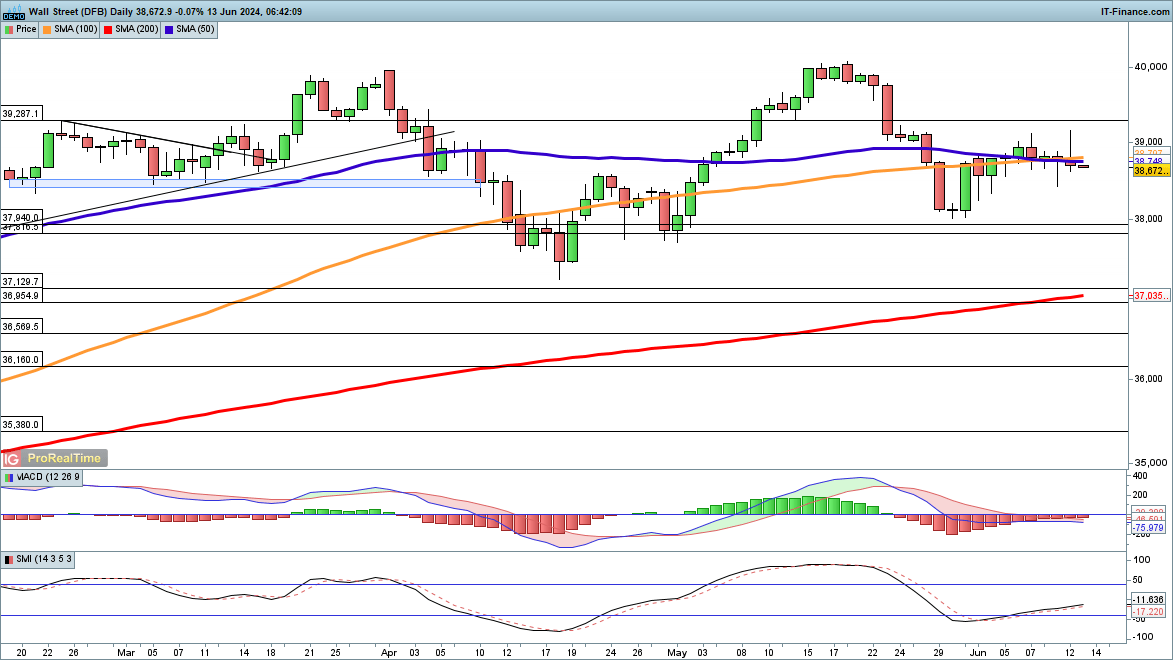

Dow’s Post-CPI Decline

The Dow Jones Industrial Average has experienced a decline following the Federal Reserve’s latest meeting, failing to maintain the post-CPI gains.

With expectations for rate cuts in 2024 reduced to one from two, investor sentiment has soured, prompting a potential retracement to levels of 38,000 or even the April lows around 37,500. A recovery above 39,000 is necessary to reignite hopes for an upward trend.

