Moneta Markets Review

Moneta Markets is a prominent online forex broker that offers global traders access to the foreign exchange market. Established in 2020, the broker's primary goal is to provide a user-friendly trading environment complemented by a diverse range of trading instruments and competitive trading conditions.

We will examine Moneta Markets in-depth in this review, offering an unbiased evaluation of its attributes, offerings, benefits, drawbacks, and comparisons to other renowned brokers. We will also look at the security protocols and safeguards Moneta Markets has put in place to secure the money and personal data of its customers.

By thoroughly examining Moneta Markets, traders can make informed decisions about whether the broker aligns with their trading needs and preferences. It is always advisable to consider multiple sources of information and stay updated with the latest developments and reviews to make well-informed choices when selecting a forex broker.

What is Moneta Markets?

Online brokerage company Moneta Markets gives traders access to a range of financial markets, including indices, cryptocurrencies, commodities, and forex (foreign currency). The site enables users to engage in trading activities, speculate on price changes, and maybe profit from market swings.

Moneta Markets strives to provide users with a fluid and user-friendly experience as a trading platform. It gives traders the resources, tools, and market data they need to help them make wise trading decisions. The platform frequently supports well-liked trading applications like MetaTrader 4 (MT4), which is renowned for its powerful features and capabilities.

Moneta Markets often provides leverage options, allowing traders to control larger positions in the market with less capital. Additionally, they offer customer support services to address any inquiries or technical issues that traders may encounter. Overall, Moneta Markets strives to provide a comprehensive trading experience, catering to the diverse needs of traders in the global financial markets.

Advantages and Disadvantages of Trading with Moneta Markets?

Trading with Moneta Markets presents a variety of advantages and disadvantages that traders should consider when selecting a forex broker. These factors contribute to the overall trading experience, and understanding them can help traders align their choice with their trading goals and preferences.

Benefits of Trading with Moneta Markets

Indeed, before diving into the benefits of trading with Moneta Markets, it's important to understand that the choice of a broker can significantly impact your trading journey. The right broker not only provides a platform for executing trades but also offers the tools, resources, and services to facilitate successful trading outcomes.

As a well-established and respected broker, Moneta Markets brings numerous advantages to the table that can enhance your trading experience. Here, we delve into the key benefits of choosing Moneta Markets as your trading partner.

Diverse Range of Trading Instruments

Moneta Markets provides access to a wide range of financial markets, including forex, commodities, indices, and cryptocurrencies. This allows traders to diversify their portfolios and take advantage of various trading opportunities.

User-Friendly Trading Platforms

Moneta Markets offers user-friendly trading platforms, including MetaTrader 4 (MT4), WebTrader, and AppTrader. These platforms provide advanced charting tools, customizable indicators, and automated trading options, enhancing the overall trading experience.

Competitive Trading Conditions

Moneta Markets strives to offer competitive trading conditions, such as tight spreads, fast execution speeds, and flexible leverage options. These factors can contribute to potentially favorable trading outcomes for traders.

Social Copy-Trading

Moneta Markets supports social copy-trading through platforms like DupliTrade and ZuluTrade. Traders can follow and copy the trades of successful traders, allowing for potential learning opportunities and the potential to replicate their success.

Educational Resources and Support

Moneta Markets provides educational resources, including trading guides, webinars, and market analysis, to help traders enhance their trading skills and knowledge. Additionally, customer support is available to assist traders with any inquiries or technical issues they may encounter.

Regulatory Oversight

Moneta Markets operates under regulatory oversight from the Vanuatu Financial Services Commission (VFSC). This regulatory framework can provide a certain level of investor protection and ensure the broker's compliance with industry standards.

Indemnity Insurance

Moneta Markets offers indemnity insurance, providing an additional layer of protection for client funds beyond regulatory coverage. This can offer traders added peace of mind regarding the safety of their investments.

