MYFX Markets Review

As a Forex trader, I understand the critical role that brokers play in our trading journey. Forex brokers act as intermediaries between us and the foreign exchange market, providing the platforms, tools, and services necessary to execute trades. Choosing the right broker is crucial for your trading success. The right choice ensures efficient trade execution, regulatory compliance, and optimal customer support, which together enhance your trading experience and profit potential.

Having traded with MYFX Markets, I can say they offer competitive spreads and a user-friendly trading platform. They provide a range of account options suitable for both beginners and experienced traders.

In this detailed review, I aim to provide an exhaustive evaluation of MYFX Markets, emphasizing its unique selling propositions and potential drawbacks. My objective is to supply you with essential insights about the broker, such as the various account options available, deposit and withdrawal processes, commission structures, and other crucial details. My balanced perspective combines expert analysis and actual trader experiences to equip you with the necessary information to make an informed decision about considering MYFX Markets as your preferred brokerage service provider.

What is MYFX Markets?

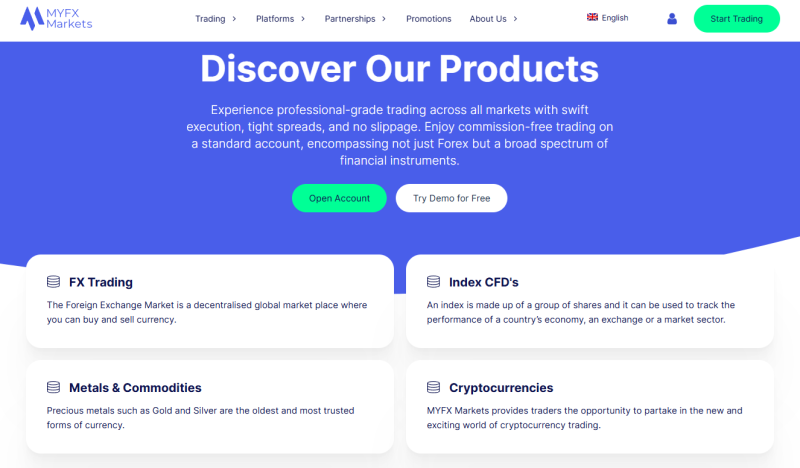

MYFX Markets is a forex and CFD broker established in 2013, offering a wide range of trading instruments and account options. They provide access to over 50 currency pairs, cryptocurrencies, metals, and indices. MYFX Markets operates using the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their user-friendly interfaces and advanced trading tools.

Traders at MYFX Markets can access a diverse range of assets, including over 100 forex pairs, various indices, commodities like oil and gold, and major cryptocurrencies such as Bitcoin and Ethereum. It also operates as an ECN broker, providing raw spreads from its liquidity providers.

Benefits of Trading with MYFX Markets

From my experience, trading with MYFX Markets comes with several notable benefits. One major advantage is the competitive spreads offered, especially on Pro accounts where spreads can start from 0.0 pips. This low-cost trading environment is ideal for traders looking to maximize their profits by minimizing trading costs.

Another benefit is the availability of high leverage up to 500:1. This can significantly increase your trading potential, allowing you to take larger positions with a smaller capital investment. For those who are experienced and understand the risks, this leverage can be a powerful tool.

The trading platforms provided by MYFX Markets, MetaTrader 4 and 5, are robust and user-friendly. These platforms offer comprehensive tools for technical analysis, automated trading, and real-time market data, which enhance the overall trading experience. Additionally, the mobile and web versions ensure you can manage your trades on the go, providing flexibility and convenience.

Customer support is accessible through multiple channels, including email, phone, and live chat. This ensures that assistance is available when needed, which can be crucial for resolving issues promptly. The comprehensive FAQ section also helps in addressing common queries efficiently.

MYFX Markets Regulation and Safety

When trading with MYFX Markets, it’s important to understand their regulatory status and safety measures. MYFX Markets is registered with the SVG FSA (St. Vincent and the Grenadines Financial Services Authority) and the FSRC (Financial Services Regulatory Commission). Knowing the regulatory framework is crucial because it provides an insight into the level of oversight and protection your funds might have.

MYFX Markets claims to keep client funds in segregated trust accounts with reliable banks. This means that your money is kept separate from the broker’s operational funds, which helps safeguard your investments in case of the broker’s financial instability. Understanding where and how your funds are held is essential for ensuring their safety.

