Maunto Review

Maunto is an all-in-one online trading tool that lets you trade forex, commodities, indices, stocks, and other financial instruments and more about forex trading. Maunto is made to suit both new and expert traders, thanks to its easy-to-use interface and competitive trading conditions.

The platform makes trading strategies easy for people who want to take advantage of market opportunities by offering low spreads and quick deal execution.

Maunto’s focus on advanced trading tools and training resources is one of its best features. These give traders the tools they need to improve their strategies. Overall, Maunto is a good choice for buyers who want a wide range of tradable assets and strong support.

Overall, Maunto’s secure trading environment is well-rounded, with a wide range of tools, training materials, and customer service options that appeal to both new and experienced traders.

What is Maunto?

Maunto is an online trading platform that provides access to a wide range of financial instruments, including forex, commodities, indices, and stocks. It was made so that traders of all levels can use it. Maunto has a simple interface and fair dealing conditions, which makes it a great choice for both new and experienced investors. The platform makes it easy for traders to take advantage of market opportunities by offering low spreads and quick deal execution.

Maunto is unique because it has a lot of different tradable assets and training materials that help users improve their strategies and keep up with market dynamics trends. The platform also puts a lot of emphasis on safe deals and trustworthy customer service, which makes it a good choice for traders who want a safe and efficient space to do business. Overall, Maunto gives traders all the knowledge, freedom, and tools they need to do well in today’s financial markets.

Maunto Regulation and Safety

Maunto tries to make sure that trading is safe and reliable to at least one trade, but it’s important to know that it’s not controlled by major financial authorities.

Some buyers may be worried about this, but the platform makes up for it by using advanced security measures to keep users’ personal and financial information safe, such as SSL encryption and safe data handling. Because of this, Maunto is a good choice for traders who care about keeping their info private.

To keep things safe, Maunto also uses separated client accounts to keep traders’ hard earned money separate from the company’s running money.

Some sellers still care a lot about regulations, but Maunto’s dedication to safety and openness makes the platform safe for most users.

Maunto Pros and Cons

Pros:

- Minimum deposit

- User-friendly interface

- Various assets

- Educational resources

Cons:

- Unregulated

- Limited account types

- No 24/7 support

- Region restrictions

Benefits of Trading with Maunto

Maunto’s low spreads, minimum deposit, and quick trade processing are two of the best things about trading with them. These features let traders take advantage of market opportunities with little cost. The site gives traders access to many different types of financial instruments, such as stocks, indices, forex, and commodities.

Maunto makes trading easier by giving users an easy-to-use interface that lets them make deals and keep an eye on their investments quickly.

Maunto is also unique because it has lots of training materials that are meant to help traders improve their strategies and keep up with market trends. The site also makes sure that transactions are safe and provides good customer service, making it a safe and effective place to trade.

Maunto is a good choice for traders who want flexibility, safety, and educational help in a market with a lot of competition because of these reasons.

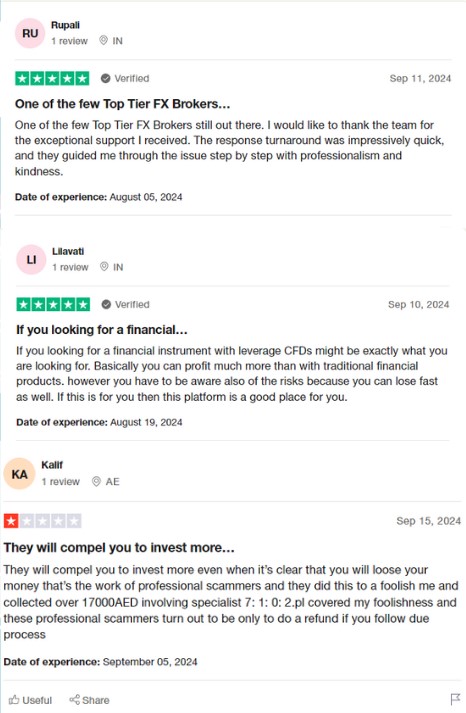

Maunto Customer Reviews

Customers have said good things about Maunto’s easy-to-use platform and wide selection of trading products. A lot of people like the site because it has low spreads and trades are executed quickly, which lets them take advantage of market changes quickly.

Maunto’s training materials have been praised by new traders in particular as helpful in improving their skills and advanced strategies.

Some users are worried, though, that the platform isn’t regulated, which could be a problem for people who like things to be regulated. Maunto still has a lot of traders because its deals are safe and its customer service is quick to respond.

