Position in Rating | Overall Rating | Trading Terminals |

258th  | 2.0 Overall Rating |  |

MTrading Review

MTrading is a global online trading platform that offers a range of financial instruments, including forex, commodities, indices, and stocks. Designed for both beginner and advanced traders, MTrading provides a user-friendly interface, making it accessible to a broad audience.

The platform’s standout feature is its low-cost trading environment, offering competitive spreads and no hidden fees. With MetaTrader 4 as its primary trading software, MTrading ensures smooth transactions and high-quality analysis tools to enhance trading strategies.

MTrading is its copy trading service, which allows users to automatically replicate the trades of experienced traders. This service is particularly beneficial for beginners, as it provides an opportunity to learn from seasoned professionals and potentially earn profits without extensive market knowledge. By selecting a preferred trader to follow, users can mirror their trading strategies in real-time, making MTrading‘s copy trading a convenient tool for those looking to enter the financial markets with guidance.

What is MTrading?

MTrading is a global online trading platform that provides access to forex, commodities, indices, and stocks. Established in 2012, MTrading serves both beginners and experienced traders, offering a user-friendly platform and competitive trading conditions.

The platform uses MetaTrader 4, enabling efficient trade execution and providing advanced tools for analysis. MTrading emphasizes client security with international regulatory compliance and offers educational resources to support traders in building their skills.

MTrading Regulation and Safety

MTrading operates under the registration of the Financial Services Authority of Saint Vincent and the Grenadines. However, this authority does not regulate forex brokers directly, meaning MTrading functions without oversight from a recognized regulatory body, which could be a concern for investor protection.

To address safety, MTrading claims to implement protective measures such as segregated accounts to keep client funds separate from company assets, reducing risks in case of insolvency. Additionally, negative balance protection is offered, ensuring clients cannot lose more than their initial investment, providing a layer of security amid market volatility. Despite these efforts, potential clients should carefully consider the regulatory aspects and safety protocols of any broker.

MTrading Pros and Cons

Pros

- Diverse instruments

- User-friendly

- Competitive spreads

- Educational resources

Cons

- Limited regulation

- Slow support

- Withdrawal delays

- Asset limitations

Benefits of Trading with MTrading

MTrading provides several key benefits for traders. Users have access to a diverse range of financial instruments, including forex, commodities, indices, and stocks, which allows for a well-rounded portfolio. The platform uses MetaTrader 4, known for its user-friendly interface and advanced analysis tools, making it accessible to both beginners and experienced traders alike.

Competitive trading conditions are another advantage, as MTrading offers low spreads, high leverage options, and quick order execution for efficient trading. Additionally, the platform provides extensive educational resources like webinars, articles, and tutorials to help traders enhance their skills. Dedicated customer support is also available through multiple channels, ensuring prompt assistance when needed. These features make MTrading a strong choice for those looking to engage in global markets confidently and effectively.

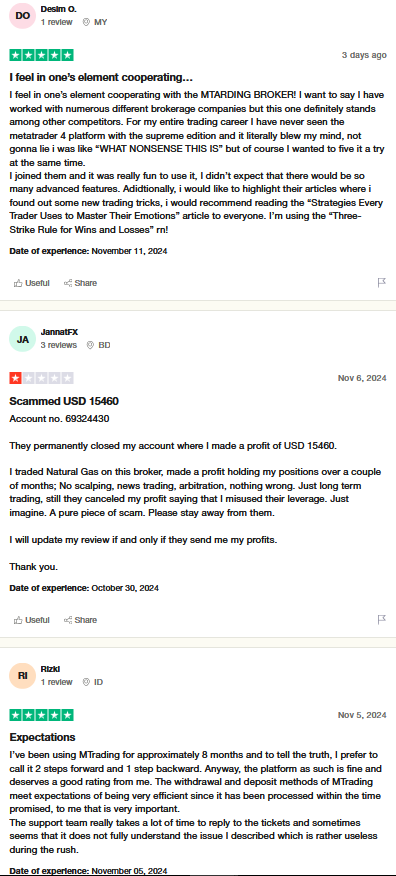

MTrading Customer Reviews

MTrading has received a range of customer feedback, reflecting both positive experiences and areas of concern. Many users appreciate the platform's user-friendly interface and the variety of financial instruments available, including forex, commodities, indices, and stocks. The use of MetaTrader 4 is often highlighted for its advanced analytical tools and efficient trade execution.