Security is also a key aspect of MYFX Markets’ operations. Changing data in your user account requires answering a secret question specified during registration. This additional layer of security helps protect your personal and financial information from unauthorized access. Awareness of these security measures can provide peace of mind and enhance your overall trading experience.

Furthermore, MYFX Markets guarantees the confidentiality of personal data through robust physical and electronic security measures. Knowing that your data is secure can build trust in the broker and ensure that your sensitive information remains protected while you focus on trading.

MYFX Markets Pros and Cons

Pros

- Competitive spreads

- High leverage

- Wide range of assets

- User-friendly platforms

- Flexible deposit methods

- 24/7 customer support

Cons

- Regulatory concerns

- Withdrawal issues

- Limited educational resources

- No cent accounts

- Potentially high fees

- Variable spreads

MYFX Markets Customer Reviews

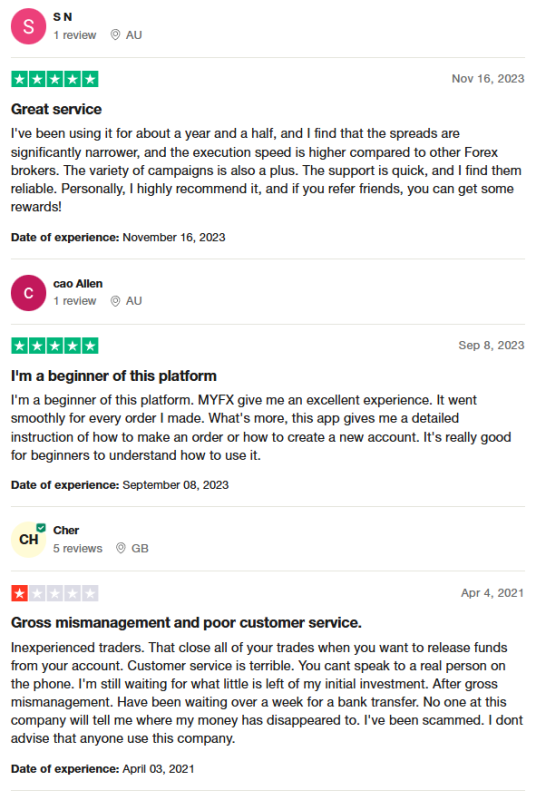

Customer reviews of MYFX Markets are mixed. Many users highlight the narrower spreads and high execution speed, appreciating the variety of campaigns and quick, reliable support. Some beginners find the platform excellent and user-friendly, noting the detailed instructions for making orders and creating accounts.

However, there are significant concerns from other users about poor customer service, issues with speaking to a real person on the phone, and delays in processing withdrawals. Complaints about the closing of trades without consent and difficulty in retrieving funds suggest potential mismanagement, leading some users to feel they have been scammed. This mixed feedback underscores the importance of careful consideration before choosing MYFX Markets as a broker.

MYFX Markets Spreads, Fees, and Commissions

Having traded with MYFX Markets, I can provide some insights into their spreads, fees, and commissions. On the Pro account, I found that spreads start as low as 0 pips, which is incredibly competitive and beneficial for those looking for tight trading conditions. In comparison, the Standard account offers spreads beginning at 0.6 pips. This difference can significantly impact your trading costs, especially if you’re trading frequently.

Regarding commissions, the Pro account charges a $7 fee per closed lot, which is a fair rate considering the low spreads offered. The Standard account doesn’t charge commissions, but the spreads are wider, so it’s essential to weigh these factors based on your trading volume and strategy.

Overnight positions incur swap fees, which vary depending on the currency pair and the interest rate differential. On Wednesdays, the swap fee is tripled to cover the weekend. This can either add to your costs or provide additional income if the swap is positive. Understanding these fees is crucial for managing long-term positions.

Depositing funds into MYFX Markets is straightforward and free of charge, with various options such as bank wire, Bitcoin, Bitpay, and Bitwallet. However, withdrawal fees can range from $3 to $30, depending on the method. For instance, bank wire withdrawals cost $25, while credit/debit card withdrawals are free. These fees can add up, so it’s something to keep in mind when planning your withdrawals.

