MultiBank Group Review

Choosing the right Forex broker is a critical step for anyone venturing into the world of Forex trading. Forex brokers act as intermediaries between traders and the financial markets, offering platforms, tools, and resources to facilitate trading. A good broker can enhance your trading experience by providing competitive spreads, reliable customer service, and robust security for your funds.

MultiBank Group, founded in 2005, is a leading financial derivatives provider known for its extensive range of trading products, including Forex, stocks, indices, commodities, and cryptocurrencies. Headquartered in Hong Kong, MultiBank Group stands out for its strong regulatory framework and commitment to client security, operating under multiple top-tier licenses from regulators like ASIC and BaFin.

In this detailed review, I’ll provide an in-depth look at MultiBank Group, highlighting its unique features and potential drawbacks. This review will cover various aspects such as account options, deposit and withdrawal processes, commission structures, and other essential details. My goal is to offer a balanced perspective, combining expert analysis and real trader experiences, to help you decide if MultiBank Group is the right brokerage service for you.

What is MultiBank Group?

MultiBank Group is a prominent financial derivatives provider founded in 2005. With over a million clients globally, it has built a solid reputation in the industry. MultiBank Group offers a wide range of trading products, including Forex, stocks, indices, commodities, and cryptocurrencies, catering to diverse trading needs.

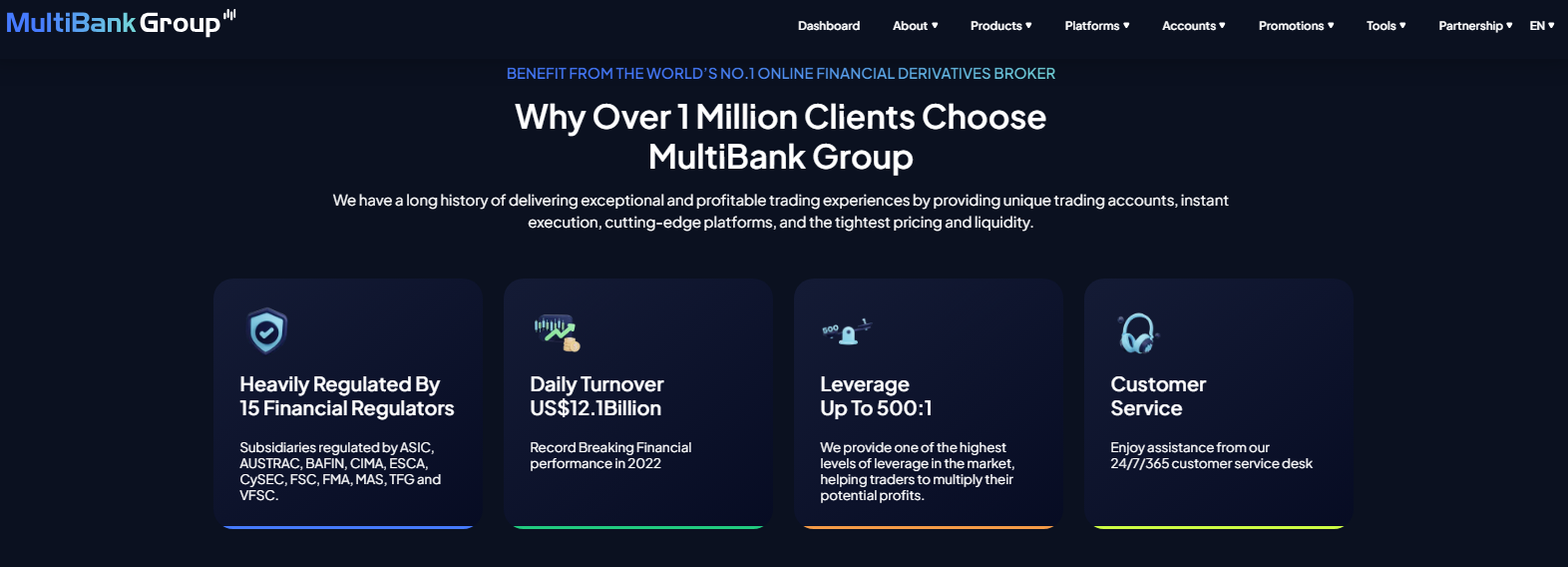

The broker is well-regulated, operating under multiple entities with licenses from Tier-1 regulators like ASIC, BaFin, and CySEC. MultiBank Group also offers a proprietary web platform and mobile trading options, ensuring traders can access their accounts from anywhere.

