M4Markets Review

In Forex trading, selecting the right broker is crucial for your investment success. Forex brokers serve as the gateway to the global currency markets, offering platforms for trading various financial instruments. The importance of choosing a broker that aligns with your trading style and goals cannot be overstated. It ensures access to competitive spreads, advanced trading tools, and robust customer support.

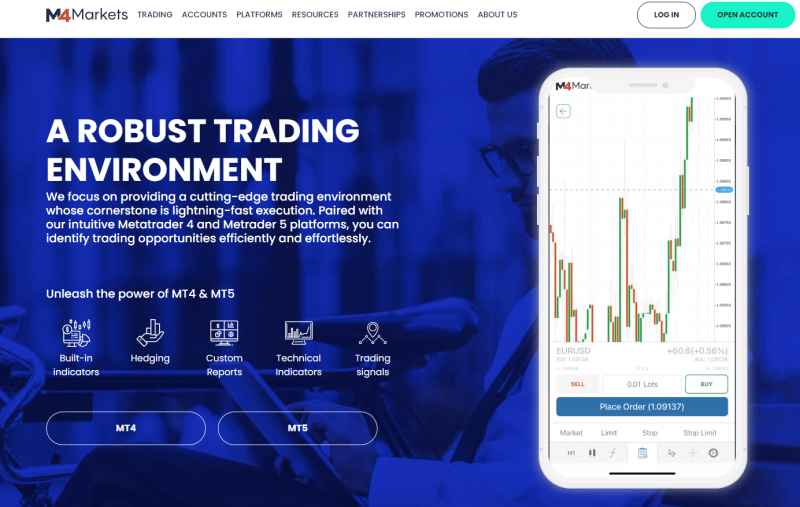

M4Markets distinguishes itself in this competitive landscape by offering MT4, MT5, and MT Mobile trading platforms, catering to traders of all levels. With a broad range of over 45 forex currency pairs, stock CFDs, commodities, indices, and precious metals like gold and silver, M4Markets positions itself as a versatile choice for personal investment and trading options.

Our review aims to dissect M4Markets’ offerings, spotlighting what sets it apart and where it might fall short. From exploring account types to unpacking the nitty-gritty of deposits, withdrawals, and fees, we endeavor to provide a comprehensive look at M4Markets. This analysis is designed to guide you through the complexities of Forex trading with M4Markets, helping you decide if it’s the right brokerage for your trading journey.

What is M4Markets?

M4Markets is a global Forex and CFD broker established in 2019, with a significant presence in Seychelles and Cyprus. It has quickly become a recognized name in the financial trading industry, serving over 4 million clients worldwide. M4Markets specializes in providing a wide array of trading options, including contracts for difference (CFDs) on currency pairs, cryptocurrencies, stocks, indices, commodities, energies, and metals.

The broker is known for its versatile account offerings. It provides a free demo account for beginners and those looking to practice their strategies without risk. For more experienced traders, there are four types of real accounts along with an Islamic (swap-free) account option, catering to a diverse clientele with various trading needs and ethical considerations. Clients can open accounts with base currencies including USD, EUR, JPY, or ZAR, making it accessible to a global audience.

Benefits of Trading with M4Markets

After trading with M4Markets, I’ve identified several key benefits that enhance the trading experience significantly. First, the availability of both MetaTrader 4 and MetaTrader 5 platforms offers a versatile trading environment. These platforms are widely acclaimed for their advanced charting tools, automated trading capabilities, and user-friendly interface, catering to the needs of both novice and experienced traders.

Another notable advantage is the competitive spreads and the option of high leverage up to 1:5000. This feature allows traders like myself to maximize potential profits by controlling a large position with a relatively small amount of capital. It’s a significant boon for those looking to scale their trading strategies without hefty initial investments.

Furthermore, the absence of withdrawal fees across a variety of payment methods stands out as a major plus. This policy ensures that traders can access their funds without incurring additional costs, making it more economical to withdraw profits. Coupled with the flexibility of multiple account types, including swap-free options for those who require them, M4Markets demonstrates a commitment to accommodating a diverse range of trading preferences and ethical considerations.

