Position in Rating | Overall Rating | Trading Terminals |

197th  | 2.7 Overall Rating |  |

Milton Prime Review

Choosing the right Forex broker is crucial for success in trading Forex in the financial markets. Reliable FX brokers ensure that your trades are executed smoothly, provides competitive spreads, and offers robust customer support. With countless brokers available, it’s important to select one that aligns with your trading goals and offers transparent operations.

One broker that has garnered attention is Milton Prime. Founded in 2015, Milton Prime provides a range of trading services on popular platforms like MetaTrader 4 and 5. It offers high leverage up to 1:500 and supports trading in various instruments including forex, CFDs, cryptocurrencies, and commodities.

In this comprehensive review, I will delve into the unique aspects and potential drawbacks of Milton Prime. You will gain insights into account options, deposit and withdrawal processes, commission structures, and more. By combining expert analysis with real trader experiences, I aim to equip you with the knowledge needed to decide if Milton Prime is the right brokerage for you.

What is Milton Prime?

Milton Prime is a Forex broker that was established in 2015 and offers a variety of trading services. They operate on the popular MetaTrader 4 and 5 platforms, providing traders with a familiar and robust trading environment. The broker supports trading in multiple instruments, including forex, CFDs, cryptocurrencies, and commodities, giving traders a wide range of options to diversify their portfolios.

One of the standout features of Milton Prime is its high leverage of up to 1:500, which can be particularly attractive for experienced traders looking to maximize their trading potential. Additionally, Milton Prime offers competitive spreads and commission-free trading, making it cost-effective for traders. The platform’s accessibility on desktop, web, and mobile devices ensures that you can manage your trades conveniently from anywhere.

Benefits of Trading with Milton Prime

Trading with Milton Prime has several notable benefits that enhance the overall trading experience. One significant advantage is the high leverage up to 1:500, which allows me to maximize my trading potential with a relatively small capital investment. This high leverage is particularly beneficial for experienced traders who can manage the associated risks effectively.

Another benefit is the competitive spreads offered by Milton Prime. Lower spreads mean lower trading costs, which can significantly improve profitability, especially for high-frequency traders. Additionally, the absence of commission fees on most accounts further reduces trading expenses, making it a cost-effective choice for active traders.

Milton Prime supports the MetaTrader 4 and 5 platforms, which are well-regarded for their robust features, including advanced charting tools and automated trading capabilities. These platforms provide a seamless trading experience, whether I’m analyzing market trends or executing trades. The availability of these platforms on desktop, web, and mobile ensures that I can manage my trades from anywhere at any time.

Milton Prime Regulation and Safety

Milton Prime operates under the regulatory oversight of two authorities, including the Financial Services Authority (FSA) and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies ensure that the broker adheres to strict financial standards and practices, providing a level of safety for traders. Knowing this is essential because it helps you trust that your funds are managed responsibly and that the broker operates transparently.

After trading with Milton Prime, I found that their commitment to regulation and compliance contributes to a safer trading environment. This means that they must maintain adequate capital reserves, segregate client funds, and regularly submit financial reports for review. This regulatory framework is designed to protect traders from potential fraud and malpractice, which is crucial for anyone looking to trade with confidence.

Moreover, Milton Prime employs various security measures to safeguard client data and transactions. They use advanced encryption technology to protect personal and financial information, ensuring that your data remains confidential and secure. Understanding these security protocols is important as it reassures you that the broker takes proactive steps to prevent unauthorized access and cyber threats.

