Position in Rating | Overall Rating | Trading Terminals |

193rd  | 2.7 Overall Rating |  |

ModMount Review

Choosing the right Forex broker is crucial for success in the trading world. The broker you select can significantly impact your trading experience, affecting everything from the fees you pay to the tools available for your use. Ensuring you pick a broker that aligns with your trading style and needs is essential for achieving your financial goals.

Introducing ModMount, a prominent Forex and CFD broker that caters to both beginners and seasoned traders. Established in 2022 and regulated by the Financial Services Authority (FSA) in Seychelles, ModMount is committed to providing a secure and reliable trading environment. They offer a wide range of trading instruments, competitive spreads, and robust customer support to ensure a seamless trading experience.

In this detailed review, I aim to provide a comprehensive evaluation of ModMount, emphasizing its unique selling points and potential drawbacks. You’ll gain essential insights into various account options, deposit and withdrawal processes, commission structures, and other critical details. My balanced perspective, combining expert analysis and actual trader experiences, will equip you with the necessary information to make an informed decision about considering ModMount as your preferred brokerage service provider.

What is ModMount?

ModMount is a relatively new Forex and CFD broker established in 2022. The broker operates under the regulation of the Financial Services Authority (FSA) in Seychelles, ensuring a secure and trustworthy trading environment. They offer a broad range of trading instruments, including Forex, cryptocurrencies, commodities, indices, and metals, catering to various trader preferences.

One of the standout features of ModMount is their competitive leverage options, allowing traders to leverage up to 1:400. This provides ample opportunities for both beginners and experienced traders to optimize their trading strategies. Additionally, ModMount provides negative balance protection, safeguarding traders from significant losses beyond their account balance.

Benefits of Trading with ModMount

Trading with ModMount has several distinct advantages. One of the key benefits is the user-friendly trading platform, which is easy to navigate and equipped with advanced tools and real-time data. This makes it accessible for both beginners and experienced traders.

I also appreciated the competitive spreads offered by ModMount, which help in keeping trading costs low. This, combined with negative balance protection, ensures that traders can manage risks effectively and not lose more than their account balance.

Another significant benefit is the range of account types, allowing traders to choose one that best suits their needs and trading style. Additionally, ModMount’s multilingual customer support ensures that help is always available, enhancing the overall trading experience.

ModMount also provides multiple funding options, including bank transfers, credit/debit cards, and e-wallets like MiFinity, Google Pay, and Apple Pay. This flexibility makes it convenient for traders to deposit and withdraw funds according to their preferences.

Lastly, the broker’s commitment to regulatory compliance under the Financial Services Authority (FSA) in Seychelles provides a level of security and trustworthiness. This regulatory oversight reassures traders that their funds are managed in a safe and transparent manner.

ModMount Regulation and Safety

ModMount operates under the regulation of the Financial Services Authority (FSA) in Seychelles. This regulatory oversight is crucial because it ensures that the broker adheres to strict financial standards and provides a secure trading environment. Trading with a regulated broker like ModMount minimizes the risk of fraud and malpractice, offering traders peace of mind.

One of the key safety features of ModMount is the segregation of client funds. This means that traders’ deposits are kept in separate accounts from the company’s operational funds, providing an extra layer of financial protection. Additionally, ModMount offers negative balance protection, which prevents traders from losing more than their account balance, a significant safeguard in volatile market conditions.