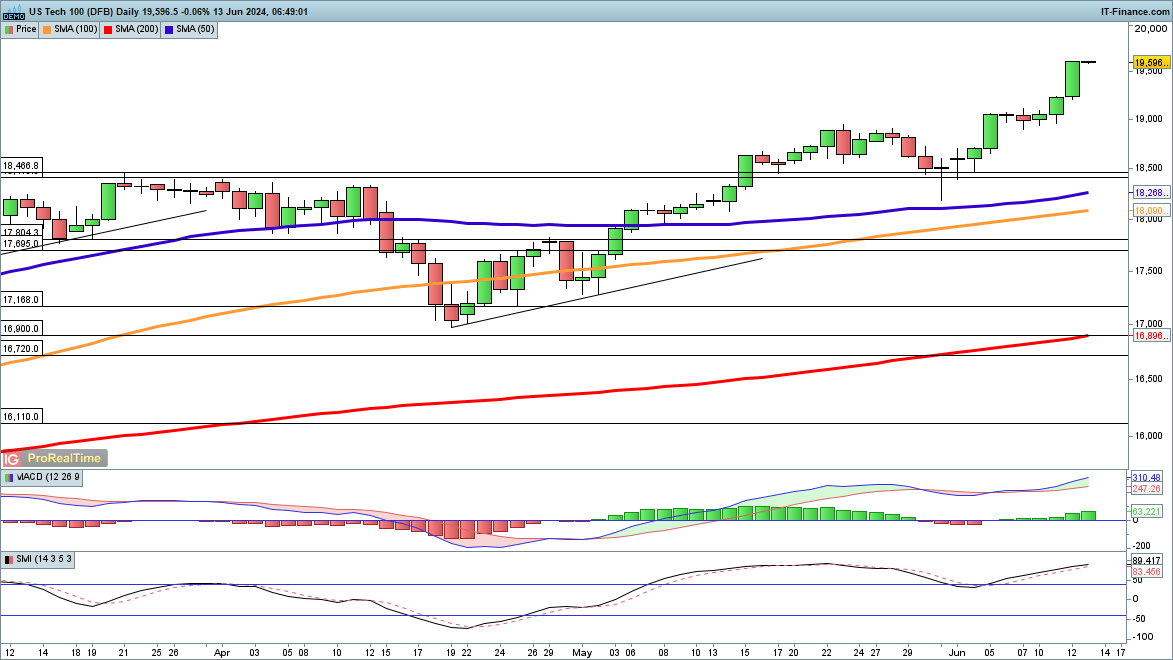

Nasdaq 100 Reaches New Heights

Contrasting with the Dow, the Nasdaq 100 has soared to unprecedented levels, surpassing 19,500 for the first time, driven by a strong rally in tech stocks starting in late May.

The index has consistently set new records, with 20,000 now appearing as a significant threshold. However, a fall below 19,000 could signal that the current rally might be tapering off.

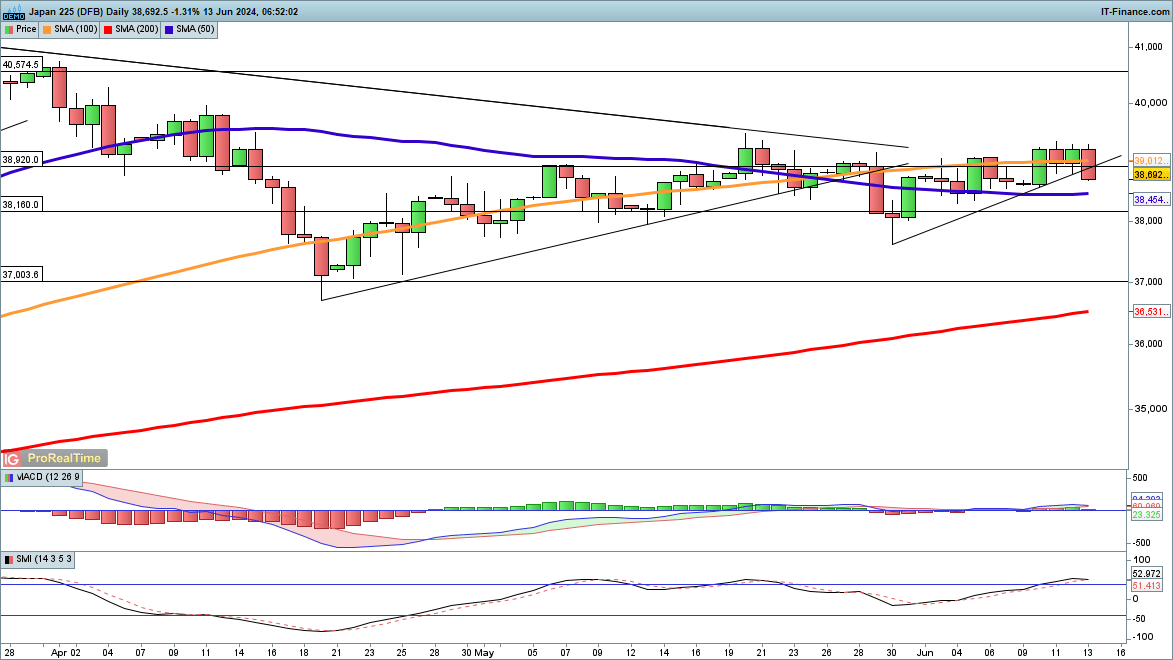

Nikkei 225 Faces Headwinds

The Nikkei 225’s recent gains have halted, affected by uncertainties regarding the Bank of Japan’s policy direction. This week’s advance halted near 39,340, aligning with resistance levels seen in mid-May.

A breach below the trendline from late May’s lows suggests potential declines toward May’s low of 37,500. A sustained move above 39,000 would be necessary to indicate the start of a new rally phase.