MarketsVox Review

Choosing the right Forex broker is crucial for any trader’s success. A Forex broker acts as a mediator between traders and the financial markets, providing the necessary platform and tools for executing trades. Selecting a reliable broker can impact everything from the quality of trade execution to the security of your funds and the fees you incur. Therefore, it’s essential to evaluate brokers carefully based on their regulatory status, trading platforms, fee structures, and customer support.

MarketsVox is a Forex broker that stands out due to its user-friendly trading platforms and a wide range of financial instruments. They offer competitive spreads, deep liquidity, and a variety of account types to cater to both novice and experienced traders. MarketsVox also emphasizes education, providing a wealth of resources to help traders improve their skills and make informed decisions.

In this detailed review, I aim to provide a comprehensive evaluation of MarketsVox, highlighting its unique selling points and potential drawbacks. My goal is to equip you with essential insights into the broker’s various account options, deposit and withdrawal processes, commission structures, and other crucial details. Combining expert analysis with actual trader experiences, this review will help you make an informed decision about considering MarketsVox as your preferred brokerage service provider.

What is MarketsVox?

MarketsVox, rebranded from ForexVox, is a Forex broker regulated by the Financial Services Authority (FSA) in Seychelles. It offers a range of trading instruments including Forex, indices, commodities, metals, and cryptocurrencies, supported by the robust MetaTrader 5 platform and a user-friendly web-based trading interface. With features like copy trading, educational resources, and responsive customer support, MarketsVox is designed to meet the needs of diverse traders, ensuring a secure and efficient trading experience.

Benefits of Trading with MarketsVox

Trading with MarketsVox has been a rewarding experience due to several key benefits. One major advantage is the advanced MetaTrader 5 platform, which offers excellent charting tools and automated trading capabilities. This has allowed me to execute trades more efficiently and with greater precision.

Another significant benefit is the competitive spreads offered by MarketsVox, which help in minimizing trading costs. Additionally, the broker provides high leverage options, up to 1:2000, which has enabled me to maximize my market exposure and potential returns.

The availability of a wide range of trading instruments, including Forex, indices, commodities, and cryptocurrencies, has made it easier for me to diversify my trading portfolio. This diversity helps in spreading risk and capitalizing on various market opportunities. The user-friendly interface and seamless integration across devices further enhance the overall trading experience.

MarketsVox Regulation and Safety

MarketsVox operates under the regulation of the Financial Services Authority (FSA) in Seychelles, which ensures that the company adheres to strict financial standards and practices. This regulatory oversight is crucial because it mandates transparency and ethical behavior, which helps safeguard client funds and maintain a trustworthy trading environment. It’s important for traders to know this because regulatory compliance means your funds are protected by laws that require the broker to keep client money separate from company funds, reducing the risk of misuse.

From my experience trading with MarketsVox, their commitment to security is evident. The broker follows stringent guidelines set by the FSA, which includes regular audits and compliance checks. This regulatory compliance ensures that MarketsVox operates in a transparent and ethical manner, giving traders peace of mind that their investments are safe. Additionally, having funds in segregated accounts further enhances security, making it less likely for client funds to be affected by the company’s operational issues.

Knowing that MarketsVox is regulated by a reputable authority can help you make an informed decision when choosing a broker. This level of oversight and the associated safety measures, such as segregated accounts and regular audits, underscore the broker’s dedication to providing a secure trading environment. For anyone considering trading with MarketsVox, understanding these aspects of their operation is crucial to ensuring your funds are protected and that you are trading within a legally compliant framework.

MarketsVox Pros and Cons

Pros

- Tight spreads

- High leverage

- Good customer support

- Active community

- User-friendly platforms

- Diverse trading instruments

Cons

- Inactivity fees.

