My Forex Funds Review

Have you ever pondered how those who are already experts in the financial industry make a living? “Prop firms,” or proprietary trading firms, are active participants in this industry. While the traders use the companies’ own funds to conduct trades and capitalize on market movements, the companies essentially support them and divide the gains with them. Since July 2020, My Forex Funds has been successfully serving the needs of professional Forex traders.

My Forex Funds is not like other prop trading firms. In fact, it has become one of the most rapidly expanding competitors. Over 100,000 buyers and sellers from around 150 countries attended in 2021.

In this post, we’ll discuss My Forex Funds’s evaluation procedure, trading platforms, and advantages. We’ll look at what sets them apart from the competition and, perhaps more crucially, where they fall short. Traders and investors can use the information in this piece to determine if My Forex Funds is right for them.

What is My Forex Funds?

Situated in Canada, My Forex Funds was launched in 2020. Despite its relatively recent entry into the market, it has quickly garnered experience in funding traders. The firm distinguishes itself through its flexible approach. They offer three distinct funding programs catering to varied trader needs.

Impressively, one of these programs allows traders to start without any preliminary assessment, letting them handle a genuinely funded trading account right from the get-go. Successful traders with the firm can be entrusted with company accounts holding as much as 2 million dollars. Additionally, they get to retain a portion of the profits they generate.

My Forex Funds has already achieved a leading position among Forex prop trading firms. Boasting a global team of over 300 staff and attracting more than 2,000 customers daily from around the world, they’ve solidified their place in the industry. Currently, they’re exploring other related areas to broaden their offerings, ensuring even more traders can leverage their expertise.

Also Read: Prop Trading: What is it and How Does it Work?

Advantages and Disadvantages of Trading with My Forex Funds

Benefits of Trading with My Forex Funds

Inclusivity and Global Reach

One of My Forex Funds’ standout features is its global accessibility. By accepting traders from almost every corner of the world, with Canada being the sole exception, they embrace a diverse range of perspectives and strategies.

This wide reach means that a multitude of traders, regardless of their geographical location, can tap into the vast resources and deep expertise that the company offers.

Tailored Financing to Match Trader Goals

Understanding that traders come with varied experiences and aspirations, My Forex Funds has established a broad array of financing options. These plans are designed to cater to the individual needs of each trader, from the novice trying to find their footing to the seasoned expert aiming for higher stakes.

By providing these flexible options, traders are empowered to select the plan that aligns perfectly with their trading style and objectives, thereby maximizing their chances of success.

Trader-friendly Risk Management

A common challenge in the trading world is managing risks, especially when it comes to losses. My Forex Funds acknowledges this challenge and responds with a more lenient stance on daily and cumulative loss limits.

By easing these restrictions, traders find themselves in a more comfortable environment, one where they can make decisions without the constant weight of stringent loss limits. This often results in more sustainable and long-term trading strategies, where risks are managed with a clear mind.