M4Markets Regulation and Safety

After trading with M4Markets, I’ve taken a closer look at its regulatory framework and safety measures. The broker is owned by Trinota Markets (Global) Ltd, a company registered in Seychelles. It’s important to understand the significance of regulation in the Forex world; it serves as a marker of reliability and security for traders. M4Markets is regulated by the FSA (Financial Service Authority) in Seychelles and the CySEC (Cyprus Securities and Exchange Commission), two respected bodies in the financial industry.

Further enhancing its credibility, M4Markets’ operations are also overseen by the DFSA and FSCA. This dual regulation is not just a formality; it’s a critical layer of protection for traders, potentially eliminating many issues that clients might face with less-regulated brokers. Knowing that M4Markets adheres to strict regulatory standards gives me a sense of security, highlighting its commitment to maintaining a safe and transparent trading environment. This information is crucial for anyone considering M4Markets as their broker, as it underscores the importance of choosing a regulated platform to safeguard their investments.

M4Markets Pros and Cons

Pros

- Accessible with a minimum deposit of $5.

- MT4 and MT5 platforms supported.

- Wide range of assets for trading.

- Four real account types plus Islamic option.

- Additional earning opportunities like copy trading.

Cons

- Only offers CFDs.

- Restrictions on clients from specific countries.

M4Markets Customer Reviews

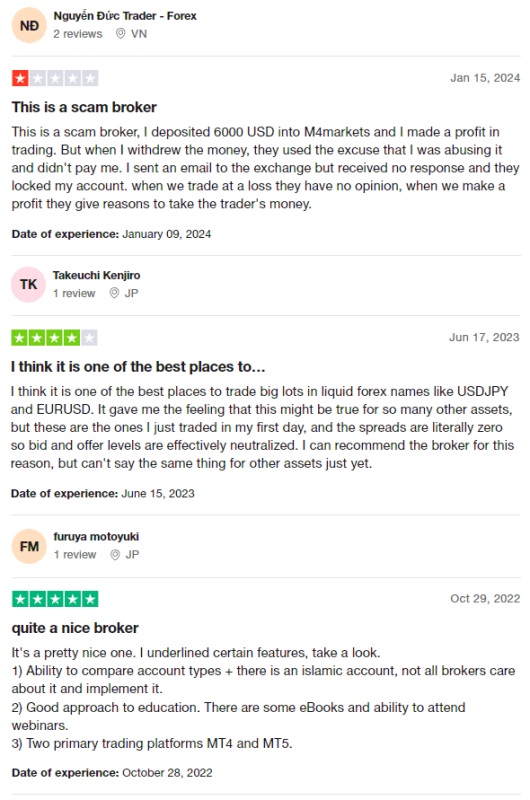

Customer reviews of M4Markets reveal mixed experiences. Some traders have raised concerns, labeling the broker as a scam after encountering issues with withdrawals and account restrictions, particularly following profitable trades. They reported a lack of response from customer service and accusations of abuse as reasons for their dissatisfaction.