Benefits of Trading with MultiBank Group

From my experience trading with MultiBank Group, one of the standout benefits is their extensive range of 20,000+ CFD products. This vast selection allows for diversification across various asset classes, including Forex, metals, commodities, indices, and cryptocurrencies, which can significantly enhance your trading portfolio and opportunities.

Another major advantage is their use of MetaTrader 4 and MetaTrader 5 platforms, which are renowned for their reliability and advanced trading features. These platforms provide a seamless trading experience with robust charting tools, automated trading capabilities, and extensive analytical features, catering to both beginners and advanced traders.

MultiBank Group also offers competitive spreads and high leverage options, which can make trading more cost-effective and potentially more profitable. Their tight spreads and leverage up to 1:500 ensure that traders can maximize their trading potential while managing costs effectively.

Customer support is another strong point. The 24/7 multilingual support ensures that you can get help whenever you need it, which is crucial for resolving any issues promptly and maintaining a smooth trading experience. This level of support adds to the overall reliability and trustworthiness of the broker.

Additionally, the security measures implemented by MultiBank Group are reassuring. With strict regulatory oversight and segregated client funds, traders can feel confident that their investments are protected and managed with transparency and integrity.

MultiBank Group Regulation and Safety

When trading with MultiBank Group, I quickly noticed the importance of its regulatory framework. The broker operates under multiple entities regulated by top-tier authorities such as ASIC, BaFin, and CySEC. This means they adhere to strict financial standards, ensuring a secure trading environment. Knowing your broker is well-regulated gives you confidence that your funds are protected and the broker operates transparently.

Safety is another critical aspect of trading with MultiBank Group. They implement negative balance protection, which ensures you won’t lose more than your account balance, and segregate client funds from the company’s operational funds. This separation means that even in the unlikely event of the broker’s insolvency, your money remains safe and accessible. These measures provide peace of mind, allowing you to focus on trading without worrying about the safety of your funds.

Furthermore, MultiBank Group offers a variety of account options to suit different trading needs, backed by robust customer support. This comprehensive regulatory and safety framework not only builds trust but also enhances your trading experience by providing a secure and reliable platform. Understanding these safety measures is crucial for any trader looking to protect their investments and trade with confidence.

MultiBank Group Pros and Cons

Pros

- Strict regulation

- Wide range of trading platforms

- Extensive trading tools

- Over 20,000 trading instruments

- No deposit or withdrawal fees

- Excellent customer support

Cons

- Occasionally slow execution speeds

- High minimum deposit for some accounts

- Account creation can be complex

MultiBank Group Customer Reviews

Customer feedback on MultiBank Group is mixed. Some users praise the responsive and polite live chat support, highlighting their fast and efficient service. However, there are complaints about delays in document approval, with one user frustrated by receiving marketing emails before their account was fully set up. Overall, many traders appreciate the satisfying and prompt service they receive, though there are areas for improvement, particularly in the account verification process.

MultiBank Group Spreads, Fees, and Commissions

When trading with MultiBank Group, I found that their spreads, fees, and commissions are designed to be competitive and transparent. For the Standard Account, the spreads start from 1.4 pips, which is slightly higher than industry averages but includes no additional trading commissions. This account is well-suited for beginners who prefer simplicity without the worry of extra costs per trade.

For more experienced traders, the Pro Account offers lower spreads starting at 0.8 pips. This account requires a higher minimum deposit of $1,000 but does not charge any commissions, making it a balanced option for those who want reduced costs without the complexity of additional fees.

The ECN Account is ideal for professional traders, featuring the tightest spreads starting from 0.1 pips and a commission of $3 per lot traded. This account type requires a significant initial deposit of $5,000 and is designed for high-volume trading, providing direct market access and the most competitive trading conditions.

