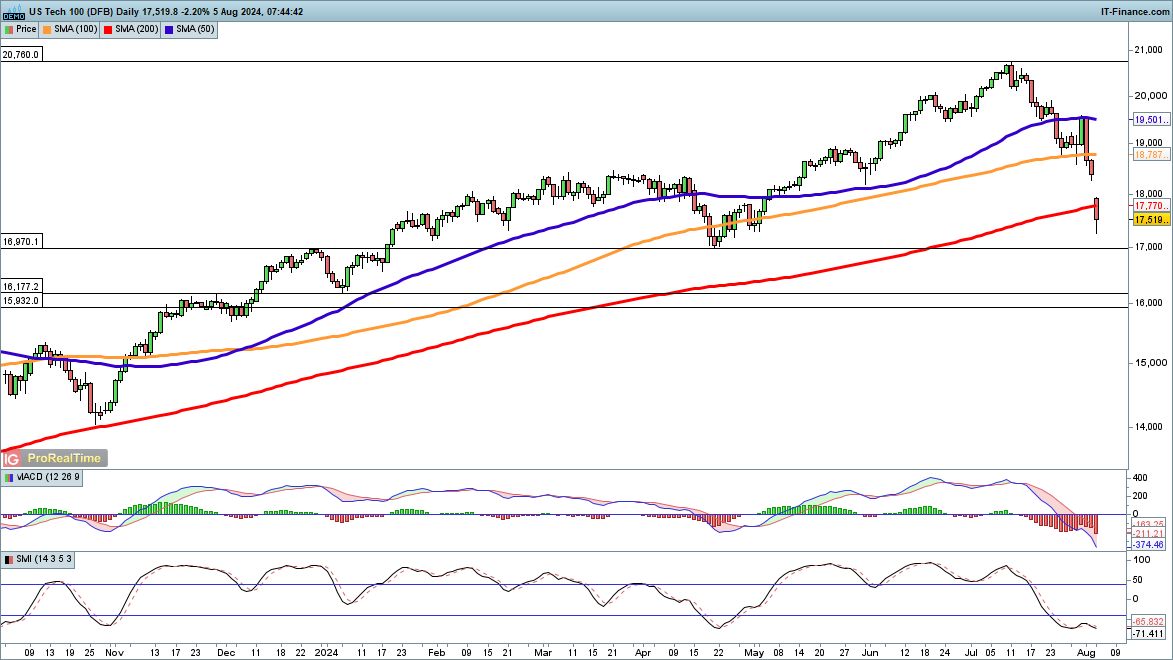

Nasdaq 100 Plummets in Morning Trade

At one point this morning, the Nasdaq 100 was anticipated to open 1,000 points lower in the cash session. The index has gapped lower, now trading below the 200-day SMA for the first time since March 2023. This drop has erased all gains since the beginning of May. The next target is April’s low around 17,000, followed by January’s low at 16,177.

Any recovery needs to maintain above the 200-day SMA and close the gap created this weekend with a move back above 18,300.

