Position in Rating | Overall Rating | Trading Terminals |

268th  | 2.0 Overall Rating |   |

My Funded Futures Review

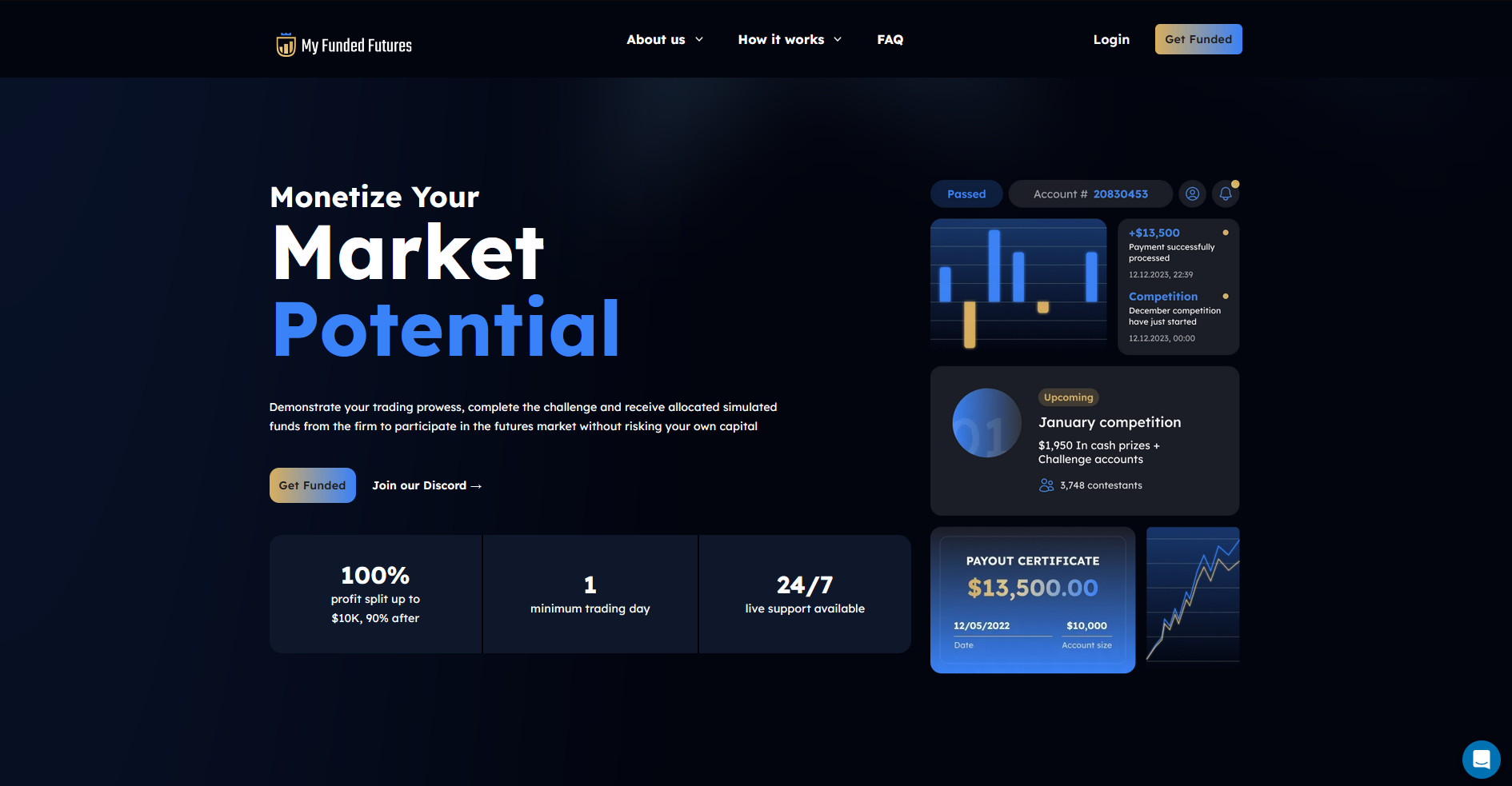

Traders who have used My Funded Futures often highlight its straightforward funding process and competitive evaluation programs. Many appreciate the platform’s transparent rules, which make it easier to understand how to qualify for funding. The trading environment provided is well-regarded for its stability and user-friendly interface.

