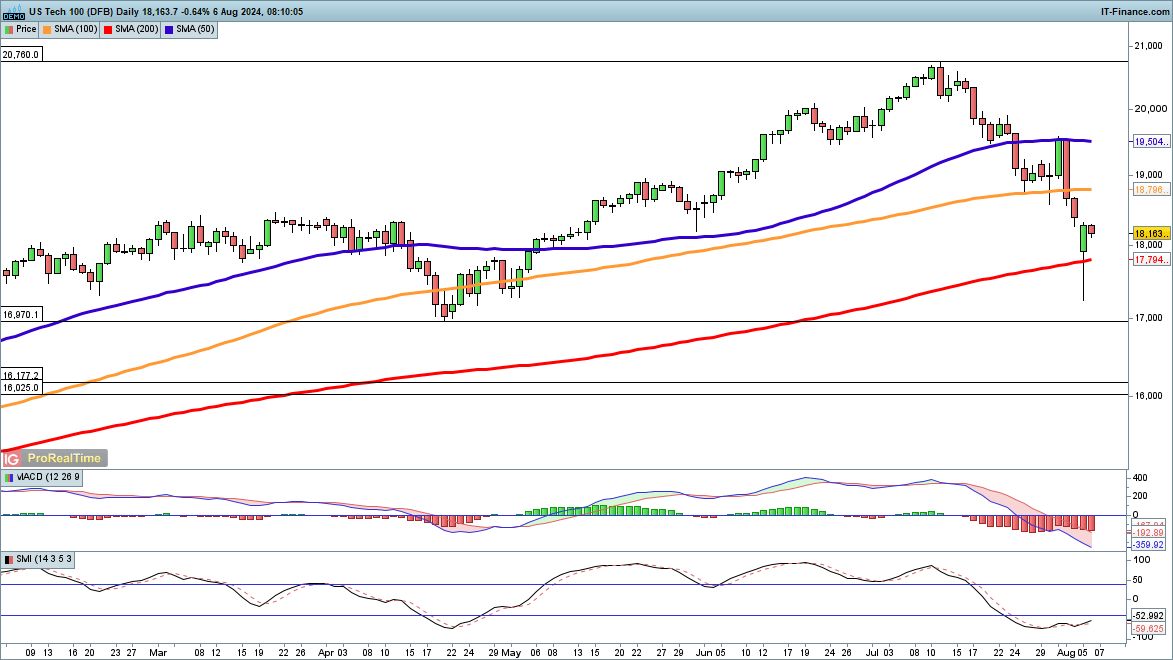

Nasdaq 100 Sees Dramatic Recovery

Yesterday witnessed a significant rebound from session lows in the Nasdaq 100. Notably, the price recovered and held above the 200-day simple moving average (SMA), currently at 17,794. The index has dropped 12.5% from its July record high, after being nearly 17% down at yesterday’s lows. This marks the largest pullback since October 2023, potentially signaling a temporary bottom.

