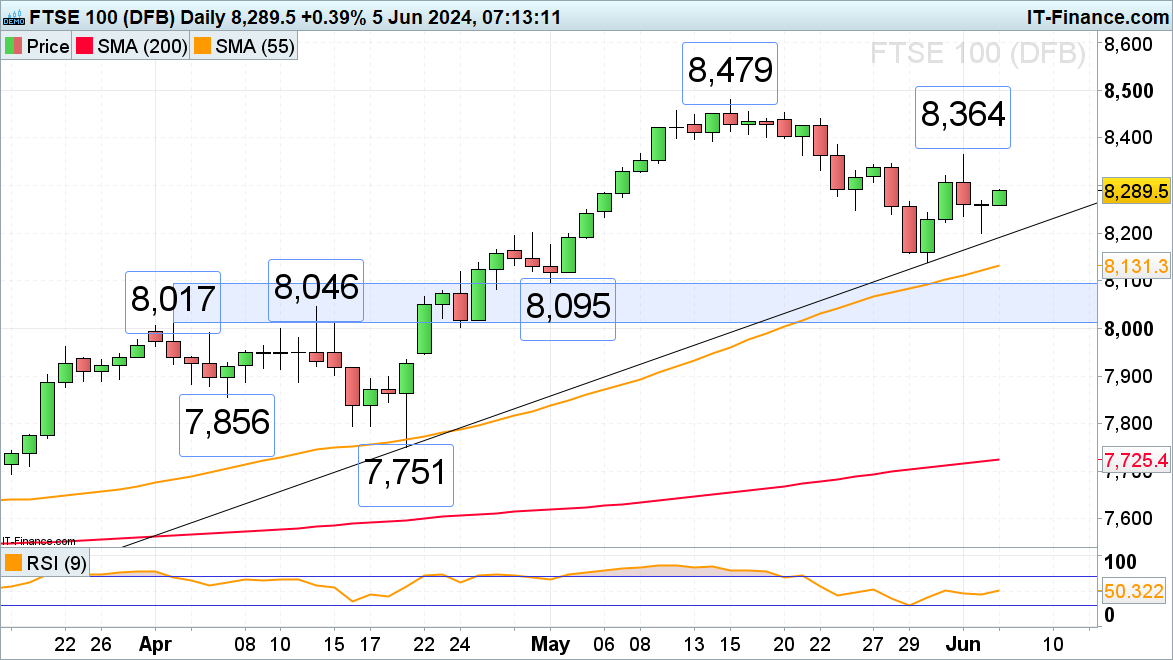

FTSE 100 Stages Comeback

The FTSE 100 displayed a potentially bullish hammer formation on Tuesday, signaling a possible reversal. Confirmation will hinge on a daily chart close above Tuesday’s high of 8,268.

Stability is supported by Tuesday’s low and the April-to-June uptrend from 8,199 to 8,192, setting the stage to revisit Monday’s high at 8,364.