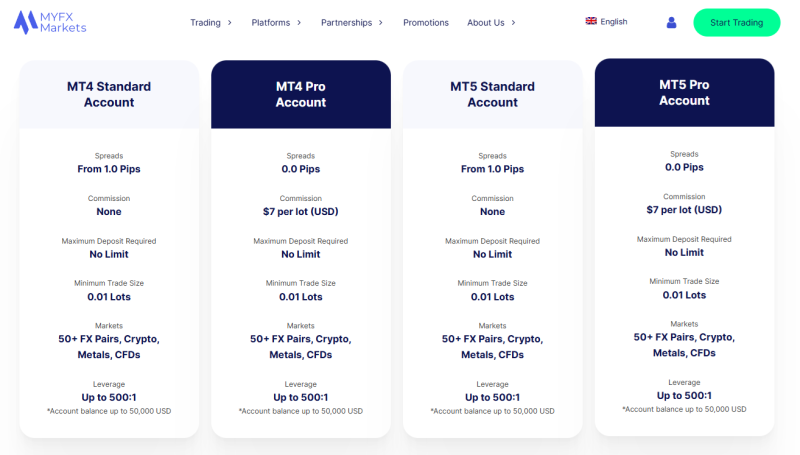

Account Types

When trading with MYFX Markets, I found they offer four main account types, each tailored to different trading needs. Here’s a breakdown:

MT4 Standard Trading Account

- Spreads from 0.6 pips

- No commissions

- No minimum deposit required

- Minimum trade size: 0.01 lots

- Leverage up to 500:1 (up to $50,000 account balance)

MT4 Pro Trading Account

- Spreads from 0.0 pips

- $7 commission per lot

- No minimum deposit required

- Minimum trade size: 0.01 lots

- Leverage up to 500:1 (up to $50,000 account balance)

MT5 Standard Trading Account

- Spreads from 0.6 pips

- No commissions

- No minimum deposit required

- Minimum trade size: 0.01 lots

- Leverage up to 500:1 (up to $50,000 account balance)

MT5 Pro Trading Account

- Spreads from 0.0 pips

- $7 commission per lot

- No minimum deposit required

- Minimum trade size: 0.01 lots

- Leverage up to 500:1 (up to $50,000 account balance)

Each account type offers access to over 50 FX pairs, cryptocurrencies, metals, and CFDs, providing flexibility and options to suit various trading strategies and preferences.

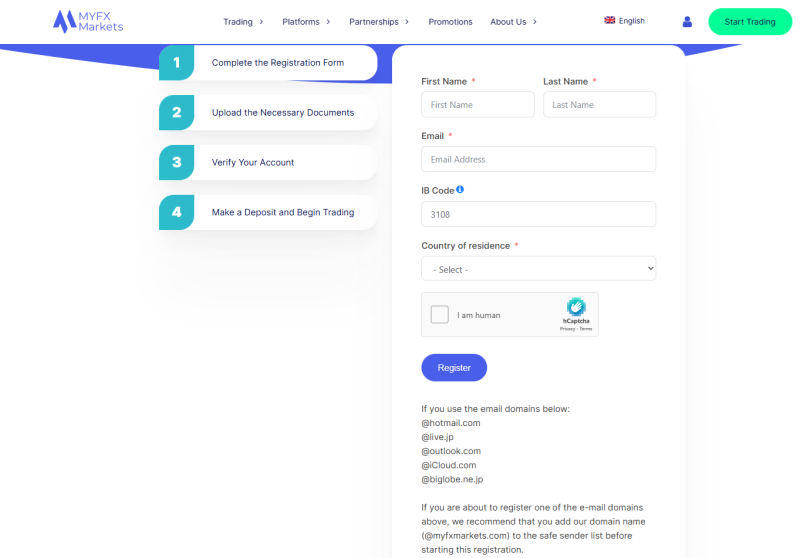

How to Open Your Account

Opening an account with MYFX Markets is a straightforward process. Here’s how you can get started in just eight steps:

- Go to the MYFX Markets official website and click on the “Open Account” button, which is located at the top right of the homepage.

- Enter your first name, last name, valid email address, and country of origin. After submitting this information, you’ll receive a validation email. Click the link in this email to proceed.

- On the next screen, choose the account type (individual or corporate) and provide additional details such as your city, address, postal code, phone number, trading experience, and a secure password.

- For account security, set up security questions and answers (e.g., your mother’s maiden name or the name of your first pet). This step ensures your account’s safety.