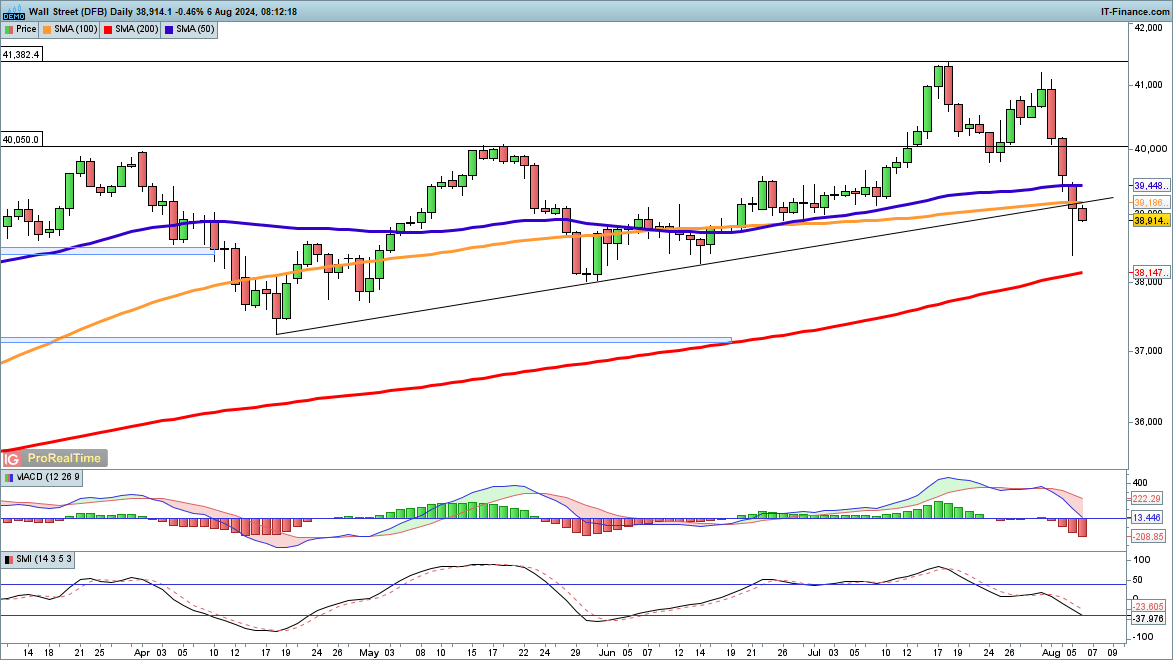

Dow Recovers from Lows

The Dow also bounced back from its lows, though the overnight rebound was less pronounced. Bulls are looking for a move above 39,200, which would position the price above yesterday’s close and the 100-day SMA.

A close below 39,000 would be bearish, indicating a possible test of Monday’s lows and the 200-day SMA, currently at 38,147.

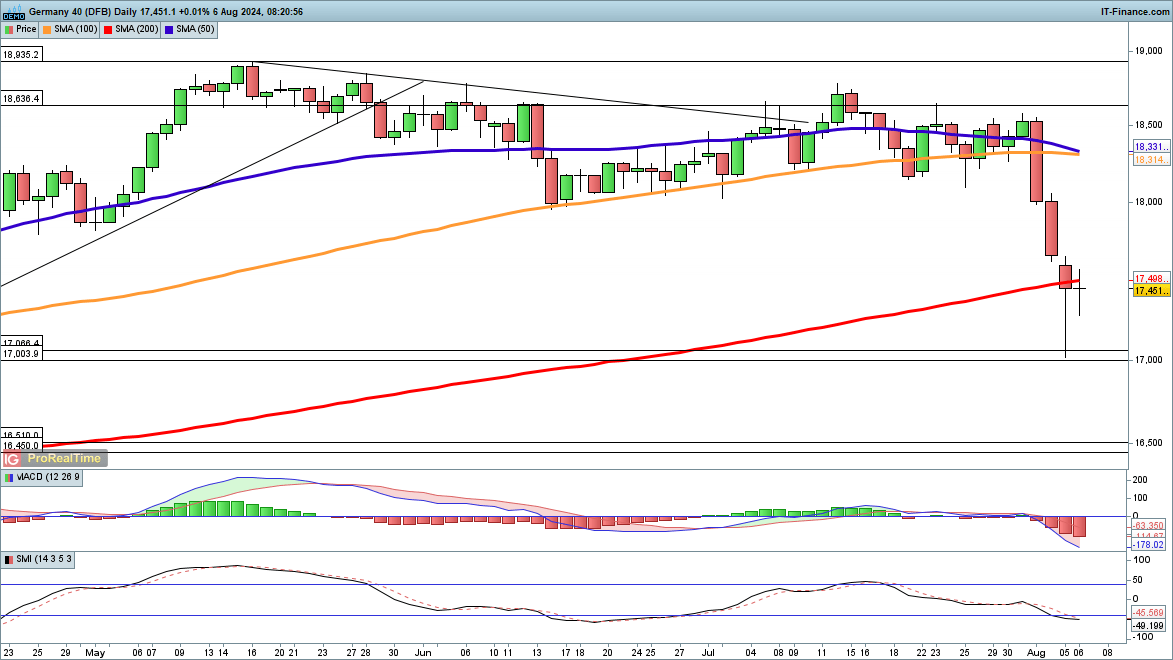

Dax Rally Faces Resistance

The Dax's overnight bounce has encountered resistance, with the price struggling to hold above the 200-day SMA. A close above this level would support the notion of a bottom and could lead to a gradual recovery.

However, further declines below 17,300 would bring yesterday’s low of 17,000 back into focus.