Markets.com Review

In the fast-paced, high-stakes world of online trading, choosing the ideal platform can feel overwhelming. Established in 2008 and operated by Safecap Investments Limited, Markets.com has risen as a prominent contender in the industry. Our all-encompassing Markets.com review is here to equip you with the knowledge you need to determine if it’s the ultimate solution for your trading endeavors.

Embark on an eye-opening journey as we unravel the mysteries of this prestigious trading platform, exploring its diverse array of trading instruments, state-of-the-art technology, tailored account types, competitive fees, and stellar customer support. With over 2,200 CFDs, ETFs, and multiple asset classes, Markets.com boasts a comprehensive offering to suit various trading styles.

Dive into our thorough analysis and allow us to navigate you through the exciting realm of Markets.com, boosting your trading prowess to unprecedented heights. Seize this opportunity to uncover the hidden gems of a top-tier trading platform and learn why it might just hold the secret formula to unlocking your financial triumph.

What is Markets.com?

Markets.com is a leading online trading platform, renowned for its exceptional offerings and cutting-edge technology. It was established in 2008 and is run by Safecap Investments Limited, a Playtech PLC subsidiary, solidifying its position as one of the top options for traders globally.

Markets.com has become stronger over time and now gives traders access to a huge selection of financial products, such as Forex, commodities, equities, indices, cryptocurrencies, and ETFs. It has been a popular platform for both new and seasoned traders due to its dedication to innovation and customer-centric attitude.

The abundance of cutting-edge trading tools and features offered on the platform is one of the main factors contributing to its outstanding reputation. Each of the three primary trading platforms—MetaTrader 4, MetaTrader 5, and Marketsx—offers distinctive advantages to accommodate various trading styles.

Markets.com is a top choice for traders looking for a dependable and user-friendly platform due to its reasonable fees, customizable account kinds, and outstanding customer service. With its extensive offerings and unwavering dedication to enhancing the trading experience, Markets.com has proven itself as a top contender in the online trading arena.

Advantages and Disadvantages of Trading with Markets.com

Benefits of Trading with Markets.com

As a leading online trading platform, Markets.com provides traders with a range of benefits and advantages that can enhance their trading experience. In this section, we will highlight some of the key benefits of trading with Markets.com, helping you understand why we’re the ideal platform for your trading journey.

Diverse Range of Trading Instruments

Markets.com offers a diverse range of trading instruments, including forex, stocks, commodities, indices, cryptocurrencies, and ETFs. This allows traders to access a wide variety of markets and create a diversified trading portfolio.

Cutting-Edge Trading Platforms

Markets.com provides access to its proprietary trading platform, Marketsx, as well as the popular MetaTrader 4 and MetaTrader 5 platforms. These platforms offer advanced charting tools, technical indicators, and a range of order types, catering to different trading styles and preferences.

Competitive Fees

Markets.com operates on a commission-free model, with fees incorporated into the spread. This provides a transparent and straightforward fee structure, with competitive spreads across all trading instruments.

Exceptional Customer Support

At Markets.com, they understand that customer support is crucial to a positive trading experience. Their dedicated support team is available 24/5 via live chat, email, or phone, providing prompt and efficient assistance.

Educational Resources

They provide their traders with an extensive knowledge base, including educational resources, trading guides, and webinars. This helps traders enhance their skills and knowledge, empowering them to make informed trading decisions.

Regulatory Oversight

Markets.com is operated by Safecap Investments Limited, which is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 092/08. Additionally, Markets.com is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa and the Australian Securities and Investments Commission (ASIC).

