Naked forex trading is trading without the use of standard technical indicators. Standard technical indicators focus on algorithms, or complex market assessment techniques. They are used to give traders insight into the prior, present, and future performance of an asset. Most forex traders rely on technical analysis because they believe that technical indicators give them an edge in the market.

Trading without indicators requires naked forex traders to rely on the current performance of the asset, They use their knowledge of market cycles, industry performance, events affecting performance of the asset, the asset's current market price movements, and the asset's potential to guide their trades.

Naked trading techniques focus on trading without indicators. Since they only focus on a few price points in real-time, technical analysis would be of no assistance to naked traders.

Also Read: Best Technical Indicators for Day Trading

Contents

Naked Trading Strategies

Naked forex traders base their trading decisions on the following types of market analysis.

Real-Time Market Chart Trends and Details

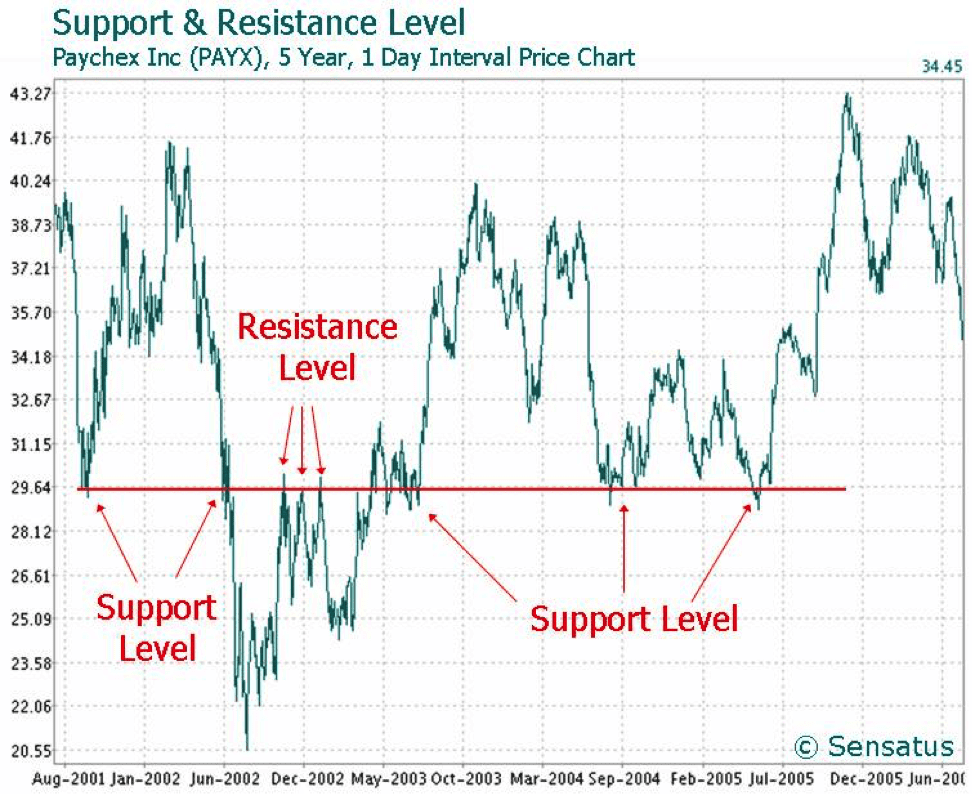

Naked traders focus on what is happening in the market at the time they are trading. They spend their time analyzing price support and resistance zones, price swings, price extremes (e.g., highest highs, higher highs, lower lows, lowest lows).

For example, in a bullish trend, traders see higher highs and higher lows. These trends signal them to buy assets. Whereas, in a bearish trend, they observe lower highs and lower lows which signal them to sell assets.

Trade Order Flows

Traders use a collection of prices that list all the interested buyers who are placing bids and the potential sellers who are placing prices. This information is listed in a lavender book that traders use to adjust their own personal price supports and resistance levels.

Trading order flow is used to identify places in the market where an asset's price fell or significantly rose. The analysis of trading order flows can be done with the naked eye and quickly.

Real-Time Price Movements

Real-Time price movements are used in combination with other market metrics. It tends to be used in combination with trading volume and order flow data. These metrics together, tell naked traders when to enter and exit a market position.