Overall, customer reviews show that users are very happy with the platform’s reasonable prices and easy-to-use tools, which makes it a good choice for both new and experienced buyers.

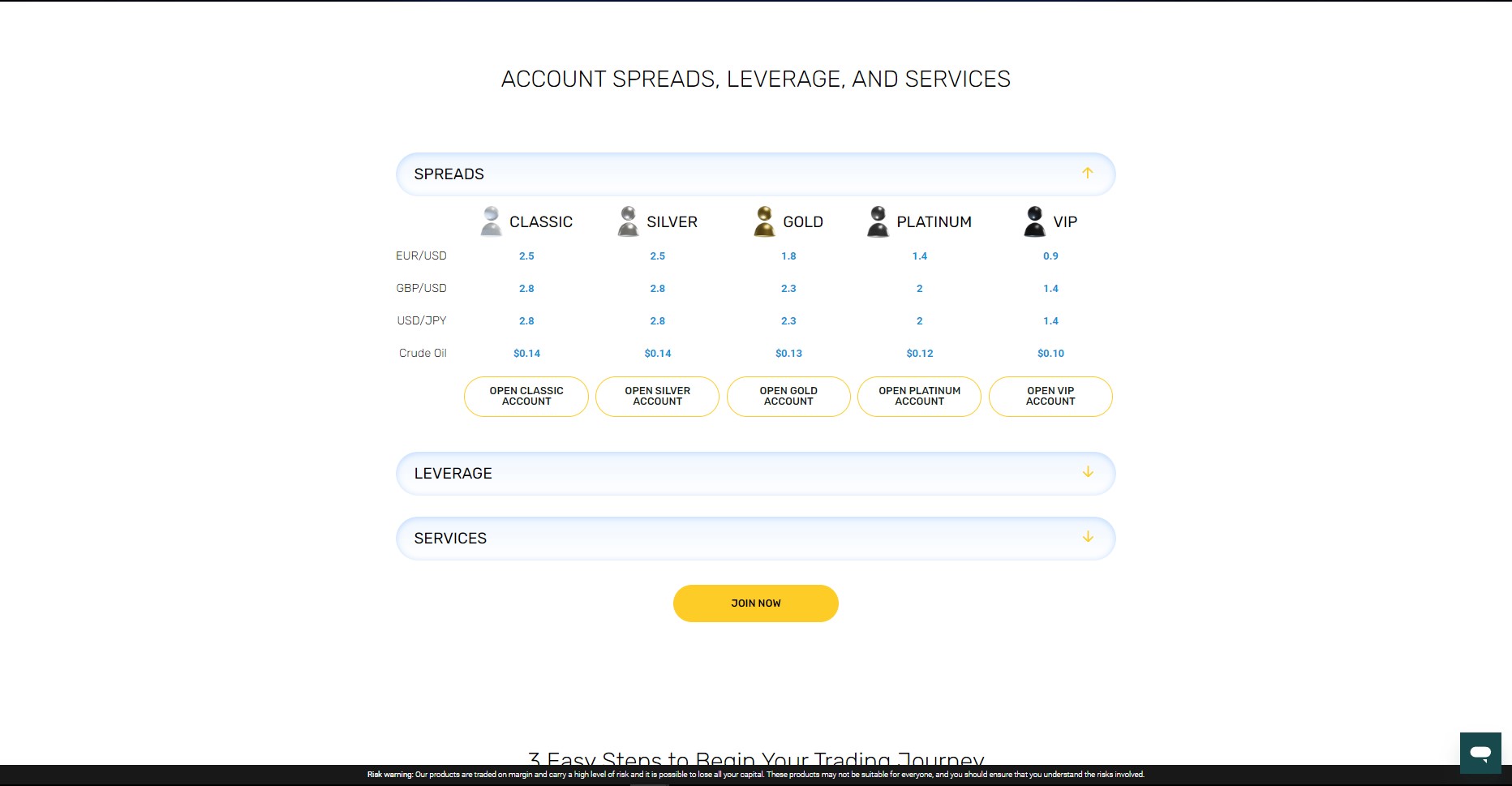

Maunto Spreads, Fees, and Commissions

Maunto has competitive spreads that are on all of its trading products, such as stocks, indices, forex, and commodities. The low spreads on the site make it very appealing to traders who want to save more money while still taking advantage of changes in the market analysis. Maunto doesn’t charge any fees for most deals, so users can focus on their strategies without having to worry about extra costs.