However, some clients have expressed concerns regarding the company's regulatory status, as MTrading operates under the registration of the Financial Services Authority of Saint Vincent and the Grenadines, which does not regulate forex brokers directly. Additionally, there have been reports of delays in fund withdrawals and instances of unresponsive customer support.

Overall, while MTrading offers a comprehensive trading platform with competitive conditions, potential users should consider these mixed reviews and conduct thorough research to determine if it aligns with their trading needs and expectations.

MTrading Spreads, Fees, and Commissions

MTrading offers various account types tailored to different trading needs. The M.Premium Account provides floating spreads starting from 1.2 pips for major pairs like EUR/USD, operating on a commission-free basis. For professional traders, the M.Pro Account offers tighter spreads from 0.2 pips and charges a commission of $4 per standard lot, combining low spreads with manageable fees.

Additional costs include overnight financing fees, known as swaps, for positions held beyond trading hours. An inactivity fee of $50 applies after twelve months of no account activity. MTrading does not impose deposit or withdrawal fees, though external payment providers may charge fees. This structure is designed to be transparent, allowing traders to choose the account that best suits their strategies.

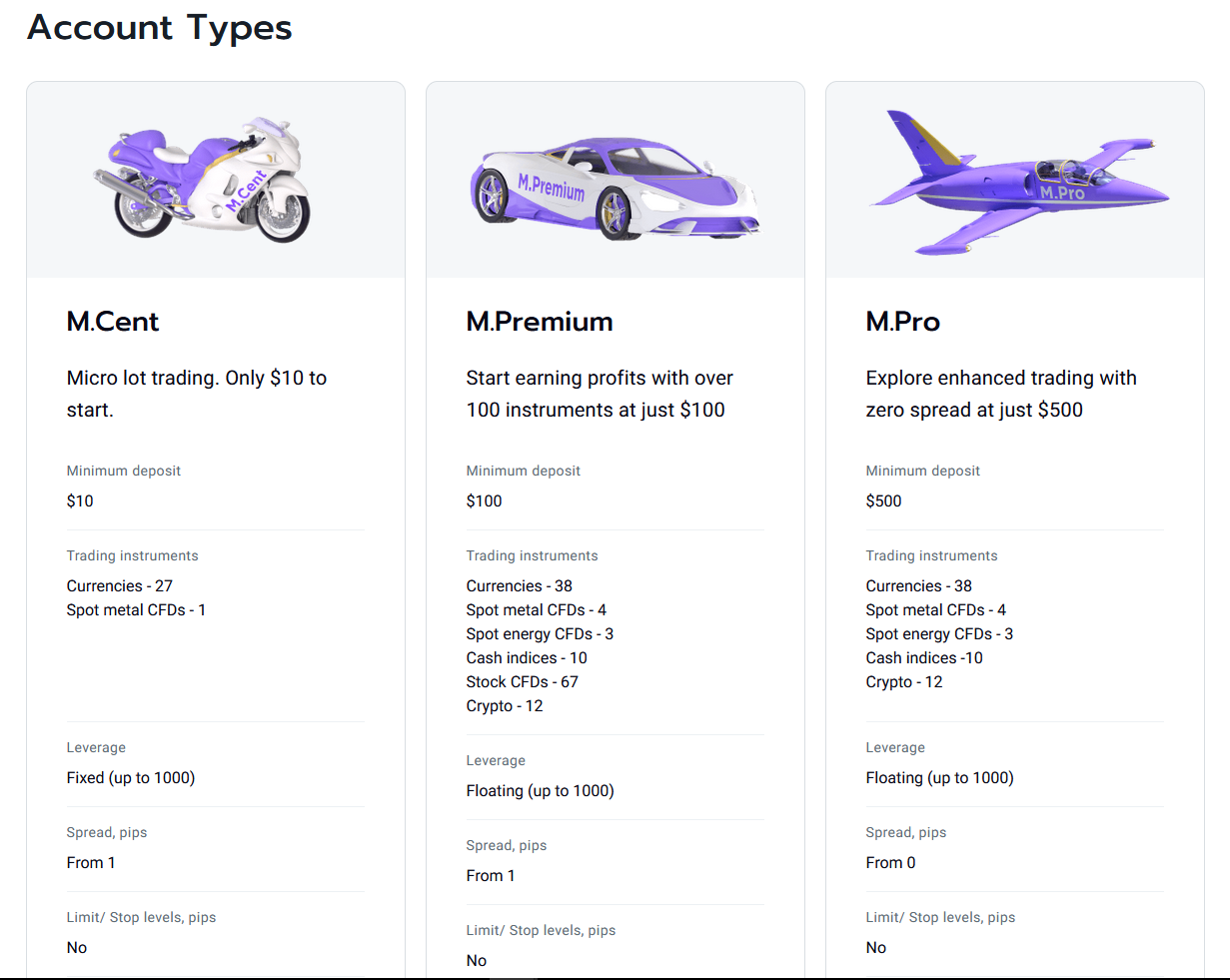

Account Types

MTrading offers multiple trading account types to cater to traders with varying experience levels and investment goals. Each account type is designed to provide specific features, ensuring that traders can choose the option that best suits their trading strategy and needs.

M.Premium Account

The M.Premium Account is designed for standard trading with no commission fees, making it ideal for beginners and casual traders. It offers floating spreads starting from 1.2 pips on major currency pairs, providing a balanced approach to cost and access.

M.Pro Account

