MEXEM Review

MEXEM is a forex broker that offers a broad range of trading services designed to support both novice and seasoned traders. The platform provides access to multiple global markets, allowing users to trade assets such as forex, stocks, and options. This variety makes MEXEM a flexible choice for investors seeking diverse trading opportunities.

With competitive fees and a user-friendly interface, MEXEM aims to create a seamless trading experience for its users. The platform’s straightforward tools and resources can help traders make informed decisions, making it an attractive option for those looking to manage their investments efficiently.

What is MEXEM?

MEXEM is a European-based brokerage firm that grants users access to a wide range of financial markets and instruments. As an introducing broker for a well-established platform, MEXEM allows clients to trade stocks, ETFs, options, futures, bonds, and more across numerous global markets.

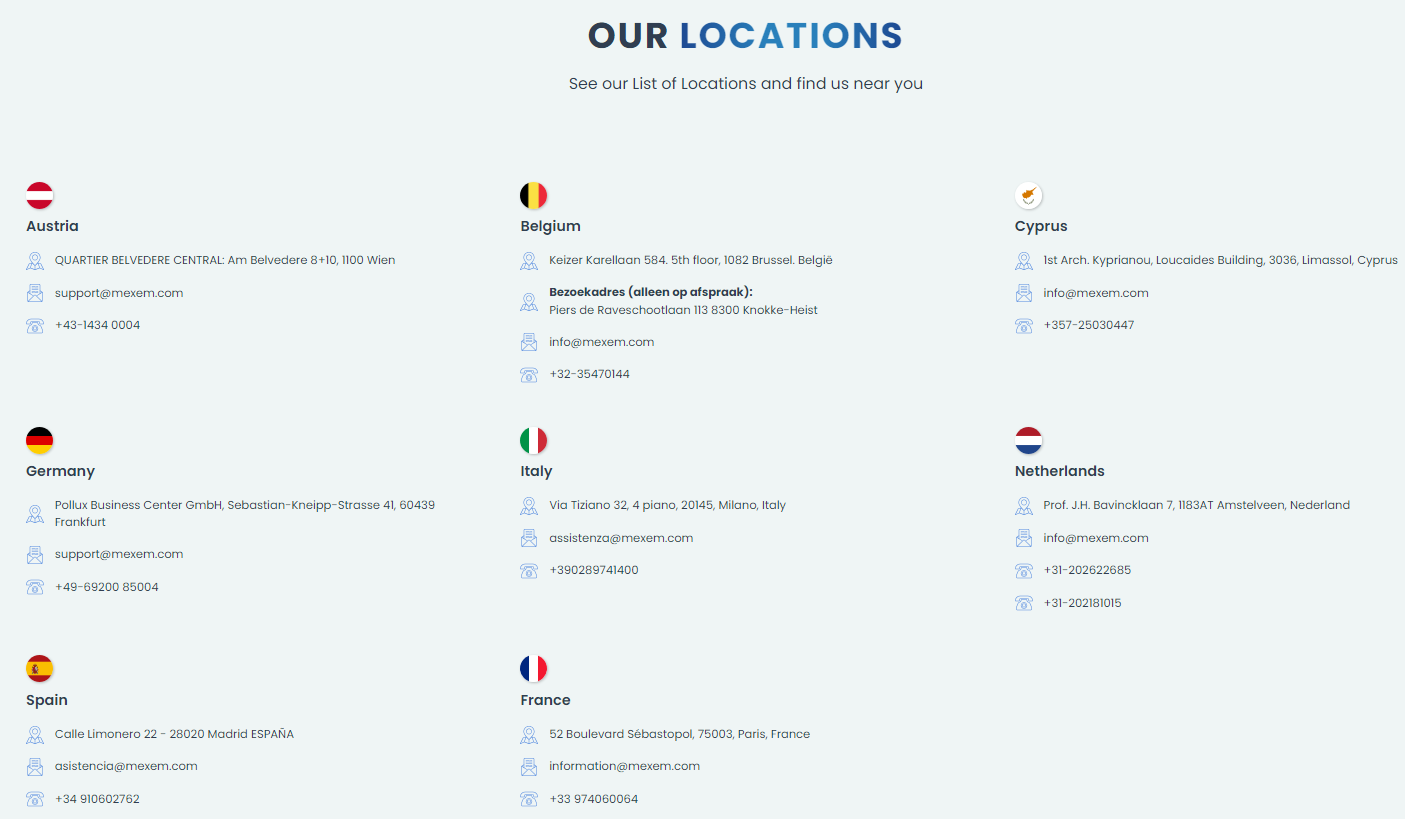

With services available in over 35 countries and multiple currencies, MEXEM caters to both beginners and seasoned investors. The platform is designed with competitive fees and advanced trading tools, supporting efficient and diversified investment strategies.

MEXEM Regulation and Safety

MEXEM is a European brokerage firm regulated broker by the Cyprus Securities and Exchange Commission (CySEC) under license number 325/17. This regulation ensures that MEXEM adheres to strict financial standards, providing clients with a secure trading environment. As an introducing broker for Interactive Brokers, MEXEM offers access to a wide range of financial instrument and markets.

Client funds are held in segregated accounts, separate from the company’s operational funds, enhancing the safety of client assets. Additionally, MEXEM is a member of the Investor Compensation Fund, which offers protection to clients up to €20,000 in the event of the firm’s insolvency. These measures underscore MEXEM‘s commitment to maintaining a secure and transparent trading platform for its users.

