Position in Rating | Overall Rating | Trading Terminals |

109th  | 3.3 Overall Rating |  |

Nash Markets Review

Forex brokers act as intermediaries between traders and the foreign exchange market. Choosing the right Forex broker is crucial for successful trading. A good broker offers a reliable platform, competitive spreads, and robust customer support. The right broker ensures seamless transactions, provides essential trading tools, and maintains a high level of security for your funds.

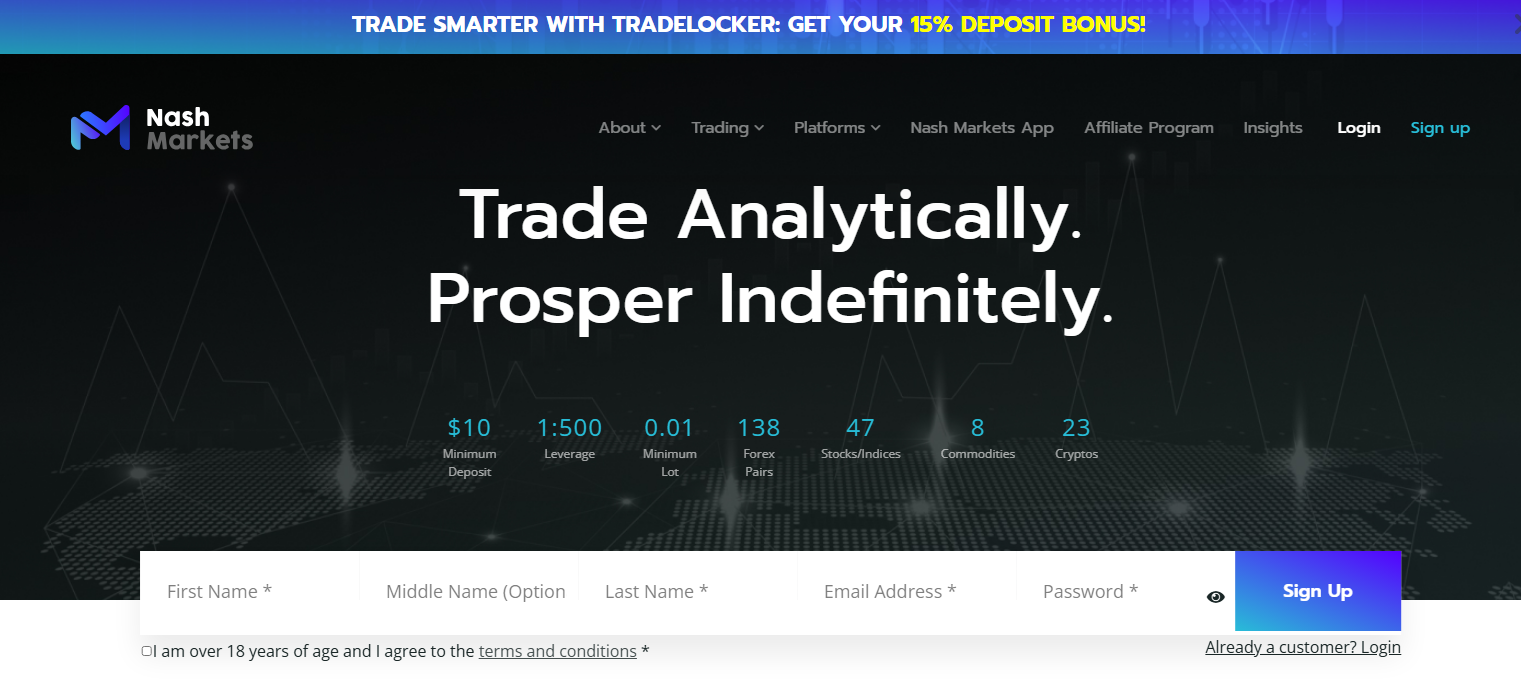

Nash Markets is a retail online Forex and CFDs broker that uses the popular MetaTrader platforms, offering a variety of financial instruments including Forex, stocks, indices, commodities, and cryptocurrencies. What sets Nash Markets apart is its focus on providing top-tier liquidity and minimal spreads, along with a user-friendly proprietary trading platform for mobile devices.