- No crypto trading

- No call center support

- Client support not available on weekends

MarketsVox Customer Reviews

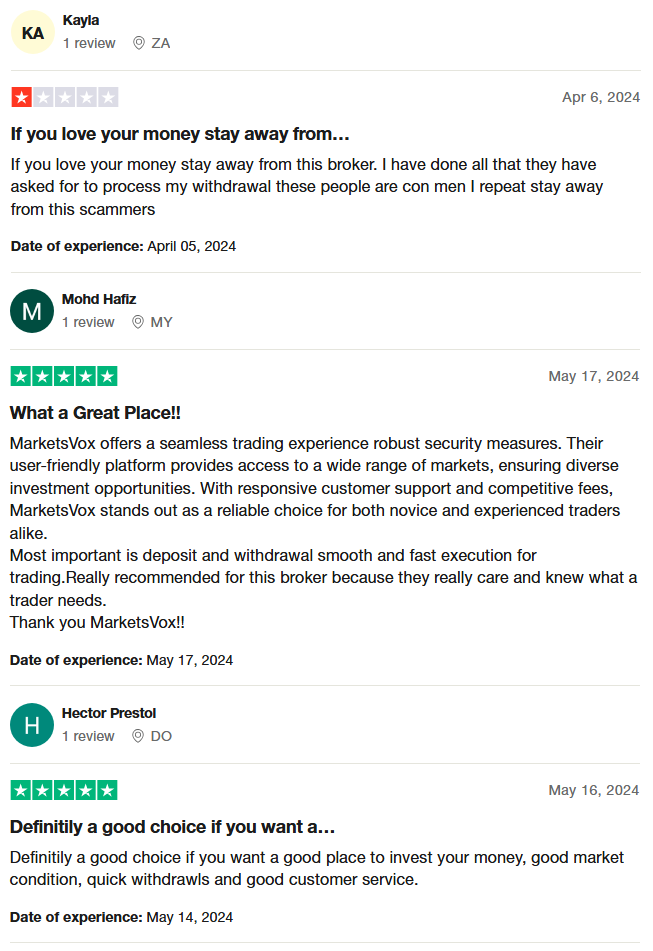

Customer reviews of MarketsVox highlight a seamless trading experience with robust security measures and a user-friendly platform. While one user warns against the broker, citing issues with withdrawal processes, other reviews praise its fast execution, responsive customer support, and competitive fees. The platform’s ability to cater to both novice and experienced traders is noted, as is the emphasis on smooth deposit and withdrawal procedures.

MarketsVox Spreads, Fees, and Commissions

When trading with MarketsVox, I found their spreads to be very competitive. The tight spreads are particularly beneficial for traders looking to minimize their costs. For example, spreads on major currency pairs like EUR/USD can be as low as 0.3 pips, which is quite attractive for frequent traders. This low spread environment helps in making trading more cost-effective and efficient.

In terms of fees, MarketsVox implements an inactivity fee of $10 per month after three consecutive months of inactivity. While this fee can be a downside if you’re not actively trading, it’s something to keep in mind to avoid unexpected charges. Additionally, there are overnight financing fees, which vary depending on the asset and position size, typically ranging from 0.01% to 0.5%.

For commissions, MarketsVox offers a straightforward structure with no hidden costs. They maintain zero commission trading on many accounts, which can significantly reduce the overall trading expenses. This is especially beneficial for new traders or those trading in high volumes. The transparency in their fee structure ensures that you know exactly what you’re paying for, allowing for better financial planning and trading strategy adjustments.