Regarding non-trading fees, MultiBank Group does not charge for deposits or withdrawals, which is a major advantage. However, there is an inactivity fee of $60 per month if your account remains inactive for over three months. This encourages traders to stay active, minimizing unnecessary charges.

Account Types

MultiBank Group offers a variety of account types designed to meet the needs of different traders. Here’s a breakdown of the main account options:

Standard Account

- Minimum deposit of $50

- Spreads starting from 1.5 pips

- Ideal for beginner traders

- No commissions on trades

- Leverage up to 1:500

- Available on both MT4 and MT5 platforms

Pro Account

- Minimum deposit of $1,000

- Spreads starting from 0.8 pips

- Suitable for experienced traders

- No commissions on trades

- Leverage up to 1:500

- Access to MT4 and MT5 platforms

ECN Account

- Minimum deposit of $5,000

- Spreads starting from 0.1 pips

- Designed for professional traders

- $3 commission per lot traded

- Leverage up to 1:500

- Available on MT4 and MT5 platforms

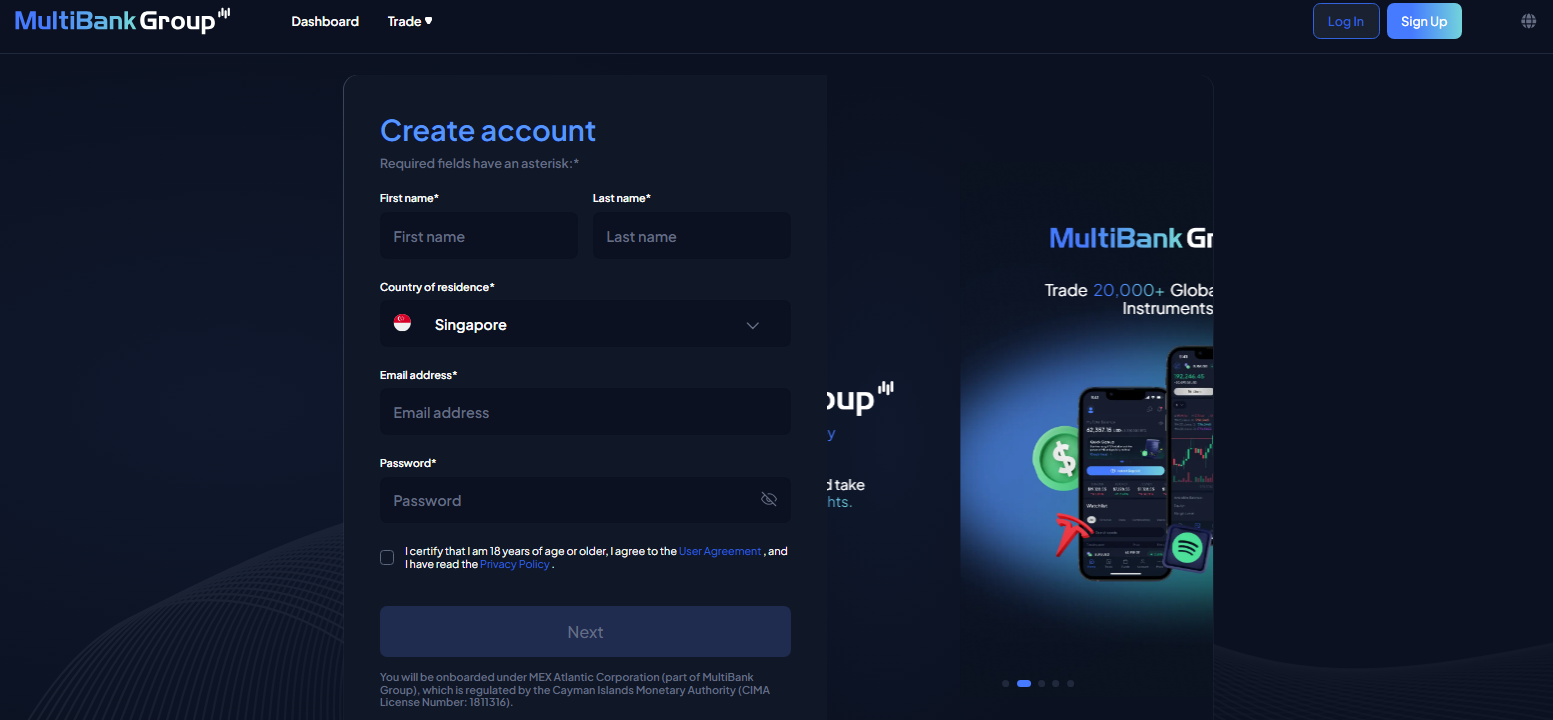

How to Open Your Account

- Visit the MultiBank Group website to start the registration process.