Maunto has a clear pricing plan for fees; there are no hidden costs for maintenance or inactivity. It’s a cheap choice for both short-term and long-term plans because traders only pay the spread on their trades with risk tolerance.

Maunto stays competitive in the global trading market by offering low spreads and clear fees. This makes it appealing to advanced traders who want to save money and time.

Account Types

Maunto offers a variety of types tailored to meet the needs of different traders:

- Basic Account: Known as classic account, this offers low spreads with lower trading costs. It is designed for those who are just starting and prefer a simple, easy-to-use interface.

- Standard Account: Aimed at more experienced traders, the Standard provides tighter spreads. It offers a balance between trading costs and advanced features.

- Pro Account: Designed for professional traders, this type offers even tighter competitive spreads, higher leverage, and access to premium trading journey. It’s ideal for high-volume traders seeking optimal trading goals and conditions.

- VIP Account: Just like gold account, it is tailored for elite and experienced trader, the VIP offers exclusive features, including the lowest spreads, priority customer support, and personalized trading solutions.

Each account types is designed to provide traders with flexibility and customizable features based on their experience level and trading strategy but not excuse to non trading fees.

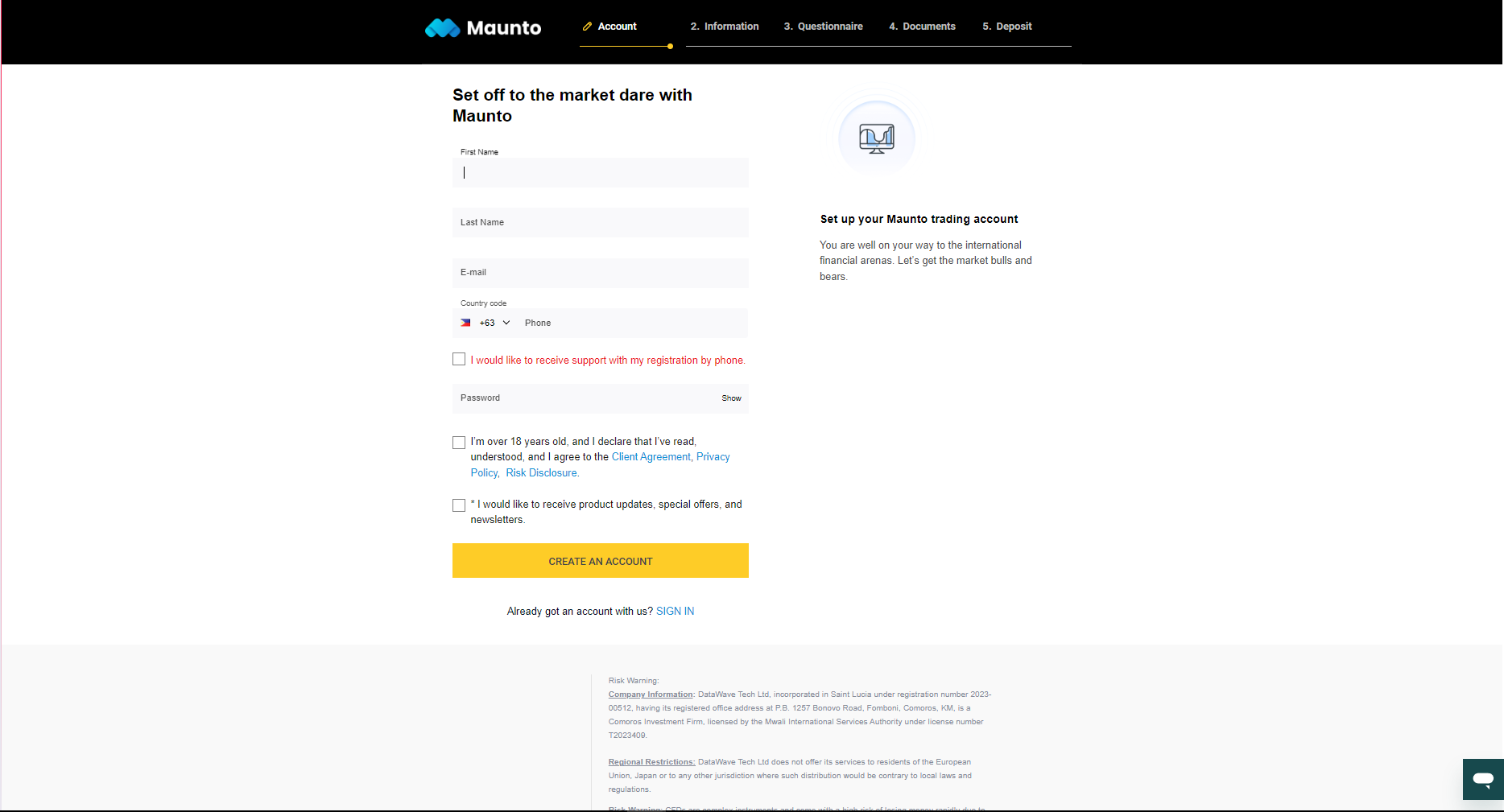

How to Open Your Account

To open a trading account with Maunto, follow these simple steps:

- Visit the Maunto website: Navigate to the official Maunto website to start the registration process.

- Choose an account type: Select the account type that best suits your trading experience and goals, whether it’s Basic, Standard, Pro, or VIP account.

- Complete the registration form: Fill in the required personal details, including name, email, phone number, and country of residence.

- Verify your identity: Submit necessary documents, such as a government-issued ID and proof of address, to complete the verification process.

- Make a minimum deposit: Deposit the required minimum amount based on your chosen account type, using your preferred payment method.

- Start trading: Once your account is verified and funded, you can access the trading platform and begin executing trades and gain big profits.

Maunto only offers a demo account to trades who qualify for a live account. With minimal or almost non deposit fees, the user can get access to a basic account.

By following these steps, users can easily open and activate their Maunto trading account or demo account as their verified clients.

Maunto Trading Platforms

Maunto’s trading tool is flexible enough to meet the needs of traders of all levels of experience. MetaTrader 4 (MT4), a trading platform that is known around the world for its powerful charting tools and easy-to-use interface, runs the platform. MT4 gives traders access to many financial tools, such as stocks, indices, forex, and commodities. This makes it easy for them to make trades and understand the markets well.