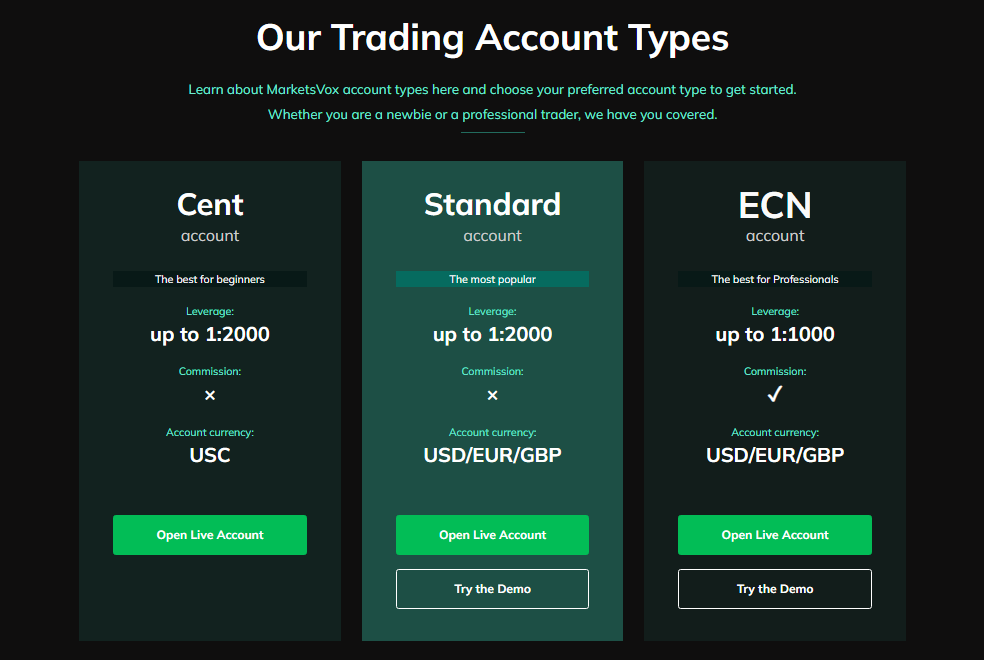

Account Types

Cent Account

- Best for beginners

- Leverage: up to 1:2000

- Commission: None

- Account Currency: USC

- Minimum Lot Size: 0.01

- Recommended Deposit: $100

Standard Account

- Most popular

- Leverage: up to 1:2000

- Commission: None

- Account Currencies: USD, EUR, GBP

- Minimum Lot Size: 0.01

- Recommended Deposit: $100

ECN Account

- Best for professionals

- Leverage: up to 1:1000

- Commission: Applicable

- Account Currencies: USD, EUR, GBP

- Minimum Lot Size: 0.01

- Recommended Deposit: $500

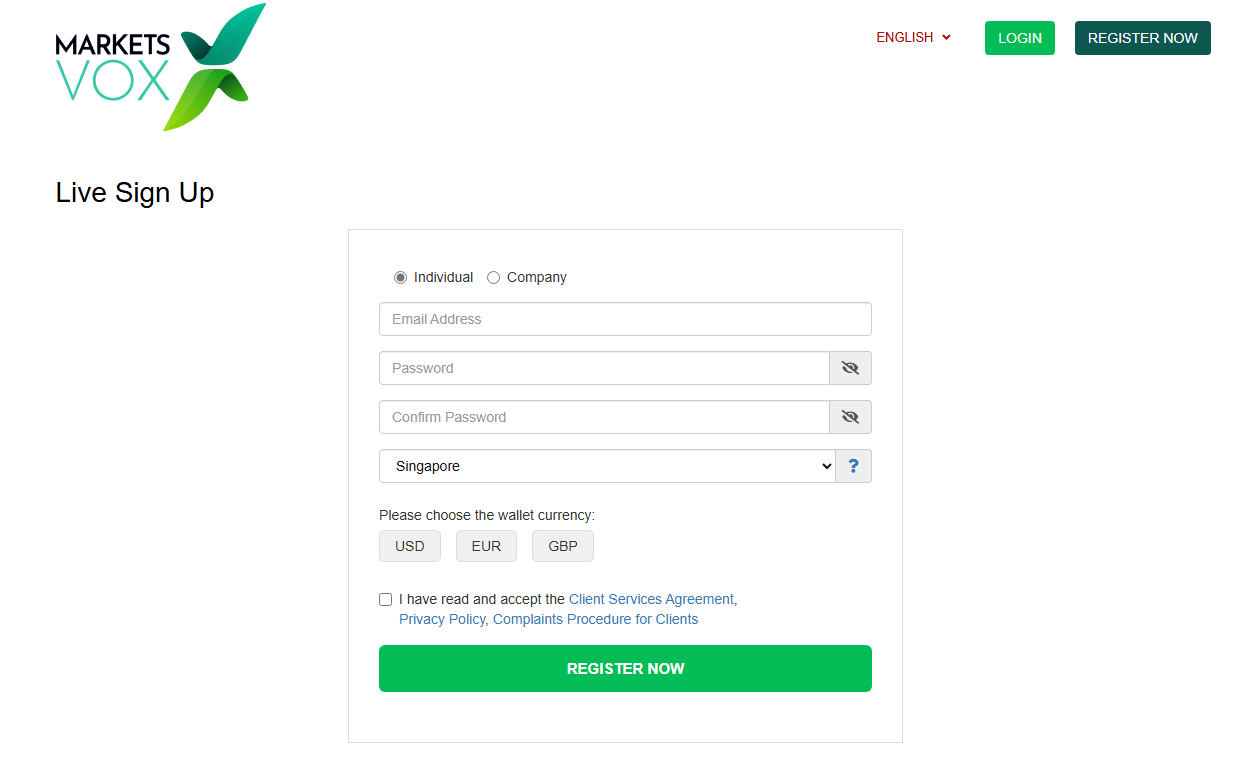

How to Open Your Account

- Visit the MarketsVox website and click on “Open Live Account.”

- Enter your personal details, including first and last names, date of birth, address, country, email, and phone number. Choose your account type and USD as the base currency, then agree to the terms of service.

- Access the user account and proceed to the verification page.

- Confirm your information by uploading the necessary documents or using the VQA system.

- Click on “My Funds” and select “Make a Deposit” to fund your account.

- Follow the instructions for your chosen deposit method and wait for the balance update.

- Download the MT4 trading platform, install it, and start trading using the registration details emailed to you.

MarketsVox Trading Platforms

When trading with MarketsVox, I primarily use the MetaTrader 5 (MT5) platform. MT5 is known for its advanced charting tools and a wide range of technical indicators, making it a robust choice for both beginners and experienced traders. The platform’s user-friendly interface allows for easy navigation and efficient trade execution.

One of the standout features of MT5 is its automated trading capabilities. With the use of Expert Advisors (EAs), I can automate my trading strategies, which helps in managing trades more effectively. This functionality significantly enhances trading efficiency, especially in volatile markets.

What Can You Trade on MarketsVox

Trading with MarketsVox offers a wide variety of instruments to diversify your portfolio. I have access to over 70 currency pairs, including major, minor, and exotic pairs, which provides ample opportunities to capitalize on global market movements. The tight spreads and deep liquidity make trading currencies both efficient and cost-effective.