Milton Prime Pros and Cons

Pros

- Competitive spreads

- High leverage up to 1:500

- MetaTrader 4 and 5 platforms

- Variety of trading instruments

- Strong regulatory oversight

- 24/5 customer support

Cons

- No proprietary trading platform

- Limited additional trading tools

- Reports of slow withdrawals

Milton Prime Customer Reviews

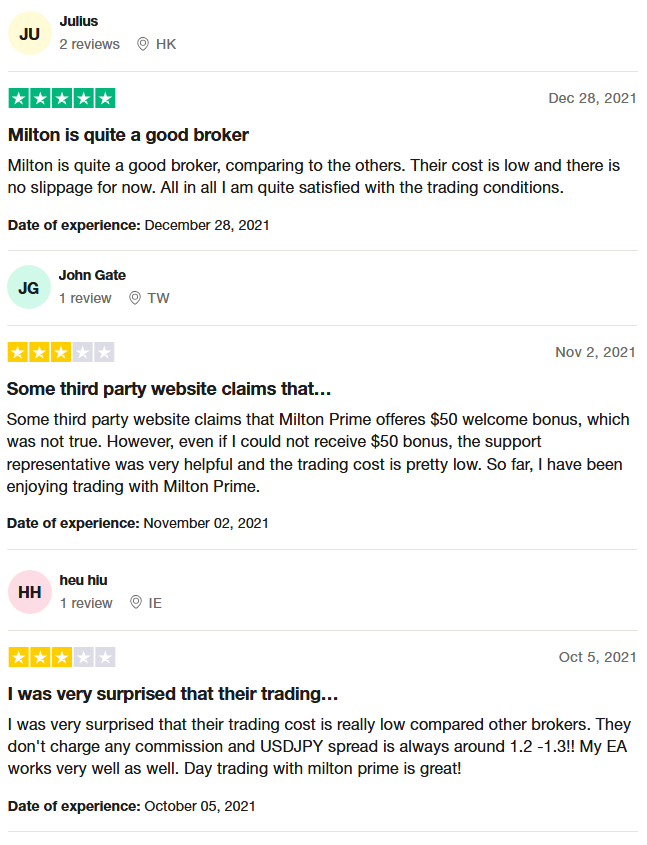

Milton Prime receives generally positive feedback from its customers. Low trading costs and minimal slippage are frequently praised, making it a competitive choice among brokers. Although some users noted discrepancies, such as the unavailability of a $50 welcome bonus, they appreciated the helpful support representatives. The absence of commissions and consistently low spreads, particularly for popular pairs like USDJPY, make Milton Prime favorable for both manual and automated trading strategies.

Milton Prime Spreads, Fees, and Commissions

Trading with Milton Prime, I found that their spreads are very competitive, especially compared to other brokers. For major currency pairs like USDJPY, the spread usually ranges from 1.2 to 1.3 pips. This low spread makes it cost-effective for both day traders and long-term investors.

Milton Prime’s fee structure is quite appealing as they do not charge any trading fees or hidden fees. This is particularly advantageous for those who trade frequently, as it can significantly reduce overall trading costs. Additionally, the broker offers tiered spreads that become tighter with higher deposit amounts, providing further cost savings for more substantial traders.

When it comes to deposit and withdrawal processes, Milton Prime offers several convenient options, including bank transfers and digital wallets. However, it’s worth noting that withdrawals via digital wallets may incur higher fees. Despite this, the overall costs remain relatively low, making Milton Prime an attractive option for traders looking for a cost-efficient brokerage.