Rewarding Profit Structure

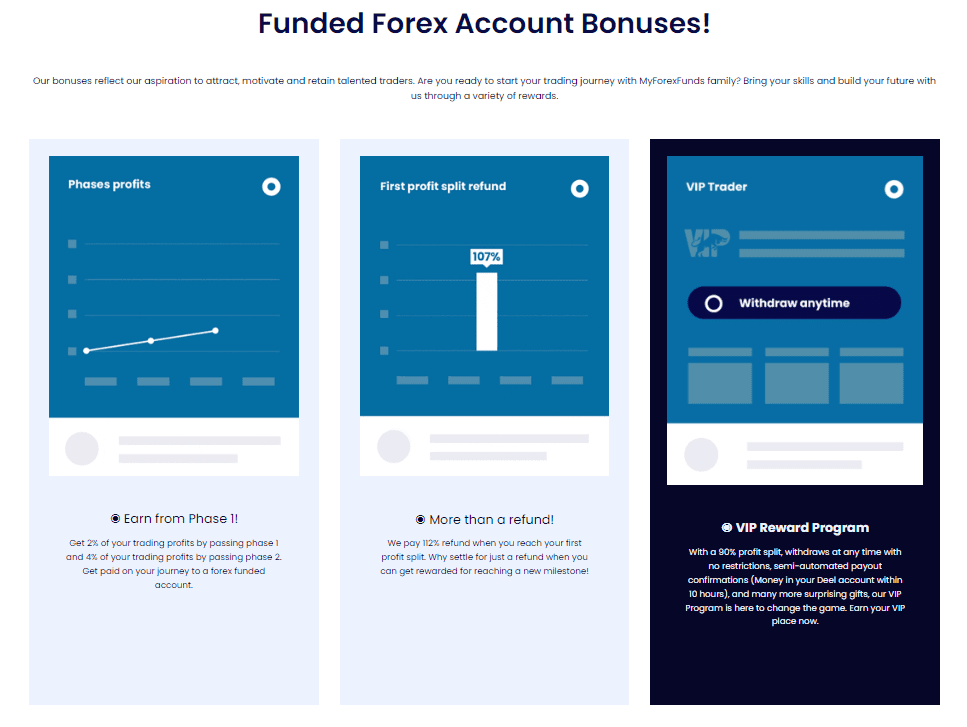

At the heart of every trader’s endeavor is the desire for profitability. My Forex Funds offers an enticing profit-sharing structure, where traders stand to earn anywhere between 12% and 85% of their total profits.

Such a generous range not only serves as a motivating factor but can also lead to substantial income. For those who master the art of trading and consistently turn in profits, this could mean a transformative earning potential.

My Forex Funds Pros and Cons

Pros:

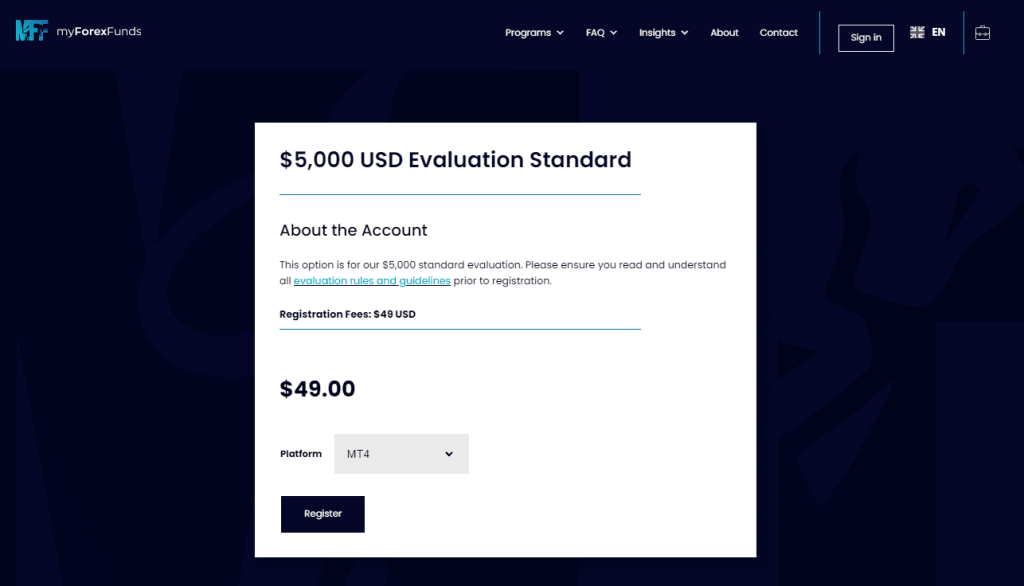

- For just $49, traders can access the company’s capital.

- s: Experienced traders can start with an accelerated plan.

- Partnership and bonus programs are available for added rewards.

Cons:

- A fee is charged per lot across all trading instruments.

- Certain trading strategies are restricted.

- Technical assistance is not available by phone.

Difficulties Met by the Traders Who Participated in the Brokers Challenge

#1. Commitment to Trading Frequency

It might be difficult for many traders to stick to a tight three-times-per-week trading plan, especially those who have other responsibilities or want a more flexible trading schedule. Regardless of their own schedules or the state of the market, traders are required by this guideline to remain informed and engaged on those particular days.