In addition to currencies, MarketsVox allows me to trade CFDs on indices. This includes major indices like the S&P 500, NASDAQ, and FTSE 100, enabling me to speculate on the performance of global stock markets. This variety helps in spreading risk and potentially enhancing returns.

I also trade commodities on MarketsVox, such as crude oil, gold, and silver. These assets are excellent for hedging against inflation and taking advantage of market volatility. The platform’s support for commodities trading is robust, with competitive spreads and leverage options.

Moreover, MarketsVox offers cryptocurrency trading, which includes popular digital assets like Bitcoin, Ethereum, and Ripple. Trading cryptos on this platform is seamless, providing me with the flexibility to engage in this highly dynamic market. The inclusion of cryptocurrencies adds another layer of diversification to my trading strategy.

MarketsVox Customer Support

When dealing with MarketsVox customer support, I found the experience to be highly efficient. They offer multiple contact options including email and live chat, both on their website and within the user account interface. This made it easy for me to get quick answers to my questions.

For more structured inquiries, the ticketing system available in the footer of every page is very handy. Additionally, MarketsVox maintains an active presence on social platforms like Facebook, LinkedIn, Twitter, Instagram, and YouTube. Following these profiles keeps me updated on their latest events and important news. This multi-channel support approach ensures I always have access to help when needed.

Advantages and Disadvantages of MarketsVox Customer Support

Withdrawal Options and Fees

With MarketsVox, submitting a withdrawal request is straightforward and can be done at any time through the user account on the broker’s website. They offer multiple withdrawal options, including bank accounts, Visa/MC debit and credit cards, and e-wallets such as Neteller and SticPay. This variety ensures flexibility and convenience when accessing your funds.