Markets.com Pros and Cons

Pros

- Wide Range of Trading Instruments

- A variety of trading platforms

- User-Friendly Interface

- Tight Spreads and Competitive Fees

- Advanced Trading Tools and Features

- Regulated and Secure

Cons

- Limited Account Types

- No Support for US Clients

- Inactivity Cost

- Limited Cryptocurrency Offerings

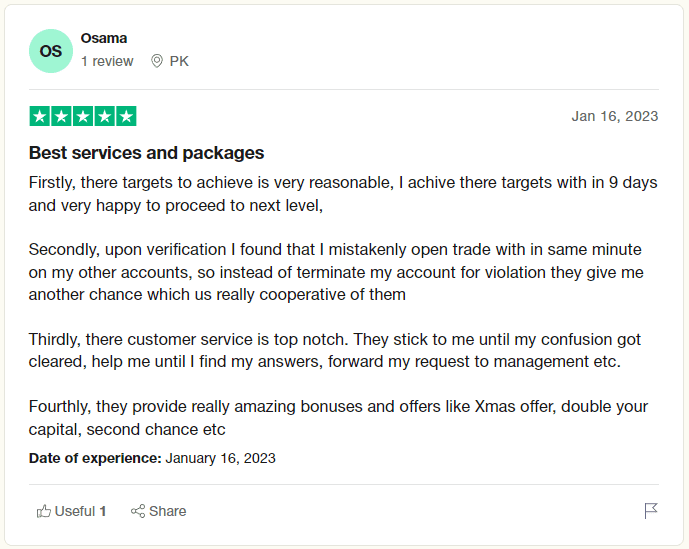

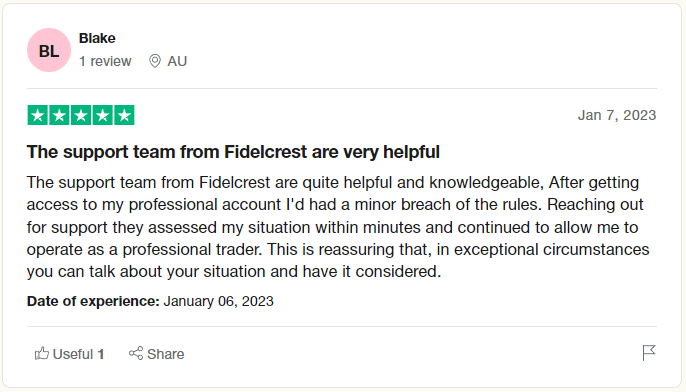

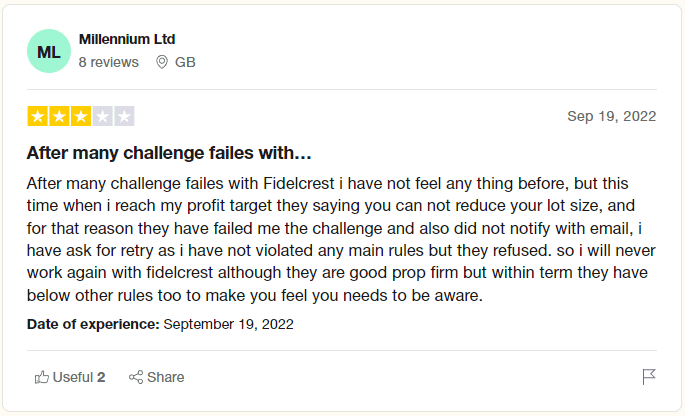

Markets.com Customer Reviews

Understanding the experiences of fellow traders can be invaluable when choosing an online trading platform. In this section, we will explore customer reviews of Markets.com to provide you with insights into the real-world experiences of traders using the platform. From user-friendliness and advanced trading tools to customer support and fee structures, we’ll cover the key aspects that matter most to traders.

Keep in mind that individual experiences may vary, and it’s always recommended to do your research and test the platform using a demo account before committing to a live trading account. Now, let’s dive into the world of Markets.com through the lens of its users.

Markets.com Spreads, Fees, and Commissions

Understanding the associated spreads, fees, and commissions when choosing an online trading platform is essential to maximize your trading profits. To give you a clear understanding of what to anticipate as a trader on this well-known platform, we will look at the various charges related to trading on Markets.com in this part.

Spreads: Markets.com offers competitive spreads on various trading instruments, which vary depending on the asset class and market conditions. For instance, Forex traders can enjoy tight spreads starting from as low as 0.6 pips for major currency pairs like EUR/USD, while spreads for other asset classes, such as stocks and commodities, may differ. It’s important to note that Markets.com operates on a floating spread model, meaning that spreads can widen or tighten based on market liquidity and volatility.