- Select the regulatory body under which you want your account to be governed.

- Choose the account type that best suits your trading needs and experience level.

- Provide your personal information, including your email address and country of residence.

- Fill out the required forms with accurate details.

- Complete the Trading Assessment to determine your trading knowledge and experience.

- Verify your identity and residency by uploading the necessary documents.

- Submit your application and wait for approval, which typically takes around 20 minutes.

MultiBank Group Trading Platforms

Based on my experience, MultiBank Group offers access to some of the best trading platforms available, namely MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are widely recognized for their reliability and advanced trading features, making them popular choices among traders.

MetaTrader 4 is known for its user-friendly interface and robust charting tools. It provides various technical analysis tools, automated trading through Expert Advisors, and supports multiple order types. This platform is ideal for both beginner and experienced traders looking for a solid, dependable trading environment.

MetaTrader 5 takes things a step further by offering more advanced features and enhanced functionalities. It includes additional timeframes, more detailed market depth information, and an improved strategy tester for backtesting trading strategies. This platform is perfect for traders who need more sophisticated tools and a broader range of analytical capabilities.

What Can You Trade on MultiBank Group

Based on my experience, MultiBank Group offers an impressive range of trading instruments, providing access to over 20,000 CFD products across six asset classes. This diversity allows traders to create a well-rounded portfolio and capitalize on various market opportunities.

In the Forex market, you can trade a wide array of currency pairs, including major, minor, and exotic pairs. The platform’s tight spreads and high liquidity make it an attractive option for both novice and experienced forex traders.

For those interested in precious metals, MultiBank Group offers trading in gold, silver, and other metals. These instruments can be excellent for hedging against market volatility and diversifying your investment portfolio.

Commodities are another strong suit of MultiBank Group, with products like oil, natural gas, and agricultural commodities available for trading. These instruments allow traders to speculate on global economic trends and supply-demand dynamics.

Indices trading on MultiBank Group includes major global indices like the S&P 500, NASDAQ, and FTSE 100. Trading indices can provide exposure to broader market movements and is suitable for those looking to invest in entire market sectors.

Cryptocurrencies have also become increasingly popular, and MultiBank Group offers a range of crypto CFDs, including Bitcoin, Ethereum, and Litecoin. This allows traders to benefit from the volatility and growth potential of the cryptocurrency market.

MultiBank Group Customer Support

MultiBank Group offers robust customer support that caters to the needs of traders at all levels. The support team is available 24/7 via live chat, email, and phone, ensuring that help is always accessible when you need it. I found their live chat to be particularly responsive and helpful, making it easy to get quick answers to any questions.

Their multilingual support ensures that language is not a barrier, which is crucial for a global client base. Additionally, they offer detailed FAQs and comprehensive help sections on their website, providing a wealth of information to help you navigate the trading platform and resolve common issues. This level of support can significantly enhance your trading experience, providing peace of mind and confidence that assistance is just a click away.

Advantages and Disadvantages of MultiBank Group Customer Support

Withdrawal Options and Fees

Withdrawing funds from your MultiBank Group account is straightforward and free of charge. Clients can use various methods, including bank transfers, credit/debit cards, electronic wallets, and cryptocurrency, making it convenient to access your money.

Withdrawals must be made to accounts under the same name as the account holder, ensuring security and compliance. The processing time for withdrawals is typically up to 24 hours, which I found to be quite efficient.

To withdraw, simply log into MyMultiBank, go to ‘Withdrawal’, select your trading account, provide the reason for the withdrawal, enter the amount, select the withdrawal method, and initiate the transaction. This process is user-friendly and ensures you can manage your funds with ease.

