LMFX Review

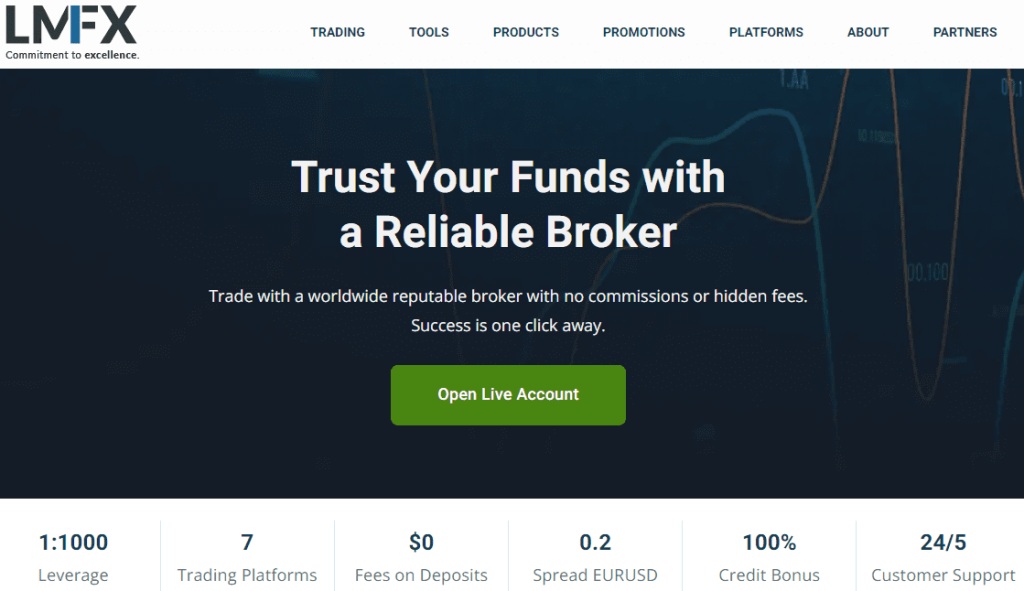

LMFX is a forex and CFD broker that provides traders with access to a wide range of trading instruments, including forex, stocks, commodities, and cryptocurrencies. This broker has gained a reputation for offering a dependable trading experience.

With LMFX, trading is made budget-friendly due to its highly competitive spreads. Besides, various account alternatives are available for traders of all levels and styles; the premium account, in particular, offers excellent conditions for seasoned traders!

This LMFX review will provide an objective evaluation of the broker’s features, trading conditions, and user experience. We will also analyze feedback from other traders to help you make an informed decision on whether LMFX is a suitable choice for your trading needs.

What is LMFX?

Trading in the financial market can be a challenging experience, especially for beginners. LMFX aims to simplify the trading process by providing user-friendly platforms, educational materials, and a supportive customer service team to help traders understand the complexities of the market.

LMFX is a forex and CFD broker that was established in 2015. The broker is regulated by the Financial Services Commission (FSC) of the Republic of Macedonia, which ensures that the broker adheres to strict guidelines and standards to protect traders’ interests. LMFX is a broker that provides an array of account types to address the specific needs of each trader.

If you are an experienced investor or a newbie to the market, LMFX offers powerful tools and resources to help ensure your success. From a range of trading instruments to a proprietary WebTrader platform and a unique Loyalty Program, LMFX has something to offer every trader. Researching and understanding the broker’s offerings before opening an account is essential. Still, LMFX’s reputation as a reliable and regulated broker makes it a good choice for traders looking to enter the market.

Advantages and Disadvantages of Trading with LMFX

Benefits of Trading with LMFX

For those searching for a broker with minimal entry requirements, LMFX is an excellent choice. With just $50 in the minimum deposit requirement, it’s an ideal platform for traders with limited capital who want to explore forex trading without investing too much money immediately. Whether new or experienced at this type of venture, LMFX provides accessibility and affordability so that nobody has to miss out on the incredible opportunities available through forex trading.

LMFX also offers a range of account types to cater to different trading styles, including demo accounts for beginners and premium accounts for advanced traders. This flexibility allows traders to choose an account that suits their needs and preferences, making it easier to manage their trades and achieve their financial goals.