The M.Pro Account is tailored for professional traders who seek tighter spreads and a more competitive trading environment. With spreads starting as low as 0.2 pips, this account includes a $4 commission per standard lot, appealing to traders who prioritize precision and lower spreads.

M.Cent Account

The M.Cent Account is a beginner-friendly option, allowing smaller lot sizes and lower minimum deposits. This account type is ideal for those new to trading who wish to gain experience with minimal risk while exploring MTrading’s features and platform.

Different account types has different minimum deposit required in it. Minimum deposit is required to operate an account. In demo accounts, minimum deposit isn't really needed because it is only just a simulation of the actual account types inside the selection. The higher the account, the higher the minimum deposit required.

How to Open Your Account

Opening an account with MTrading is a straightforward process designed for both new and experienced traders. By following a few simple steps, users can quickly gain access to the trading platform and begin exploring various financial instruments.

Step 1: Visit the MTrading Website

To start, go to the official MTrading website and click on the “Open Account” button located on the homepage. This will direct you to a registration form where you’ll enter basic details like name, email, and contact information.

Step 2: Complete the Registration Form

Fill out the form accurately, including personal information and financial background if required. MTrading may also ask for details about trading experience to ensure appropriate account setup.

Step 3: Verify Your Identity

To comply with regulatory requirements, MTrading will need identity verification. Upload a valid government-issued ID and proof of address, which will be reviewed before account approval.

Step 4: Fund Your Account

After verification, proceed to deposit funds into your MTrading account using one of the available payment methods. Minimum deposit requirements may vary depending on the account type selected.

Step 5: Start Trading

Once funded, your MTrading account is ready for use, and you can start trading across forex, commodities, indices, and other available instruments. Log into the platform and explore the trading options to begin.