Feedback also indicates that My Funded Futures offers flexible account options tailored to different trading styles. Users report that the evaluation costs are reasonable and provide good value, especially for those looking to test their skills without significant upfront capital. The profit-sharing model is another praised feature, rewarding consistent and disciplined trading.

Overall, traders find My Funded Futures reliable for those seeking funded accounts with clear-cut requirements. Its focus on transparency and trader support has garnered positive reviews, making it a favored choice in the prop trading space.

What is My Funded Futures?

My Funded Futures is a trading prop firm that provides traders with the opportunity to access funded accounts after completing an evaluation process. Traders who have interacted with the platform commend its accessible entry requirements, making it an attractive option for those with limited capital. The platform emphasizes transparency in its evaluation criteria, ensuring a clear understanding of what’s required to secure funding.

Users often praise My Funded Futures for its structured programs that cater to various trading strategies. It offers flexibility in account sizes, allowing traders to choose options that align with their goals. The supportive trading environment and reliable technology are frequently mentioned as standout features.

Traders view My Funded Futures as a valuable resource for gaining access to capital while honing their skills. Its commitment to fairness and trader growth has established it as a trusted name in the prop trading industry.

My Funded Futures Regulation and Safety

Traders have shared mixed feedback on the regulation and safety aspects of My Funded Futures. While the firm operates as a prop firm trading company and does not fall under traditional financial regulatory bodies, users note that its transparent policies and clear terms of service help build trust. Many appreciate the detailed information provided about the evaluation process and account funding.

In terms of safety, My Funded Futures has earned a reputation for offering a secure trading environment. Traders highlight the platform’s reliable technology and data protection measures as reassuring features. The lack of regulatory oversight, however, is something users consider when deciding whether the platform aligns with their trading needs.