Maunto has both a PC version and a mobile trading app that lets users trade while they’re out and about. The mobile platform has all the same features as the desktop version. For example, you can access real-time market info, use technical analysis tools, and trade with just one click. Traders can handle their portfolios at any time and from anywhere thanks to this flexibility.

Expert Advisors (EAs) let Maunto’s platform support automated trading, and traders can set up and modify automated strategies. For both new and expert traders, Maunto maintains trading platform a good choice who want a complete trading experience because it is flexible, has advanced tools, and is automated.

What Can You Trade on Maunto

Maunto gives traders access to many different types of financial products, which helps them spread out their holdings. Traders can trade foreign exchange, which gives them access to major, minor, and exotic currency pairs and trading possibilities on markets around the world. Low spreads and fast execution on the platform make forex trading a good choice for both new and expert traders.

Maunto lets you trade more than just forex. You can also trade famous goods like gold, silver, oil, and other precious metals. Traders can use these asset class as an alternative way to protect themselves against market instability and spread out their investments.

There are also indices and stocks that traders can look into. These include big global indices like the S&P 500, NASDAQ, and DAX, as well as individual stocks from top companies. This wide range of tradable assets classes gives Maunto users the freedom to trade in many markets, which increases their trading possibilities and currency pairs.

Maunto Customer Support

Maunto’s quick customer service when they need it and to assist traders. The platform gives support 24 hours a day, seven days a week through live chat, email, and the phone, so users can quickly solve problems during the trading week.

Maunto’s services is known for being knowledgeable and helpful. They can help with trade questions, managing your account, and using the platform’s features. For people who like to do things on their own, the website also has a full Frequently Asked Questions (FAQ) part with answers to many common questions about trading, setting up an account, and other topics.

Some traders may want help 24 hours a day, seven days a week, but Maunto’s 24/5 hours work well with trading hours, making it a reliable service for most users. Maunto’s customer service is reliable for sellers of all levels because there are many ways to get in touch with them and the staff is friendly and helpful.

Advantages and Disadvantages of Maunto Customer Support

Withdrawal Options and Fees

Maunto gives its users around the world a number of withdrawal process to meet their needs. Traders can get their entire money out of the account using e-wallets like Skrill and Neteller, bank transfers, and credit/debit cards. This gives users the freedom to pick the withdrawal process that works best for such distribution based on the users risk management.

When you make a withdrawal, Maunto makes the fees clear, and most of the ways have low or no fees while lessening the risks involved. However, based on the user’s bank or region, some options, like bank transfers, may come with extra fees for risk management. Traders should check the fees for their chosen withdrawal way before making a request so that they don’t get hit with any surprises.