Also Read: How To Use Volume Price Analysis

Probability Trading Without Indicators

People trading without indicators use a streamlined and highly effective approach to trading. Naked trading techniques focus on a simple and superior way to read the market. For example, they use probability techniques for trading that incorporate human psychology and behavior into their trading strategy. Using their knowledge of people and careful observation of the market, they make trading without indicators an effective trading strategy.

Naked forex traders rely on high probability trading. They use simple, high probability techniques to find good market positions for entry and exit. A class of these market techniques are referred to as the Trapped Trader techniques.

Trapped Traders

The trapped trader techniques are naked forex high probability techniques that have proven themselves to be a superior way to trade.

Who are the trapped traders?

Trapped traders are the forex traders who didn't exit the market before it moved against them. When they realize how much money they've lost or may lose due to the market moving against them (e.g., market reversal or break), they go into shock (understandably) and behave in a predictable way that enriches the fortunes of naked traders who are aware of the situation in the market.

Types of Trapped Traders

There are 2 types of trapped traders, the overwhelmed and the chasers.

The overwhelmed trapped traders realize that they are trapped in the market and rush to exit it. They hastily exit the market because they want to avoid greater losses of profit and/or capital.

The chasers are obsessed with finding the next winning market position. They look for profitable market trends and then chase them. Since they usually never predict the market trends, they never get into them. They are forever chasing profit without actually earning a lot of it.

Quasimodo Trading

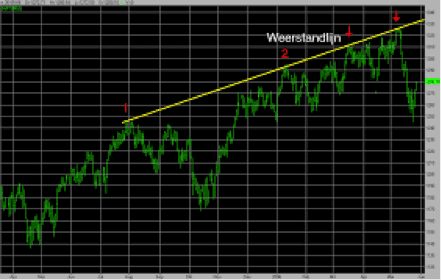

In this trading scheme, trapped traders get stuck between consecutive lows that are sandwiched between higher highs or lower lows sandwiched between lowest lows.

When these traders get really scared, they exit the market in large numbers. As the traders exit the market en masse, they sell off their holdings to curb their losses. While they are doing this, the asset's price rapidly falls and naked traders begin buying up the asset after its price has severely fallen. In the end, the naked traders get a valuable asset at a heavily discounted market price and make a nice profit on it after the price rebounds.

Two-Legged Correction

The two-legged correction, also referred to as the complex pullback, often traps traders. This market pattern is characterized by the asset's price movement consolidating or retracing itself.

The trapped traders become fearful and anxious because they are incurring heavy losses. In a panic, they exit the market driving the asset's market valuation down as they go. Their mass exodus creates the next market trend that is captured early by naked traders who have correctly read the market.

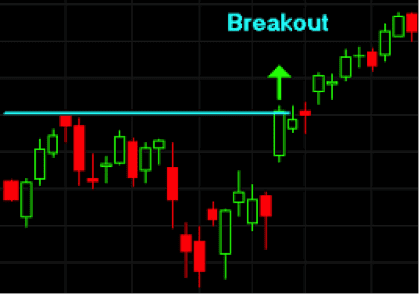

Pinocchio Bar Strategy

Pinocchio Bar charts have price movements that break through the earlier price swings and then stop after they break through the support/resistance line. This is known as a price rejection.

A price rejection is marked by a candlestick tail, wick or shadow, that is longer than the highest high or lower than the lowest low. The price rejection is a signal to naked traders that large numbers of trapped traders are entering or exiting the market. If they are entering or exiting the market in large numbers, that is a golden opportunity for naked traders to make a smart market move.

Other Trapped Trader Strategies

There are more than 3 trapped trader trading techniques. Experienced naked traders learn to understand the mindset of trapped traders in the market charts. They use their understanding of the trapped trader mindset to understand and exploit market psychology and its real-time dynamics. In their case, trading without indicators only refers to technical indicators not human ones.

Summary

Naked trading, trading without indicators, is a simple trading technique that combines real-time market observation, knowledge of market cycles and patterns, human psychology and behavior. Being able to do all these things in their minds quickly allows them to cut through the market noise and find the market gems. If you want to use naked forex trading as your trading strategy, trade with care, objectivity, and personal restraint (don't become a trapped trader).