Fees: One of the significant advantages of Markets.com is its fee structure. The platform primarily earns through spreads, which means there are no added commissions charged on trades for most instruments. This cost-effective approach allows traders to better manage their expenses and maximize profits. However, it’s worth noting that overnight financing fees (also known as swap fees) may apply for positions held open overnight. These fees depend on the instrument being traded and can be found on the platform’s instrument information.

Commissions: As mentioned earlier, Markets.com does not charge commissions on most trades, as their revenue comes primarily from spreads. However, there are a few exceptions, such as when trading share CFDs. In this case, a commission may be charged, which typically ranges between 0.08% and 0.15% of the trade value. It’s essential to review the specific instrument details on the platform to understand any associated commission fees.

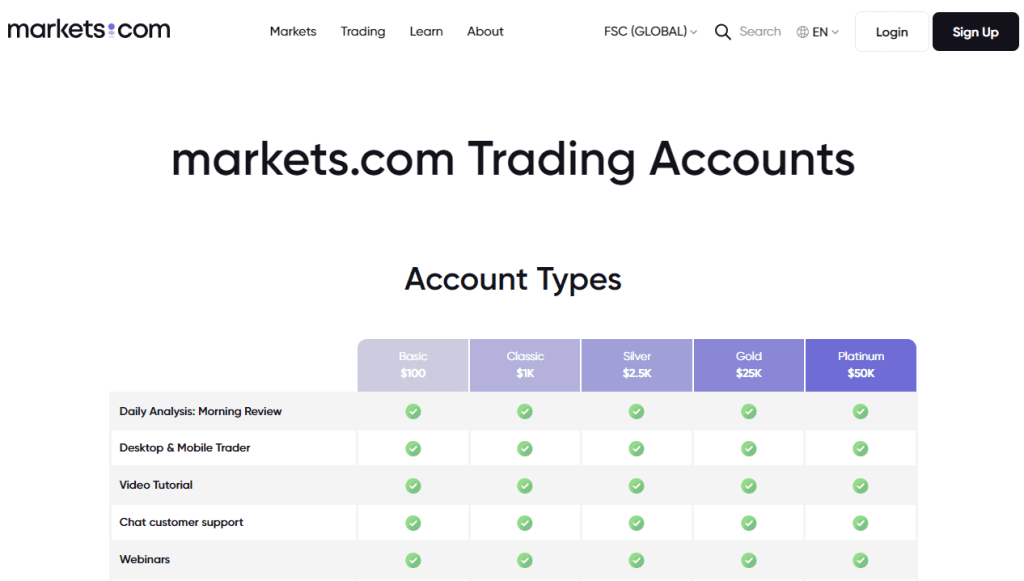

Account Types

Markets.com offers a range of account types to accommodate the varying needs and preferences of its diverse clientele. In this section, we will explore the different account options available on Markets.com, allowing you to determine the best fit for your unique trading requirements.

Retail Account:

The Retail Account is the most common account type on Markets.com, suitable for beginner to intermediate traders. This account offers access to a wide range of trading instruments, user-friendly platforms, and excellent customer support. With a Retail Account, traders can enjoy competitive spreads, leverage of up to 1:30 (as per ESMA regulations), and negative balance protection. The minimum deposit required to open a Retail Account varies depending on the region but typically starts at $100.

Professional Account:

Designed for experienced traders who meet specific eligibility criteria, the Professional Account offers additional benefits compared to the Retail Account. These include higher leverage of up to 1:300, lower margin requirements, and access to premium trading resources. To qualify for a Professional Account, traders must meet at least two of the following requirements:

1. Sufficient Trading Activity: The trader must have executed an average of 10 significantly sized transactions per quarter in the past year.

2. Financial Portfolio: The trader’s financial portfolio, including cash deposits and financial instruments, must exceed €500,000.

3. Professional Experience: The trader must possess professional experience in the financial sector for at least one year.

It’s important to note that Professional Accounts do not have the same regulatory protections as Retail Accounts, such as negative balance protection.