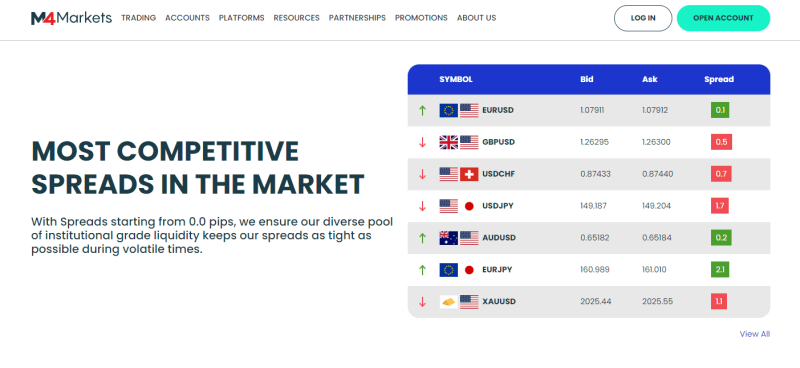

On the other hand, many users praise M4Markets for its competitive spreads, especially in liquid forex pairs like USDJPY and EURUSD, and appreciate the broker’s trading conditions for large lot sizes. Additionally, the availability of various account types, including an Islamic account option, and a focus on trader education through eBooks and webinars have been highlighted as positive aspects. This blend of feedback underscores the importance of due diligence and personal experience when evaluating the suitability of a Forex broker.

M4Markets Spreads, Fees, and Commissions

M4Markets tailors its spreads, fees, and commissions to accommodate various trading preferences and strategies. The broker operates with floating spreads, meaning these spreads fluctuate based on market conditions. In my experience, the “Standard” account offers spreads starting from 1.1 pips, which is competitive for casual traders. For those utilizing dynamic leverage, the spreads begin at 1.6 pips. Notably, M4Markets also provides options where spreads start from 0 pips, catering to more aggressive trading styles.

Regarding commissions, M4Markets adopts a straightforward approach. Only the “Raw Spread” and “Premium” accounts incur commission charges, set at $3.5 and $2.5 respectively. This tiered commission structure allows traders to choose an account that best suits their trading volume and strategy preferences.

Withdrawal fees at M4Markets are another aspect to consider. While some brokers impose fixed or percentage-based fees on withdrawals, M4Markets stands out by not charging any withdrawal fees for most methods. This policy enhances the broker’s attractiveness by reducing the overall cost of trading for its clients. However, it’s always wise to verify the specific terms for your preferred withdrawal method, as conditions and policies may vary.

Account Types

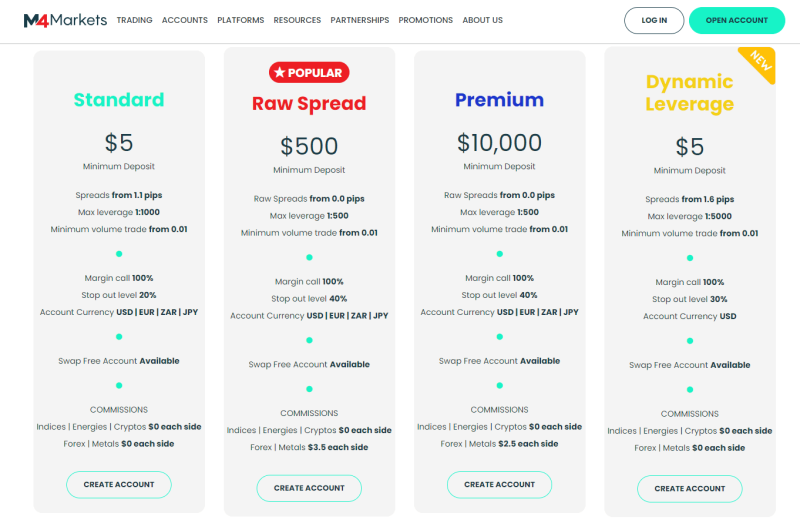

Standard Account

The Standard Account is an excellent starting point for newcomers, requiring a minimal deposit of just $5. Spreads begin at 1.1 pips, and there’s no commission on trades. It offers a generous maximum leverage of 1:1000, with a margin call set at 100% and a stop-out level at 20%. This account is ideal for those looking to enter the Forex market with a low investment.

Raw Spread Account

For traders focusing on minimizing spreads, the Raw Spread Account offers spreads starting from 0 pips and charges a commission of $3.5 per lot. A higher minimum deposit of $500 is required, with leverage available up to 1:500. The margin call and stop-out levels are set at 100% and 40%, respectively, making it suitable for more experienced traders seeking tighter spreads and higher leverage.