Moneta Markets Pros and Cons

When choosing a forex broker, understanding the pros and cons can provide a balanced perspective to aid decision-making. Here are some key advantages and disadvantages associated with Moneta Markets:

Pros

- Extensive in-house education portal and market updates

- Wide range of instruments, with over 1000 products available for trading

- Offers three popular trading platforms: MT4, MT5, and PRO Trader

- No deposit fees or inactivity fees

- Multilingual client portal and website available in 12 languages

Cons

- Does not accept traders from the United States

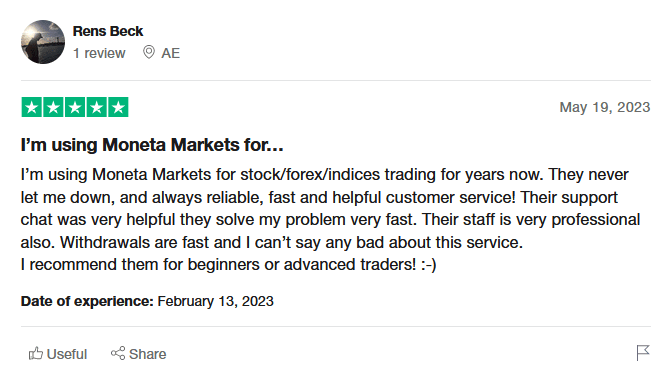

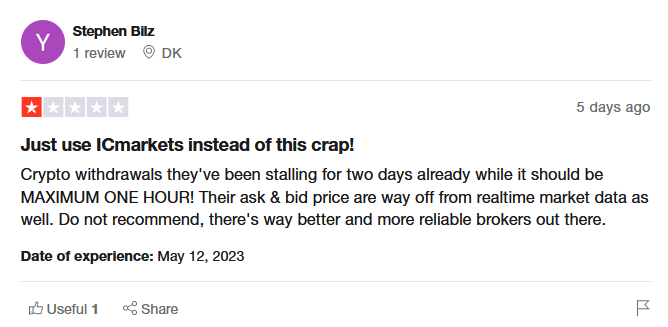

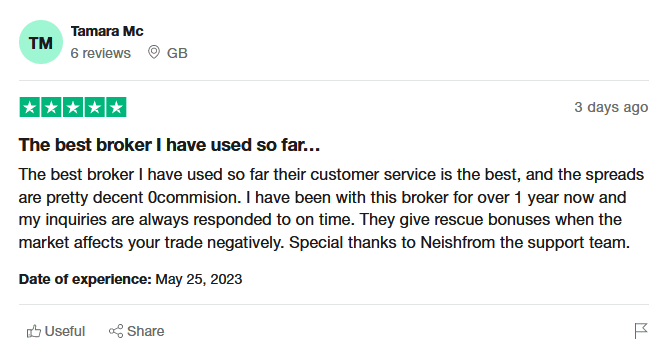

Moneta Markets Customer Reviews

Customer reviews of Moneta Markets highlight several positive aspects of the broker. One notable highlight is the excellent trading platforms offered by Moneta Markets, such as MT4, MT5, and PRO Trader.

Customers appreciate the user-friendly interfaces, advanced charting tools, and smooth trade execution provided by these platforms. Additionally, the streamlined onboarding process stands out as a positive aspect, with customers finding it convenient and efficient to open an account and start trading quickly.

Another highly regarded feature is the multilingual customer support, which allows traders to receive assistance in their preferred language, enhancing communication and overall satisfaction.

These positive customer experiences indicate that Moneta Markets offers reliable trading platforms, a seamless onboarding process, and responsive multilingual support, contributing to a positive trading experience for its customers.

Keep in mind that reviews can be subjective and are often based on personal experiences, so it's wise to look for patterns and consistent feedback among multiple reviews. Remember, while user reviews can be helpful, they should not be the only factor considered when choosing a forex broker.

Moneta Markets Spreads, Fees, and Commissions

Choosing a broker with competitive spreads, fees, and commissions is a key factor in maximizing your trading profits. It's not just about the trading platform's capabilities or the variety of markets available to trade.

Costs associated with each trade can quickly add up and impact your bottom line, especially for active traders. In this section, we'll examine the fee structure at Moneta Markets and how it may affect your trading experience.