MultiBank Group Vs Other Brokers

#1. MultiBank Group vs AvaTrade

MultiBank Group and AvaTrade both offer a wide range of trading instruments and robust trading platforms. MultiBank Group provides access to over 20,000 CFD products, including Forex, metals, commodities, indices, and cryptocurrencies. They offer MetaTrader 4 and MetaTrader 5, which are known for their reliability and advanced features. AvaTrade, on the other hand, supports a variety of platforms including MT4, MT5, AvaOptions, and its proprietary AvaTradeGO, providing a comprehensive trading experience. AvaTrade also excels in educational content and offers innovative tools like AvaProtect, which provides loss protection. Both brokers offer competitive spreads and leverage options, but AvaTrade’s no-commission structure on trades is a key highlight.

Verdict: AvaTrade is a better choice for those seeking diverse trading platforms and advanced risk management tools. However, if you prefer a broker with a vast range of CFDs and robust MetaTrader support, MultiBank Group might be more suitable.

#2. MultiBank Group vs RoboForex

MultiBank Group and RoboForex are both established brokers with a strong presence in the Forex market. MultiBank Group offers a significant number of CFD products across multiple asset classes and uses MetaTrader 4 and 5 platforms. RoboForex also provides a variety of trading instruments, including Forex, stocks, indices, and cryptocurrencies, and supports multiple platforms such as MT4, MT5, cTrader, and its proprietary R Trader. RoboForex is known for its competitive spreads and flexible leverage options, which can go up to 1:2000, higher than MultiBank’s maximum leverage of 1:500. Additionally, RoboForex offers a wide range of account types tailored for different trading needs.

Verdict: RoboForex is better suited for traders who need higher leverage and a broader range of platform choices. MultiBank Group is ideal for those who prefer trading with the highly reliable MetaTrader platforms and a large selection of CFDs.

#3. MultiBank Group vs Exness

MultiBank Group and Exness are reputable brokers that cater to both beginner and advanced traders. MultiBank Group offers extensive CFD trading options and uses the MetaTrader 4 and 5 platforms. Exness, however, provides more flexibility with its high leverage options up to 1:2000 and a broad range of trading instruments including Forex, metals, cryptocurrencies, energies, and indices. Exness also offers the MT4 and MT5 platforms, along with a user-friendly web terminal and mobile app. Both brokers provide 24/7 customer support, but Exness is known for its excellent trading conditions, including lower spreads and no hidden fees.

Verdict: Exness stands out for its higher leverage and superior trading conditions, making it ideal for high-volume traders. MultiBank Group is more suited for traders who need a large variety of CFDs and robust MetaTrader platform support.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH MULTIBANK GROUP

Conclusion: MultiBank Group Review

Based on my insights and user feedback, MultiBank Group stands out as a robust choice for traders looking for a diverse range of CFD products and reliable trading platforms like MetaTrader 4 and 5. They offer competitive spreads, high leverage options, and strong customer support, making them a compelling option for both novice and experienced traders. The broker’s commitment to security, with extensive regulatory oversight and segregated client funds, adds an extra layer of trust and reliability.

However, there are some drawbacks to consider. Users have noted occasional slow execution speeds and a somewhat complicated account creation process. Additionally, the high minimum deposit required for the ECN account may be prohibitive for some traders. It’s essential to weigh these factors against the benefits to determine if MultiBank Group aligns with your trading needs and preferences.

Also Read: GCM Forex Review 2024 – Expert Trader Insights

MultiBank Group Review: FAQs

What are the main trading platforms offered by MultiBank Group?

MultiBank Group offers MetaTrader 4 and MetaTrader 5 platforms, which are known for their reliability and advanced trading features.

Is there a fee for withdrawing funds from a MultiBank Group account

No, withdrawing money from your MultiBank Group account is free of charge.

What is the minimum deposit required to open an account with MultiBank Group?

The minimum deposit varies depending on the account type, ranging from $50 to $5,000.

OPEN AN ACCOUNT NOW WITH MULTIBANK GROUP AND GET YOUR BONUS