- Choose the account type you want (Standard or Pro), the trading platform (MT4 or MT5), your preferred currency, and the maximum leverage you wish to use.

- To verify your identity, upload color photos of a valid ID (passport, driver’s license, or national ID) and a recent utility bill or bank statement showing your address.

- Wait for the account verification process. Once your documents are approved, you will receive a confirmation email.

- After your account is verified, log into your client office, make an initial deposit using one of the available funding methods, and start trading.

MYFX Markets Trading Platforms

Based on my experience trading with MYFX Markets, I can attest to the quality and reliability of their trading platforms. MYFX Markets offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are among the most popular platforms in the forex trading community. These platforms provide robust tools for technical analysis, automated trading, and seamless execution of trades.

MT4 is known for its user-friendly interface and extensive charting tools. It offers numerous technical indicators and graphical objects that help in detailed market analysis. I find MT4 particularly beneficial for automated trading using Expert Advisors (EAs). The platform supports multiple order types, which allows me to execute complex trading strategies with ease.

MT5 is an advanced version of MT4, offering additional features such as more timeframes, enhanced charting tools, and an economic calendar. MT5 supports a wider range of asset classes, including forex, commodities, and cryptocurrencies. I appreciate MT5’s superior execution speed and the ability to handle multiple markets from a single platform. The backtesting and optimization tools for EAs on MT5 are also more sophisticated, which enhances my trading efficiency.

What Can You Trade on MYFX Markets

Based on my experience with MYFX Markets, the platform offers a diverse range of trading instruments. Here’s a detailed look:

- Forex Trading: You can trade over 50 currency pairs, including majors, minors, and exotics. This variety provides ample opportunities for different trading strategies.

- Index CFDs: MYFX Markets allows trading on various indices from global markets, such as the S&P 500, NASDAQ, and FTSE 100. These instruments enable you to speculate on the performance of entire stock markets.

- Metals and Commodities: Trading precious metals like gold and silver, as well as commodities like oil and natural gas, is available. These options help diversify your trading portfolio and hedge against inflation.

- Cryptocurrencies: The platform also supports trading in popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin. This allows you to participate in the dynamic and rapidly growing crypto market.

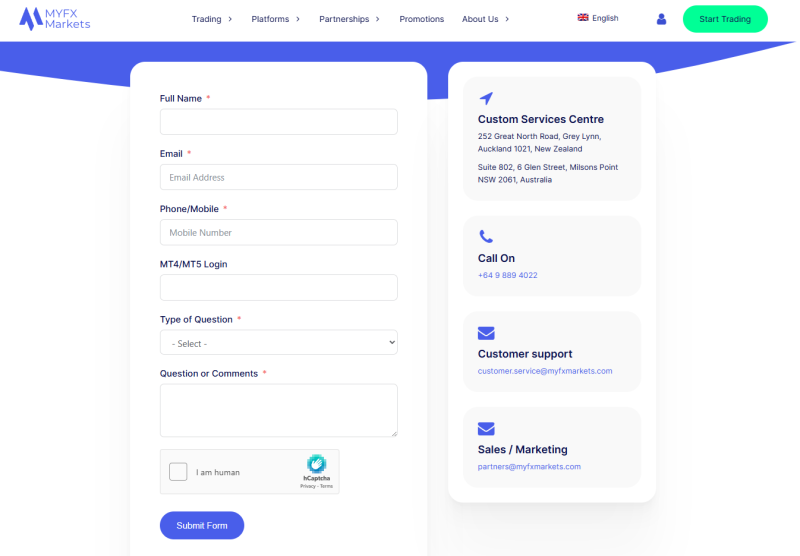

MYFX Markets Customer Support

Based on my experience, MYFX Markets offers a variety of customer support options to address your needs. You can reach their support team via email at customer.service@myfxmarkets.com , which is efficient for detailed inquiries. They also provide a live chat feature on their website, which is convenient for quick questions and immediate assistance.

For more personalized support, you can contact them by phone at +64 9 889 4022. Their customer service team is responsive and aims to resolve issues promptly. Additionally, the website has a comprehensive FAQ section that addresses common questions, providing a quick reference for traders.

Advantages and Disadvantages of MYFX Markets Customer Support

Withdrawal Options and Fees

When I traded with MYFX Markets, they offered a variety of withdrawal options, including bank transfer, Bitcoin, Bitpay, and Bitwallet. The process is straightforward, but it’s important to note that each method comes with different fees and processing times.