In this detailed review, I’ll provide an exhaustive evaluation of Nash Markets, emphasizing its unique selling points and potential drawbacks. My goal is to supply you with essential insights about the broker, including the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. Combining expert analysis with actual trader experiences, I aim to equip you with the necessary information to make an informed decision about considering Nash Markets as your preferred brokerage service provider.

What is Nash Markets?

Nash Markets is a retail online Forex and CFDs broker that offers a range of financial instruments including Forex, stocks, indices, commodities, and cryptocurrencies. The broker utilizes the popular MetaTrader platforms, which are known for their reliability and comprehensive trading tools. Nash Markets provides access to both MetaTrader 4 and MetaTrader 5, catering to the needs of both beginner and experienced traders.

One of the standout features of Nash Markets is its commitment to providing top-tier liquidity and minimal spreads. This means traders can benefit from tighter bid-ask spreads, leading to lower trading costs. Additionally, the broker operates with a Straight Through Processing (STP) and Electronic Communication Network (ECN) model, ensuring that there is no dealing desk intervention and enhancing transparency in trade execution.

Benefits of Trading with Nash Markets

One of the main benefits I’ve experienced while trading with Nash Markets is their competitive spreads. Whether you’re trading major Forex pairs or popular indices, the low spreads help in minimizing trading costs, which can significantly enhance profitability over time. The ability to trade with minimal commissions on certain accounts also adds to the cost-efficiency, making it an attractive option for frequent traders.

Another advantage is the range of account types offered by Nash Markets. From standard to pro and even mini accounts, there’s a choice to fit different trading styles and investment levels. This flexibility means you can start trading with as little as $10, making it accessible for beginners. The availability of a demo account is also a great feature, allowing new traders to practice without risking real money.

I also appreciate the availability of the MetaTrader 4 and 5 platforms, which are known for their robust features and user-friendly interfaces. These platforms support various trading strategies and come with a plethora of technical indicators and charting tools. The mobile trading app provided by Nash Markets is another strong point, offering convenience for managing trades on the go.

Nash Markets Regulation and Safety

When trading with Nash Markets, it’s important to understand that the broker is currently not regulated by any recognized financial authority. This means that there is no external body overseeing its operations to ensure compliance with industry standards. Knowing this is crucial because trading with an unregulated broker carries certain risks, such as a lack of investor protection and potential issues with fund safety.

Despite the lack of regulation, Nash Markets employs standard security measures to protect client funds and personal information. This includes the use of encryption technology and segregated accounts to keep client money separate from the broker’s operational funds. These practices are designed to provide a level of safety and security even though the broker isn’t subject to regulatory oversight.

As someone who has traded with Nash Markets, it’s essential to weigh the pros and cons of their regulatory status. While the broker offers competitive trading conditions and a user-friendly platform, the absence of regulation might be a red flag for more cautious traders. Understanding these factors can help you make an informed decision about whether to trade with Nash Markets or consider alternatives with more robust regulatory frameworks.