How to Overcome the Difficulty

By setting aside specific times on their favorite trading days, traders can prevent this. By maintaining a consistent schedule, they may better align their trading operations with market trends and openings. Using calendar reminders or trade alarms, they can also make sure they don’t miss the required trading days.

#2. Managing Stringent Drawdown Limits

A daily drawdown cap of 5% may be considered restrictive by some traders, particularly those who opt for higher-risk methods or deal with choppy market conditions. Trading with such a limit requires tremendous vigilance to prevent going over the cap too soon.

How to Overcome the Difficulty

To get around this problem, traders should consider putting a comprehensive risk management plan in place. This requires them to diversify their trades, place exact stop-loss orders, and continuously monitor the profitability of their portfolio. By closely monitoring their equity, traders may immediately adjust their positions and safeguard their investment.

#3. Striking a Balance Between Objectives

Traders frequently juggle a number of goals, from aiming for particular profit margins to following the guidelines of their trading plan. Another layer of complexity is added when a severe drawdown restriction is introduced, making it difficult to find a balance without sacrificing one goal for another.

How to Overcome the Difficulty

Setting daily trading goals as a priority is a good strategy. Traders can choose which goals to concentrate on for each particular session by assessing market conditions and their own trading strengths. By monitoring and changing strategies in real time, trading software with strong analytics can also assist in achieving a harmonious balance between various trading objectives.

#4. Meeting Profit Benchmarks

There is a need to achieve a 10% profit on conventional accounts and 20% on emphatic accounts to advance. Setting a high profit target, like 10% or 20%, can be daunting. Such benchmarks push traders to strive for substantial returns, which might tempt them to take on excessive risks or deviate from their established strategies.

How to Overcome the Difficulty

The key here is patience and consistency. Traders should focus on achieving consistent, smaller gains rather than chasing after larger, riskier returns. It’s also vital to continuously educate oneself, keeping abreast of market trends, and refining trading strategies based on recent data and experiences. Over time, these incremental profits can accumulate, helping traders gradually inch towards the set profit benchmarks without unnecessary risks.

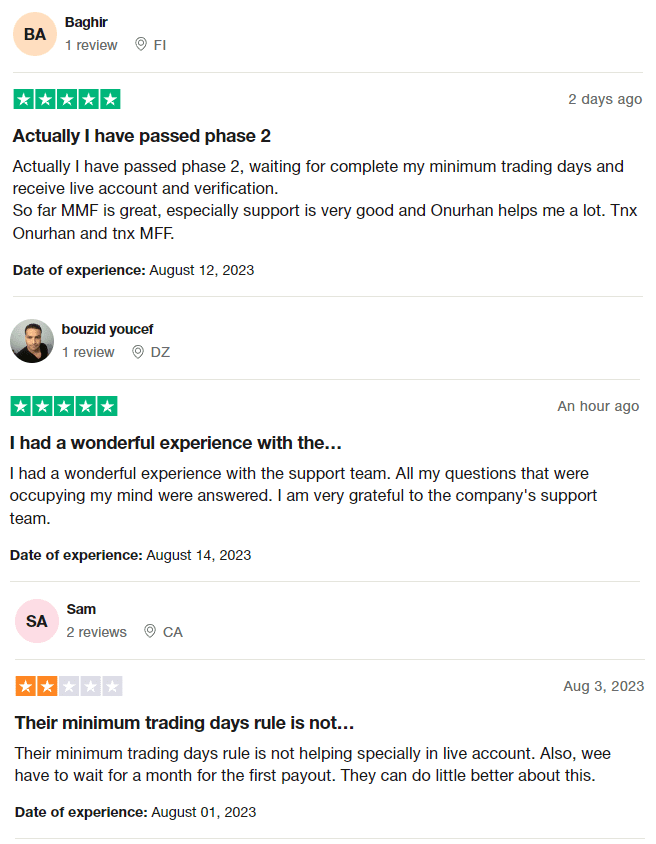

My Forex Funds Customer Reviews

Customers generally appreciate the support provided by My Forex Funds, highlighting the responsiveness and helpfulness of the team. However, some users have expressed concerns about the rule requiring minimum trading days, especially when it comes to live accounts. Additionally, the waiting period of a month for the initial payout has been pointed out as an area that could benefit from improvement.