Premium Account

The Premium Account is designed for high-volume traders, with a significant minimum deposit of $10,000. It mirrors the Raw Spread Account in terms of spreads and leverage but offers a lower commission rate of $2.5 per lot. The high deposit requirement, combined with low spreads and competitive commissions, positions this account for serious traders with substantial capital.

Dynamic Leverage Account

The Dynamic Leverage Account stands out for its flexibility in leverage, going up to 1:5000, and appeals to those willing to take on high risk for potentially higher rewards. With a minimum deposit of just $5 and spreads starting from 1.6 pips without any commission, this account offers a unique balance between accessibility and high-leverage trading opportunities. The margin call is at 100%, and the stop-out level is adjusted to 30%, catering to traders who prioritize leverage in their strategies.

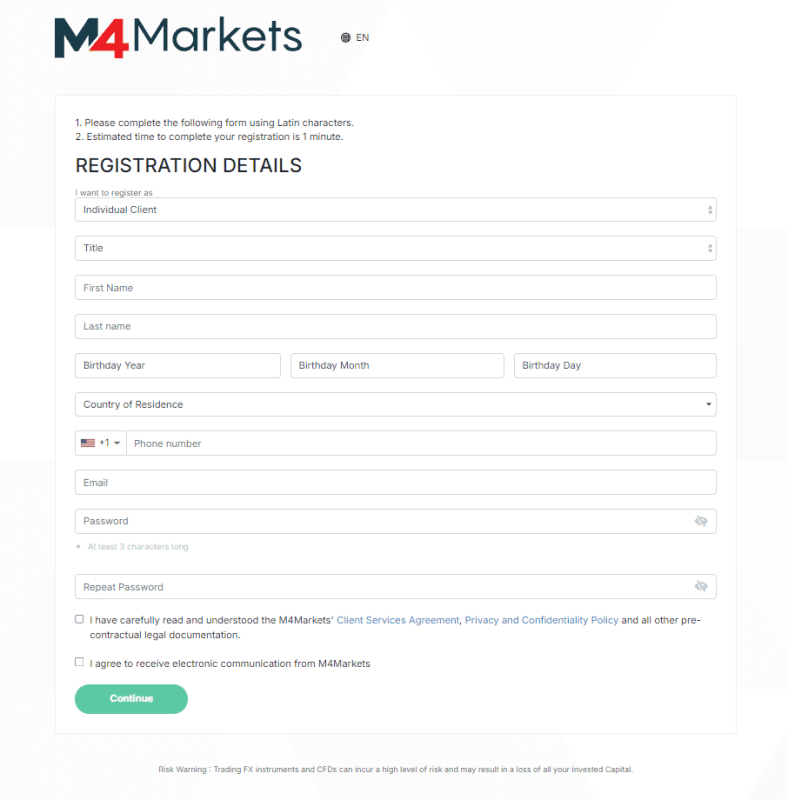

How to Open Your Account

- Visit the broker’s website and select your preferred language in the top right corner.

- Click on “Open Account” and choose between an individual or corporate account, then fill in your name, date of birth, and country of residence.

- Provide your contact details such as phone number and email address, create a password, and agree to the terms and conditions.

- After clicking “Continue,” check your email for a PIN code, enter it on the website, or click on the “Confirm Email” button in the email.

- Verify your account by clicking on the verification link, upload the required documents as instructed, and wait for approval.

- Click on “Open Real Account,” select the desired account type and its specifications.

- To fund your account, click on the “Deposit” button, choose a deposit method, and complete the necessary steps.

- Download the trading platform from the “Downloads” section, install it, log in, and begin trading.

M4Markets Trading Platforms

Based on my experience, M4Markets offers traders the flexibility of choosing between two of the most renowned trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms are widely recognized for their robust features, catering to both novice and experienced traders. MT4 is particularly famous for its user-friendly interface, comprehensive analytical tools, and automated trading capabilities. It’s a solid choice for those looking to dive into forex trading with a platform that supports a wide range of trading strategies.