Nash Markets Pros and Cons

Pros

- Low minimum deposit

- User-friendly mobile app

- Competitive spreads

- Multiple account types

- No deposit or withdrawal fees

Cons

- Not regulated

- Limited educational resources

- No phone support, callback required

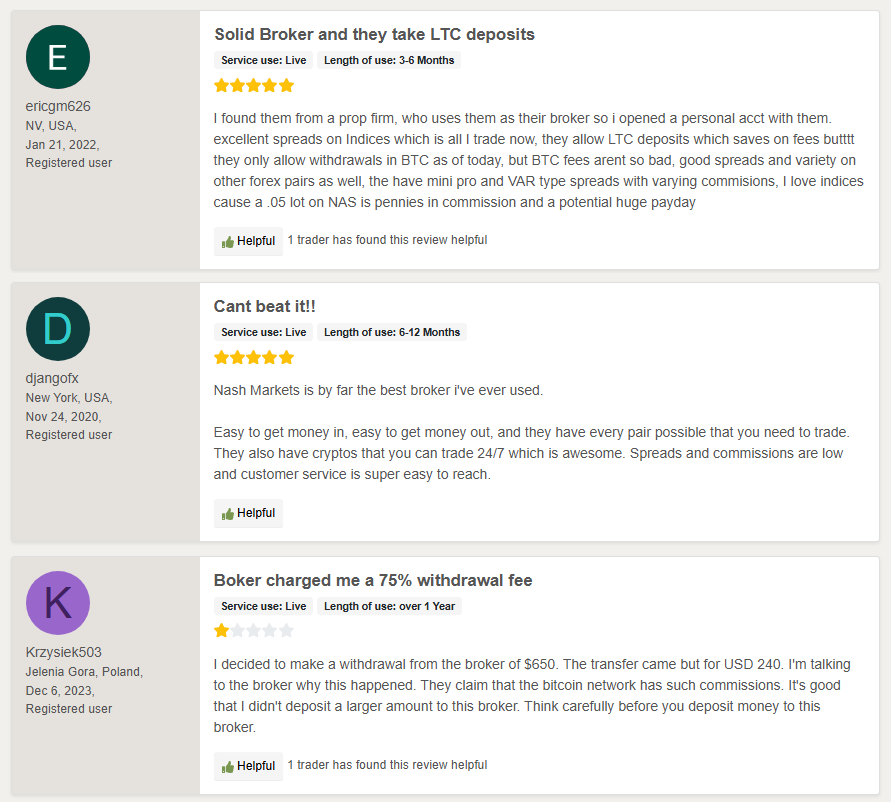

Nash Markets Customer Reviews

Customers have mixed experiences with Nash Markets. Many appreciate the broker’s excellent spreads and variety of trading instruments, particularly for indices and cryptocurrencies, which can be traded 24/7. Deposits and withdrawals are noted to be easy, though some users have faced issues with withdrawal amounts and fees, particularly when using Bitcoin. The availability of different account types with varying commissions is seen positively, but there are concerns about high fees on larger transactions.

Nash Markets Spreads, Fees, and Commissions

When trading with Nash Markets, I noticed that the spreads are quite competitive, especially for popular instruments like indices and major Forex pairs. For instance, trading indices like NASDAQ with a 0.05 lot incurs minimal commission, making it appealing for day traders and scalpers. The variety of account types, including mini, pro, and VAR accounts, allows traders to choose the structure that best fits their trading style, each with varying spreads and commission levels.

In terms of fees, Nash Markets does not charge any deposit or withdrawal fees, which is a significant advantage for frequent traders. However, they only allow withdrawals in Bitcoin, which can incur network fees. The transaction speed for deposits and withdrawals is generally fast, ensuring that traders can access their funds quickly when needed. This convenience is a big plus, though it’s essential to be aware of potential fees from the Bitcoin network itself.

The commission structure at Nash Markets is also noteworthy. For standard accounts, the commission is $5 per standard lot, while pro accounts have a commission of $10 per standard lot but offer zero spreads. This flexible commission setup helps cater to different trading preferences, whether you prioritize lower spreads or lower commissions. Understanding these costs is crucial for effective trading and maximizing profits.