My Forex Funds Fees and Commissions

My Forex Funds operates with a variety of fees that traders should be aware of. For starters, the spread for currency pairs begins at a minimum of 1 pip. Additionally, for every lot traded, the company imposes a $3 charge. This is important for traders to keep in mind as it impacts the overall transaction cost.

Regarding the company’s own fee structure, a one-time subscription fee is levied. The cost of this fee can range from $49 to as much as $4,900. The exact amount depends on the financing plan a trader chooses. This fee is separate from other potential charges that might be incurred when using banks or payment systems for withdrawals. Traders should also be mindful of these as they can add to the transaction costs.

Lastly, for traders who decide to leave their position open overnight, there’s something called a swap fee. However, this fee is specifically applied only to live accounts. While My Forex Funds does offer accounts that are swap-free to cater to specific trader needs, there’s an exception. For currency pairs that involve either MXN (Mexican Peso) or ZAR (South African Rand), swap charges will be applied regardless of the account type.

Account Types

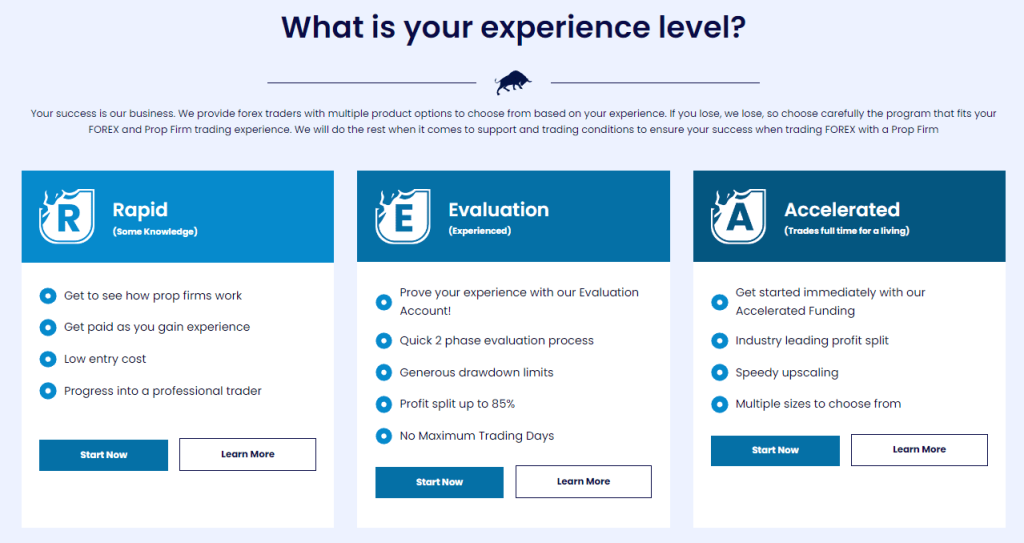

My Forex Funds provides a variety of programs with different account types tailored to cater to traders with different experience levels and financial capacities.

Evaluation Program

This program is split into two stages. The initial stage, named Evaluation, spans 30 days. Within this timeframe, a trader is expected to attain a profit margin of 8%. Following this, the Establishment phase kicks in, where the trader is tasked with achieving a 5% profit over the course of 60 days. Alongside these profit targets, there are other criteria that aspiring traders should meet: the daily loss limit is capped at 5% while the overall loss limit stands at 12%. It’s worth noting that throughout both these stages, trading takes place in a simulated environment.