MEXEM Pros and Cons

Pros

- Low fees

- Diverse assets

- Advanced tools

- Global access

Cons

- Complex setup

- Limited support

- High margin

- Regional restrictions

Benefits of Trading with MEXEM

MEXEM provides access to over 150 markets across 35 countries, allowing traders to invest in a diverse range of assets, such as stocks, ETFs, options, futures, and bonds. This broad market reach supports portfolio diversification and offers opportunities in both emerging and established markets.

With competitive commission rates, MEXEM promotes cost-effective trading, such as low fees for U.S. and European stocks. The platform also offers free real-time data for EU and U.S. stocks, enhancing traders’ decision-making. Advanced trading tools, including the award-winning Trader Workstation, cater to both beginner and experienced traders, making MEXEM a versatile choice for a wide range of users.

MEXEM Customer Reviews

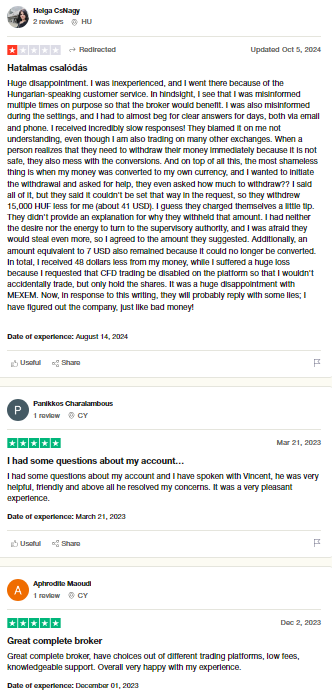

MEXEM has received mixed reviews from customers, highlighting both strengths and areas for improvement. Many users appreciate the platform’s extensive market access, competitive fees, and advanced trading tools that cater to both novice and experienced traders.

However, some clients have mentioned issues with customer support responsiveness and noted that the platform can feel complex for beginners. While MEXEM offers solid trading features, potential users should weigh these reviews to decide if it suits their trading needs.

MEXEM Spreads, Fees, and Commissions

MEXEM offers a competitive fee structure across various financial instrument. For U.S. stocks, the commission is $0.005 per share, with a minimum of $1 and a maximum of 2% of the trade value. European stock trades are charged at 0.06% of the trade value, with a minimum fee of €1.80. Options trading incurs a fee starting at $0.65 per contract, plus additional exchange, regulatory, transaction, and clearing fees. Futures contracts on U.S. markets have commissions beginning at $0.85 per contract, excluding exchange and regulatory fees.