My Funded Futures Pros and Cons

Pros

- Low fees

- Quick payouts

- Transparent rules

- Flexible plans

Cons

- Strict criteria

- Limited assets

- No demo access

- Region restrictions

Benefits of Trading with My Funded Futures

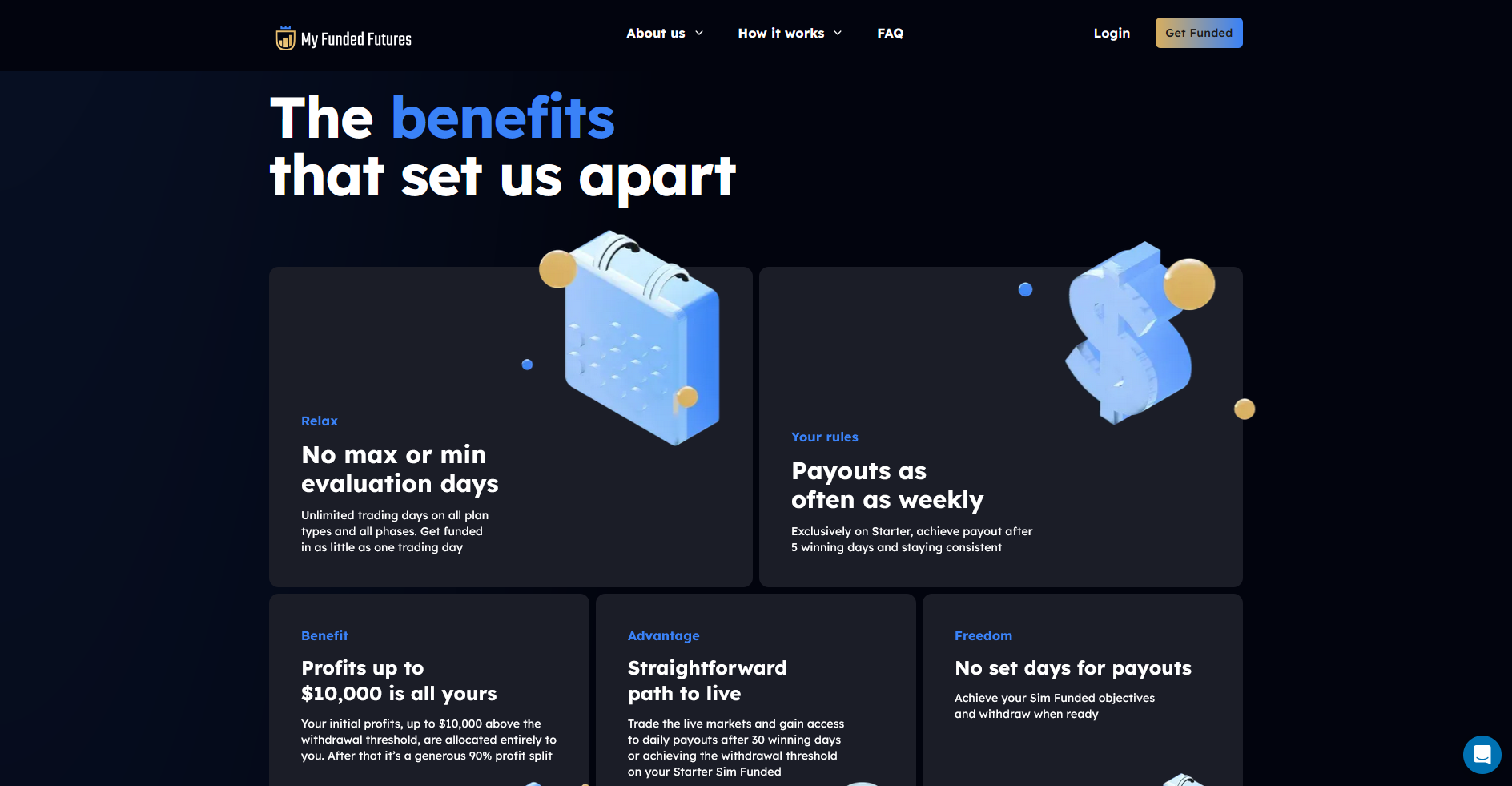

Traders frequently highlight several benefits of trading with My Funded Futures, starting with its accessible funding programs. The platform allows traders to showcase their skills through evaluations, with no need for significant upfront capital. This approach makes it appealing for both new and experienced traders seeking a cost-effective way to trade larger accounts.

Another advantage often mentioned is the flexibility offered by My Funded Futures in account sizes and trading strategies. Traders appreciate the clear rules and profit-sharing model, which rewards disciplined trading. The absence of hidden fees and transparent policies further enhance the trading experience.

My Funded Futures Customer Reviews

Customer reviews of My Funded Futures reveal a largely positive experience, especially regarding its transparent evaluation process. Traders commend the platform for its clear rules and straightforward funding requirements, which make it easier to understand the path to securing an account. Many highlight the affordability of the evaluation programs as a significant advantage.

Traders also frequently praise My Funded Futures for its reliable technology and responsive customer support. The platform’s focus on creating a seamless trading experience is a recurring theme in reviews. However, some users note that the firm’s non-regulated status is a factor to consider, though it doesn’t diminish the overall positive feedback.

My Funded Futures Spreads, Fees, and Commissions

Traders have shared positive feedback about the spreads, fees, and commissions offered by My Funded Futures, noting that they are competitive and transparent. The platform does not charge hidden fees, which many traders appreciate for simplifying cost management. Evaluation fees are seen as reasonable, providing access to funded accounts without significant financial burden.

Regarding spreads, My Funded Futures ensures fair pricing that aligns with market standards. Users highlight the absence of high commission charges, making it more appealing for frequent traders. The overall cost structure is praised for being straightforward and supportive of traders aiming for long-term profitability.

Account Types

My Funded Futures offers a variety of account types tailored to traders with different levels of expertise and financial goals. Each account type is designed to provide traders with the tools and resources they need to excel in the futures trading market.