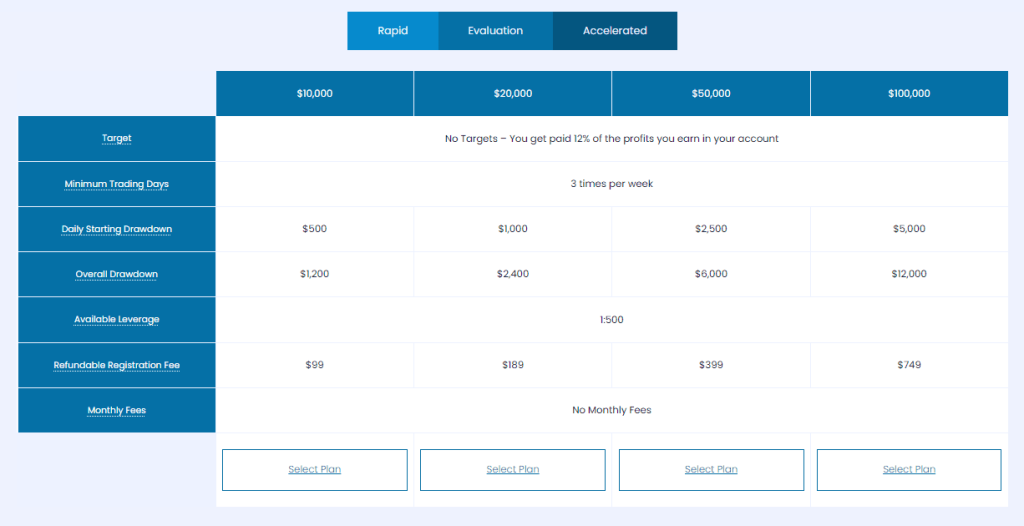

Rapid Program

This program offers two distinct account options. The Consistency Enabled Accounts (CEAs) emphasize compliance with set standards pertaining to the volume and number of trades. If a trader fails to meet these standards, no payments will be made for that month. Conversely, the Non-Consistency Accounts (NCAs) are more flexible, placing no bounds on trading activities. Depending on the chosen Rapid account, the account size can vary between $10,000 to $100,000. Earnings-wise, traders can expect 12% of all profits when trading in a demo setting, and a considerably higher 50% to 80% when trading live.

Accelerated Program

This program stands out by granting traders immediate access to a live trading account. The funds made available range from $2,000 to $50,000. Traders have the option between two accounts: the Conventional account sets a loss limit at 5% of the starting balance, while the Emphatic account has a more lenient threshold at 10%. In this program, traders enjoy considerable freedom—there aren’t any caps on daily losses, the size of the trades, or even the trading style and frequency.

How to Open Your Account

Opening an account with My Forex Funds is a straightforward process. Here’s a simple guide to walk you through each step:

1. Navigate to the official My Forex Funds website.

2. Once there, locate the “Start Now” button which is prominently displayed in the center of the main page. Click on it.

3. The website will then show you various tariff plans. Take a moment to review each one to determine which best aligns with your trading goals and strategies.

4. Once you’ve made your choice, proceed by clicking on the “Select Plan” button associated with that plan.

5. A registration form will pop up next. Here, you’ll be prompted to choose a trading platform. Make your selection and hit the Register button.

6. Two separate forms will appear at this stage. The first one is for your personal details. You’ll need to enter your first and last names, country, residential address, phone number, and email address.

7. Once you’ve provided this information, move on to the second form, which is for the payment process. Follow the instructions, make your payment, and you’re all set to start trading with My Forex Funds.