In addition to trading commissions, MEXEM imposes other fees. For instance, the first withdrawal each month is free, while subsequent withdrawals may incur charges depending on the currency and method used. It’s important to note that MEXEM does not charge inactivity fees, making it cost-effective for traders who may not trade frequently. However, forex trading fees are relatively higher, with a commission of 0.005% and a minimum of $5 per trade, plus spread costs. Overall, MEXEM provides a transparent fee structure, allowing traders to understand the costs associated with their transactions.

Account Types

MEXEM offers a range of account types tailored to meet the diverse needs of its clients, from individual investors to large institutional entities. Each account type provides unique features to support different trading goals and investment strategies.

Individual Account

The Individual Account is designed for single investors seeking direct control over their investments. This account offers access to a broad range of assets and tools, suitable for both beginners and seasoned traders who want flexibility and independence in managing their portfolios.

Joint Account

Joint Accounts allows two individuals to share control and access over the same trading account. This type of account is ideal for partners or family members who wish to jointly manage investments while retaining all the benefits and trading capabilities available to individual accounts.

Small Business Account

The Small Business Account is intended for businesses and organizations looking to manage investments on behalf of their company. This account provides access to advanced trading features and tailored services that meet the needs of corporate investors, including enhanced reporting and administrative controls.

Friend and Family Account

The Friend and Family Account is suited for hedge funds, mutual funds, and other large financial institutions. This account type offers specialized services, including priority support, advanced research tools, and bulk trade capabilities, catering to the high-volume needs of institutional clients.

Demo account is also available in MEXEM. Transparent brokers who wants to try without giving minimum deposit and to understand risk navigator, getting a demo account is a good choice.

MEXEM offers clients access to a comprehensive Mutual Fund Marketplace, featuring over 45,000 funds from 480 different fund families worldwide. Office Account for a Family Office Manager Friends & Family Account for a group of up to 15 members Small Business Account for small companies Copyright Trading Group Account for a corporation

How to Open Your Account

Establishing a MEXEM account is a straightforward process designed to provide investors with access to a wide range of financial instruments and trading platform. By following a series of simple steps, individuals and institutions can begin their investment journey with MEXEM.

Step 1: Visit the MEXEM Website

Navigate to MEXEM’s official website to initiate the account opening process. The platform offers detailed information on various account types and services to assist prospective clients in making informed decisions.

Step 2: Select the Appropriate Account Type

MEXEM provides multiple account options, including Individual, Joint, Corporate, and Institutional accounts. Choose the account type that aligns with your investment goals and organizational structure.

Step 3: Complete the Online Application

Fill out the online application form with accurate personal or corporate information. This step involves providing identification details, financial information, and answering questions related to trading experience and objectives.

Step 4: Submit Required Documentation

Upload necessary documents to verify identity and address. For individuals, this may include a valid passport, driver’s license, bank statement and a recent utility bill. Corporate accounts may require additional documentation, such as incorporation certificates and authorized signatory lists.

Step 5: Await Account Approval

After submitting the application and documents, MEXEM’s compliance team will review the information. This process typically takes a few business days, during which the team ensures all regulatory requirements are met.

Step 6: Fund Your Account

Upon approval, fund the MEXEM account using one of the available deposit methods. MEXEM supports various funding options, including bank transfers and other electronic payment systems, to facilitate a seamless deposit process. To pay an account, get the trader’s account number and choose a payment method.

Step 7: Begin Trading

With the account funded, clients can access MEXEM’s trading platform to start investing in a diverse array of financial products. The platforms offer advanced tools and resources to support informed trading decisions.

By following these steps, clients can efficiently set up their MEXEM accounts and embark on their investment activities with confidence.

MEXEM Trading Platforms

MEXEM offers a variety of trading platform to accommodate different trader preferences and needs. The Client Portal serves as a user-friendly web-based platform, allowing traders to monitor accounts, place trades, and access real-time market data efficiently. For those seeking advanced features, the Trader Workstation (TWS) desktop platform provides comprehensive tools, including advanced charting, algorithmic trading options, and access to over 100 order types, catering to active traders who require a robust trading environment.