Processing times for withdrawals typically range from 1-3 days, depending on the chosen method. This efficient process ensures that you receive your funds promptly, making it easier to manage your trading profits and financial planning. The availability of multiple channels caters to different preferences, enhancing the overall user experience.

MarketsVox Vs Other Brokers

#1. MarketsVox vs AvaTrade

MarketsVox and AvaTrade both offer robust trading platforms and a wide range of financial instruments, but they differ significantly in their approach and customer base. MarketsVox provides MetaTrader 5, known for advanced charting tools and automated trading capabilities, catering to both novice and experienced traders. AvaTrade, established in 2006, boasts over 1,250 financial instruments and serves more than 300,000 registered customers globally, with a strong regulatory presence in multiple jurisdictions but excluding US traders. AvaTrade’s extensive experience and broader regulatory coverage provide a comprehensive trading environment.

Verdict: AvaTrade stands out due to its extensive regulatory framework and a broader range of financial instruments, making it better for those seeking a highly regulated environment and diverse trading options. MarketsVox, with its focus on advanced trading tools and user-friendly platforms, is ideal for traders prioritizing cutting-edge technology and automated trading.

#2. MarketsVox vs RoboForex

Both MarketsVox and RoboForex offer advanced trading platforms and a wide range of assets. MarketsVox uses MetaTrader 5, providing excellent automated trading features and a user-friendly interface. RoboForex, regulated by FSC and operating since 2009, offers a variety of platforms including MetaTrader, cTrader, and RTrader, catering to different trading styles and preferences. RoboForex also runs ContestFX, offering demo contests with real account prizes, which is unique and beneficial for new traders seeking practical experience.

Verdict: RoboForex has an edge with its variety of trading platforms and the unique ContestFX feature, making it a better choice for traders who want diverse platform options and interactive learning experiences. MarketsVox excels in providing a streamlined, advanced trading environment suitable for traders focused on automated strategies.

#3. MarketsVox vs Exness

MarketsVox and Exness both provide extensive trading options and advanced platforms, but they cater to different needs. MarketsVox offers MetaTrader 5, focusing on automated trading and ease of use. Exness, regulated in Cyprus and Seychelles, provides CFDs on various assets, including cryptocurrencies, and offers infinite leverage for small deposits, catering to high-risk traders. Exness’s monthly trading volume is substantial, reflecting its large user base and reliable trading environment.

Verdict: Exness is better suited for high-risk traders looking for significant leverage and a wide range of CFDs, including cryptocurrencies. MarketsVox, with its emphasis on advanced trading tools and a user-friendly platform, is ideal for traders who prefer a more controlled and automated trading environment.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH MARKETSVOX

Conclusion: MarketsVox Review

Based on my experience and user feedback, MarketsVox offers a solid trading platform with the advanced capabilities of MetaTrader 5. The broker provides competitive spreads, high leverage options, and a user-friendly interface, making it suitable for both novice and experienced traders. Their diverse trading instruments, including Forex, indices, commodities, and cryptocurrencies, allow for extensive portfolio diversification. However, it’s important to note the inactivity fees and the limited customer support options, which can be inconvenient.

Also Read: MultiBank Group Review 2024 – Expert Trader Insights

MarketsVox Review: FAQs

What trading platforms does MarketsVox offer?

MarketsVox offers the MetaTrader 5 (MT5) platform, known for its advanced charting tools and automated trading capabilities.

What types of accounts are available with MarketsVox?

MarketsVox provides Cent, Standard, and ECN accounts, catering to both beginners and professional traders with different leverage and commission structures.

How can I contact MarketsVox customer support?

You can reach MarketsVox customer support via email, live chat on their website and user account, and through their social media profiles on Facebook, LinkedIn, Twitter, Instagram, and YouTube.

OPEN AN ACCOUNT NOW WITH MARKETSVOX AND GET YOUR BONUS