Account Types

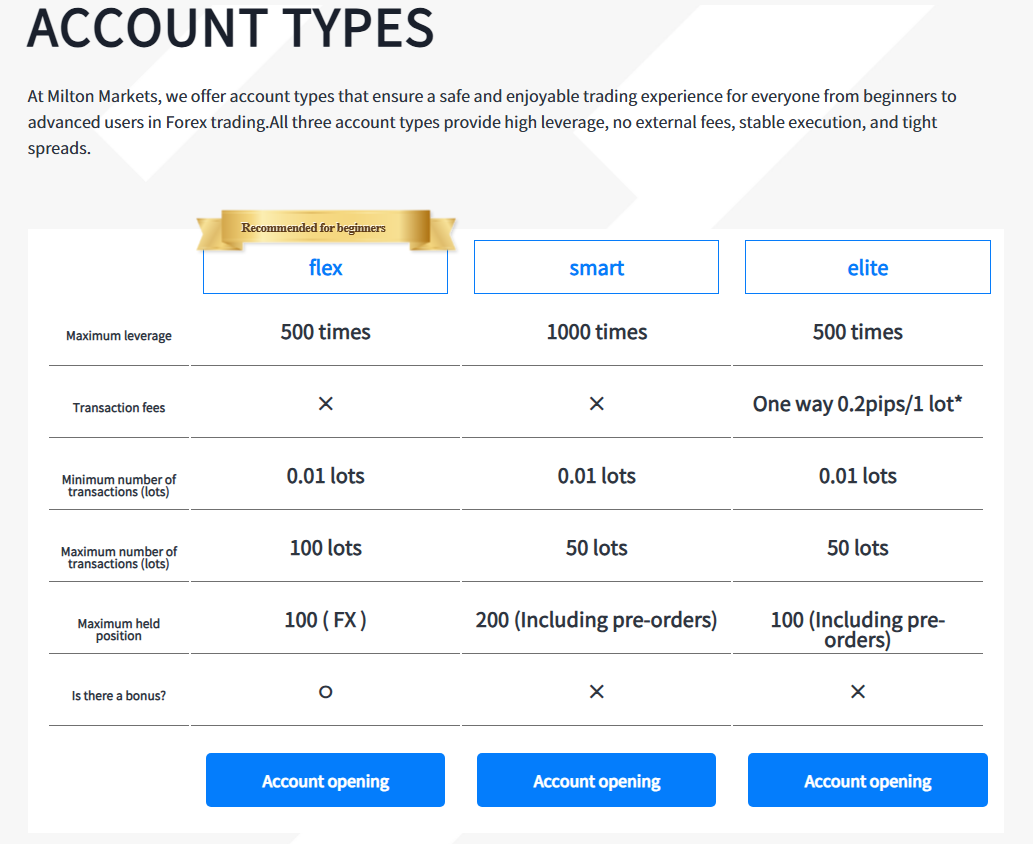

Milton Prime offers several account types tailored to different trading needs:

Flex Account

- Leverage: Up to 1:500 (variable with balance)

- Transaction Fee: None

- Spread (major currency): From 1.7 pips

- Maximum Number of Positions: 100 (FOREX)

- Minimum Deposit: $50

Smart Account

- Leverage: Up to 1:1000 (variable with balance)

- Transaction Fee: None

- Spread (major currency): From 1.0 pips

- Maximum Number of Positions: 200 (including reserved order)

- Minimum Deposit: $100

Elite Account

- Leverage: Up to 1:500 (variable with balance)

- Transaction Fee: One-way 0.2pips /1 lot

- Spread (major currency): From 0.2 pips

- Maximum Number of Positions: 100 (including reserved order)