Another benefit of trading with LMFX is the availability of the popular MetaTrader 4 platform. Known for its intuitive interface, advanced charting, and expert advisor support, MetaTrader 4 is a popular choice among traders. The platform is easy to use and provides powerful tools to help traders analyze market data and execute trades precisely.

LMFX provides competitive trading conditions, including tight spreads, fast execution speeds, and sufficient trading leverage. These trading conditions can help traders maximize their potential profits and minimize risk exposure.

Overall, LMFX is a reputable broker with a range of benefits for traders of all levels. Whether you’re a beginner or an experienced trader, the platform offers a range of features and tools to help you achieve your financial goals.

LMFX Pros and Cons

Pros

- Low entry threshold

- Sufficient trading leverage

- Convenient and popular platform MetaTrader 4

- Multiple Account Types

Cons

- No crypto, ETF, or options trading

- Withdrawal processing times can be slow

LMFX Customer Reviews

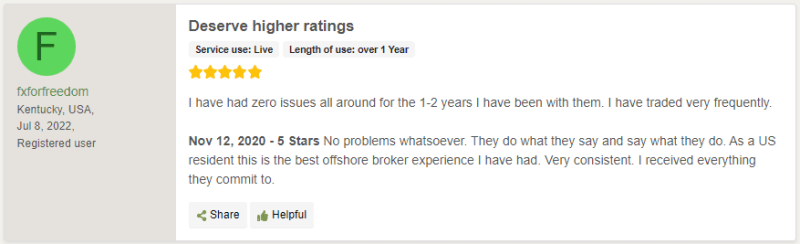

There are mixed reviews about LMFX from customers. One registered user had a positive experience and gave a 5-star review, stating that they had no problems trading with LMFX and received everything promised. As a US resident, they also noted that LMFX was the best offshore broker they have dealt with.

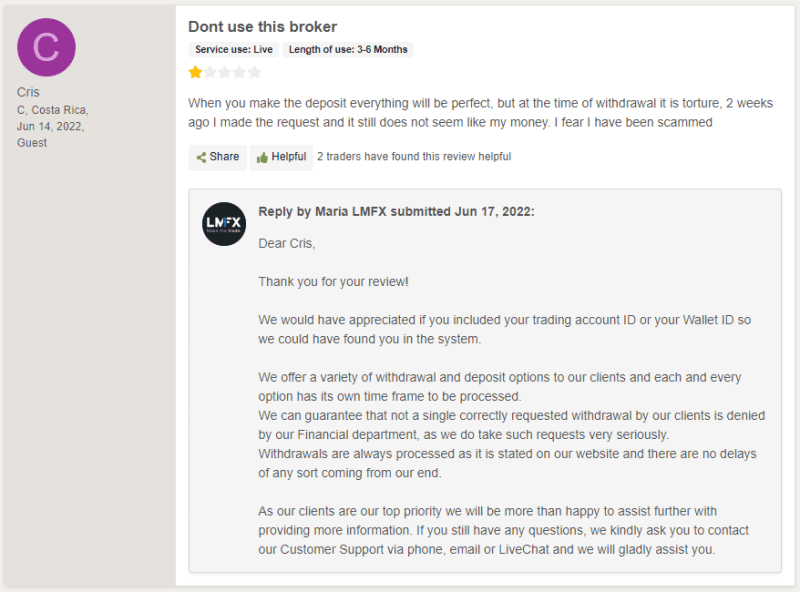

However, another user faced issues while withdrawing their funds and mentioned that it took two weeks to complete the process, which they found torture. This indicates that the withdrawal processing time of LMFX may be slower than some traders expect.

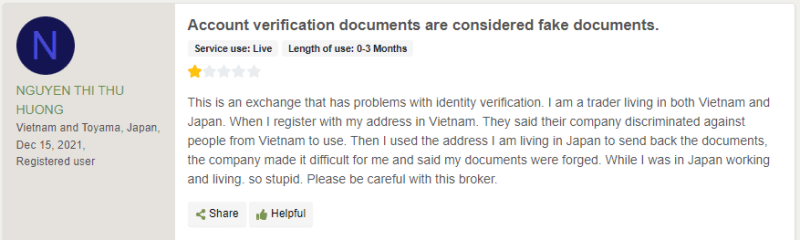

Another trader had a negative experience while verifying their identity with LMFX. They mentioned that the company had problems with identity verification and had difficulty registering as a trader in Vietnam and Japan. The trader also stated that LMFX accused them of using forged documents. This highlights the importance of carefully following LMFX’s registration and verification process to avoid issues.