MTrading Trading Platforms

MTrading provides a selection of trading platform to suit different trader needs, with MetaTrader 4 (MT4) as its primary platform. Known for its user-friendly interface and powerful analytical tools, MT4 allows trading across forex, commodities, indices, and stocks. It offers real-time quotes, interactive charts, and a wide range of technical indicators. Traders can also use automated trading strategies through Expert Advisors (EAs) on MT4, making it suitable for both manual and algorithmic trading.

For those preferring browser-based trading, MT4 WebTrader offers the full functionality of MT4 directly from any web browser, requiring no software installation. This version provides secure access to trading accounts, live market data, and smooth trade execution. Additionally, MTrading offers the MT4 Mobile App for iOS and Android devices, enabling traders to manage accounts, monitor real-time quotes, and execute trades on the go. These platforms ensure a flexible, comprehensive trading experience for all MTrading clients.

What Can You Trade on MTrading

MTrading offers a wide range of trading options that cater to different financial interests and goals. With access to global markets, traders can explore forex, commodities, indices, and stocks, all through a user-friendly platform designed to suit both beginners and experienced investors.

Forex

Forex trading on MTrading includes a variety of major, minor, and exotic currency pairs. This market operates 24/5, allowing traders to engage in real-time currency fluctuations influenced by global events and economic data.

Commodities

MTrading provides access to popular commodities like gold, silver, and crude oil. Trading commodities offers diversification options as they often behave differently compared to traditional markets like stocks.

Indices

Traders can invest in indices on MTrading, including major indices like the S&P 500, NASDAQ, and FTSE. These indices allow traders to speculate on the performance of a group of stocks rather than individual companies, making them suitable for diversified market exposure.

Stocks

With MTrading, users can trade shares of prominent companies, giving them a direct way to participate in the equity markets. Stock trading allows traders to benefit from price movements in individual companies, based on financial performance and industry trends.

MTrading Customer Support

MTrading offers comprehensive customer support to assist traders effectively. Clients can reach the support team through multiple channels, including email and live chat, ensuring prompt responses to inquiries. The platform also provides a detailed FAQ section, addressing common questions related to account management, trading platform, and financial transactions. Additionally, MTrading broker assigns personal account managers to clients, offering tailored assistance and guidance. This multi-faceted support system is designed to enhance the trading experience by providing timely and personalized help.

This online broker provides customer support team to assist traders seeking the forex market. MTrading broker is giving trading opportunities to the new and experienced traders with risk management. Of course, traders will apply for their premium account and this broker should be responsible of assisting them.

Advantages and Disadvantages of MTrading Customer Support

Withdrawal Options and Fees

MTrading provides several electronic payment systems withdrawal options to suit the diverse needs of its clients. While MTrading itself does not charge for withdrawals, third-party fees may apply depending on the chosen method. Below are the primary withdrawal methods available, each with specific requirements and potential charges.

Bank Transfer

Bank transfers are available for minimum deposit and withdrawals, offering secure but sometimes slower processing times. Fees may be applied by the client’s bank, and transfer times can vary from 2 to 5 business days.

Credit/Debit Card

Withdrawing funds to a credit or debit card provides a convenient option for many users. Processing times are typically shorter, though some card providers may impose their own fees.

E-Payment Systems

MTrading supports popular e-payment options like Skrill and Neteller, which offer faster transaction times. While MTrading does not charge fees, these providers may have their own costs for transactions.

Cryptocurrencies

Clients can withdraw funds using cryptocurrencies for greater flexibility and faster processing. This method may involve network fees, which are determined by the blockchain network rather than MTrading.

