yields soaring, pushed the dollar higher 📈, and made life a bit harder for emerging markets. Ouch.

Here’s the kicker: Friday’s inflation data (the Fed’s favorite metric) showed some promise. Monthly price rises were pretty chill, and core inflation saw its smallest gain in six months. But… it’s still way above the Fed’s 2% target. 🚨

For now, traders are betting on about 44 basis points of rate cuts next year—just shy of the two 25 bp cuts the Fed teased last week. Compare that to September’s forecast of four cuts, and the market is already pushing the first easing into mid-2025. ⏳

The Dollar and the Euro Dance 🕺

The dollar index held steady at 107.78, not far from Friday’s two-year high of 108.54. The euro? Not having a great year. It’s lounging at $1.0434, close to its two-year low, and down 5.5% for the year.

Yen: The Wildcard 🎰

The yen’s journey this year? A soap opera. It’s currently chilling at 156.65 per dollar, near a five-month low. Japanese authorities are tossing out verbal warnings like frisbees, but markets expect more jawboning as liquidity thins out heading into year-end. 🏖️

Flashback: The yen hit multi-decade lows in April and July, triggering Tokyo’s intervention squad. It recovered briefly in September but is now back in the danger zone. In 2023 alone, the yen’s down 10% vs. the dollar, marking a fourth straight year of declines. 😵💫

As trading volumes thin over the holidays, the risk of sharp, illiquid market moves increases, particularly for the yen. Historically, levels near 160 per dollar have prompted Tokyo’s intervention, and the current environment suggests a heightened likelihood of such measures if volatility spikes.

For seasoned traders, this is a time to leverage cross-market analysis: monitor Treasury yields and inflation trends in the U.S. while keeping an eye on policy cues from Japan. Positioning ahead of potential intervention levels requires precision, not speculation.

🌏 Consensus 2025 is Coming to Hong Kong This February🌐

Save the date, crypto enthusiasts! From February 18-20, 2025, the Hong Kong Convention and Exhibition Centre will host Consensus Hong Kong 2025, presented by CoinDesk Events. This is your chance to be part of the biggest gathering of blockchain innovators, investors, and developers.

What’s the buzz about? The event will feature:

🔥 Panels on blockchain’s hottest trends and Web3 innovations.

💡 Exclusive insights to help you prepare for the next big market moves.

🤝 Networking opportunities with industry leaders and top minds in crypto.

And let’s not forget—Hong Kong is the perfect backdrop for a world-class event like this. 🌆

►►► Get Your 15% Discounted Pass Here for Consensus Hong Kong 2025 ◄◄◄

🚩 Bitcoin Takes a Breather After a Winning Streak 💰

Bitcoin just posted its first weekly loss since Trump’s election victory, shedding 7% in the past seven days (ouch). It’s the biggest drop since September, with the rest of the crypto market faring even worse—tokens like Ether and Dogecoin joined the pity party, sinking around 10%. 🐕💸

What happened? Blame it on the Federal Reserve’s hawkish pivot. Last week, the Fed handed us a third rate cut but threw a wet blanket on optimism, signaling a slower pace of easing next year. Translation: inflation hawks win, speculative traders lose.

Meanwhile, Trump’s promises of crypto-friendly policies (and a rumored national Bitcoin stockpile) couldn’t stop the sell-off. 📉 Even Bitcoin-loving MicroStrategy seems to be hitting pause, as the ETF outflows in Bitcoin last week hit a record high.

BTC/USD Daily Chart as of December 23rd, 2024 (Source: TradingView)

Where Bitcoin Stands Now 💰

Bitcoin is trading at $94,344, still up 37% since Trump’s election but a hefty $14,000 below its all-time high. Traders are watching $90,000 closely—break below that, and we could see further liquidations. 👀

Options markets are also flashing warning signs, with a surge in downside hedging at strikes between $75,000 and $80,000 for early 2025.

But don’t count Bitcoin out just yet! David Lawant from FalconX predicts a choppy ride through the holidays, thanks to low liquidity and the largest options expiry in crypto history coming up on Dec. 27. Volatility could spike, but Lawant sees a bullish Q1 2025 ahead. 🚀

Bitcoin’s decline underscores how sensitive the crypto market remains to macroeconomic shifts—even with political tailwinds like Trump’s pro-crypto stance. The Fed’s hawkish tone and ETF outflows are forcing traders to rethink their short-term bullish bets.

Key levels to watch: the $90,000 support zone and activity in the options market. The clustering of significant hedging activity between $75,000 and $80,000 reflects growing caution heading into 2025.

For serious traders, the Dec. 27 options expiry event could be a make-or-break moment. Thin liquidity combined with heightened volatility creates both opportunities and risks—staying nimble and managing positions effectively will be critical.

MEMES OF THE DAY

Lesson learned: “All in” is not a strategy, it’s a cry for help 🐻

Investing, trading, and pure chaos. Choose your fighter 🐉