Position in Rating | Overall Rating | Trading Terminals |

262nd  | 2.0 Overall Rating |  |

Nadex Review

Nadex is a U.S.-regulated exchange specializing in binary options, knock-outs, and call spreads. It offers traders an accessible platform to speculate on various financial markets, including forex, indices, and commodities. The platform's unique approach allows users to trade with limited risk, clearly defined outcomes, and transparent fee structures.

One of the standout features of Nadex is its easy-to-use interface, making it suitable for both beginners and experienced traders. Additionally, the exchange provides a demo account, enabling users to practice strategies before committing real funds. Its regulation by the CFTC adds a layer of trust and credibility, ensuring traders operate within a secure environment.

Overall, Nadex is an excellent choice for individuals looking for innovative trading options with controlled risk. Its clear-cut pricing and diverse market access make it a competitive player in the online trading space.

What is Nadex?

Nadex is a U.S.-regulated exchange that offers binary options, knock-outs, and call spreads for trading. It allows individuals to speculate on various markets, including forex, commodities, and stock indices. Known for its transparency, Nadex provides defined risk and reward structures, making it appealing to traders seeking controlled outcomes.

The platform is designed to be user-friendly, catering to both beginners and experienced traders. It includes tools such as a demo account and educational resources to help users build their trading skills. With regulation by the Commodity Futures Trading Commission (CFTC) as a Designated Contract Market, Nadex ensures a secure trading environment.

Nadex Regulation and Safety

The North American Derivatives Exchange (Nadex) is a U.S.-regulated trading platform specializing in binary options, knock-outs, and call spreads, offering traders a secure and transparent environment for diverse market opportunities. This regulation provides traders with confidence in the platform's transparency and security.

Safety is further enhanced through its clear risk structure, where traders know their maximum potential loss before entering a trade. The platform employs robust security measures to protect personal and financial information, giving users a secure trading experience. Nadex also holds client funds in segregated accounts within U.S.-based banks, safeguarding user deposits.

Nadex Pros and Cons

Pros

- Low fees

- Regulated platform

- Fast payouts

- Easy interface

Cons

- Limited assets

- U.S.-only users

- Learning curve

- No MT4 integration

Benefits of Trading with Nadex

Nadex offers several benefits for traders, making it a preferred choice for those seeking innovative financial instruments. One key advantage is its clearly defined risk and reward structure, allowing traders to know their maximum potential loss or gain before entering a trade. This transparency makes Nadex an appealing option for risk-conscious individuals.

The platform also provides access to a diverse range of markets, including forex pairs, commodities, and stock indices, all from a single account. Its user-friendly interface and availability of a free account help traders of all skill levels to practice and refine their strategies. Additionally, as a CFTC-regulated exchange, Nadex ensures a secure and compliant trading environment.

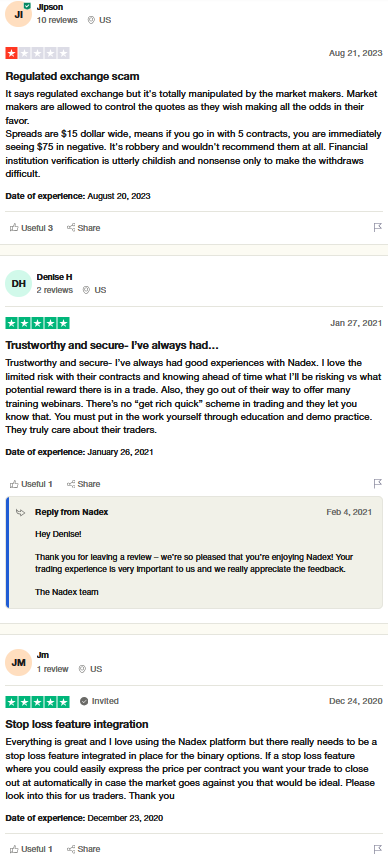

Nadex Customer Reviews

Customer reviews of Nadex highlight its user-friendly platform and clear risk-reward structure as standout features. Many traders appreciate the ability to trade binary options and other instruments with defined outcomes, which helps in managing potential losses effectively. The platform's account and educational resources also receive positive feedback for supporting beginners.

On the other hand, some users mention the need for a deeper understanding of trading strategies to succeed, as the platform requires active decision-making. However, Nadex's regulation by the CFTC reassures customers about its security and legitimacy, earning trust from traders who prioritize a safe trading environment.

