While many traders follow prevailing market trends, seasoned investors often find that the best opportunities lie in unconventional strategies such as contrarian trading. This approach goes against dominant market sentiment to exploit potential shifts, using tools like IG client sentiment to capture crowd psychology and predict possible reversals.

Contrarian strategies aren't just about opposing the majority for its own sake but identifying when the consensus may be mistaken and capitalizing on these moments.

These strategies shine when combined with a comprehensive approach that includes both technical and fundamental analysis, revealing deeper market dynamics often overlooked by trend followers.

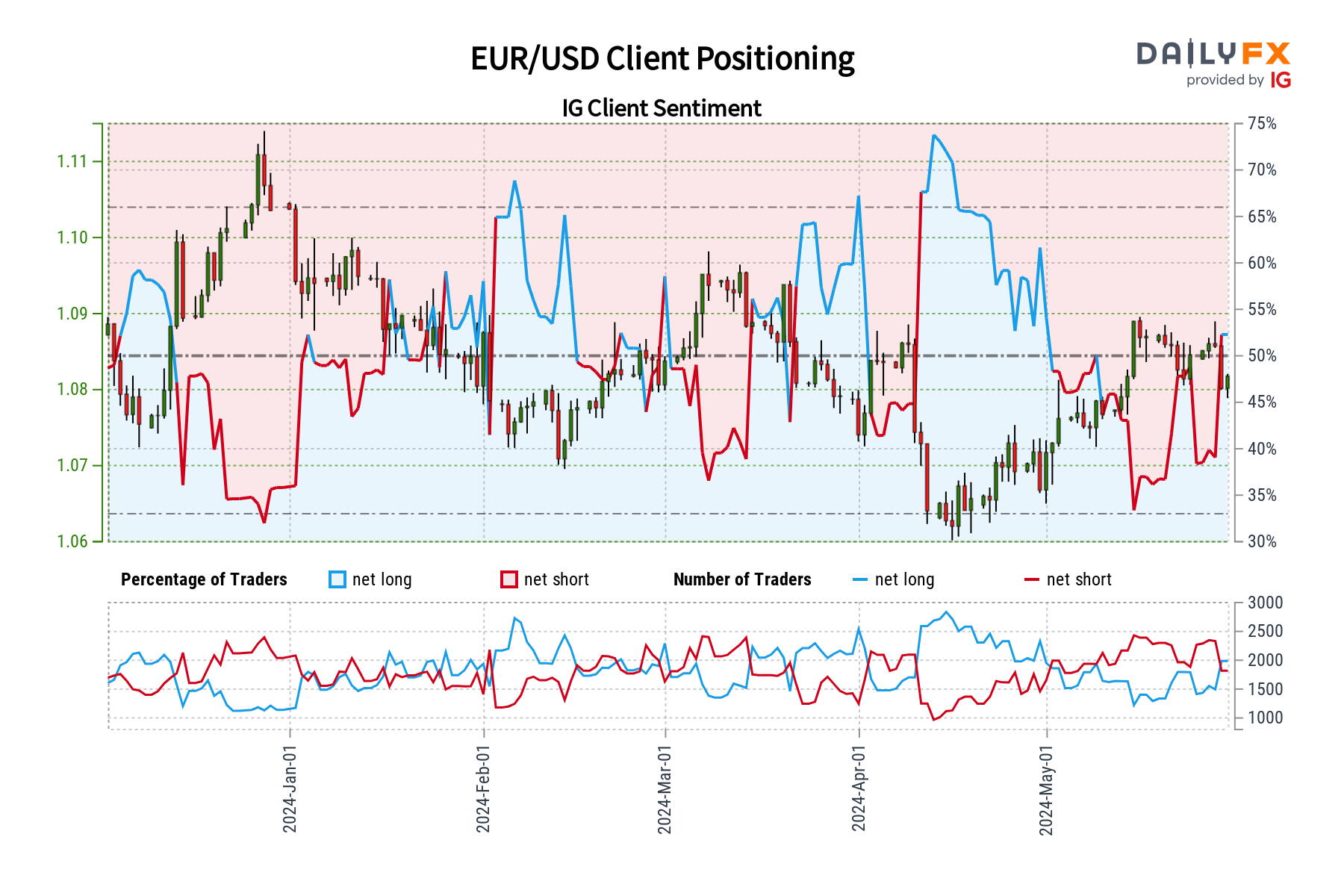

EUR/USD Market Sentiment

Current IG data shows that 50.87% of traders are bullish on EUR/USD, with a long-to-short ratio of 1.04 to 1. Buyer numbers have increased by 23.99% since yesterday, and short positions have dropped significantly.