Overall, these reviews suggest that while some traders may have had a positive experience trading with LMFX, others have faced withdrawal and identity verification issues. Traders must research and consider the pros and cons before choosing to trade with LMFX.

LMFX Spreads, Fees, and Commissions

LMFX offers traders different account types with variable spreads, fees, and commissions. Premium and Fixed accounts have no commissions charged, and the spreads start from 1.1 pips for EUR/USD. However, for Premium accounts, the typical spread for GBP/USD is 2.6 pips, and for EUR/GBP, it is 2.1 pips. Meanwhile, Fixed accounts have higher base rates for GBP/USD and EUR/GBP, with spreads of 2.6 pips and 2.2 pips, respectively, and a spread of 1.1 pips for EUR/USD.

On the other hand, the Zero account offers raw spreads with no markup, resulting in lower spreads of 0.8 pips for GBP/USD, 0.5 pips for EUR/GBP, and 0.2 pips for EUR/USD. However, Zero accounts charge a commission of $4 per lot traded.

LMFX offers competitive leverage ratios of up to 1:1000 for Premium accounts, which is higher than the 1:400 leverage ratio for Fixed accounts and the 1:250 leverage ratio for Zero accounts. Traders should take note of the risks involved in high leverage, as it can amplify both profits and losses.

Deposit fees and inactivity fees are not assessed by LMFX. Traders must confirm any additional fees that their financial institution may impose. There are no withdrawal costs.

Regarding fees, spreads, and commissions on CFDs and forex trading, traders can expect spreads ranging from 0.7 pips to 3 pips, depending on the asset being traded. It is essential to consider these costs when trading with LMFX, as they can affect overall profitability.

Account Types

LMFX offers three different account types to cater to the needs of traders with varying preferences, experience levels, and capital requirements.

#1. The Premium

The Premium account is ideal for standard trading strategies and less experienced traders. This account has a minimum deposit requirement of $50. It offers fifth decimal pricing, a personal account manager, access to MT4 and mobile trading platforms, and a range of trading instruments.

#2. The Fixed

The Fixed account is designed for automated trading using expert advisors. It has higher spreads than the Premium account but offers zero commissions. The minimum deposit requirement for this account type is $250. Traders can access fifth decimal pricing, a personal account manager, and both MT4 and mobile trading platforms.

#3. The Zero

The Zero account is best suited for scalping and high-volume trading. It has the lowest spreads of all the account types and offers raw spreads with no markup. The minimum deposit requirement for this account type is $100, and it comes with a commission of $4 per lot traded. Traders with this account type can also access fifth decimal pricing, a personal account manager, and MT4 and mobile trading platforms.

Overall, LMFX provides a range of account types to meet the varying needs of traders, with competitive features such as low minimum deposits, fifth decimal pricing, and access to both MT4 and mobile trading platforms.

How To Open Your Account?

LMFX is a forex trading platform that allows interested traders to open an account with them. Opening an account is simple and can be completed in a few steps. First, visit the LMFX Official Website and click on “Open Live Account” at the top menu. This will take you to the registration page, where you will fill in your personal details and create your account.

After registering, you will receive a confirmation email from LMFX with your login credentials. Use these credentials to log in to LMFX’s account management portal from the LMFX Official Website. Once logged in, you can deposit into your account using the available payment options. The minimum deposit amount is $50.

Next, download the LMFX MT4 trading platform on your PC or mobile phone. You can then use your login credentials to log into the platform and start trading. LMFX offers a variety of account types, each with different features and benefits, so choose the one that best suits your trading needs.

LMFX also provides excellent customer support. You can contact their team online for assistance if you encounter any problems or questions. Overall, opening an account with LMFX is a straightforward process that can be completed in simple steps.

What Can You Trade on LMFX

LMFX is a forex and CFD trading platform offering clients a wide range of tradable instruments. The platform allows traders to trade various financial instruments such as Forex, metals, CFDs, indexes, and stocks. With LMFX, traders can access different markets and instruments in real time through the platform’s user-friendly interface.