For trading on the go, MEXEM provides mobile applications compatible with both iOS and Android devices. These apps enable users to trade various financial instruments, monitor portfolios, and receive real-time notifications directly on their smartphones or tablets. Additionally, MEXEM supports API integration, allowing traders to develop custom trading solutions or connect third-party software, offering flexibility for those who prefer automated trading strategies. This diverse range of platforms ensures that MEXEM can meet the needs of both novice and experienced traders, providing tools that align with their trading styles and requirements.

What Can You Trade on MEXEM

MEXEM provides investors with access to a diverse array of financial instruments, enabling the creation of well-rounded and strategic portfolios. The platform supports trading across multiple asset classes, catering to both novice and experienced traders.

Stocks

Investors can trade shares of companies listed on global exchanges, gaining ownership stakes and participating in corporate growth. MEXEM offers access to a vast selection of stocks, facilitating exposure to various industries and markets.

Exchange-Traded Funds (ETFs)

ETFs allow investors to diversify their holdings by investing in a collection of assets through a single security. MEXEM provides a wide range of ETFs, covering different sectors, commodities, and indices, suitable for various investment strategies.

Options

Options trading on MEXEM enables investors to hedge positions or speculate on market movements with defined risk. The platform offers advanced tools for options traders, supporting strategies like spreads, straddles, and strangles.

Futures

Futures contracts allow investors to speculate on the future price of assets such as commodities, indices, and currencies. MEXEM’s platform supports futures trading, providing opportunities for hedging and leveraging market positions.

Bonds

MEXEM offers access to corporate and government bonds, allowing investors to earn interest income and diversify their portfolios. The platform provides electronic access to bonds across various regions, including the USA, Europe, and Asia.

Mutual Funds

Through MEXEM, investors can access a broad selection of mutual funds, enabling investment in professionally managed portfolios. This option is suitable for those seeking diversified exposure without direct involvement in individual asset selection.

Metals

MEXEM facilitates trading in precious metals like gold and silver, providing exposure to commodities often considered safe-haven assets. Investors can trade these metals to hedge against inflation or diversify their investment portfolios.

By offering a comprehensive range of trading instruments, MEXEM empowers investors to tailor their investment strategies to align with their financial goals and risk tolerance. On the downside, forex and margin fees are comparatively high for margin accounts.

MEXEM Customer Support

MEXEM provides customer support via phone and email, aiming to assist clients within regular trading hours. However, the lack of 24/7 availability can be challenging for users in different time zones or those needing immediate assistance outside of these hours.

While some clients report positive experiences with prompt responses, others have noted delays or found the support inconsistent. This suggests MEXEM has room to improve its customer service to ensure a reliable experience for all users.

Advantages and Disadvantages of MEXEM Customer Support

Withdrawal Options and Fees

MEXEM offers multiple withdrawal options to suit different client needs, with varying fees and conditions depending on the method selected. Clients are encouraged to review the specifics of each option to ensure they choose the most convenient and cost-effective method for their withdrawals.

Bank Transfer (Wire)

Bank or wire method are available for all clients to transfer funds. The first withdrawal each month is free, while any additional withdrawals incur a fee of €8 for EUR transfers. This option is suitable for those who prefer standard bank withdrawals.

SEPA Transfer

Clients in the Single Euro Payments Area (SEPA) can use SEPA transfers for EUR withdrawals. Like wire transfers, the first SEPA withdrawal each month is free, with a €1 fee applied to subsequent monthly withdrawals. This option is ideal for clients within the SEPA region who need quick and low-cost transfers.

Monthly Free Withdrawal

MEXEM provides clients with one free withdrawal per calendar month, regardless of the method chosen. Any additional withdrawals within the same month are subject to the respective fees of each method. This benefit is especially helpful for clients planning limited withdrawals.

Currency Conversion Fees

If funds are withdrawn in a currency different from the account’s base currency, a currency conversion fee may apply. Clients should review MEXEM’s currency conversion rates before initiating such withdrawals to understand the potential costs involved.