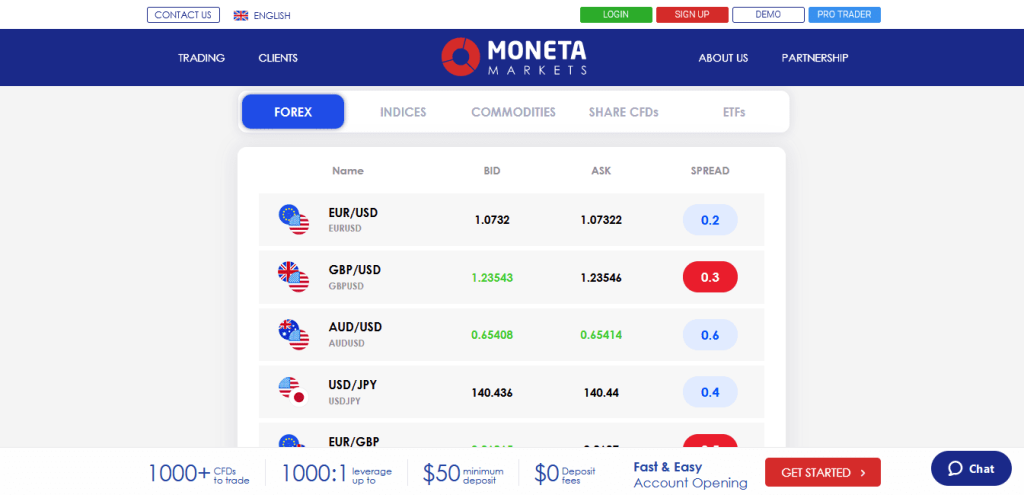

Moneta Markets offers three account options with varying trading costs. The commission-based STP account is expensive for forex trading, while the commission-free True ECN account has tighter spreads and a commission of $6 per round-turn lot, which is closer to the industry average.

Spread-only accounts have an average spread of 1.22 pips for the EUR/USD pair, while the True ECN account has an average spread of 0.15 pips for the same pair, with an all-in cost of approximately 0.75 pips, slightly below the industry average. Overall, Moneta Markets' pricing is not competitive compared to top forex brokers.

Account Types

Moneta Markets offers a range of live account choices for traders. These include the Essential Account, Original Account, and Signature Account. Additionally, an Islamic Account version is available for all these account types. Traders can also access a demo account upon registration to practice and familiarize themselves with the platform. Here's an overview:

Direct STP

The Direct STP account type offered by Moneta Markets features STP (Straight Through Processing) execution, making it suitable for beginners or traders who prefer a straightforward trading experience. With this account, traders can execute trades directly in the market without dealing with a dealing desk. Hedging of positions is allowed, providing flexibility in risk management. The account has a 50% Stop Out level, meaning that if the account's equity falls to 50% of the required margin, positions will be automatically closed to protect against further losses.

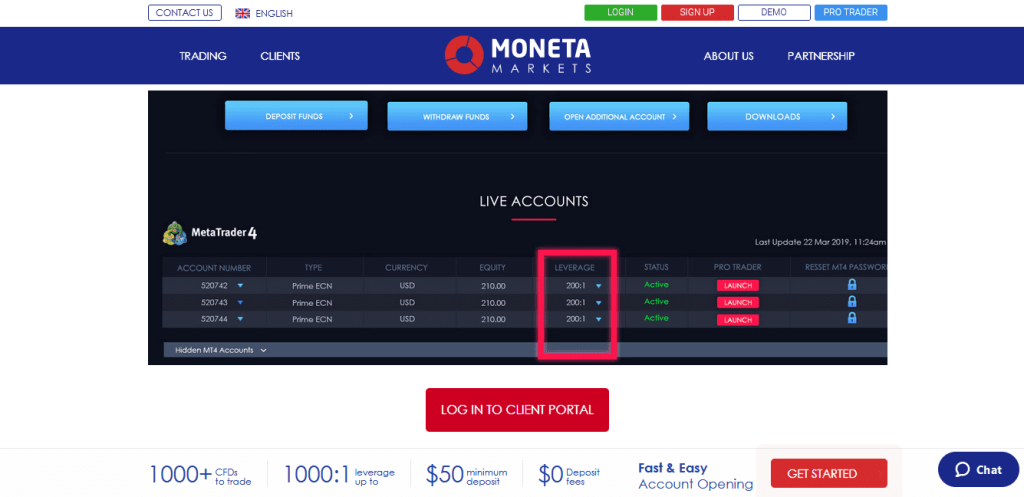

Prime ECN

Moneta Markets' Prime ECN account type is designed for scalpers and traders utilizing Expert Advisors (EAs). It offers ECN (Electronic Communication Network) execution, which provides direct access to liquidity providers and potentially faster trade execution. Like the Direct STP account, hedging is allowed. The account also has a 50% Stop Out level, meaning positions will be closed if the equity falls to 50% of the required margin.