Demo Account:

Markets.com offers a free Demo Account for traders who want to familiarize themselves with the platform and practice their trading strategies before committing to a live account. The Demo Account provides access to the same trading instruments, platforms, and tools as a live account, but with virtual funds, allowing traders to hone their skills without risking real capital.

How To Open Your Account?

In order to get you up and running as soon as possible, opening an account with Markets.com is a short and straightforward process. To help you easily start trading on this well-liked platform, we will walk you through the processes in this portion of opening your account.

Step 1: Go to the website for Markets.com

Visit Markets.com and select the “Sign Up” or “Create Account” button, which is typically found in the top-right corner of the homepage.

Step 2: Fill out the registration form

Your name, email address, and phone number should all be entered on the registration form. Additionally, a password for your account must be created by you. Click “Next” or “Continue” once you’ve finished the form.

Step 3: Account Verification

A verification email from Markets.com will be sent to you with a link to activate your account. To begin with, setting up your account and verifying your email address, click the link.

Step 4: Complete the Account Setup

Log into your Markets.com account and finish the account setup process after your email address has been verified. Additional details, such as your date of birth, place of residence, and financial background, in addition to your trading expertise and experience, will be requested of you.

Step 5: Submit Identification Documents

As a regulated platform, Markets.com requires users to submit identification documents to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. You will need to upload a copy of a valid government-issued ID (such as a passport or driver’s license) and a proof of residence document (such as a utility bill or bank statement) dated within the last six months.

Step 6: Account Approval

Once you have submitted the required documents, Markets.com will review your application. This process usually takes a few business days. You’ll get a confirmation email after your application is accepted.

Step 7: Deposit Funds

Place a Deposit You must fund your Markets.com account before you can begin trading. Select your preferred payment option after logging into your account and going to the “Deposit” section. To finish the deposit process, adhere to the on-screen instructions.

Step 8: Start Trading

With your account funded, you can now start trading on Markets.com. Explore the platform, select your preferred trading instruments, and execute your trades using the tools and features available.

What Can You Trade on Markets.com?

Markets.com provides traders with a wide variety of trading instruments, giving them several options to diversify their portfolios and profit from market fluctuations. This section will help you comprehend the complete range of trading options accessible to you by examining the various asset classes that can be traded on Markets.com.

Forex

Markets.com is renowned for its vast Forex selection, giving users access to over 67 currency pairs, including major, minor, and exotic pairs. To profit from changes in the value of different currencies, traders can use the Forex market’s narrow spreads and strong liquidity.

Commodities

The platform offers a wide range of commodities for trading, including precious metals like gold and silver, energy products such as crude oil and natural gas, and agricultural commodities like wheat, corn, and coffee. Trading commodities allows you to benefit from price movements in essential goods and hedge against inflation.

Indexes

On Markets.com, traders have access to more than 25 international indexes, such as the S&P 500, Dow Jones, NASDAQ, FTSE 100, and DAX 30. Indices allow traders to acquire broad exposure to the equity markets without owning specific stocks because they reflect the performance of a certain stock market or a particular sector of the market.

Stocks

Markets.com gives traders access to over 2,000 stocks from top international exchanges, giving them the chance to trade share CFDs of well-known corporations like Apple, Amazon, Facebook, and more. You can profit from price changes by trading stock CFDs without actually holding the underlying shares.

Cryptocurrencies

Markets.com provides a range of CFDs for prominent cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple. Without having to hold or keep the actual coins, you can profit from the price changes of digital currencies by trading cryptocurrency CFDs.

Exchange-Traded Funds (ETFs)

Markets.com provides traders with access to a range of ETFs, which are investment funds that monitor the performance of a certain index, industry, or commodity. Trading ETF CFDs is a useful instrument for portfolio diversification because it gives you access to a variety of assets with a single deal.