Nadex Spreads, Fees, and Commissions

Nadex offers a transparent fee structure, making it easy for traders to understand costs upfront. The platform charges a $1 fee per contract for opening and closing trades, with a $1 settlement fee applied to contracts held until expiration. Importantly, Nadex caps total transaction fees at $50 per side, ensuring affordability for higher-volume trades.

When it comes to spreads, Nadex provides competitive bid-ask pricing on its binary options, knock-outs, and spread contracts. The spreads represent the maximum potential risk and reward, allowing traders to manage their positions effectively. There are no hidden fees or additional charges, as all costs are integrated into the trade structure.

Account Types

Nadex offers a range of account types designed to cater to different trading needs and expertise levels. Each account provides access to innovative trading tools and a variety of markets, making it easier for traders to find the best fit for their goals.

Call Spreads

Call spreads are another trading option on Nadex, offering a defined range within which traders speculate on market movements. Profits and losses are capped by the range's floor and ceiling, providing clear boundaries for risk. Call spreads are suited for traders looking for controlled risk while benefiting from market volatility within a specific range.

Knock-outs

Knock-outs are a type of trade on Nadex with a set price range, where the position automatically closes if the market reaches either the floor or ceiling of the range. These contracts allow traders to control their maximum risk and reward, making them ideal for managing exposure. Knock-outs are popular for short-term strategies due to their predictable outcomes.

Demo Account

The Demo Account is a risk-free option for beginners or those testing strategies. It comes with virtual funds, enabling users to explore Nadex‘s platform without financial risk.