ModMount Pros and Cons

Pros

- High leverage options

- Competitive spreads

- Negative balance protection

- User-friendly platform

- Extensive educational resources

- Regulated by FSA

Cons

- Inactivity fees

- Monthly maintenance fees

- Limited regulatory coverage

- Higher minimum spreads

ModMount Customer Reviews

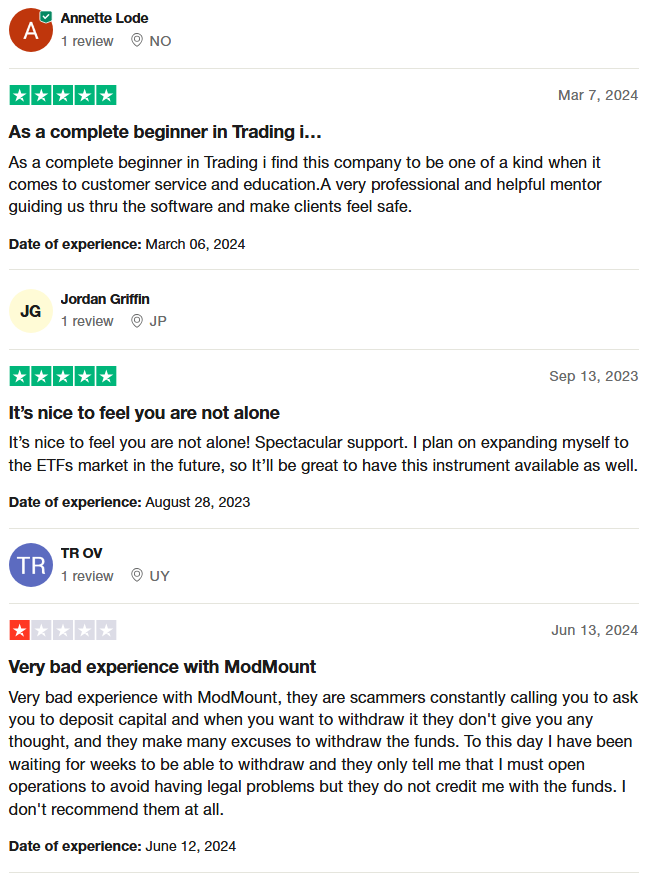

Customer reviews of ModMount show a mixed bag of experiences. Many beginners appreciate the excellent customer service and comprehensive educational resources provided by the broker, which help them feel secure and supported. However, some customers have reported issues with withdrawing funds and claim the broker employs pressure tactics to encourage additional deposits, describing these practices as scam-like. The lack of ETF trading options also disappoints traders looking to diversify their portfolios further.

ModMount Spreads, Fees, and Commissions

When it comes to spreads, fees, and commissions, ModMount offers a structure that’s generally favorable for traders. They provide commission-free trading on Forex, which is a significant advantage, especially for frequent traders. The spreads are competitive, starting from 0.9 pips for premium accounts. This can help keep trading costs low and improve overall profitability.

However, it’s important to be aware of some additional fees that ModMount imposes. They charge inactivity fees if your account is dormant, which can add up if you’re not actively trading. There’s also a monthly maintenance fee, which applies regardless of your trading activity. These fees are something to consider when evaluating the overall cost of trading with ModMount.

Deposit and withdrawal fees can also impact your trading costs. For instance, there’s a withdrawal fee for bank transfers that you need to account for. While ModMount does offer multiple funding methods, it’s crucial to review these charges to manage your expenses effectively. Understanding these aspects helps you make an informed decision and plan your trading activities accordingly.