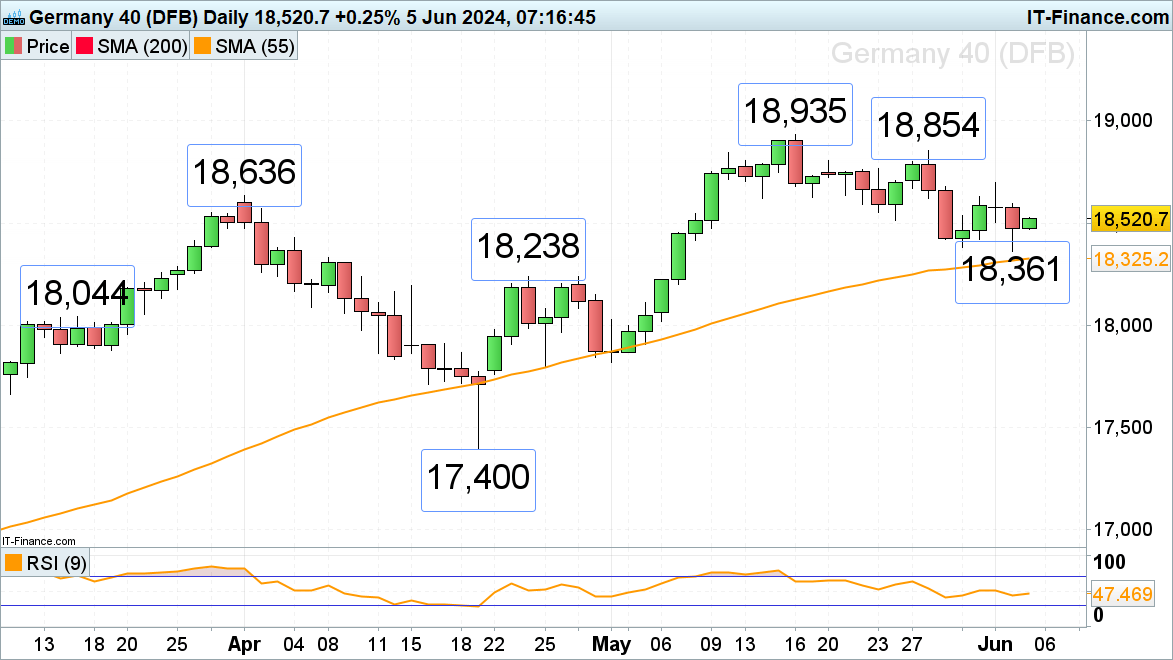

DAX 40 Recovers from Recent Drop

The DAX 40 tested last week’s low, dipping to 18,361, before regaining ground. Surpassing Tuesday’s high of 18,594 is crucial for refocusing on Monday’s peak at 18,700.

A break below this week’s low and the 55-day SMA from 18,361 to 18,325 could shift attention to the late April high at 18,238.

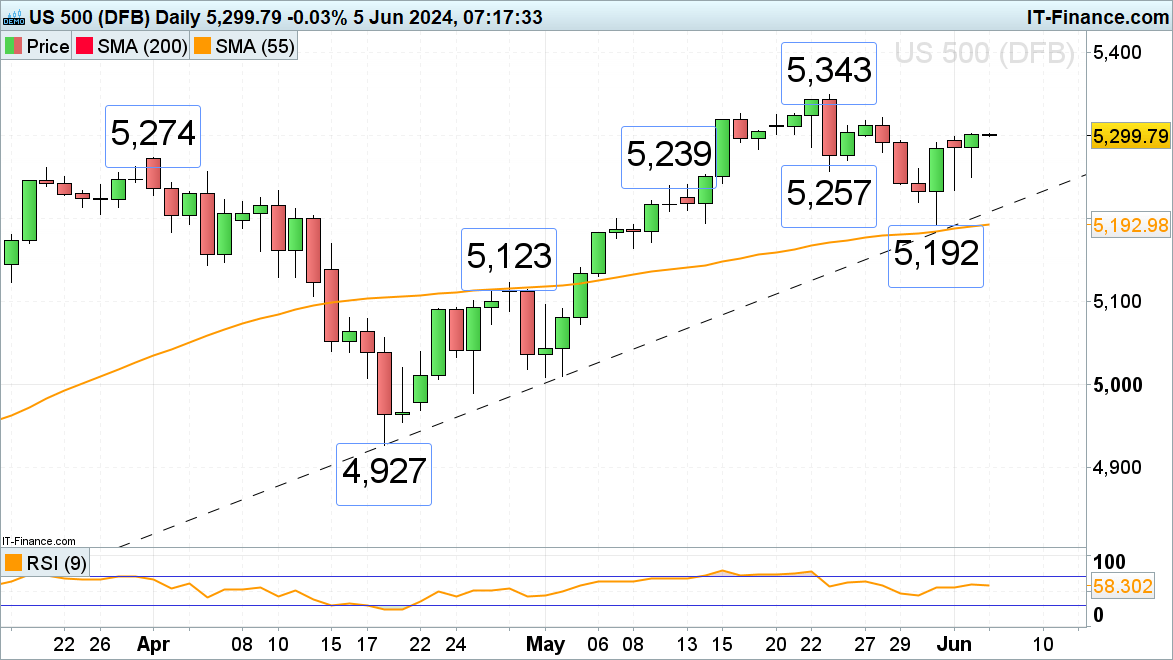

S&P 500 Rallies from Dip

The S&P 500’s pullback from its May record high of 5,343 to last Friday’s low at 5,192 seems to have concluded with last week’s low, indicative of an Elliott wave abc zig zag correction. This setup suggests an impending rally to new all-time highs, with the immediate target being the 28 May high at 5,321.

The medium-term uptrend remains secure as long as the late May low at 5,192 is maintained, with additional support at the 30 May high of 5,260 and the 23 May low of 5,257.