Forex Trading

Forex Trading is one of the most popular types of trading on LMFX. Traders can trade over 50 forex pairs, including major currency pairs like EUR/USD, USD/JPY, and GBP/USD. With LMFX, traders can benefit from competitive spreads, fast execution, and various tools and indicators to assist them in trading decisions.

Metals Trading

Metals Trading is another popular asset class offered by LMFX. Traders can trade in various precious metals like Gold, Silver, and Platinum. These metals are available for trading as spot contracts, and traders can also trade them on margin.

CFD Trading

CFD Trading is also a popular type of trading on LMFX. With CFDs, traders can speculate on the price movements of various financial instruments such as indices, commodities, and cryptocurrencies. LMFX offers a range of CFDs on different markets, including major indices like the S&P 500, commodities like crude oil and natural gas, and cryptocurrencies like Bitcoin and Ethereum.

In addition to forex, metals, and CFDs, LMFX also offers traders the opportunity to trade stocks. With LMFX, traders can buy and sell shares of some of the world’s largest and most well-known companies, such as Apple, Amazon, Facebook, and Google.

Overall, LMFX offers traders access to a broad range of tradable instruments, making it an attractive platform for traders of all levels. With its user-friendly interface, competitive spreads, and fast execution, LMFX is an excellent choice for traders looking for a reliable and feature-rich trading platform.

LMFX Customer Support

The platform understands the importance of providing top-notch customer service. It is committed to ensuring its clients receive the support they need whenever needed.

One of the primary customer support options available on LMFX is email support. Traders can email the support team anytime, and they will receive a response within 24 hours. The support team is highly trained and knowledgeable. They can help with various issues, including account inquiries, technical difficulties, and trading-related questions.

In addition to email support, LMFX also offers live chat support. The live chat feature is available on the platform’s website. It allows traders to chat with a support representative in real time. The live chat feature is ideal for traders who need immediate assistance with an issue and want to get an email response immediately.

Another customer support option available on LMFX is phone support. Traders can call the support team directly to speak with a representative who can assist them with any questions or concerns. The phone support line is available during regular business hours. It is an excellent option for traders who prefer to speak with someone directly.

Overall, LMFX offers a range of customer support options to ensure that its clients receive the help they need whenever they need it. The support team is highly trained and knowledgeable and committed to providing the highest level of customer service possible.

Advantages and Disadvantages of LMFX Customer Support

Security for Investors

Withdrawal Options and Fees

LMFX offers a variety of withdrawal options for traders who want to access their funds. The platform understands the importance of timely and secure withdrawals. It has designed its withdrawal process to be as easy and convenient as possible for its clients.

One of the primary withdrawal options available on LMFX is a bank transfer. Traders can withdraw funds directly to their bank account, and the process typically takes 2-7 business days to complete. The platform also offers a range of e-wallet options, including Skrill, Neteller, and Fasapay, which provide faster processing times and lower fees than bank transfers.

LMFX does not charge any withdrawal fees for e-wallet withdrawals. Still, there may be fees associated with bank transfers, depending on the bank used. Traders should also be aware that fees may be associated with currency conversions, depending on the currency used for the withdrawal.

Overall, LMFX offers a range of withdrawal options to ensure traders can access their funds quickly and easily. The platform is committed to providing transparent and competitive fees and strives to make the withdrawal process as seamless as possible for its clients.

LMFX Vs Other Brokers

#1. LMFX vs Avatrade

One of the primary advantages of LMFX compared to Avatrade is its range of account types, including zero-spread and premium accounts. In addition, LMFX offers high leverage of up to 1:1000, which can be attractive to traders looking to maximize their profits. However, AvaTrade may offer more advanced trading features and analysis tools than LMFX.

When it comes to account types, LMFX offers three types of accounts: the Zero account with no commission, the Premium account with a commission, and the Fixed account with fixed spreads. Avatrade, on the other hand, offers four account types: Standard, Gold, Platinum, and Ava Select.

In terms of trading instruments, LMFX offers a range of currency pairs, as well as commodities, indices, and shares. Avatrade offers a similar range of trading instruments, but also includes options trading.

Overall, both LMFX and AvaTrade are reputable brokers with competitive trading conditions. However, based on account types and trading instruments offered, AvaTrade may be more suitable for traders looking for a wider range of options.