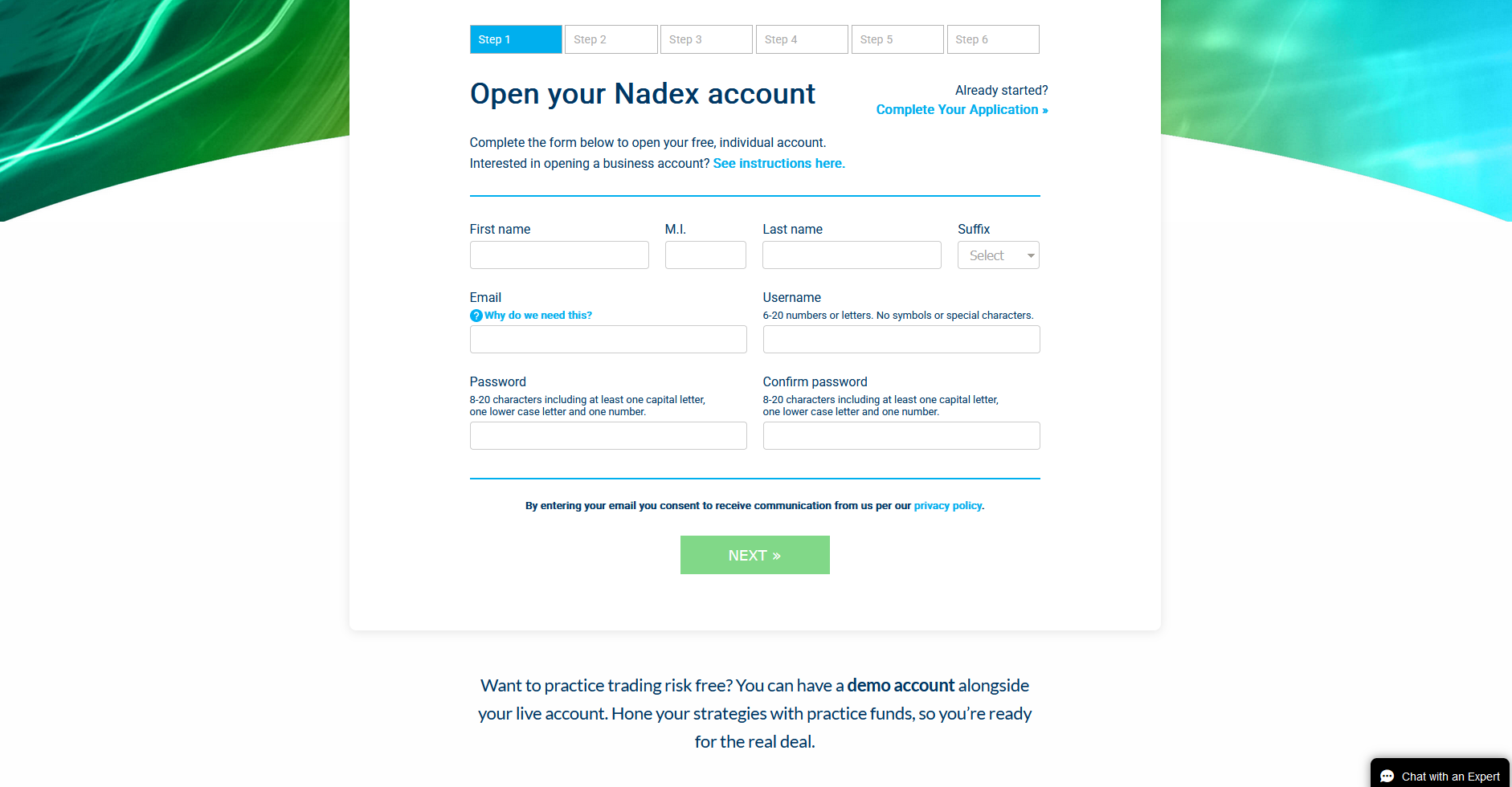

How to Open Your Account

Opening an account with Nadex is a straightforward process designed to make trading accessible for beginners and experienced traders alike. By following a few easy steps, users can gain access to a wide range of trading opportunities on this innovative platform.

Step 1: Visit the Nadex Website

Navigate to the official Nadex website to begin the account registration process. Look for the “Sign Up” or “Create Account” button prominently displayed on the homepage.

Step 2: Provide Personal Information

Fill out the registration form with accurate details, including your name, email address, and phone number. Ensure all the information matches your official identification for verification purposes.

Step 3: Verify Your Identity

Upload the required documents, such as a government-issued ID and proof of address, to verify your identity. Nadex prioritizes security to comply with regulatory standards.

Step 4: Fund Your Account

Choose a preferred payment method and deposit funds into your Nadex account. The platform supports various funding options, including bank transfers and debit cards.

Step 5: Start Trading

Once your account is funded and verified, you can access the trading platform. Explore the available markets and start placing trades on Nadex with ease.

Nadex Trading Platforms

Nadex provides a robust and user-friendly trading platform designed to cater to both beginners and experienced traders. Its web-based platform offers access to binary options, knock-outs, and call spreads, with intuitive navigation and tools for analyzing markets. The platform’s real-time data and charting features enable informed decision-making for a wide range of markets, including forex, commodities, and indices.

For traders on the go, Nadex offers a mobile app that mirrors the functionality of its desktop version. Users can execute trades, monitor positions, and manage their accounts seamlessly from their smartphones. The platform also includes a free trial account, allowing users to practice strategies without risking real money.

What Can You Trade on Nadex

Nadex is a trading platform that offers a wide range of short-term, limited-risk financial instruments. It allows traders to speculate on various markets, including forex, commodities, stock indices, and economic events, using binary options, call spreads, and knock-outs. The platform is designed for both new and experienced traders seeking flexibility and risk management.

Forex Trading

Nadex offers forex trading through binary options and knock-outs, allowing traders to speculate on currency pairs like EUR/USD or GBP/USD. These instruments provide clear risk and reward, making it easier for traders to manage their positions in a volatile forex market.

Commodities Trading

Traders can engage in commodities trading on Nadex, covering markets like crude oil, gold, and natural gas. These contracts let users profit from price movements in global commodity markets while controlling risk.

Stock Indices

Nadex provides access to stock indices such as the S&P 500, NASDAQ, and Dow Jones. Traders can speculate on the performance of major equity markets without directly owning stocks.

Economic Events

Trading on economic events is another unique feature of Nadex, allowing users to predict the outcomes of reports like non-farm payrolls or jobless claims. This type of trading offers opportunities tied directly to macroeconomic data releases.

Nadex Customer Support

Nadex offers reliable customer support to assist traders with their inquiries and concerns. Users can access support through multiple channels, including email, phone, and live chat, ensuring prompt and convenient communication. The support team is knowledgeable about the platform and trading processes, making it easy for customers to resolve issues.

In addition to direct assistance, Nadex provides extensive educational resources, such as webinars, tutorials, and a comprehensive FAQ section. These tools help traders improve their skills and navigate the platform more effectively. The combination of responsive support and educational materials enhances the overall user experience.