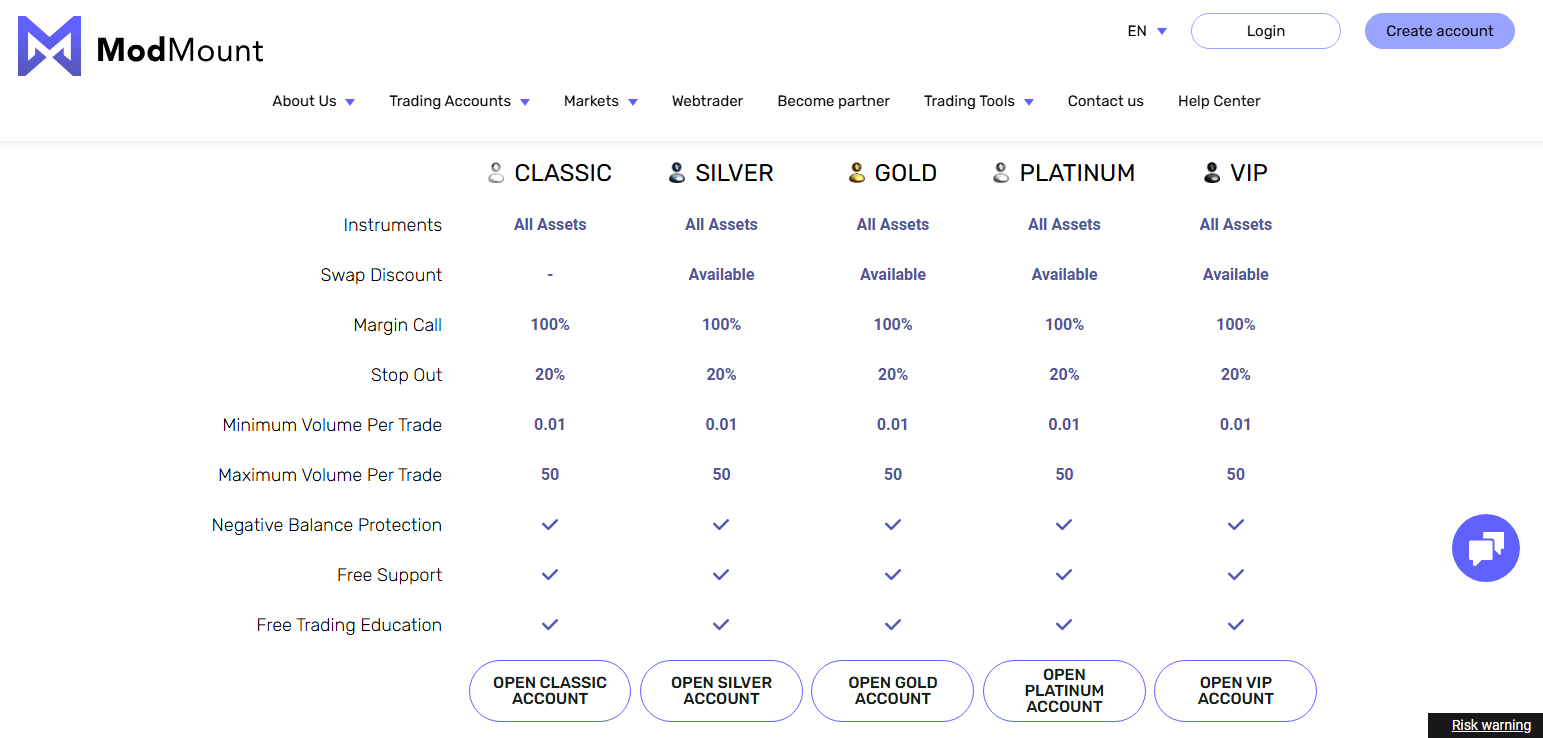

Account Types

Classic Account

- Perfect for new traders

- Offers vital tools and standard customer support

- Spreads starting at 2.5 pips

- Allows trading in various currencies

- Provides average execution speed

Silver Account

- Ideal for traders with some experience

- Includes more tools and information

- Spreads starting at 2.5 pips

- Designed for expanding trading capabilities

- Offers fast execution times and multilingual support

Gold Account

- Tailored for more experienced traders

- Features lower spreads starting at 1.8 pips

- Provides extensive tools for advanced trading techniques

- Faster execution speeds compared to Classic and Silver accounts

- Comprehensive support in multiple languages

Platinum Account

- Targeted at advanced traders

- Offers ultra-low spreads starting at 1.4 pips

- Includes premium features like top-tier analytical tools

- Priority customer service

- Fastest execution rates among all account types

VIP Account

- Designed for high-net-worth individuals and experienced traders

- Competitive spreads starting at 0.9 pips

- Provides a personalized trading experience with dedicated account managers

- Special market information

- Rapid execution speeds

- Support available in various languages

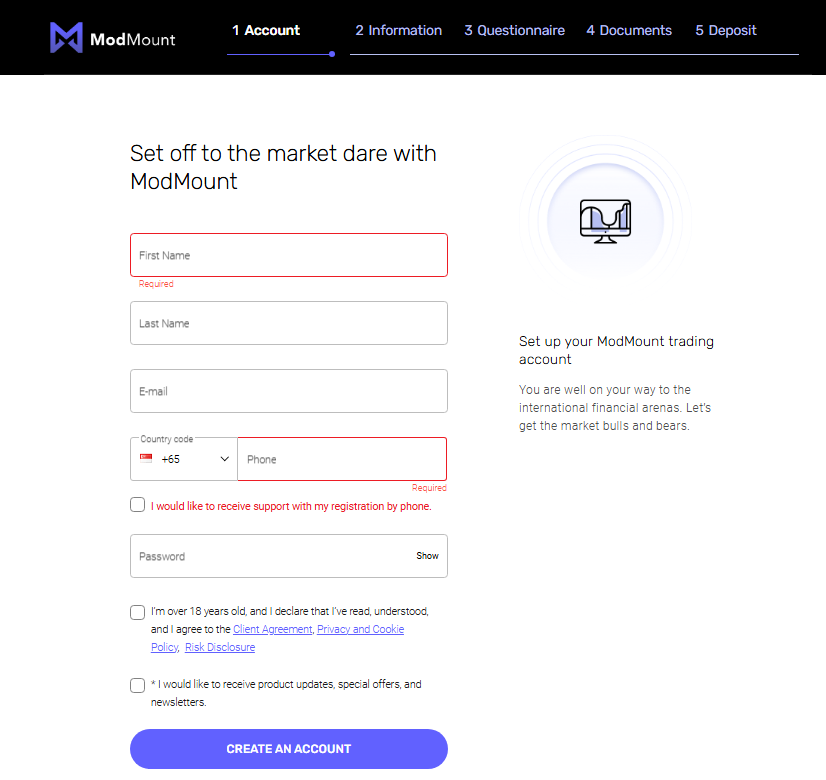

How to Open Your Account

- Start by navigating to the ModMount website and find the registration page.

- Provide your name, e-mail address, phone number, and desired password in the online application form.

- Click on the “Create an Account” button to complete the initial registration process.

- Verify your account by uploading a copy of a government-issued ID and a proof of residency document, such as a utility bill.

- Comply with global AML/KYC requirements, which may include providing additional information if requested by ModMount.

- Verify your payment method to ensure smooth transactions for deposits and withdrawals.

- Fill in personal data, including your tax ID number, trading experience, income, and planned deposit size.

- Make an initial deposit of at least $250 using various accepted methods like bank wires, credit/debit cards, MiFinity, Google Pay, or Apple Pay.

ModMount Trading Platforms

When I started trading with ModMount, I found their trading platforms to be both user-friendly and versatile. They offer a proprietary WebTrader app that is intuitive and easy to navigate. This platform supports a variety of trading instruments, making it suitable for both beginners and experienced traders.