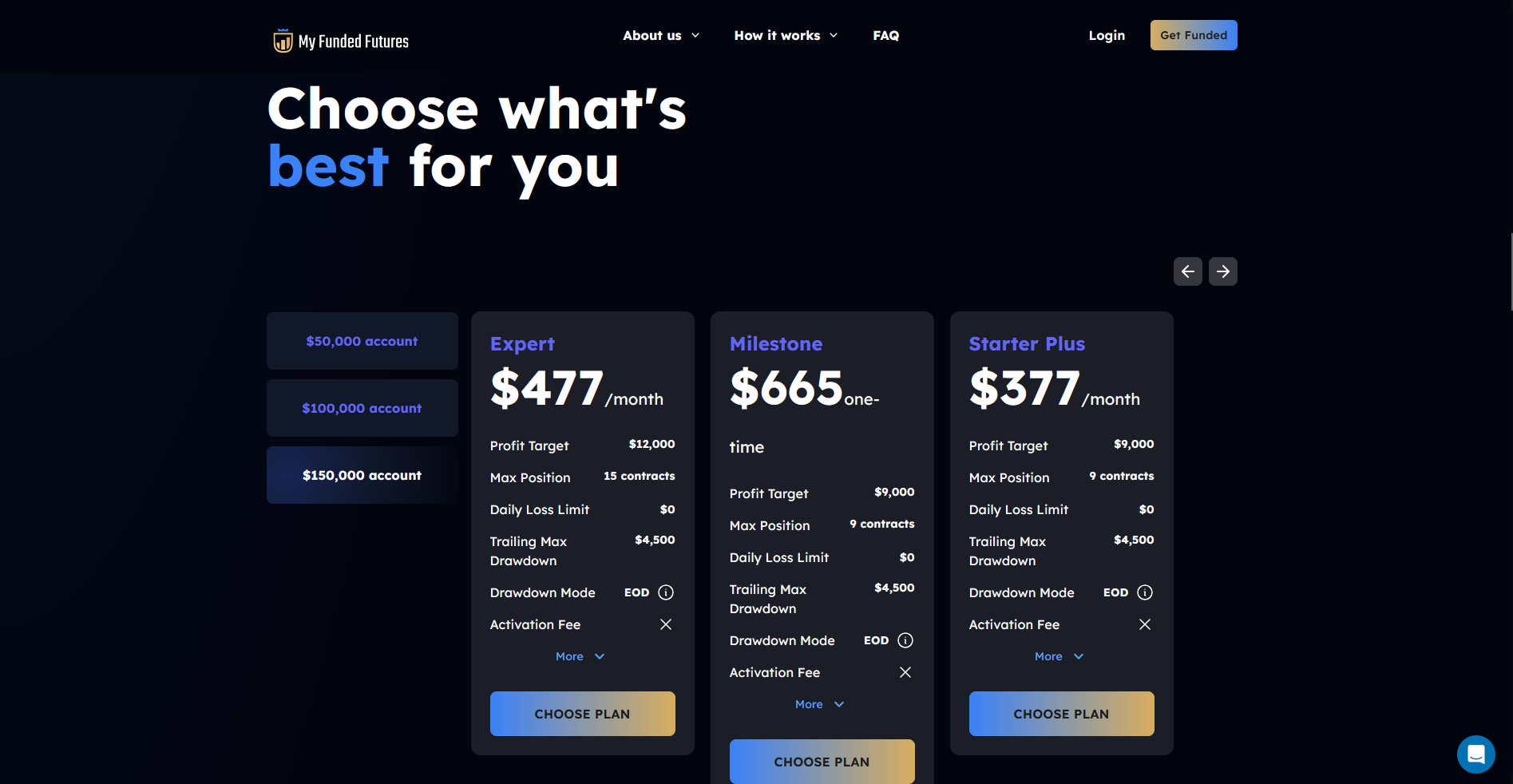

Expert Account

Traders with the Expert Account can aim for a $12,000 profit target while managing up to 15 contracts. The account has a trailing max drawdown of $4,500 and no daily loss limit, offering flexibility for aggressive trading styles. It is available at $477 per month with no activation fee.

Milestone Account

The Milestone Account provides a $9,000 profit target and supports up to 9 contracts. It includes a trailing max drawdown of $4,500 with no daily loss limit, catering to traders focused on long-term goals. This account requires a one-time payment of $665, making it ideal for those seeking fixed costs.

These options are the maximum funded futures account sizes that traders can choose out of the 3 options. With the starter accounts on their website, funded trader makes this as one of the best futures prop firm in the financial market, which makes funded futures legit.

Starter Plus Account

Designed for balanced trading, the Starter Plus Account offers a $9,000 profit target and allows a maximum of 9 contracts. With a trailing max drawdown of $4,500 and no daily loss limit, it supports traders aiming for steady growth. This account is priced at $377 per month with no activation fee.

How to Open Your Account

Opening an account with My Funded Futures is a straightforward process designed to help traders quickly start their funded trading journey. By following a few easy steps, you can gain access to their trading platform and begin exploring funding opportunities.