Ultra ECN

The Ultra ECN account type is geared towards professional Moneta Managers and experienced traders. It also features ECN execution, ensuring access to deep liquidity pools and potentially tighter spreads. Hedging is allowed in this account as well.

Similar to the other account types, it has a 50% Stop Out level, meaning that positions will be closed if the account's equity reaches 50% of the required margin.

Traders should carefully consider their trading style, experience level, and preferences when choosing among these Moneta Markets account types to ensure the best fit for their needs.

How To Open Your Account?

Opening an account with Moneta Markets is a straightforward process. Here's a step-by-step guide. Be sure to check Moneta Markets' official website for any changes to this process.

Visit the Moneta Markets website: Start by going to the Moneta Markets official website.

Sign Up: Click on the “Register” or “Open Live Account” button, usually located at the top right of the website.

Complete the Registration Form: You'll be asked to fill out a form with personal details, including your name, email address, phone number, and country of residence.

Choose an Account Type: Select the account type that best fits your trading needs and deposit requirements –Direct STP, Prime ECN, and Ultra ECN.

Verify Your Identity: To comply with financial regulations, Moneta Markets will require proof of identity and proof of residence. This can usually be completed by uploading a scanned copy of a valid passport or ID for proof of identity, and a utility bill or bank statement for proof of residence.

Fund Your Account: Once your account is verified, you can deposit funds. Moneta Markets offers several funding options, including bank transfer, credit/debit card, and various online wallets. Select the method that suits you best and follow the instructions to complete the deposit.

Start Trading: After your deposit has been processed, you can start trading. Download the trading platform, log in with your account details, and begin your trading journey.

What Can You Trade on Moneta Markets?

Moneta Markets provides a diverse range of financial instruments for trading, allowing traders to access multiple markets from a single platform. While specific offerings may evolve over time, here are some of the common instruments you can trade on Moneta Markets:

Forex: Traders can participate in the foreign exchange market (forex) and trade major, minor, and exotic currency pairs. This provides opportunities to speculate on the fluctuations in currency exchange rates.

Commodities: Moneta Markets offers the ability to trade various commodities, such as gold, silver, oil, and other precious metals and energy products. Traders can take advantage of price movements in these markets.

Indices: Traders have the opportunity to trade a selection of global stock market indices, representing the overall performance of specific stock markets or sectors. This allows traders to speculate on the direction of the broader market.

Share CFDs: Moneta Markets provides access to Contract for Difference (CFD) products based on shares of various companies. Traders can trade CFDs on shares without owning the underlying assets, allowing for potential profits from price movements.

ETFs: Exchange-Traded Funds (ETFs) are also available for trading on Moneta Markets. ETFs are investment funds that track the performance of a specific index or asset class. Traders can take positions on the price movements of ETFs.

Bonds: Moneta Markets offers the ability to trade bonds, which are debt securities issued by governments or corporations. Traders can speculate on the interest rate and yield movements of bonds.

Trading hours, spreads, and commissions vary depending on the specific instrument and market. Traders should refer to the platform or contact Moneta Markets for accurate and up-to-date information regarding trading hours as well as the associated spreads and commissions for each product.

Moneta Markets Customer Support

Moneta Markets prides itself on providing reliable and efficient customer support to assist traders with their inquiries and concerns. The broker offers multiple channels for customer support, ensuring that assistance is readily available when needed.

Moneta Markets is known for its responsive and helpful customer support. The live chat feature provides fast assistance, ensuring that traders can quickly get their questions answered or issues resolved.

Additionally, emails sent to the support team are typically responded to within 24 hours with relevant and informative answers. However, it's worth mentioning that 24/7 support is not available, which means that assistance may not be immediately accessible outside of specific hours.