The WebTrader platform includes advanced charting tools and technical indicators that help in making informed trading decisions. I appreciated the real-time market data and efficient order execution, which are crucial for active trading. The platform’s layout is clean and customizable, allowing traders to set it up according to their preferences.

One of the standout features of ModMount’s trading platform is its accessibility across multiple devices. Whether I was trading on my desktop or mobile, the experience remained seamless. This flexibility ensures that I can trade on the go without compromising on functionality or performance.

What Can You Trade on ModMount

When I started trading with ModMount, I was impressed by the wide range of trading instruments available. They offer over 45 currency pairs, including major, minor, and exotic pairs, which is ideal for forex traders looking to diversify their portfolios. The variety allows for flexibility and numerous trading opportunities in the global currency markets.

ModMount also provides access to more than 20 different commodities, including popular ones like gold, silver, and crude oil. Trading these commodities allows me to take advantage of price movements in various sectors, offering a hedge against inflation and currency fluctuations. The inclusion of such commodities adds depth to my trading strategy.

Additionally, the platform includes a selection of over 12 major world indices, such as the Dow Jones, NASDAQ, and S&P 500. This is particularly useful for those interested in trading the broader market trends. Indices provide a way to speculate on the performance of global stock markets without having to invest in individual stocks.

For those interested in equities, ModMount offers CFDs on over 60 major stocks, including big names like Apple and Microsoft. This allows for speculation on stock price movements without the need to own the underlying asset. It’s a convenient way to trade high-value stocks with lower capital requirements.

Moreover, ModMount supports cryptocurrency trading, featuring over 10 cryptocurrency futures, including Bitcoin and Ethereum. The platform’s support for digital currencies is beneficial for traders looking to enter the rapidly growing crypto market. It provides an opportunity to profit from the volatility and growth of cryptocurrencies.

ModMount Customer Support

When dealing with ModMount, I found their customer support to be exceptionally responsive and helpful. Their support team is available 24/5, ensuring assistance is just a call or message away whenever the markets are open. You can reach them through live chat, email, or phone, making it convenient to get help in the way that suits you best.