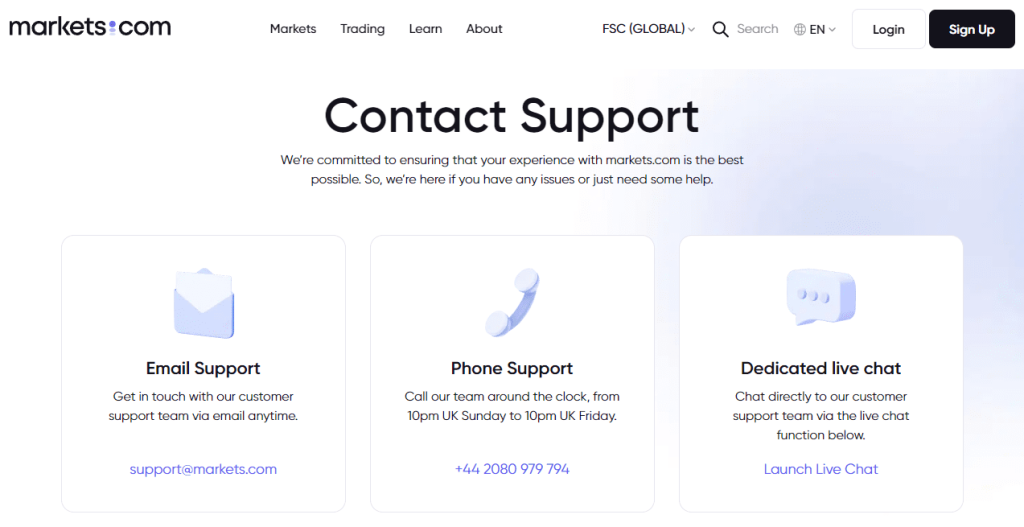

Markets.com Customer Support

Any online trading platform must offer dependable and attentive customer service in order to guarantee that users may voice their concerns and receive timely responses to their inquiries. In this section, we’ll talk about Markets.com’s customer service options, stressing the several assistance channels and their dedication to giving customers a seamless trading experience.

Live Chat

Markets.com offers a live chat feature, allowing traders to connect with a support representative in real time. This support channel is ideal for quick inquiries and resolving issues efficiently. The live chat feature is typically available 24/5, providing assistance to traders throughout the trading week.

Phone Support

If you prefer to speak directly with a support representative, Markets.com offers phone support in multiple languages. This option is suitable for traders who need immediate assistance or prefer discussing their concerns over the phone. Keep in mind that phone support hours may vary depending on your location and the language of support.

Email Support

For less urgent inquiries or more complex issues, Markets.com provides email support. Traders can send their questions or concerns to the support team, and expect a detailed response within a reasonable time frame, typically within 24 hours.

Help Center and FAQs

Markets.com also features an extensive Help Center and a Frequently Asked Questions (FAQs) section on their website, providing answers to common inquiries and addressing various platform-related topics. This resource can be useful for traders seeking quick answers to general questions without needing to contact the support team directly.

Educational Resources

In addition to the dedicated customer support channels, Markets.com offers a wealth of educational resources, including webinars, articles, and video tutorials. These materials cover a range of trading topics, from basic concepts to advanced strategies, and can be beneficial in resolving trading-related questions or improving your overall trading knowledge.

Advantages and Disadvantages of Markets.com Customer Support

Effective customer support plays a pivotal role in the overall trading experience on an online platform. In this section, we will discuss the advantages and disadvantages of Markets.com’s customer support, helping you gain a better understanding of what to expect when seeking assistance from the platform’s support team.

Contacts Table

Please note that the phone support hours may vary depending on your location and the language of support. Additionally, these contact details may be subject to change, so it’s always a good idea to visit the Markets.com website for the most up-to-date information.

Security for Investors

Security is a top priority for any online trading platform, as it directly impacts the safety of investors’ funds and personal information. Markets.com understands the importance of security, which is why it uses advanced security measures to protect its clients’ funds and personal information.

The platform is regulated by reputable regulatory bodies, including the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Australian Securities and Investments Commission (ASIC), ensuring that the platform complies with strict regulations and operates transparently.

Additionally, Markets.com provides a range of retail and investor accounts, including forex trading, trading CFDs, and more, allowing traders to access a variety of markets and create a diversified trading portfolio. The platform also offers competitive trading fees and a low minimum deposit requirement, making it accessible to traders of all levels.