Nonetheless, the overall customer support provided by Moneta Markets is highly regarded for its efficiency and effectiveness. It's worth noting that the availability of customer support channels, response times, and language options may vary based on factors such as the trader's location and the specific service package they have chosen.

Advantages and Disadvantages of Moneta Markets Customer Support

When considering the customer support provided by Moneta Markets, it's important to assess both the advantages and disadvantages to gain a comprehensive understanding. Here are some potential advantages and disadvantages of Moneta Markets' customer support:

Security for Investors

Moneta Markets provides negative balance protection for client trading accounts, ensuring that clients do not incur losses beyond their deposited funds. However, it's important to note that the broker operates under mid-tier regulation, which may offer limited investor protection compared to stricter regulatory authorities.

Moneta Markets does not hold a banking license and is not listed on a stock exchange. As a result, investors should carefully consider the level of security and regulatory oversight provided by Moneta Markets before making investment decisions.

Understanding the limitations and implications of the broker's regulatory status is crucial in assessing the overall security measures and investor protections offered by Moneta Markets.

Withdrawal Options and Fees

Moneta Markets provides a wide range of deposit and withdrawal options for its clients. The broker offers flexibility in choosing the most convenient method for funding and withdrawing funds from trading accounts.

Withdrawal Options: Moneta Markets provides various convenient withdrawal options for traders to access their funds. These options typically include bank transfers, credit/debit cards, and popular e-wallets, ensuring flexibility and ease of transactions.

Fees: Moneta Markets adopts a customer-friendly fee structure. The broker offers low-cost ECN trading with a fee of just $1 per lot per side, providing cost-effective trading for clients.

Additionally, for UK and European Share CFDs, the broker charges low commissions starting from just 0.1% of the nominal value. It's important to note that all other tradable products offered by the broker are commission-free, allowing traders to focus on their trading strategies without additional charges.

Deposit Fees: Moneta Markets does not charge any fees for depositing funds into the trading account. This means that traders can transfer money to their accounts without incurring any additional charges, contributing to a seamless funding process.

Withdrawal Fees: Moneta Markets typically refunds one withdrawal fee per month, ensuring that traders can withdraw their funds without incurring excessive charges. This approach is designed to accommodate the majority of traders' needs.

Inactivity Fees: Moneta Markets does not impose inactivity fees, distinguishing itself as a broker that does not penalize traders for a lack of trading activity. This aligns with the broker's commitment to providing a customer-centric approach and competitive pricing.

Moneta Markets Vs Other Brokers

When comparing Moneta Markets to other brokers, it's essential to consider various factors that can impact the trading experience. Here, we'll explore the comparisons between Moneta Markets and AvaTrade, RoboForex, and Alpari to help you make an informed decision.

#1. Moneta Markets Vs AvaTrade

Moneta Markets stands out with its competitive trading costs, including low spreads and commissions. It provides a wide range of tradable instruments, including forex, commodities, indices, share CFDs, cryptocurrencies, ETFs, and bonds.

Traders can access popular platforms like MT4, MT5, and the web-based PRO Trader platform. The broker also offers negative balance protection and responsive customer support.

On the other hand, AvaTrade is a well-established broker with a strong reputation. It provides a diverse range of instruments for trading, such as forex, commodities, stocks, indices, and cryptocurrencies.

AvaTrade offers multiple trading platforms, including MT4, MT5, and their proprietary AvaTradeGO platform. It excels in educational resources and tools for traders. The broker also has strong regulatory oversight and investor protection.

Ultimately, the choice between Moneta Markets and AvaTrade depends on individual preferences. Opt for Moneta Markets for low trading costs, a wide range of instruments, and responsive customer support.

Choose AvaTrade for its reputation, regulatory oversight, educational resources, and user-friendly platforms. Traders should carefully evaluate their needs and consider the pros and cons of each broker before making a decision.

#2. Moneta Markets vs. RoboForex

Moneta Markets stands out with its competitive trading costs, wide range of tradable instruments including forex, commodities, indices, share CFDs, cryptocurrencies, ETFs, and bonds, and access to popular platforms like MT4, MT5, and PRO Trader. It also provides negative balance protection and responsive customer support.