Overall, Maunto’s several withdrawal choices and clear fees make the process easy, making sure that traders can quickly get to their money. The platform’s focus on making things clear and making withdrawals easy makes trade enjoyable in terms of financial transactions.

Maunto Vs Other Brokers

#1. Maunto vs AvaTrade

Both brokers, Maunto and AvaTrade, provide a large selection of trading instruments, such as stocks, indices, commodities, and FX. Maunto is a wonderful option for traders looking for a straightforward and affordable trading environment because of its reputation for having low spreads and an easy-to-use platform. AvaTrade, on the other hand, offers a variety of platforms, including MetaTrader 4, MetaTrader 5, and its in-house AvaTradeGO, to meet the needs of traders seeking cutting-edge trading tools and platform diversity.

AvaTrade offers greater security for traders that value regulatory monitoring because to its extensive regulation across multiple jurisdictions, which is a significant distinction between the two. Though it offers low pricing, traders who are more cautious may be concerned by Maunto’s lack of top-tier regulation. Beginners find AvaTrade’s wealth of educational materials and strong customer service particularly enticing, but traders looking to minimize expenses are drawn to Maunto because of its cheap fees and quick execution.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

#2. Maunto vs RoboForex

Both RoboForex and Maunto, when compared, offer a large selection of trading instruments, such as equities, indices, commodities, and currencies. Low spreads and an easy-to-use platform that accommodates both novice and seasoned traders seeking a plain, economical trading experience make Maunto a popular choice. However, RoboForex offers a greater number of account types, such as Cent, Standard, and ECN accounts, which appeals to a wider spectrum of traders, from beginners to experts.

The fact that RoboForex is a registered broker is one obvious distinction, offering traders who value regulatory monitoring an extra degree of protection. Though it provides quick execution and competitive pricing, Maunto is unregulated, which could worry more cautious traders. While Maunto primarily targets MetaTrader 4 for its users, RoboForex gives more versatility by offering different trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader.

Also Read: RoboForex Review 2024 – Expert Trader Insights

#3. Maunto vs Exness

In terms of broker comparison, Maunto and Exness are similar in that they offer access to a large variety of trading instruments, such as stocks, indices, commodities, and FX. Maunto is a popular choice for traders looking for a simple and affordable trading experience because of its user-friendly platform and minimal spreads. Conversely, Exness provides traders with infinite leverage, making it appealing to more seasoned traders who want to optimize their exposure to the market.

Security and regulation represent two of the two brokers’ main points of distinction. Exness is a highly regulated broker that provides traders with additional assurance due to its compliance in numerous jurisdictions. Although Maunto offers reasonable prices, traders who value security may be concerned about the lack of regulatory control. While Maunto primarily focuses on MetaTrader 4 for its trading environment, Exness offers more versatility by giving access to MetaTrader 4, MetaTrader 5, and other advanced tools.

Also Read: Exness Review 2024 – Expert Trader Insights

Conclusion: Maunto Review

In summary, Maunto offers an affordable trading platform that appeals to both novice and seasoned traders because to its user-friendly design and minimal spreads. In order to give traders a variety of options for participating in the markets, the platform provides access to a large assortment of trading products, such as stocks, indices, commodities, and FX. Maunto is a compelling choice for individuals looking for a simple and effective trading environment because of its quick trade execution and transparent fees.

Traders who value regulated brokers due to security concerns may find the platform’s lack of regulation concerning. Although Maunto makes up for it with safe transactions and excellent customer service, traders who are risk cautious might be put off by the lack of top-notch regulatory control.

In general, Maunto is a good option for traders that prioritize usability and price over regulatory support because of its competitive pricing, simplicity, and accessibility. It is especially appropriate for people searching for a dependable platform with adaptable trading options.

Maunto Review: FAQs

Is Maunto a regulated broker?

No, Maunto operates without top-tier regulatory oversight. While this may concern some traders, the platform compensates with secure transactions and strong customer support.

What trading platforms does Maunto offer?

Maunto primarily offers MetaTrader 4 (MT4), a globally recognized platform known for its user-friendly interface, advanced charting tools, and automated trading capabilities.

What can I trade on Maunto?

Maunto provides access to a wide range of trading instruments, including forex, commodities, indices, and stocks, allowing traders to diversify their portfolios.

OPEN AN ACCOUNT NOW WITH MAUNTO AND GET YOUR BONUS