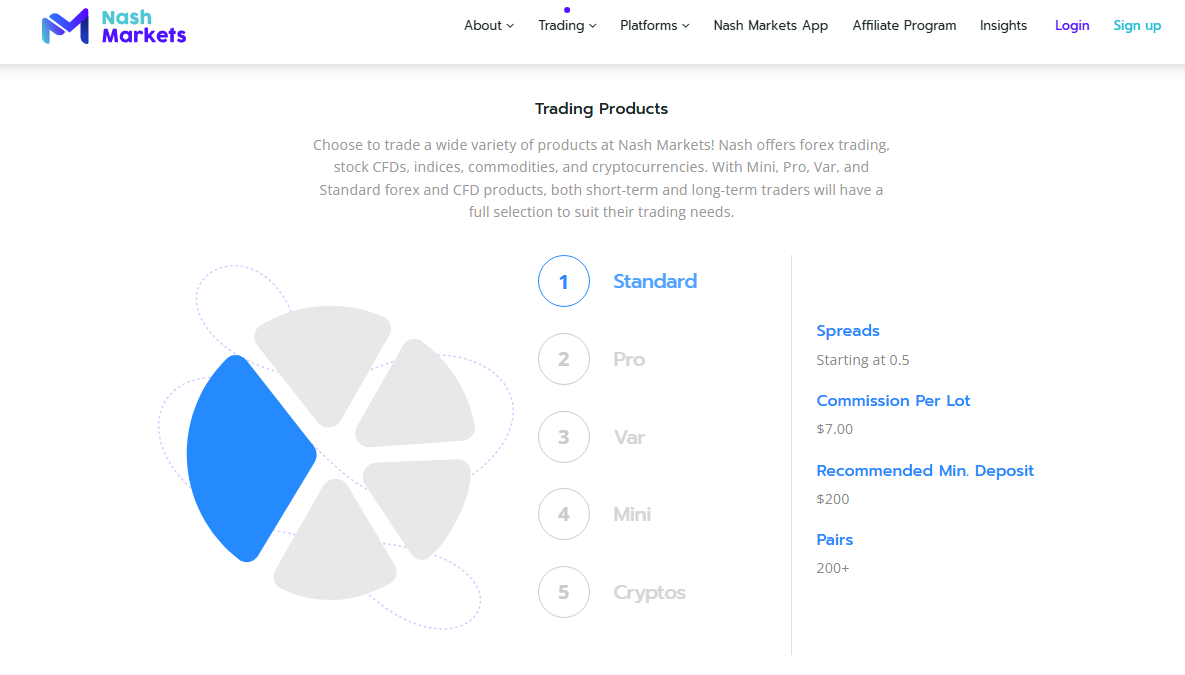

Account Types

Standard Account

- Spreads start from 0.5 pips

- Commission: $5 per standard lot

- Minimum deposit: $200

- Access to over 200 financial instruments

Pro Account

- Spreads start from 0.0 pips

- Commission: $10 per standard lot

- Minimum deposit: $200

- Ideal for precise market entries

Var Account

- Spreads start from 1.0 pips

- No commission fees

- Minimum deposit: $200

- Best for avoiding commission costs

Mini Account

- Spreads start from 1.2 pips

- Commission: $1 per lot

- Minimum deposit: $50

- Suitable for beginners or testing strategies

Crypto Account

- Variable spreads

- Commission: $10 per standard lot

- Minimum deposit: $10

- Focused on 17 cryptocurrency CFDs

Demo Account

- Preloaded with virtual funds

- Risk-free way to practice trading

- Useful for getting comfortable with the platform

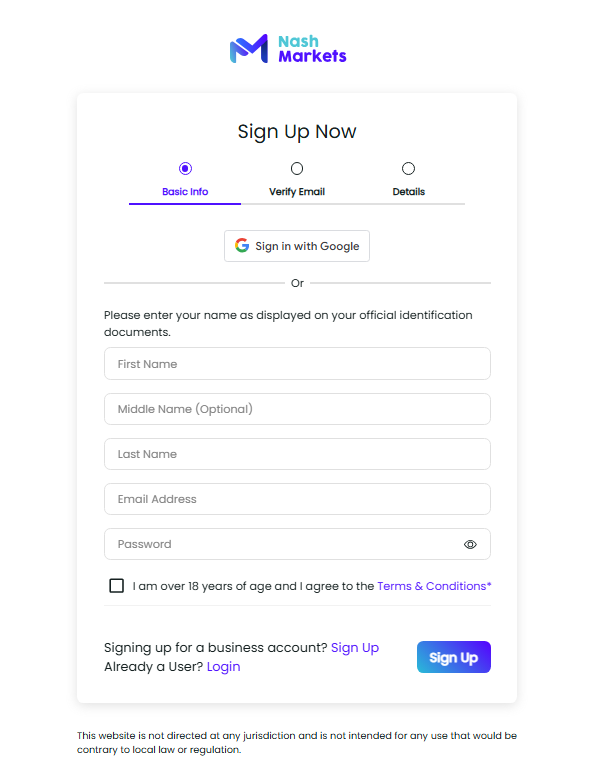

How to Open Your Account

- Go to the official Nash Markets website and click the “Sign Up” button.

- Enter your personal information as requested by the company.

- Create a secure password for your account.

- Confirm your email address through the link sent to your inbox.

- Log in to your user account using your email and password.

- Complete the KYC (Know Your Customer) verification process by uploading the required documents.

- Choose the type of trading account that best suits your needs.

- Make your initial deposit using one of the accepted payment methods and start trading.

Nash Markets Trading Platforms

Their primary trading platforms are MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are known for their reliability and comprehensive tools, which make trading more efficient and effective. MT4 is particularly user-friendly, making it a popular choice among traders who are new to the market, while MT5 offers more advanced features for experienced traders.

The MetaTrader 4 platform provides a wide range of technical indicators and charting tools, which are essential for thorough market analysis. It is available on desktop, web, and mobile versions, ensuring that you can trade anytime and anywhere. I found the interface to be intuitive and customizable, allowing me to set it up according to my trading preferences.