Step 1: Visit the Official Website

Go to the official My Funded Futures website and locate the “Sign Up” or “Create Account” button. Click on it to start the registration process and provide your basic details, such as your name, email, and contact information.

Step 2: Complete the Registration Form

Fill out the registration form with accurate personal information. Ensure you double-check your email and other details, as these will be used for account verification.

Step 3: Verify Your Email

After submitting the form, you will receive a verification email from My Funded Futures. Open the email and click the provided link to confirm your account.

Step 4: Choose a Funding Plan

Log in to your newly created account and explore the funding plans offered by My Funded Futures. Select a plan that aligns with your trading goals and proceed with payment.

Step 5: Start Trading

Once your payment is confirmed, you’ll gain access to the trading platform. Download the necessary software or tools and begin your funded trading experience with My Funded Futures.

My Funded Futures Trading Platforms

Traders using My Funded Futures have access to two of the most popular trading platforms: TradingView and NinjaTrader. TradingView is widely appreciated for its intuitive interface and advanced charting tools, making it a favorite among both beginner and experienced traders. There’s a lot of options that this broker offers but the two are the most popular among those.

NinjaTrader, on the other hand, is known for its powerful features designed for professional traders. It offers advanced analytics, customizable tools, and a reliable trading experience. The platform is highly praised for its smooth performance and ability to support complex strategies.

By providing TradingView and NinjaTrader, My Funded Futures ensures traders have access to industry-leading platforms for their trading needs. These platforms enhance the overall experience with their reliability, flexibility, and robust tools.

What Can You Trade on My Funded Futures

My Funded Futures offers traders access to a diverse range of trading instruments, enabling them to participate in various financial markets. This platform is designed to provide opportunities for both beginners and experienced traders to expand their portfolios through funded accounts.

Futures Contracts

Futures contracts are standardized agreements to buy or sell an asset at a predetermined price on a specific date. On My Funded Futures, traders can explore options such as commodity futures, financial futures, and index futures, allowing them to hedge or speculate on market movements.

Commodities

Commodities include assets like crude oil, natural gas, and agricultural products such as wheat and corn. My Funded Futures enables traders to capitalize on price fluctuations in these essential goods.

Stock Index Futures

Stock index futures represent agreements to trade the value of a stock market index, such as the S&P 500 or NASDAQ. My Funded Futures provides access to these contracts, offering a way to speculate on or hedge against broad market trends.

Financial Instruments

Financial futures include interest rate futures and currency futures, which allow traders to engage with global monetary markets. My Funded Futures caters to those looking to manage risk or gain exposure to international financial movements.

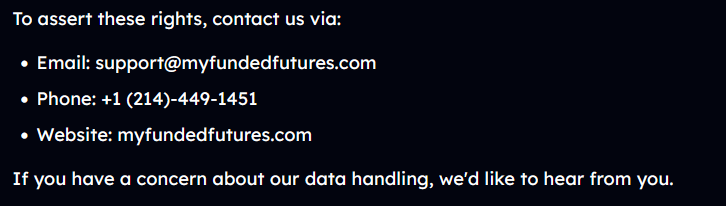

My Funded Futures Customer Support

Traders frequently praise the customer support provided by My Funded Futures, noting its responsiveness and effectiveness in addressing concerns. Many highlight the ease of reaching the support team through various channels, with prompt assistance on technical issues and account-related queries. This has been a key factor in building trust among users.

The support team at My Funded Futures is often described as professional and knowledgeable, ensuring traders receive clear and helpful guidance. Feedback indicates that the platform prioritizes customer satisfaction, which enhances the overall trading experience.

Advantages and Disadvantages of My Funded Futures Customer Support

Withdrawal Options and Fees

My Funded Futures provides traders with a range of withdrawal options designed to ensure flexibility and convenience. Understanding the available methods and associated fees can help traders plan their payouts effectively. Below is an overview of the withdrawal types offered by My Funded Futures and their details.

Bank Transfer

Bank transfers are a secure and reliable option for withdrawing funds from My Funded Futures. This method typically takes 3-5 business days to process, and fees vary depending on the receiving bank and location.