With its commitment to security, transparency, and accessibility, Markets.com is a reliable and trustworthy forex broker for traders looking to enter the online trading world.

Regulatory Compliance

Markets.com is operated by Safecap Investments Limited, which is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 092/08. Additionally, Markets.com is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa, and the Australian Securities and Investments Commission (ASIC). These regulatory authorities impose strict rules and guidelines, ensuring that Markets.com adheres to high standards of security, transparency, and investor protection.

Fund Safety

Markets.com ensures the safety of clients’ funds by holding them in segregated accounts at top-tier banks, separate from the company’s operational funds. This segregation ensures that client funds remain protected and cannot be used for the platform’s operational expenses or in the event of company insolvency.

Secure Transactions

All transactions and private information passed between users and the platform are encrypted using state-of-the-art methods like Secure Sockets Layer (SSL). This safeguards your private and financial data against hackers and other cybercriminals.

Negative Balance Protection

Markets.com offers negative balance protection for its clients, ensuring that you can never lose more than the balance in your trading account. This feature protects traders from incurring significant losses due to high market volatility or rapid price movements.

Know Your Customer (KYC) and Anti-Money Laundering (AML) Procedures

Markets.com adheres to stringent KYC and AML standards to confirm its clients’ identities and thwart any fraudulent actions on the site. This includes requiring customers to produce identification papers before they can begin trading, such as a government-issued ID and proof of domicile.

Two-Factor Authentication (2FA)

Markets.com offers 2FA, which adds another degree of security to your account. When 2FA is activated, you will need to enter your password and a special code that was delivered to your mobile device in order to log in or complete specific transactions.

Withdrawal Options and Fees

Efficient withdrawal options and transparent fee structures are crucial components of a seamless trading experience. In this section, we will explore the various withdrawal methods available on Markets.com, along with any associated fees, to help you understand how to access your funds quickly and conveniently.

Withdrawal Options

Markets.com offers multiple withdrawal methods to cater to the diverse needs of its clients, including:

Credit/Debit Card

You can withdraw your funds directly to your Visa or MasterCard credit or debit card. The processing time for credit/debit card withdrawals is typically 1-3 business days.

Bank Wire Transfer

Withdrawals can also be processed through bank wire transfers to your personal bank account. The processing time for wire transfers can take up to 5 business days, depending on your bank’s processing times.

e-Wallets

Please be aware that depending on where you are located and the type of account you have, not all withdrawal options may be available.

Withdrawal Fees

Fees for withdrawals are not assessed by Markets.com. It is crucial to understand that third-party fees can be charged, depending on the withdrawal method you select. For instance, the processing fee for the transaction might be assessed by your bank or e-wallet provider. Before starting a withdrawal, it is a good idea to ask your preferred financial institution about any possible fees.

Minimum Withdrawal Amounts

Markets.com requires a minimum withdrawal amount for each method:

1. Credit/Debit Card: $10 or equivalent in your account currency

2. Bank Wire Transfer: $100 or equivalent in your account currency

3. e-Wallets: $5 or equivalent in your account currency

Markets.com Vs Other Brokers

#1. Markets.com Vs AvaTrade

Markets.com is regulated by top-tier authorities such as the FCA and CySEC, while AvaTrade is regulated by multiple reputable entities, including the FCA, ASIC, and CySEC. This gives AvaTrade an advantage in terms of regulatory credibility and investor protection.

In terms of trading platforms, Markets.com offers its proprietary platform, while AvaTrade provides a range of platforms including MetaTrader 4 and MetaTrader 5. Traders can choose the platform that aligns with their preferences and trading strategies.

When it comes to trading conditions, Markets.com offers competitive spreads, while AvaTrade also provides favorable trading conditions with low spreads. Both brokers offer leverage options to enhance trading opportunities.

Considering the overall comparison, both Markets.com and AvaTrade have their strengths. However, AvaTrade’s strong regulatory standing and diverse platform options make it a preferred choice for many traders.