Bank wire withdrawals incur a $25 fee, which can be quite high compared to other methods. Bitcoin, Bitpay, and Bitwallet withdrawals are free, making them more cost-effective options. The processing time for withdrawals can vary, but generally, it takes a few business days for the funds to reach your account. Always ensure that the account details match to avoid delays.

MYFX Markets Vs Other Brokers

#1. MYFX Markets vs AvaTrade

MYFX Markets and AvaTrade both offer a range of trading instruments and platforms, but they cater to different trader needs. MYFX Markets provides tight spreads and high leverage up to 500:1, making it suitable for traders looking for cost-effective trading conditions. They support MetaTrader 4 and 5, offering robust tools for analysis and automated trading. AvaTrade, on the other hand, offers a more comprehensive range of platforms, including their proprietary AvaTradeGO and WebTrader, alongside MT4 and MT5. AvaTrade is heavily regulated across multiple jurisdictions, providing a higher level of security and trust. They offer fixed spreads, which can be beneficial for traders preferring predictability in trading costs.

Verdict: AvaTrade might be the better choice for those seeking strong regulatory oversight and a variety of trading platforms. However, MYFX Markets is preferable for traders looking for tighter spreads and higher leverage.

#2. MYFX Markets vs RoboForex

When comparing MYFX Markets with RoboForex, both brokers offer competitive trading conditions but with distinct differences. MYFX Markets provides access to MetaTrader 4 and 5 with spreads starting from 0.0 pips on Pro accounts and leverage up to 500:1. RoboForex offers a wider range of trading platforms including MT4, MT5, cTrader, and R Trader, catering to different trading styles. RoboForex also provides a variety of account types, including cent accounts, which are great for beginners. Additionally, RoboForex supports a broad array of deposit and withdrawal methods, often without fees, which adds flexibility for traders.

Verdict: RoboForex stands out for its broader range of platforms and account types, making it a better option for beginners and traders who require diverse trading tools. MYFX Markets excels in offering tight spreads and high leverage, suitable for experienced traders.

#3. MYFX Markets vs Exness

MYFX Markets and Exness both cater to different aspects of trading needs. MYFX Markets offers MetaTrader 4 and 5 with competitive spreads starting from 0.0 pips on Pro accounts and leverage up to 500:1. Exness provides a more extensive range of account options and allows for extremely high leverage, sometimes up to 2000:1, which is attractive for high-risk traders. Exness also boasts excellent customer support and a user-friendly platform interface, making it accessible for traders at all levels. Both brokers offer a wide range of trading instruments, but Exness’s regulatory environment is more robust, ensuring higher security and trust.

Verdict: Exness might be the better option for traders looking for a highly regulated broker with extremely high leverage options and diverse account types. MYFX Markets remains a solid choice for those who prioritize tight spreads and straightforward, high-leverage trading.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH MYFX MARKETS

Conclusion: MYFX Markets Review

Based on my experience and user feedback, MYFX Markets offers several advantages that make it a solid choice for forex traders. They provide competitive spreads, especially on their Pro accounts, and high leverage options up to 500:1, which can be appealing for experienced traders looking to maximize their trading potential. The availability of both MetaTrader 4 and 5 platforms ensures solid tools for analysis and automated trading, enhancing the overall trading experience.

However, there are some considerations to keep in mind. The broker’s regulatory oversight is not as strong as some of its competitors, which might be a concern for those prioritizing security and compliance. Additionally, while their customer support is accessible through multiple channels, the quality and responsiveness can vary. Withdrawal fees and processing times can also be a point of frustration for some users.

Also Read: Skilling Review 2024 – Expert Trader Insights

MYFX Markets Review: FAQs

What trading platforms does MYFX Markets offer?

MYFX Markets offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, providing traders with robust tools for technical analysis and automated trading.

What are the minimum deposit requirements for MYFX Markets accounts?

There is no minimum deposit required for both the Standard and Pro accounts at MYFX Markets, making it accessible for traders of all levels.

What is the maximum leverage available at MYFX Markets?

MYFX Markets offers leverage up to 500:1, allowing traders to potentially maximize their trading positions.

OPEN AN ACCOUNT NOW WITH MYFX MARKETS AND GET YOUR BONUS