E-Wallets

My Funded Futures supports e-wallets for fast and seamless withdrawals. These transactions are usually processed within 1-2 business days and may include minimal service fees depending on the e-wallet provider.

Cryptocurrency

For those seeking modern withdrawal options, My Funded Futures allows cryptocurrency transfers. This method provides near-instant processing, with fees determined by blockchain network costs.

Debit or Credit Card Refund

Traders can opt for refunds to their debit or credit cards when withdrawing with My Funded Futures. Processing times range from 5-7 business days, and fees depend on the card issuer’s policies.

My Funded Futures Vs Other Brokers

#1. My Funded Futures vs AvaTrade

My Funded Futures is tailored for traders seeking funding programs focused on futures trading, offering structured evaluations and access to high capital with defined profit splits. In contrast, AvaTrade is a comprehensive broker catering to retail traders with diverse asset classes, including forex, stocks, and cryptocurrencies, supported by multiple trading platforms and educational tools. While My Funded Futures emphasizes performance-based progression, AvaTrade provides flexibility in trading styles with lower initial capital requirements. The user experience for My Funded Futures centers on serious traders aiming for consistent profitability, whereas AvaTrade appeals to a broader audience, including beginners.

Verdict: For futures traders focused on funded accounts, My Funded Futures is a specialized choice with clear progression paths. AvaTrade, however, is more suitable for traders seeking variety and accessibility across multiple markets.

#2. My Funded Futures vs RoboForex

My Funded Futures caters to traders seeking funding opportunities with clear evaluation phases and a focus on futures trading, offering tailored resources for professional growth. In contrast, RoboForex is a traditional brokerage platform supporting a wide range of assets, including forex, stocks, and cryptocurrencies, with competitive spreads and flexible account types. While My Funded Futures emphasizes providing capital to skilled traders, RoboForex targets a broader audience with robust trading tools and automated strategies. The former’s niche focus makes it ideal for futures specialists, whereas the latter’s diverse offerings suit multi-asset traders.

Verdict: My Funded Futures is better suited for traders seeking funding and specialization in futures, while RoboForex is ideal for those needing a comprehensive platform for various markets. The choice depends on trading goals and the preferred asset focus.

#3. My Funded Futures vs Exness

My Funded Futures is tailored for traders seeking funding programs with clear evaluation phases and performance-based rewards. It emphasizes futures trading and offers specific account types to suit various trading goals. On the other hand, Exness caters to a broader audience, providing access to forex, commodities, and CFDs with flexible leverage options and low spreads. While My Funded Futures focuses on skill-based growth and funded accounts, Exness appeals to independent retail traders with advanced trading tools and high liquidity access. Both platforms offer robust trading conditions but target distinct trader profiles.

Verdict: My Funded Futures is ideal for those aiming to secure funding through structured trading programs, while Exness is better suited for individual traders looking for diverse asset classes and flexible trading conditions. Your choice depends on whether you prioritize funding opportunities or independent trading versatility.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH MY FUNDED FUTURES

Conclusion: My Funded Futures Review

My Funded Futures stands out as a reliable prop trading firm that allows traders to trade futures with accessible programs and transparent trading rules. As a leading futures prop firm, it provides opportunities for traders to access capital and participate in the futures market. Positive feedback highlights its clear evaluation process and strong support for achieving success.

This futures review emphasizes the platform’s focus on flexibility and growth, especially for those interested in foreign exchange futures. With its competitive structure and efficient funded futures payout, My Funded Futures has become a favored choice for traders seeking opportunities in the futures market.

Traders have consistently shared positive experiences, noting the straightforward evaluation process and supportive environment. Many commend the access to advanced trading tools like TradingView and NinjaTrader, which enhance their performance and decision-making. The transparent payout system and reliable platform make My Funded Futures a trusted name among futures traders.

My Funded Futures Review: FAQs

What is the evaluation process like with My Funded Futures?

Users describe the evaluation process as straightforward, with clear rules and achievable goals to qualify for funded accounts.

Are there hidden fees with My Funded Futures?

Traders confirm that there are no hidden fees, and the evaluation costs are transparent and reasonable.

How reliable is the trading platform?

Users praise the platform’s reliability, highlighting its stable performance and compatibility with popular trading tools.

OPEN AN ACCOUNT NOW WITH MY FUNDED FUTURES AND GET YOUR BONUS