Verdict: AvaTrade may be the better choice due to its superior regulation, diverse platform options, and competitive trading conditions.

#2. Markets.com Vs RoboForex

Markets.com is regulated by reputable authorities like the FCA and CySEC, while RoboForex is regulated by IFSC in Belize. Both regulators provide oversight, but some traders may perceive stricter regulations in certain jurisdictions as offering greater security.

In terms of trading platforms, Markets.com offers its proprietary platform, while RoboForex provides access to popular platforms like MetaTrader 4 and MetaTrader 5. The choice of platform depends on individual preferences and desired features.

When it comes to trading conditions, Markets.com offers competitive spreads, and RoboForex also provides favorable trading conditions with various account types and low spreads.

Overall, both brokers have their strengths. Markets.com stands out with its strong regulatory framework and comprehensive proprietary platform, while RoboForex offers popular MetaTrader platforms and a variety of account options.

Verdict: The choice between Markets.com and RoboForex depends on individual preferences, with Markets.com excelling in terms of regulatory standing and proprietary platform, while RoboForex provides diverse platform options and attractive trading conditions.

#3. Markets.com Vs FX Choice

Markets.com is regulated by top-tier authorities such as the FCA and CySEC, while FX Choice is regulated by the IFSC in Belize. Both regulators provide oversight, but some traders may perceive stricter regulations in certain jurisdictions as offering greater security.

In terms of trading platforms, Markets.com offers its proprietary platform, while FX Choice provides access to popular platforms like MetaTrader 4 and MetaTrader 5. Traders can choose the platform that aligns with their preferences and trading strategies.

When it comes to trading conditions, Markets.com offers competitive spreads, and FX Choice provides potentially more favorable trading conditions with low spreads and flexible account options.

Considering the overall comparison, both Markets.com and FX Choice have their strengths. Markets.com’s strong regulatory presence and proprietary platform may appeal to certain traders, while FX Choice’s attractive trading conditions and popular MetaTrader platforms can be advantageous for others.

Verdict: The choice between Markets.com and FX Choice depends on individual preferences and priorities, with Markets.com offers a strong regulatory framework and proprietary platform, while FX Choice provides flexible account options and potentially more favorable trading conditions.

Conclusion: Markets.com Review

Markets.com is a reputable online trading platform that offers traders a range of benefits and advantages. The platform provides a diverse range of trading instruments, including forex, stocks, commodities, indices, cryptocurrencies, and ETFs, and operates on a commission-free model with competitive spreads. Markets.com also provides advanced trading platforms, including its proprietary platform, Marketsx, and the popular MetaTrader 4 and MetaTrader 5 platforms, catering to different trading styles and preferences.

Additionally, Markets.com provides exceptional customer support, with a dedicated support team available 24/5 via live chat, email, or phone, and an extensive knowledge base for traders. The platform is also regulated by reputable regulatory bodies, providing traders with the assurance that it is a safe and reliable platform.

Markets.com Review FAQs

At Markets.com, we ensure that our platform is evaluated under strict criteria to give traders a reliable and unbiased recommendation. Our goal is to provide traders with a transparent and reliable trading platform that caters to their diverse needs. By answering the most common questions about our platform, we hope to provide a transparent picture that can help you make an informed trading decision.

On Markets.com, what trading instruments are offered?

Forex, equities, commodities, indices, cryptocurrencies, and ETFs are just a few of the many trading instruments available on Markets.com. As a result, traders can access a broad range of marketplaces and build a diversified trading portfolio.

Which trading platforms is Markets.com able to provide

Access to Markets.com’s proprietary trading platform, Marketsx, as well as the well-liked MetaTrader 4 and MetaTrader 5 platforms, is available. These platforms offer advanced charting tools, technical indicators, and a range of order types, catering to different trading styles and preferences.

Is Markets.com a regulated broker?

Yes, Markets.com is operated by Safecap Investments Limited, which is regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 092/08. Additionally, Markets.com is authorized by the Financial Sector Conduct Authority (FSCA) in South Africa and the Australian Securities and Investments Commission (ASIC).