Advantages and Disadvantages of Nadex Customer Support

Withdrawal Options and Fees

Understanding the withdrawal process and associated fees is crucial for users trading on Nadex. The platform offers various withdrawal methods, each with its specific requirements and costs, ensuring flexibility and transparency for traders.

Bank Transfer

Nadex supports bank transfers as a secure withdrawal method. These transfers are ideal for users seeking to move funds directly to their bank accounts. However, a standard fee applies for this service, which may vary depending on the user's location.

Debit Card

Withdrawals to a linked debit card are quick and convenient. Nadex ensures that users can access their funds without delay, although certain restrictions may apply to the amount that can be withdrawn per transaction.

Wire Transfer

For larger withdrawals or international users, Nadex offers wire transfers. While this option is reliable, it often incurs higher fees compared to other methods and may take a few business days for processing.

Paper Check

For those preferring traditional methods, Nadex provides the option to withdraw funds via a paper check. This method is slower than electronic options and may include additional mailing fees.

Nadex Vs Other Brokers

#1. Nadex vs AvaTrade

Nadex and AvaTrade cater to different trading needs, with Nadex focusing on binary options and call spreads while AvaTrade offers a broader range of assets, including forex, CFDs, and cryptocurrencies. Nadex operates as a regulated exchange in the U.S., making it ideal for traders seeking defined risk and short-term strategies. In contrast, AvaTrade provides extensive trading platforms, advanced tools like AvaOptions, and global regulation, appealing to those seeking long-term and diversified trading opportunities. However, Nadex's proprietary platform simplifies binary options trading, while AvaTrade offers third-party integrations like MT4 and MT5 for advanced traders.

Verdict: Choose Nadex if binary options and limited risk appeal to you, especially for short-term trades. Opt for AvaTrade if you prefer diversified assets, advanced tools, and global platform flexibility.

#2. Nadex vs RoboForex

Nadex and RoboForex serve distinct trading needs. Nadex specializes in binary options, spreads, and call spreads, offering regulated access to a limited range of markets ideal for short-term traders seeking defined risks. In contrast, RoboForex provides a broader range of trading instruments, including forex, stocks, and cryptocurrencies, catering to traders looking for flexibility and extensive asset coverage. Nadex operates under strict U.S. regulation, while RoboForex is regulated internationally, appealing to global traders but with varying levels of oversight. Nadex's fee structure is transparent and tied to contracts, whereas RoboForex offers tighter spreads and commission-free options for cost efficiency.

Verdict: Choose Nadex if you prioritize binary options trading with U.S. regulation and simplicity. RoboForex is better suited for traders seeking diverse instruments and cost-effective trading on a global scale.

#3. Nadex vs Exness

Nadex and Exness cater to different trading audiences with unique offerings. Nadex specializes in binary options, call spreads, and knock-out contracts, providing a US-regulated platform ideal for short-term traders seeking capped risk. In contrast, Exness offers a broader range of financial instruments, including forex, CFDs, and cryptocurrencies, with competitive spreads and a high leverage model tailored for global retail and professional traders. While Nadex focuses on simplicity and regulatory transparency, Exness appeals to traders who prioritize diverse markets and advanced trading tools like MetaTrader 4/5.

Verdict: Nadex is better suited for traders focused on binary options within a highly regulated environment, while Exness excels in offering versatile trading instruments and tools for a more traditional and globally diversified trading experience. The choice depends on the trader’s desired trading style and risk tolerance.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: Nadex Review

In conclusion, Nadex stands out as a secure and innovative trading platform specializing in binary options, knock-outs, and call spreads. Its transparent fee structure, defined risk-reward framework, and user-friendly platform make it appealing to traders of all levels. The availability of a free trial account and educational resources further supports users in refining their strategies.

Regulated by the CFTC, Nadex ensures a safe and compliant trading environment, earning trust among its users. With reliable customer support and a focus on accessibility, Nadex is a top choice for individuals seeking controlled risk trading opportunities in diverse markets.

Nadex Review: FAQs

Is Nadex regulated?

Yes, Nadex is regulated by the Commodity Futures Trading Commission (CFTC), ensuring compliance with U.S. trading laws.

What markets can I trade on Nadex?

Nadex offers access to forex, commodities, stock indices, and economic events through binary options, knock-outs, and call spreads.

Does Nadex offer a demo account?

Yes, Nadex provides a free trial account, allowing users to practice trading with virtual funds.

OPEN AN ACCOUNT NOW WITH NADEX AND GET YOUR BONUS