Given this, our contrarian view suggests a potential decline for EUR/USD as the retail segment shows increased bullish sentiment.

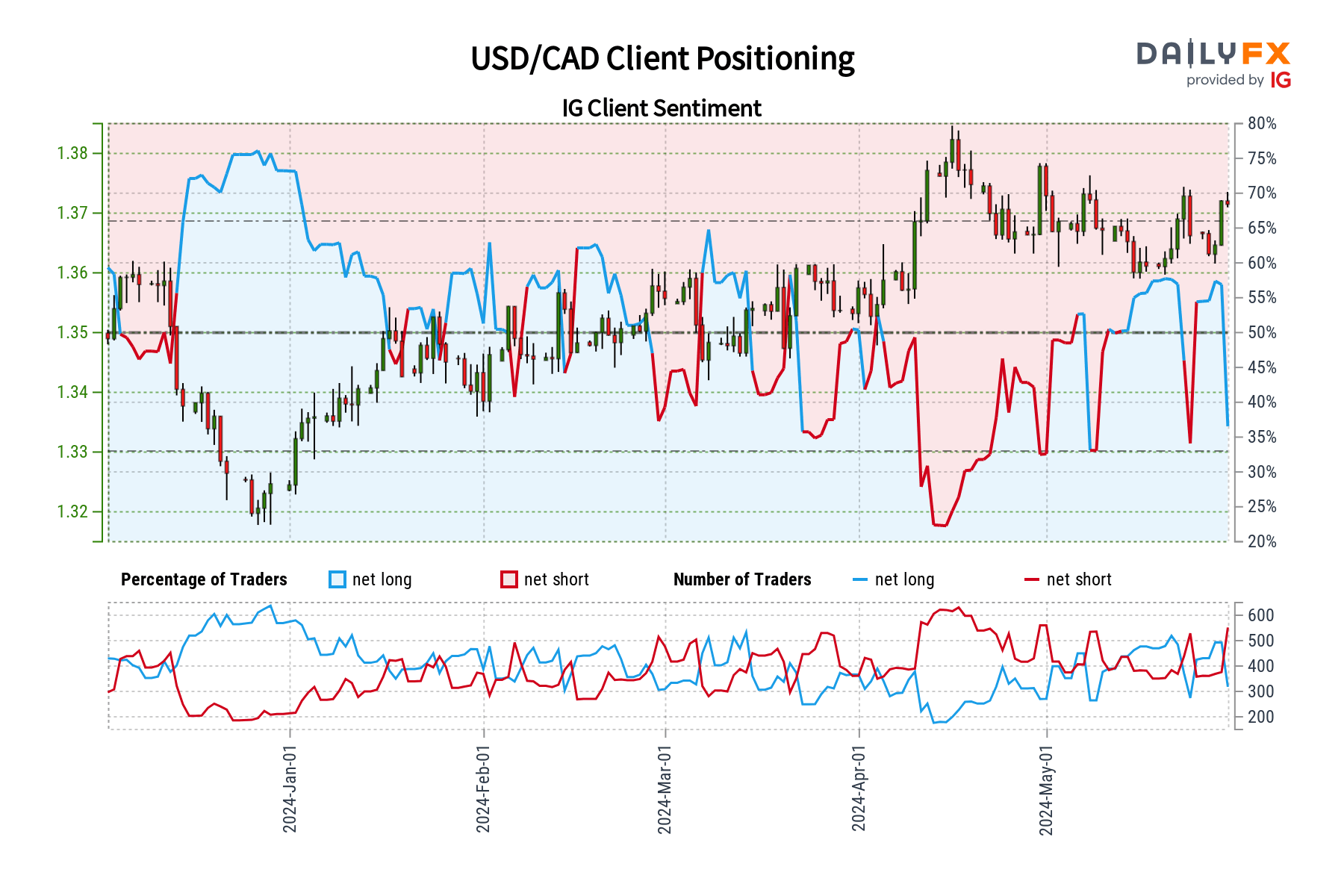

USD/CAD Market Sentiment

According to IG, 66% of traders are bearish on USD/CAD, with a short-to-long ratio of 2.27 to 1.

The notable increase in short positions coupled with a decrease in long bets enhances our bullish contrarian stance, anticipating potential upward movement for the pair.