MetaTrader 5, on the other hand, offers enhanced functionalities such as additional timeframes and order types. This platform is ideal for those who require more sophisticated trading tools and access to a broader range of financial instruments, including stocks and commodities. MT5 also supports automated trading through Expert Advisors, which can be a significant advantage for traders looking to implement complex strategies.

Nash Markets also provides a proprietary mobile trading app, which is convenient for managing trades on the go. The app supports both iOS and Android devices, offering real-time price quotes and the ability to execute trades directly from your phone. This flexibility makes it easier to stay connected to the markets and respond quickly to trading opportunities.

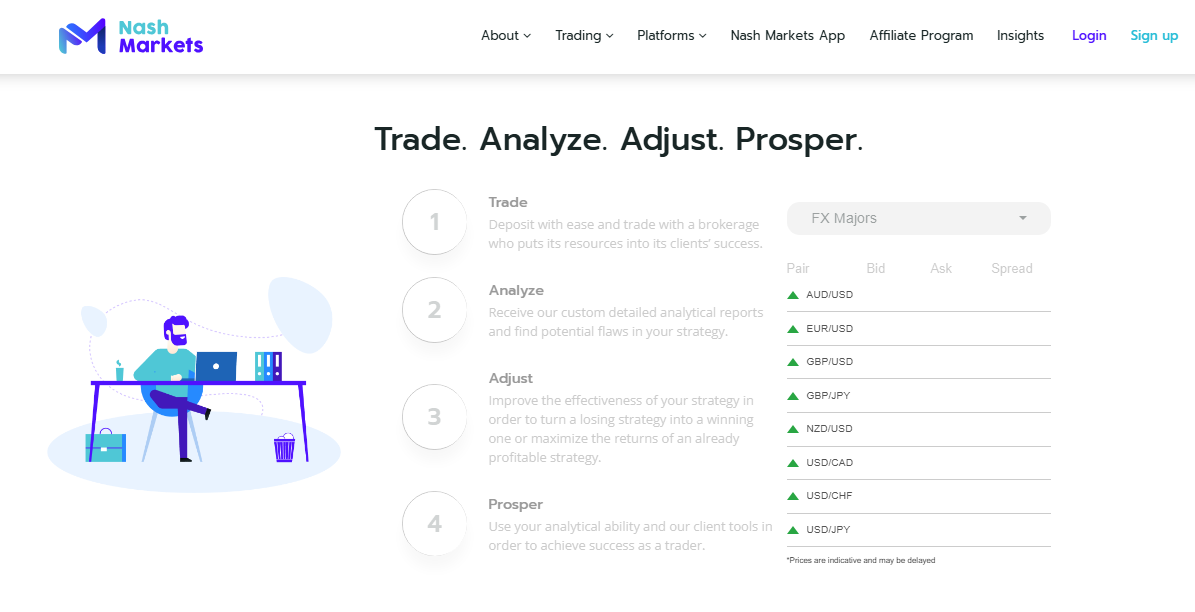

What Can You Trade on Nash Markets

They offer a diverse range of trading instruments that cater to different trading preferences. You can trade major and minor Forex pairs, which include popular currencies like EUR/USD, GBP/USD, and USD/JPY. The Forex market on Nash Markets is highly liquid, providing ample opportunities for both short-term and long-term traders. Their spreads on Forex pairs are competitive, making it cost-effective to trade these instruments.

In addition to Forex, Nash Markets allows you to trade various CFDs on stocks and indices. This includes well-known indices such as the NASDAQ, S&P 500, and Dow Jones Industrial Average. Trading indices can be a great way to diversify your portfolio and take advantage of broader market movements. The broker also offers CFDs on major global stocks, giving you access to a wide range of equity markets.

For those interested in commodities, Nash Markets provides trading options in precious metals like gold and silver, as well as energy commodities such as oil and natural gas. Commodities can be a good hedge against market volatility and offer additional diversification to your trading portfolio. The ability to trade these assets alongside Forex and stocks makes Nash Markets a versatile platform for traders.

Cryptocurrency trading is also available on Nash Markets, which is perfect for those looking to capitalize on the volatility of digital assets. You can trade popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin, with the added benefit of being able to trade them 24/7. This round-the-clock trading capability ensures you never miss an opportunity in the rapidly changing crypto market.