- Minimum Deposit: $5000

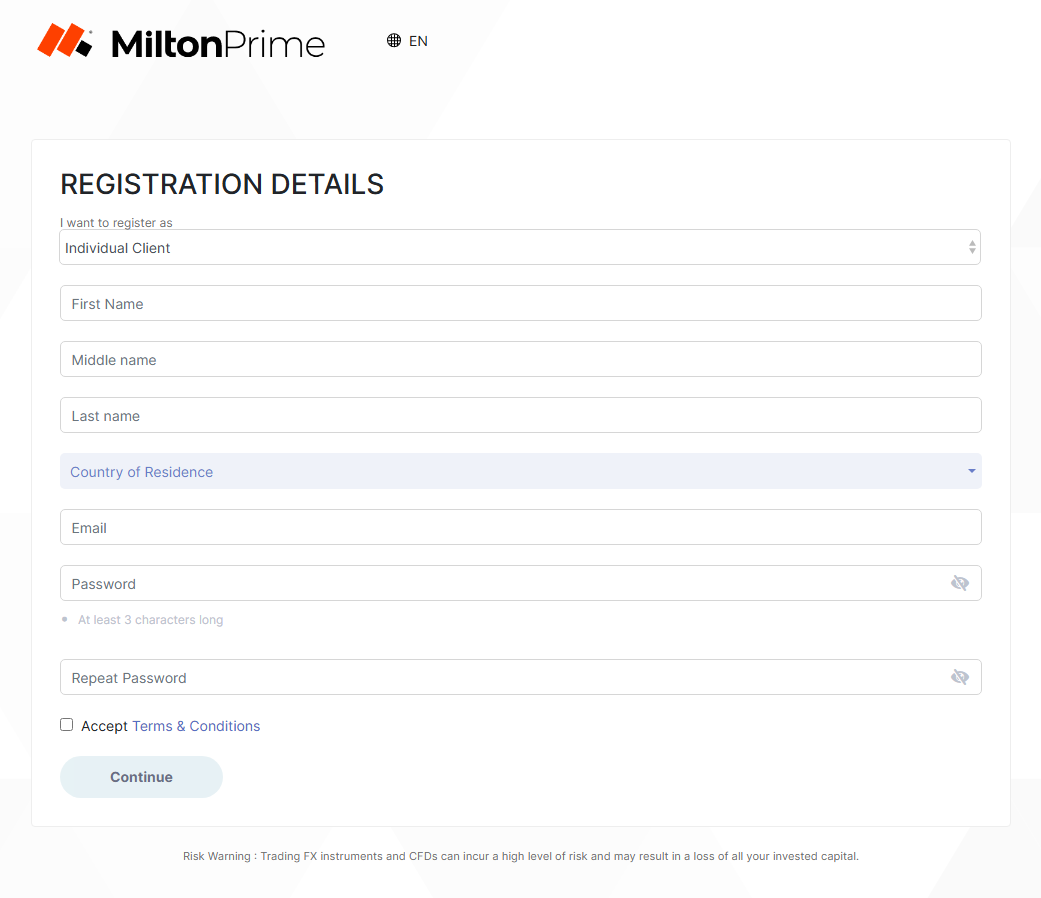

How to Open Your Account

- Visit the Milton Prime website and go to the account registration page.

- Click the “Sign Up” button to begin the registration.

- Fill in your personal details, such as name, email, and phone number.

- Select the account type that suits your trading needs.

- Complete the financial and trading experience questionnaire.

- Verify your identity by uploading necessary documents like a government-issued ID and proof of address.

- Set up a strong password for your account security.

- Fund your account using one of the accepted deposit methods to start trading.

Milton Prime Trading Platforms

Milton Prime offers a robust trading experience through its platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are well-known in the trading community for their reliability and extensive features. MT4 is particularly favored for its user-friendly interface and comprehensive charting tools, making it ideal for both beginners and experienced traders.

One of the standout features of MT4 is its support for automated trading through Expert Advisors (EAs), which allows you to automate your trading strategies. This can be a game-changer if you want to trade efficiently without constant monitoring. MT5 builds on MT4’s strengths by offering additional timeframes, more order types, and an integrated economic calendar, providing a more detailed and flexible trading experience.

Both platforms are available on desktop, web, and mobile, ensuring you can trade from anywhere at any time. The mobile versions are particularly useful for managing trades on the go, with the same functionalities as the desktop versions. I found the web-based platform to be especially convenient as it doesn’t require any installation, allowing quick access to my trading account from any device.

What Can You Trade on Milton Prime

Milton Prime offers a diverse range of trading instruments, making it a versatile choice for traders. You can trade over 50 forex currency pairs, including majors, minors, and exotic pairs. This wide selection allows you to diversify your trading portfolio and explore various market opportunities. I found this particularly beneficial as it provided numerous options for hedging and speculating.

In addition to forex, Milton Prime supports trading in CFDs on stocks, indices, and commodities. This means you can trade popular stock indices, precious metals like gold and silver, as well as energy commodities such as oil. The ability to trade such a variety of assets on one platform enhances the trading experience, allowing you to manage all your investments in a single place.

Cryptocurrency trading is also available on Milton Prime, with pairs like BTC/USD and ETH/USD. This inclusion is excellent for those looking to venture into the digital currency market. Trading cryptocurrencies alongside traditional assets offers a comprehensive trading environment, catering to both conventional and modern traders.

Milton Prime Customer Support

Milton Prime’s customer support has been a notable aspect of my trading experience with them. Available 24/5 through phone, live chat, and email, their support team is accessible and responsive. This extensive availability ensures that I can get help whenever needed, which is crucial for resolving any trading issues promptly.

The customer support is offered in multiple languages including English, Japanese, and Spanish, making it convenient for traders from different regions. I found the support representatives to be knowledgeable and helpful, providing clear and concise answers to my queries. This multilingual support enhances the overall user experience, making it easier to communicate effectively.