On the other hand, MT5 presents a more advanced trading experience, offering additional technical indicators, timeframes, and graphical objects. This platform is designed to accommodate more sophisticated trading operations, including the trading of CFDs on stocks, which makes it a versatile option for traders looking to expand beyond forex.

What Can You Trade on M4Markets

From my experience trading with M4Markets, the range of trading instruments available is impressively diverse. The broker offers Contracts for Difference (CFDs) on a wide array of assets, ensuring that traders of all interests and strategies can find opportunities. Among these, CFDs on currency pairs are a standout, offering access to major, minor, and exotic pairs, which provides a broad spectrum for forex trading strategies.

Moreover, M4Markets doesn’t stop at forex; it extends into cryptocurrencies, stocks, indices, commodities, energies, and metals. This variety means you can trade on the price movements of popular digital currencies, dive into the stock market, speculate on global indices, or explore commodities like oil and gold. The inclusion of energies and metals further broadens the investment opportunities, allowing for a well-rounded trading portfolio. Based on my trading journey, M4Markets caters to those who seek a comprehensive trading experience with the flexibility to move across different markets.

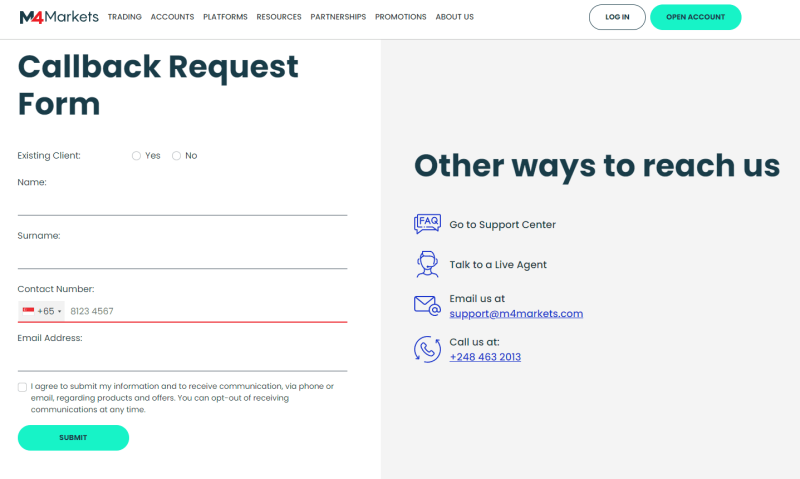

M4Markets Customer Support

Based on my experience, M4Markets’ customer support is both accessible and versatile, catering to a wide range of preferences for communication. The broker offers multiple channels for reaching out, including the option to request a callback directly from their website, which is convenient for those who prefer speaking with a representative over the phone. Additionally, support can be contacted through email or LiveChat, both available on the website and within the user account, providing immediate assistance for urgent inquiries.

M4Markets also maintains a strong presence on social media platforms like Facebook, Instagram, LinkedIn, Twitter, and YouTube. This not only facilitates another avenue for contacting support but also allows clients to stay updated with the latest company news and market insights. Following their profiles is recommended to keep abreast of any updates or changes. From my dealings with them, M4Markets’ approach to customer support reflects their commitment to ensuring a satisfactory trading experience for all clients, highlighting their dedication to effective and efficient service.

Advantages and Disadvantages of M4Markets Customer Support

Withdrawal Options and Fees

When trading on a demo account with M4Markets, it’s important to remember that all transactions are conducted with virtual currency. This means you cannot withdraw real profits since these trades are simulations designed for practice. The switch to a real account, however, opens the door to actual trading, where generated income becomes withdrawable.

M4Markets provides its clients the flexibility to withdraw their earnings at any point. Withdrawal requests can be easily made through the user account on the broker’s website. Available withdrawal methods include bank transfer, Visa, Mastercard, Skrill, Neteller, Perfect Money, FasaPay, and PayRedeem, catering to a wide range of preferences.