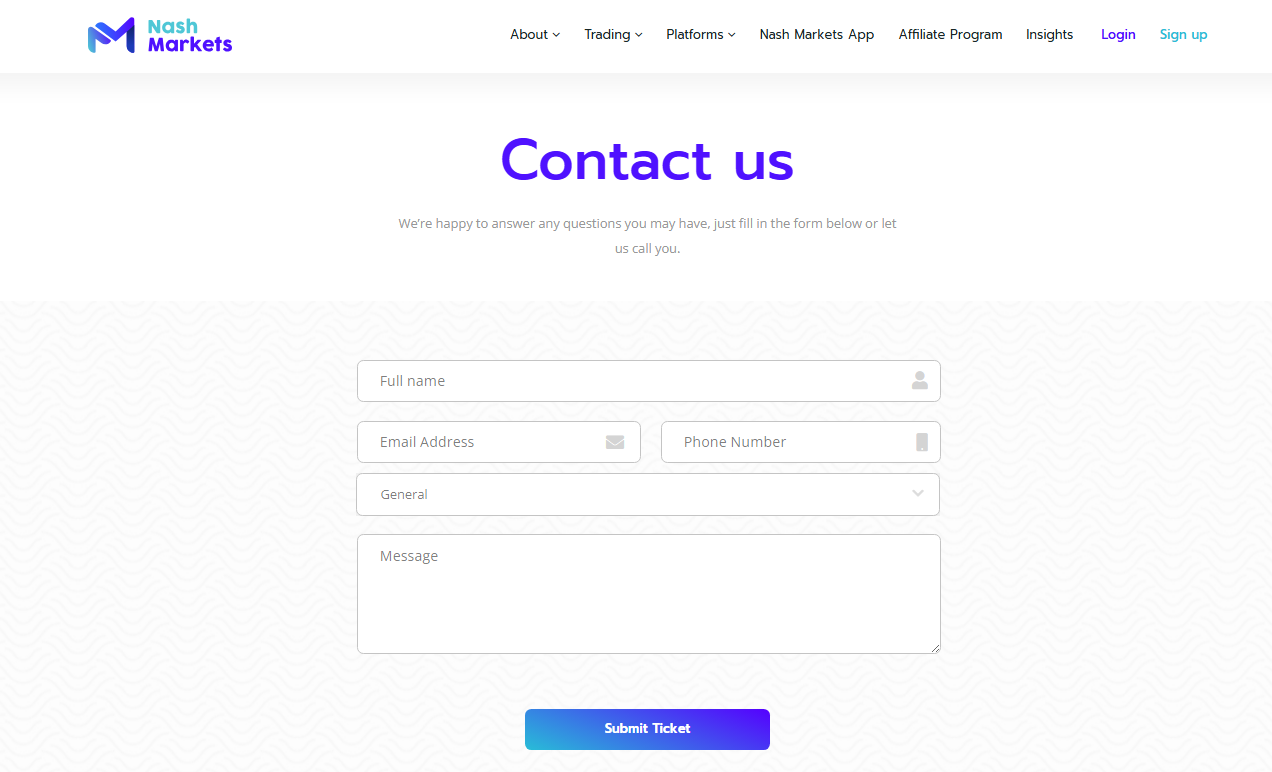

Nash Markets Customer Support

Their customer support is quite efficient and accessible. They offer 24/7 support via live chat, ensuring that help is available at any time, which is crucial for traders who operate in different time zones. The live chat feature is particularly responsive, with representatives typically replying within a minute, which makes it easy to resolve issues quickly.

You can also reach out to Nash Markets through their email support or by submitting a ticket through the Contact section on their website. This multi-channel support approach ensures that you have several options for getting help, whether it’s a quick question or a more detailed issue. Their email support is reliable and usually responds within a few hours, providing detailed and helpful answers.

For those who prefer social media, Nash Markets has active profiles on platforms like Twitter, Facebook, and Instagram. This allows for more casual interaction and quick updates about any service changes or new features. Additionally, you can chat with other Nash Markets clients on Discord, which fosters a community of traders who can share insights and tips.