Advantages and Disadvantages of Milton Prime Customer Support

Withdrawal Options and Fees

Milton Prime offers multiple withdrawal options including bank transfers and digital wallets like Bitwallet. This flexibility is convenient for accessing your funds quickly and efficiently. I found that digital wallet withdrawals are processed almost instantly, while bank transfers can take up to three business days.

When it comes to fees, Milton Prime does not charge withdrawal fees for amounts above $300. This is particularly beneficial for traders looking to withdraw larger sums without incurring extra costs. However, it’s important to note that withdrawals below $300 may incur fees, which can add up if you frequently make smaller withdrawals.

Milton Prime Vs Other Brokers

#1. Milton Prime vs AvaTrade

Milton Prime and AvaTrade both offer robust trading services, but they cater to different types of traders. AvaTrade, established in 2006, boasts over 300,000 registered customers from more than 150 countries, offering more than 1,250 financial instruments. It is heavily regulated and provides extensive educational resources and support. In contrast, Milton Prime, although newer, focuses on providing high leverage up to 1:500, competitive spreads, and the popular MetaTrader 4 and 5 platforms. While AvaTrade offers a broader range of instruments and global presence, Milton Prime appeals to traders looking for high leverage and lower trading costs.

Verdict: AvaTrade is better for traders seeking a wide range of instruments and extensive educational resources, while Milton Prime is more suitable for those prioritizing high leverage and lower costs.

#2. Milton Prime vs RoboForex

RoboForex, established in 2009, offers a wide selection of trading platforms including MetaTrader, cTrader, and RTrader, and provides over 12,000 trading options across eight asset classes. It is known for its advanced technology, personalized trading terms, and contest projects like ContestFX. Milton Prime, on the other hand, focuses on providing high leverage, competitive spreads, and the MetaTrader 4 and 5 platforms. While RoboForex offers a greater variety of platforms and trading options, Milton Prime’s straightforward approach with high leverage and lower costs may be more appealing to certain traders.

Verdict: RoboForex stands out with its variety of platforms and extensive trading options, making it ideal for advanced traders, whereas Milton Prime’s high leverage and lower trading costs are better for those looking for simplicity and cost efficiency.

#3. Milton Prime vs Exness

Exness, operational since 2008, offers CFDs for stocks, energy, metals, over 120 currency pairs, and cryptocurrencies. It is known for its high trading volume, cheap commissions, immediate order execution, and infinite leverage on small deposits. Milton Prime, by comparison, offers high leverage up to 1:500, competitive spreads, and uses the MetaTrader 4 and 5 platforms. While Exness provides a wider range of instruments and innovative features like infinite leverage, Milton Prime’s focus on high leverage and competitive costs may attract traders looking for specific trading conditions.

Verdict: Exness provides more innovative features and a wider range of instruments, making it suitable for traders looking for diverse opportunities and flexibility. Milton Prime is better for traders seeking high leverage and competitive trading costs.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH MILTON PRIME

Conclusion: Milton Prime Review

Based on my experience and user feedback, Milton Prime is a solid choice for traders looking for high leverage and competitive spreads. Their support for MetaTrader 4 and 5 platforms makes it convenient for traders familiar with these tools. Additionally, the variety of trading instruments, from forex to cryptocurrencies, provides ample opportunities for diversification.

However, it’s important to be aware of some drawbacks. While Milton Prime offers various withdrawal options, some users have reported occasional delays and issues with email support responses. Also, the absence of 24/7 customer support may be a limitation for traders who require immediate assistance outside of regular hours.

Also Read: FXDD Review 2024 – Expert Trader Insights

Milton Prime Review: FAQs

What trading platforms does Milton Prime offer?

Milton Prime offers the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, which are popular for their advanced charting tools and automated trading capabilities.

What is the minimum deposit required to open an account with Milton Prime?

The minimum deposit required to open an account with Milton Prime is $50 for the Flex Account, $100 for the Smart Account, and $5000 for the Elite Account.

Are there any withdrawal fees with Milton Prime?

Milton Prime does not charge withdrawal fees for amounts above $300. However, withdrawals below this amount may incur fees.

OPEN AN ACCOUNT NOW WITH MILTON PRIME AND GET YOUR BONUS