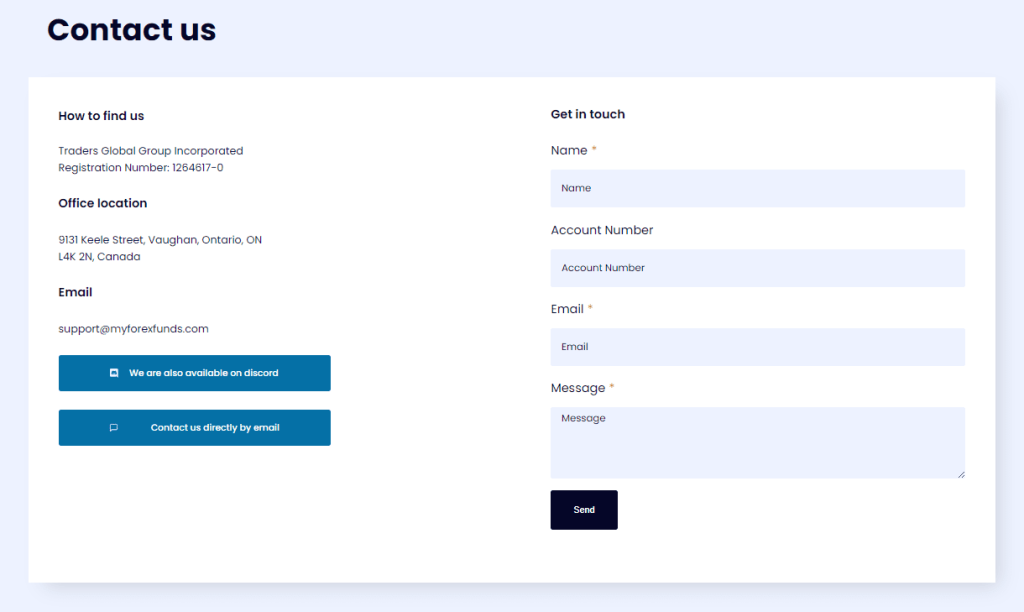

My Forex Funds Customer Support

My Forex Funds provides a number of different contact options for its customers. If a customer needs quick help, they can use the website’s built-in chat service.

Those who have more in-depth questions or who prefer a more conventional approach can send an email. In addition, customers can reach the business via numerous social media channels. These include Facebook, Instagram, and LinkedIn.

My Forex Funds is committed to its user community beyond these primary channels of interaction. My Forex Funds also offers its traders the exclusive chance to join its community on the messaging app Discord.

Advantages and Disadvantages of My Forex Funds Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

Clients can withdraw profits through various methods like Wise, PayPal, Revolut, and even cryptocurrencies such as BTC and ETH. The withdrawal conditions vary based on the chosen financing program. For instance, Rapid program members on a CEA account can take out funds bi-weekly, while NCA account holders can do so monthly.

Accelerated account holders can withdraw weekly, starting after five days of trading, but they need to make their request by 15:00 (EST) or wait until the next payment cycle. Transfers usually take 1-3 days.

Since January 1, 2023, Evaluation program participants have new minimum withdrawal amounts: those with $5,000-$20,000 financing must withdraw at least $50, $50,000-$100,000 financing at least $100, and $200,000-$300,000 financing at least $150. They can make their first withdrawal after one month of trading and subsequent withdrawals every two weeks.

What Makes My Forex Funds Different from Other Prop Firms

My Forex Funds has carved out a niche for itself among prop firms with its unique offerings and distinct approach. One of its notable attributes is the diverse array of account types it offers, catering to different trading styles and experience levels. From the Evaluation to the Accelerated programs, traders are endowed with the liberty to opt for an account that aligns seamlessly with their strategy.

Moreover, while many proprietary firms impose stringent trading rules, My Forex Funds extends a degree of leniency in several areas. An instance of this is the Accelerated Program, where traders are privy to an immediate live account without rigorous restrictions on factors like daily drawdowns or lot size. This flexibility is complemented by MFF’s global outreach. Although they exclude Canadian traders, their platform is open to traders from a myriad of other countries, including those from the USA, thereby promoting global inclusivity.

An aspect where My Forex Funds truly shines is its profit-sharing structure. The firm offers a dynamic range, allowing traders to pocket anywhere between 12% to 85% of their profits. Such a lucrative and varied sharing model is not commonplace in the industry. Complementing this financial advantage is the robust support and community engagement that MFF fosters.

Traders are not just provided with diverse channels for assistance but are also integrated into a spirited community on platforms like Discord. Here, they can exchange insights and partake in enriching discussions with peers, thereby elevating their trading experience.

How Can Asia Forex Mentor Help You Pass My Forex Funds‘ Evaluation?