Advantages and Disadvantages of Nash Markets Customer Support

Withdrawal Options and Fees

They offer limited withdrawal options, primarily focusing on cryptocurrency transactions. You can make withdrawals using Bitcoin, which is processed quickly, usually within 1-2 hours. This speed is a significant advantage, especially for traders who need rapid access to their funds.

However, one downside is that Nash Markets only allows withdrawals in Bitcoin, which can be a limitation for some traders. While Bitcoin transactions are generally fast, they can sometimes incur network fees. These fees are not charged by Nash Markets directly, but they can add up depending on the blockchain’s current congestion.

Another point to consider is the absence of traditional withdrawal methods like bank transfers or e-wallets. This lack of options might be inconvenient for traders who prefer more conventional methods. Despite the efficiency of crypto withdrawals, having more withdrawal options would make the platform more accessible to a broader range of users.

Nash Markets Vs Other Brokers

#1. Nash Markets vs AvaTrade

Nash Markets and AvaTrade are both prominent brokers, but they cater to different types of traders. Nash Markets offers a wide range of trading instruments, focusing heavily on cryptocurrencies and indices with competitive spreads and fast execution. In contrast, AvaTrade boasts over 1,250 financial instruments and operates under multiple regulatory bodies across several countries, ensuring a high level of security and trust. AvaTrade’s extensive global presence and rigorous regulation make it appealing for traders looking for a secure trading environment. Meanwhile, Nash Markets is ideal for traders who prefer flexibility in cryptocurrency trading and lower initial deposit requirements.

Verdict: AvaTrade is better for traders prioritizing regulation and a vast range of instruments, while Nash Markets excels for those focusing on cryptocurrency and lower costs.

#2. Nash Markets vs RoboForex

Both Nash Markets and RoboForex provide a comprehensive trading experience, but they differ in their offerings and focus. Nash Markets is known for its straightforward and efficient trading platform, especially beneficial for cryptocurrency traders. RoboForex, however, provides a broader array of trading platforms, including MetaTrader, cTrader, and RTrader, along with a unique contest feature, ContestFX, which can help traders enhance their skills and win real funds. Additionally, RoboForex supports a wide range of asset classes and offers personalized trading conditions, making it a versatile choice for various trading styles.

Verdict: RoboForex is superior for traders seeking a variety of platforms and competitive trading conditions, while Nash Markets is preferable for those focused on cryptocurrency trading and simplicity.

#3. Nash Markets vs Exness

Nash Markets and Exness each offer distinct advantages. Nash Markets excels in cryptocurrency and indices trading with competitive spreads and a user-friendly mobile platform. Exness, on the other hand, provides an extensive range of CFDs, including over 120 currency pairs, and boasts a significant monthly trading volume. Exness is known for its low commissions, immediate order execution, and the option of infinite leverage on small deposits, catering to both novice and experienced traders. Furthermore, Exness offers a demo account, making it easier for traders to practice and refine their strategies.

Verdict: Exness is better suited for traders looking for a wide range of CFDs and flexible leverage options, whereas Nash Markets is ideal for those prioritizing cryptocurrency and straightforward trading.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH NASH MARKETS

Conclusion: Nash Markets Review

In conclusion, Nash Markets offers a robust trading experience with competitive spreads and a user-friendly platform. Their strengths lie in cryptocurrency trading and low initial deposit requirements, making them an attractive choice for both new and experienced traders. The availability of the MetaTrader 4 and 5 platforms adds flexibility and sophistication to their trading tools, enhancing the overall trading experience.

However, it is important to note that Nash Markets operates without regulatory oversight, which can be a significant drawback for some traders. Their limited withdrawal options, primarily through Bitcoin, and potential network fees may also pose challenges for those accustomed to more traditional banking methods. Despite these drawbacks, Nash Markets’ fast execution and competitive trading conditions make them a viable option for many traders.

Also Read: Uniglobe Markets Review 2024 – Expert Trader Insights

Nash Markets Review: FAQs

Is Nash Markets regulated?

No, Nash Markets is not regulated by any recognized financial authority, which means it operates without external oversight.

What trading platforms does Nash Markets offer?

Nash Markets offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with a proprietary mobile trading app.

What are the withdrawal options and fees at Nash Markets?

Withdrawals at Nash Markets are primarily done through Bitcoin, and while the broker does not charge direct fees, network fees may apply depending on blockchain congestion.

OPEN AN ACCOUNT NOW WITH NASH MARKETS AND GET YOUR BONUS