On the other hand, RoboForex offers multiple account types to cater to different trading preferences, a wide range of tradable instruments including forex, commodities, indices, stocks, and cryptocurrencies, and access to popular platforms like MT4, MT5, and cTrader. The broker provides competitive trading conditions and strong regulatory oversight.

However, it may have limitations in terms of educational resources and customer support response times. Ultimately, the choice between Moneta Markets and RoboForex depends on individual trading priorities. Opt for Moneta Markets for low trading costs, a diverse range of instruments, and responsive customer support.

Choose RoboForex for multiple account types, competitive trading conditions, and strong regulatory oversight. Traders should carefully evaluate their needs and consider the pros and cons of each broker before making a decision.

#3. Moneta Markets vs. Alpari

Moneta Markets stands out with its competitive trading costs, offering low spreads and commissions. It provides a wide range of tradable instruments, including forex, commodities, indices, share CFDs, cryptocurrencies, ETFs, and bonds.

Traders can access popular platforms like MT4, MT5, and the web-based PRO Trader platform. The broker also offers negative balance protection and responsive customer support.

On the other hand, Alpari is a well-established broker known for its strong reputation in the industry. It offers a wide range of tradable instruments, including forex, commodities, indices, stocks, and cryptocurrencies.

Alpari provides access to popular platforms like MT4, MT5, and Alpari Invest. The broker offers multiple account types to cater to different trading preferences. Additionally, it maintains strong regulatory oversight and investor protection.

However, traders should consider that Alpari may have higher trading costs compared to some competitors and limited educational resources. Customer support response times may also vary.

Ultimately, the choice between Moneta Markets and Alpari depends on individual trading priorities. Opt for Moneta Markets for low trading costs, a diverse range of instruments, and responsive customer support.

Choose Alpari for its reputation, regulatory oversight, multiple account types, and access to popular platforms. Traders should evaluate their needs and weigh the pros and cons of each broker before making a decision.

Conclusion: Moneta Markets Review

Moneta Markets stands out as a leading forex and CFD broker, offering traders a comprehensive range of over 1000+ financial instruments, including forex, commodities, indices, share CFDs, cryptocurrencies, ETFs, and bonds.

With razor-sharp ECN spreads from 0.0 pips and partnerships with Tier 1 liquidity providers, traders can benefit from competitive pricing and optimal trade execution. The broker holds licenses and authorizations from reputable regulatory bodies, including SVGFSA, FSCA, and FSA, ensuring a regulated and secure trading environment for clients.

Moneta Markets offers a variety of trading platforms to cater to its clients' needs. Traders can choose from popular platforms such as MT4 and MT5, known for their comprehensive features and advanced charting tools. Additionally, the web-based PRO Trader platform, developed by TradingView, provides a user-friendly interface and access to a wide range of trading instruments.

With these platforms, Moneta Markets clients can engage in live trading, take advantage of market opportunities, and manage your investments effectively. The availability of these platforms ensures a safe and convenient trading experience, while also aligning with the market buzz surrounding Moneta Markets as a reliable broker.

The broker does not charge any deposit or withdrawal fees and accepts various payment methods, including credit/debit cards, wire transfers, FasaPay, and cryptocurrencies (BTC, USDT, and more). It also accommodates a wide range of local and regional deposit options, catering to the diverse needs of its clients.

In summary, Moneta Markets stands as a client-centric broker with a strong focus on delivering value to its clients. With its extensive product range, advanced technology infrastructure, competitive pricing, regulatory compliance, and customer support, Moneta Markets strives to provide traders with a comprehensive and rewarding trading experience.

Moneta Markets Review FAQs

What markets can I trade with Moneta Markets?

With Moneta Markets, you can trade a wide range of markets, including forex, commodities, indices, share CFDs, cryptocurrencies, ETFs, and bonds.

What trading platforms does Moneta Markets offer?

Moneta Markets offers popular trading platforms such as MT4 (MetaTrader 4), MT5 (MetaTrader 5), and the web-based PRO Trader platform developed by TradingView.

Does Moneta Markets charge deposit or withdrawal fees?

No, Moneta Markets does not charge any deposit or withdrawal fees, providing a cost-effective trading experience for its clients.