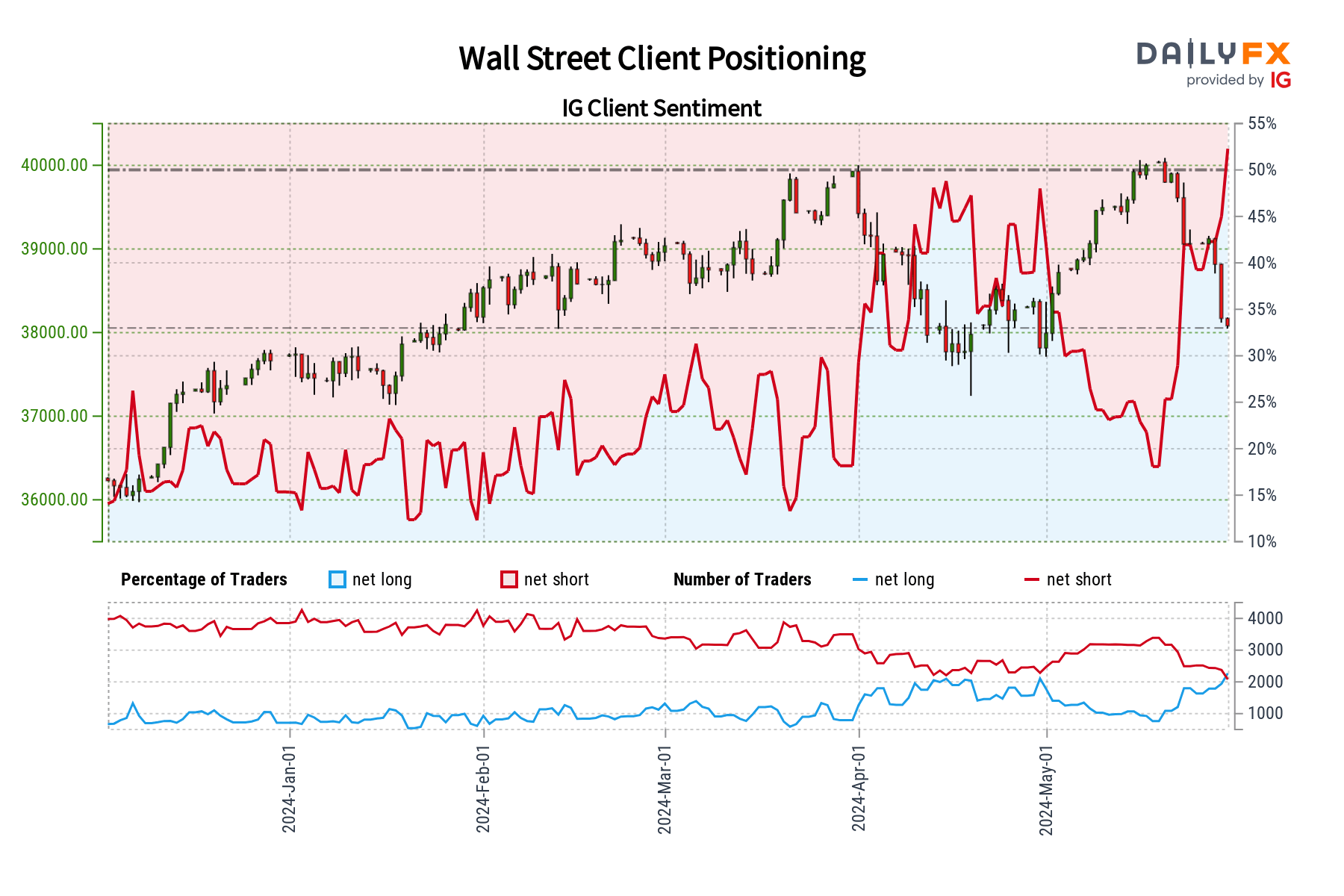

Dow Jones 30 Market Sentiment

IG data indicates 54.25% of traders are bullish on the Dow Jones 30, with a long-to-short ratio of 1.19 to 1.

The significant increase in net-long positions juxtaposed with a decrease in bearish bets suggests that despite the bullish sentiment, there might be room for downside, aligning with our bearish contrarian outlook.

These analyses across different assets demonstrate how contrarian thinking, supported by detailed sentiment analysis, can provide unique insights into market directions, challenging simpler bullish or bearish perspectives.