At Asia Forex Mentor, we’re deeply committed to ensuring our students succeed in their forex trading journey, and that includes helping them navigate challenges like passing My Forex Funds’ evaluation process. When Asia Forex Mentor was founded back in 2008, right here in Singapore, it was a humble venture. We merely wanted to guide a handful of close friends through the intricate world of forex trading.

But as word spread about the effectiveness of our methods and our unique style of instruction, our small circle rapidly grew into a thriving community. So much so, that the demand led to us hosting live in-person sessions, with trading firms and banks eager to have us train their teams. This rapid growth and the invaluable feedback from countless students helped refine and distill our teachings into what is now known as the AFM Proprietary One Core Program.

Our One Core Program is a comprehensive roadmap. Designed meticulously, it empowers traders to craft their very own trading system, delve deep into accurate forex market analysis, and manage their trading accounts with consistency and confidence. Aspiring and experienced traders alike can benefit from this expansive curriculum, which spans 26 detailed modules, encompassing over 60 specific topics. And it’s not just about theory. Each topic is supported by high-quality online videos, punctuated with real-world examples and analyses I’ve handpicked to reinforce the learning.

Our program gives you the appropriate tools and also instills a mindset. It’s crafted to be beginner-friendly, ensuring that newcomers can grasp concepts without feeling overwhelmed. At the same time, the depth and breadth of the content make it invaluable for seasoned traders looking to refine their strategies.

When you train with us, you’re not just learning to trade; you’re learning to trade with minimized risks and maximized potential. So, if you’re eyeing success with My Forex Funds or any other trading endeavor, let Asia Forex Mentor be your guiding hand.

Our Journey at Asia Forex Mentor

At Asia Forex Mentor, our journey has been marked by the countless lives we’ve touched and transformed. Under the guidance of our founder, Ezekiel Chew, we’ve been privileged to mentor thousands spanning a range of backgrounds – from retail traders, those in banking sectors, forex professionals within trading establishments to those at investment firms.

What’s most heartening is witnessing the evolution of many of our students. Many who started with us as novices in the forex realm have now embraced trading as their full-time vocation, and some have even climbed the ranks to become fund managers.

Central to our teaching philosophy is the Asia Forex Mentor One Core Program. Beyond the foundational and advanced trading strategies, the latter modules delve into crucial areas like the benefits of bar-by-bar backtesting and the intricacies of trading psychology. Ezekiel, with his wealth of experience, provides invaluable insights on maintaining a trading diary, further elucidating his perspective on the path to forex trading success.

Within the One Core Program, we introduce essential concepts that differentiate us from others. These include the set-and-forget principle, our unique auto stop-loss tool, a deeper dive into the free trade philosophy, and a comprehensive breakdown of the nuances between large and small stop-loss levels.

We believe in the value we offer, and to ensure our program aligns with your goals, we provide a seven-day free trial. After experiencing the potentially transformative power of our teachings, should you choose to continue, there’s a one-time fee of $997. However, if you’re already convinced of the program’s merits and wish to bypass the trial, a discounted rate of $940 is available for the course.

Conclusion: My Forex Funds Review

In the ever-evolving landscape of forex trading, My Forex Funds has positioned itself as a prominent player. Catering to traders of various experience levels, it offers a range of account types and financing programs. The company demonstrates flexibility through its diverse tariff plans, enabling traders to select the most suitable option based on their goals and strategies.

While it offers myriad advantages like access to the company’s capital and lucrative bonus programs, there are also some concerns raised, such as the absence of telephone support and some restrictions on trading strategies.

In all, My Forex Funds provides traders with a platform that is robust, albeit with a few caveats. Those interested should weigh the pros against the cons, keeping in mind their individual trading objectives and preferences.

Also Read: FTMO Review 2024

My Forex Funds Review FAQs

How does the fee structure of My Forex Funds work?

Fees are varied and may include charges like a fee per lot for spreads and subscription payments that depend on the chosen financing plan.

Can traders access the company’s capital?

Yes, after a nominal payment, traders can access the company’s capital and trade a wide range of instruments.

How often can profits be withdrawn?

Withdrawal frequencies depend on the selected financing program and can range from weekly to monthly.