What stands out is their multilingual support, which caters to traders from various regions, ensuring language is never a barrier. Additionally, they provide a dedicated section on their website where you can submit inquiries or report issues, receiving prompt and professional responses. This comprehensive support system makes trading with ModMount a seamless experience.

Advantages and Disadvantages of ModMount Customer Support

Withdrawal Options and Fees

Withdrawing funds from ModMount is straightforward, offering multiple options to suit different preferences. I found that bank wire transfers, credit and debit cards, and various e-wallets like MiFinity, Google Pay, and Apple Pay are all supported. This variety ensures that you can choose the method most convenient for you.

However, it’s essential to be aware of the fees associated with withdrawals. For instance, there is a withdrawal fee for bank transfers and potential third-party processing costs. Additionally, currency conversion fees may apply, which is something to consider when planning your withdrawals. Being mindful of these fees can help manage your trading costs effectively.

ModMount Vs Other Brokers

#1. ModMount vs AvaTrade

ModMount, founded in 2022, is a newer entrant in the Forex and CFD market, offering a variety of trading instruments and competitive spreads. AvaTrade, established in 2006, has a long-standing reputation with over 300,000 registered customers from more than 150 countries, providing access to over 1,250 financial instruments. AvaTrade is heavily regulated and operates from multiple global locations, offering a robust and secure trading environment. Both brokers offer comprehensive customer support, but AvaTrade’s extensive experience and regulatory framework give it a more established presence.

Verdict: AvaTrade is better for traders seeking a well-regulated and established broker with a broad range of instruments and global presence. ModMount, while promising, lacks AvaTrade’s extensive regulatory oversight and experience.

#2. ModMount vs RoboForex

ModMount offers a range of account types and competitive spreads but is relatively new to the market. RoboForex, established in 2009, provides an extensive selection of over 12,000 trading options across eight asset classes. RoboForex stands out with its advanced trading platforms, including MetaTrader, cTrader, and RTrader, and unique features like ContestFX. Both brokers cater to traders of all levels, but RoboForex’s long-standing experience and technological advancements make it a more robust choice.

Verdict: RoboForex is better due to its diverse trading options, advanced platforms, and unique features like trading contests. ModMount is suitable for those looking for a straightforward, newer broker with competitive spreads.

#3. ModMount vs Exness

ModMount offers competitive spreads and a variety of trading instruments, focusing on user-friendly platforms and customer support. Exness, operating since 2008, provides over 120 currency pairs, including cryptocurrencies, with features like infinite leverage on small deposits and immediate fund withdrawals. Exness’s extensive experience, high trading volume, and beneficial working conditions make it a strong contender. Both brokers offer demo accounts for practice, but Exness’s broader range of services and stable brokerage environment give it an edge.

Verdict: Exness is better for traders seeking extensive trading options, flexible leverage, and a well-established trading environment. ModMount is a good option for those preferring a newer broker with competitive spreads and user-friendly platforms.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: ModMount Review

ModMount is a promising new broker offering competitive spreads, a variety of account types, and strong customer support. Its user-friendly platform and multilingual support make it accessible to traders worldwide. However, being a newer entrant, it lacks the extensive regulatory oversight and long-standing reputation of more established brokers.

While ModMount provides a solid trading experience with features like negative balance protection and various funding options, potential users should be aware of its inactivity and withdrawal fees. For those seeking a newer broker with competitive terms, ModMount is a viable option, but caution is advised due to its shorter track record.

Also Read: Trive Review 2024 – Expert Trader Insights

ModMount Review: FAQs

What account types does ModMount offer?

ModMount provides several account types including Classic, Silver, Gold, Platinum, and VIP, each with different features and spreads to cater to various trading needs.

Are there any fees associated with withdrawals at ModMount?

Yes, ModMount charges a withdrawal fee for bank transfers and there may be additional third-party processing and currency conversion fees.

Is ModMount regulated?

Yes, ModMount is regulated by the Financial Services Authority (FSA) in Seychelles, ensuring compliance with financial standards and offering a secure trading environment.

OPEN AN ACCOUNT NOW WITH MODMOUNT AND GET YOUR BONUS