By offering a variety of withdrawal options, MEXEM aims to provide flexibility while keeping costs manageable. MEXEM Ltd Central Bank of Ireland €20,000 MEXEM offers negative balance protection for forex spot and CFD trading exclusively to retail clients within the European Union.

MEXEM Vs Other Brokers

#1. MEXEM vs AvaTrade

MEXEM and AvaTrade provide unique trading experiences, each tailored to different types of investors. MEXEM offers a broad range of global markets and assets, including stocks, ETFs, options, and futures, appealing to experienced traders who need in-depth research tools and competitive fees. However, its advanced platform may feel complex for beginners. AvaTrade, on the other hand, specializes in forex and CFD trading with a user-friendly interface, streamlined account setup, and educational resources, making it accessible to newer traders. AvaTrade’s platform also includes popular trading tools like MetaTrader, although its range of assets is narrower than MEXEM’s.

Verdict: MEXEM suits seasoned traders aiming for diverse asset access and advanced tools, while AvaTrade is a practical choice for newcomers focused on forex and CFDs in a simpler, educational platform.

#2. MEXEM vs RoboForex

MEXEM and RoboForex cater to distinct trading preferences and expertise levels. MEXEM, operating as an introducing broker for Interactive Brokers, grants access to a vast array of global markets, including stocks, ETFs, options, and futures. Its platform is renowned for advanced research tools and low fees on stock and ETF trades, making it particularly appealing to experienced traders seeking comprehensive market access. However, MEXEM’s complex platform may present a steep learning curve for beginners. In contrast, RoboForex focuses on forex and CFD trades, delivering a user-friendly interface with easy and fast account opening, free deposit and withdrawal options, and great research tools. It supports a variety of trading platform, including MetaTrader 4 and 5, and offers educational resources, making it more accessible to novice traders. Nonetheless, RoboForex’s product range is narrower, and its fees for certain instruments may be higher compared to MEXEM.

Verdict: MEXEM is well-suited for seasoned traders seeking extensive market access and advanced tools, while RoboForex offers a more approachable platform ideal for those focusing on forex and CFD trades.

#3. MEXEM vs Exness

MEXEM and Exness cater to different trading needs and expertise levels. MEXEM, operating as an introducing broker for Interactive Brokers, provides access to a vast array of global markets, including stocks, ETFs, options, and futures. Its platform is renowned for advanced research tools and low fees on stock and ETF trades, making it particularly appealing to experienced traders seeking comprehensive market access. However, MEXEM’s complex platform may present a steep learning curve for beginners. In contrast, Exness focuses on forex and CFD trading, delivering a user-friendly interface with easy and fast account opening, free deposit and withdrawal options, and great research tools. It supports a variety of trading platforms, including MetaTrader 4 and 5, and offers educational resources, making it more accessible to novice traders. Nonetheless, Exness’s product range is narrower, and its fees for certain instruments may be higher compared to MEXEM.

Verdict: MEXEM is well-suited for seasoned traders seeking extensive market access and advanced tools, while Exness offers a more approachable platform ideal for those focusing on forex and CFD trading.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: MEXEM Review

MEXEM stands out as a brokerage offering broad market access, competitive fees, and various trading platforms tailored to different user needs. Its features make it suitable for both beginners and experienced traders seeking diversification and cost-effective trading options.

However, some users have pointed out challenges with customer support and platform complexity. Overall, MEXEM is a reliable option for those prioritizing a comprehensive trading experience, although potential users should consider their support needs and familiarity with trading tools.

MEXEM Review: FAQs

What is MEXEM?

MEXEM is a European-based brokerage firm offering access to global financial markets. It serves as an introducing broker, allowing users to trade a range of assets, including stocks, ETFs, options, and forex.

Is MEXEM regulated?

Yes, MEXEM is regulated by the Cyprus Securities and Exchange Commission (CySEC), ensuring compliance with European financial standards and providing a secure trading environment.

What fees does MEXEM charge?

MEXEM offers competitive fees, including low commissions for U.S. and European stocks. Forex incurs additional spreads and a minimum commission of $5 per trade.

OPEN AN ACCOUNT NOW WITH MEXEM AND GET YOUR BONUS