MTrading Vs Other Brokers

#1. MTrading vs AvaTrade

MTrading and AvaTrade are both prominent online trading platform, each offering a range of financial instruments such as forex, commodities, indices, and stocks. MTrading utilizes the MetaTrader 4 platform, known for its user-friendly interface and advanced analytical tools, catering to both novice and experienced traders. It provides competitive trading conditions with low spreads and high leverage options. However, MTrading operates under the registration of the Financial Services Authority of Saint Vincent and the Grenadines, which does not directly regulate forex brokers, potentially raising concerns about investor protection. On the other hand, AvaTrade offers a variety of trading platforms, including its proprietary WebTrader and AvaTradeGO, alongside MetaTrader 4 and 5. It is regulated in multiple jurisdictions, providing a higher level of oversight and security for traders. AvaTrade also offers a broader range of educational resources and customer support options, enhancing the overall trading experience.

Verdict: While both platforms offer robust trading features, AvaTrade‘s extensive regulatory oversight and diverse platform offerings provide a more secure and versatile trading environment compared to MTrading.

#2. MTrading vs RoboForex

MTrading and RoboForex are both online brokers offering access to various financial instruments, including forex, commodities, indices, and stocks. MTrading utilizes the MetaTrader 4 platform, known for its user-friendly interface and advanced analytical tools, catering to both novice and experienced traders. The broker provides competitive spreads and offers educational resources to enhance trading skills. However, MTrading operates under the registration of the Financial Services Authority of Saint Vincent and the Grenadines, which does not directly regulate forex brokers, potentially raising concerns about investor protection. On the other hand, RoboForex offers a broader range of trading platforms, including MetaTrader 4, MetaTrader 5, cTrader, and its proprietary R StocksTrader platform, accommodating various trading preferences. The broker provides access to a more extensive selection of trading instruments and offers additional features such as copy trading services. RoboForex is regulated by the International Financial Services Commission (IFSC) of Belize, which, while not as stringent as top-tier regulators, does provide a level of oversight.

Verdict: RoboForex offers a more diverse platform selection and a wider range of trading instruments, making it a more versatile choice for traders seeking variety and additional features. However, traders prioritizing a user-friendly experience with a focus on forex trading may find MTrading to be a suitable option, keeping in mind the differences in regulatory oversight.

#3. MTrading vs Exness

MTrading and Exness are popular trading platforms offering access to forex, commodities, indices, and stocks, with each providing competitive spreads and leverage options. MTrading operates on MetaTrader 4, focusing on user-friendly features and advanced analysis tools, though it lacks direct regulation from major authorities, which may impact investor protection. Exness, by contrast, supports both MetaTrader 4 and 5 and is regulated by authorities like the FCA and CySEC, offering broader asset coverage, including cryptocurrencies, and 24/7 customer support. Exness’ regulatory backing and variety of assets make it appealing for traders who prioritize security and a wide range of trading instruments.

Verdict: Exness stands out with stronger regulatory oversight and asset options, providing a more comprehensive environment for those seeking security and versatility in trading.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: MTrading Review

In conclusion, MTrading offers a versatile platform suitable for both novice and experienced traders. With access to a wide range of financial instruments and the popular MetaTrader 4 software, MTrading provides user-friendly tools and competitive trading conditions. The platform’s low spreads, educational resources, and multiple support options make it appealing to traders looking for flexibility and accessibility.

The financial markets is a bit complicated, automated trading systems and market trends are difficult to understand especially if the trader is novice. Trading currencies and market execution is a hard platform to be in, that's why this technical analysis provides a deep understanding about trading industry.

However, the absence of direct regulation from a recognized financial authority may be a consideration for those prioritizing regulatory oversight. Overall, MTrading presents a well-rounded trading experience with transparent fees and services, though potential users are advised to review all aspects to ensure it meets their trading requirements.

MTrading Review: FAQs

What account types does MTrading offer?

MTrading provides M.Premium, M.Pro, and Cent accounts to cater to different trading needs.

What trading platforms are available?

MTrading uses MetaTrader 4 (MT4) available on desktop, web, and mobile.

How can I deposit and withdraw funds?

MTrading supports bank transfers, credit/debit cards, and e-payment systems, with no internal fees but possible third-party charges.

OPEN AN ACCOUNT NOW WITH MTRADING AND GET YOUR BONUS