#2. LMFX vs RoboForex

Roboforex and LMFX are both popular forex and CFD trading platforms. Still, there are some differences in their fees and trading conditions. LMFX offers competitive spreads and a range of account types, while Roboforex provides low spreads and commission-based pricing. Additionally, LMFX offers high leverage of up to 1:1000, which can attract traders looking to maximize their profits. Still, Roboforex may offer more advanced trading features and analysis tools compared to LMFX.

When it comes to regulation, LMFX is regulated by the offshore jurisdiction of Saint Vincent and the Grenadines, while Roboforex is regulated by the more reputable CySEC in Cyprus. This may make Roboforex a more trustworthy option for some traders. However, it is important to note that both brokers have been in operation for a number of years and have established reputations in the industry.

In terms of customer support, both brokers offer 24/5 customer support via live chat, email, and phone. LMFX also offers a personal account manager for their clients. When it comes to fees and charges, both brokers offer similar fees for deposits and withdrawals, with LMFX charging a slightly higher withdrawal fee for some methods.

In terms of the winner of this comparison, it really depends on what is most important to the individual trader. LMFX offers a wider range of account types and a lower minimum deposit, while Roboforex offers more trading platforms and is regulated by a more reputable authority.

#3. LMFX vs Alpari

LMFX offers a range of account types, competitive spreads, and high leverage of up to 1:1000. In contrast, Alpari offers commission-based pricing and a range of trading platforms. Additionally, LMFX is regulated in Belize, while Alpari is regulated in multiple jurisdictions, which may offer greater oversight and protection for traders. However, Alpari may offer more advanced trading features and analysis tools than LMFX.

In terms of customer support, both brokers offer 24/5 customer support via live chat, email, and phone. Alpari also offers a range of educational resources for traders, including webinars, trading analysis, and a trading school.

When it comes to fees and charges, both brokers offer similar fees for deposits and withdrawals, with LMFX charging a slightly higher withdrawal fee for some methods. In terms of the winner of this comparison, Alpari’s regulation by reputable authorities may make it a more attractive option for some traders, while LMFX’s lower minimum deposit and a wider range of account types may make it a better fit for others.

Conclusion: LMFX Review

LMFX is a forex and CFD trading platform that offers a range of features and benefits for traders. Overall, LMFX has several advantages that make it a competitive choice for traders, including a range of account types, competitive spreads, high leverage of up to 1:1000, and multiple customer support options.

In addition, LMFX offers a range of educational resources and market analysis tools to help traders make informed trading decisions. This includes daily market analysis, trading signals, and access to webinars and video tutorials.

However, there are also some potential disadvantages to using LMFX, such as its limited range of trading platforms and potential withdrawal fees. It is also worth noting that LMFX is regulated in Belize, which may not offer the same level of oversight and protection as other regulatory jurisdictions.

Overall, LMFX is a good choice for traders looking for a competitive trading platform with a range of features and benefits. However, it is important to carefully consider your trading needs and preferences and compare LMFX to other brokers to determine whether it is the best fit for you.

LMFX Review FAQs

Is LMFX regulated?

LMFX is regulated by the International Financial Services Commission (IFSC) of Belize. The IFSC is a regulatory body that oversees financial services providers in Belize, including forex brokers like LMFX. While Belize may not offer the same level of regulatory oversight as some other jurisdictions, LMFX is still required to comply with the IFSC’s regulations and standards to maintain its license.

What is LMFX minimum deposit?

The minimum deposit required to open an account with LMFX varies depending on the account type. The minimum deposit for a standard account is $50, while the minimum deposit for a premium account is $25,000. Additionally, LMFX offers a zero-spread account that requires a minimum deposit of $250. It is worth noting that the minimum deposit amounts may vary based on the deposit method used.

How long does LMFX withdrawal take?

The time it takes to process a withdrawal with LMFX depends on several factors, such as the withdrawal method used and the verification status of the account. In general, LMFX aims to process withdrawal requests within 24 hours, although it may take longer in some cases. The actual time it takes for the funds to be credited to the trader’s account will also depend on the withdrawal method used, as some methods may take longer than others. It is recommended to review LMFX’s withdrawal policies and contact their customer support team for specific information on withdrawal processing times.