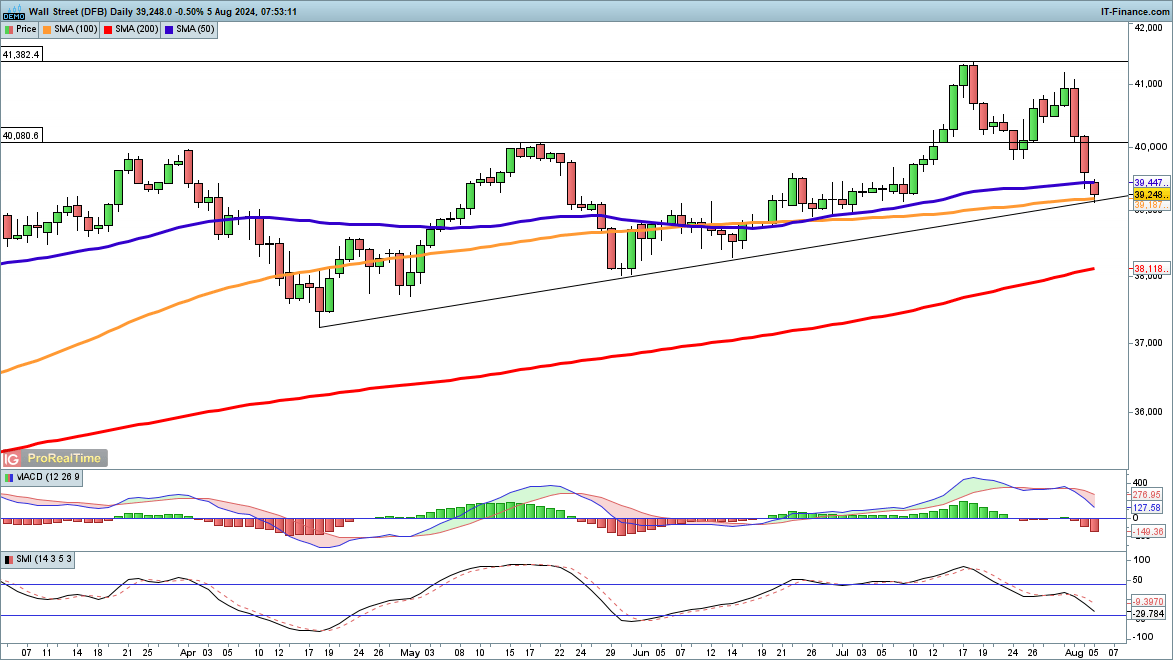

Dow Holds Above Key Support, but July Gains Erased

For now, the index is holding above 39,000, though it has also given back all gains made in July. The price is sitting right on trendline support from the April low. A close below this level would open the way towards 38,000 and the 200-day SMA.

In the short term, buyers will seek a rebound back above 39,500, but with significant losses in other indices worldwide, this may only be a brief pause before another decline.

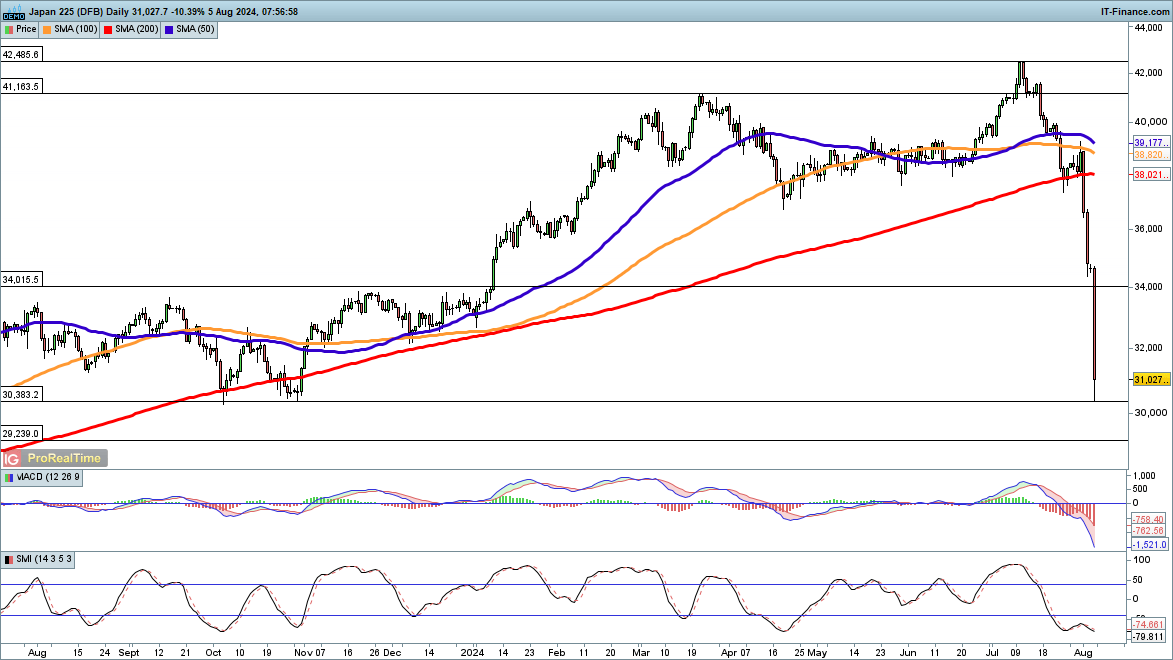

Nikkei 225 Hits Lowest Level Since November

The declines have intensified for this index, as it plunges to its lowest level since November. All gains for the year have been wiped out. It seems almost unbelievable that the index was trading at a record high less than a month ago, around 11,000 points higher than its current level.

Such a move rarely concludes in one day, suggesting further volatility ahead. A close below November 2023’s low at 30,383 and below 30,000 would likely trigger additional selling.