One of the standout features of M4Markets is the absence of withdrawal fees. This broker ensures that clients can access their funds without incurring additional charges, regardless of the withdrawal method selected, the amount, or any other conditions. However, it’s crucial for traders to note that while M4Markets doesn’t charge fees, external charges from banks or payment processors may apply.

M4Markets Vs Other Brokers

#1. M4Markets vs AvaTrade

M4Markets and AvaTrade are both respected brokers in the Forex and CFD trading space, but they cater to different trader needs and preferences. M4Markets, established in 2019, offers competitive spreads, high leverage up to 1:5000, and a wide range of trading platforms including MT4 and MT5. AvaTrade, on the other hand, has been around since 2006 and stands out with its broad array of over 1,250 financial instruments and commitment to heavy regulation and licensing across multiple jurisdictions. AvaTrade’s global reach and regulatory compliance make it a preferred choice for traders looking for stability and a wide range of trading options.

Verdict: AvaTrade edges out for traders valuing regulation and instrument diversity, while M4Markets is more suited for those seeking high leverage and advanced trading platforms.

#2. M4Markets vs RoboForex

Comparing M4Markets to RoboForex highlights distinct differences in their offerings and market focus. RoboForex, operational since 2009, emphasizes technology and a vast selection of trading platforms, including MetaTrader, cTrader, and RTrader, alongside offering more than 12,000 trading options across eight asset classes. M4Markets, with its high leverage and focus on Forex and CFDs, provides a streamlined trading experience with access to the popular MetaTrader platforms.

Verdict: RoboForex is the better option for traders looking for technological diversity and a wide array of trading instruments. M4Markets, however, might appeal more to Forex-focused traders prioritizing leverage and platform familiarity.

#3. M4Markets vs Exness

When comparing M4Markets to Exness, the latter brings to the table a strong reputation in the Forex industry since 2008, with a remarkable monthly trading volume and an extensive offering of over 120 currency pairings, including exotic options like cryptocurrencies. Exness is known for its low commissions, instant order execution, and the unique offering of unlimited leverage on small deposits. M4Markets, while newer, competes with dynamic leverage and a variety of account types.

Verdict: Exness stands out for traders who prioritize a wide selection of currency pairs and the unique benefit of unlimited leverage, making it an attractive choice for both new and seasoned traders seeking flexibility and broad market access. M4Markets, however, holds its ground for those looking for high leverage and a straightforward trading experience.

Also Read: AvaTrade Review 2024- Expert Trader Insights

OPEN AN ACCOUNT WITH M4MARKETS

Conclusion: M4Markets Review

M4Markets emerges as a competitive option in the Forex and CFD trading arena, especially for traders drawn to high leverage, a selection of advanced trading platforms, and a diverse range of trading instruments. The broker’s commitment to offering both MT4 and MT5 platforms caters to the needs of various trading styles, from beginners to advanced traders. Additionally, the absence of withdrawal fees across a broad spectrum of withdrawal methods stands out as a significant advantage, enhancing the overall trading experience by making it more cost-efficient for traders.

However, potential clients should be mindful of the broker’s limitations, such as the exclusive focus on CFDs, which may not suit all investment strategies, and the geographical restrictions that could affect traders in certain regions. The mixed customer reviews, highlighting both positive aspects and areas of concern, underscore the importance of careful consideration and due diligence before committing to a broker.

Also Read: ZFX Broker Review 2023 – Expert Trader Insights

M4Markets Review: FAQs

What trading platforms does M4Markets offer?

M4Markets provides access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, catering to a wide range of trader needs and preferences, from beginners to advanced users.

Are there any withdrawal fees at M4Markets?

M4Markets does not charge any withdrawal fees, regardless of the method chosen. However, traders should be aware that external fees may be applied by their chosen payment provider or bank.

Can traders from all countries open an account with M4Markets?

M4Markets serves a global client base but does not accept traders from certain countries, including Syria, North Korea, and Cuba, due to regulatory restrictions and compliance requirements.

OPEN AN ACCOUNT NOW WITH M4MARKETS AND GET YOUR BONUS