Lirunex Review

Individual trader connections to the foreign currency markets are made possible by forex brokers, which play a crucial part in the trading ecosystem. One such platform that is gaining popularity is Lirunex. This foreign broker provides a range of trading conditions and assets to accommodate various trading philosophies. Lirunex wants to satisfy traders all over the world with its user-friendly platforms and competitive spreads that start at 0.0 pips.

As a seasoned trader, I will go into great detail about Lirunex’s operation in this assessment. I’ve gathered opinions from other traders who have used the service, so this evaluation isn’t just my opinion. We want to provide you with a comprehensive overview to enable you to determine whether Lirunex is the best broker for you, including information on its advantages and disadvantages, commission schedule, and available account kinds.

What is Lirunex?

Lirunex is a prominent participant in the retail forex and CFD trading market, having been registered in Cyprus and being regulated by several authorities. An extra degree of security is provided to dealers by this legislation. Lirunex offers a range of tradeable assets, including cryptocurrencies, commodities, and indices, in an effort to accommodate a wide range of trading requirements.

Lirunex excels in terms of trading conditions, offering leverage of up to 1:30 exclusively for FX trading, along with competitive spreads. These characteristics help to create a trading environment that is adaptable and advantageous to traders.

Lirunex uses the MetaTrader 4 trading platform, which can be accessed on mobile and desktop devices. Order types supported by the platform include market, limit, and stop orders. In the quick-paced world of trading, it even has a One-Click Trading function that facilitates order execution.

Furthermore, Lirunex provides a wide range of trading tools and educational resources as an investment in the development and decision-making of traders. For the novice or seasoned trader trying to hone their abilities and methods, these tools can be quite helpful.

Advantages and Disadvantages of Trading with Lirunex?

Benefits of Trading with Lirunex

Following trading with this prop firm, Lirunex’s cost-effectiveness is one of its main advantages. For traders who trade regularly, the broker’s Low Fees are especially alluring because they help to optimize profit margins. This is a feature that can really help, particularly for day traders.

An other noteworthy benefit is the regulatory supervision.Being regulated by the CySEC, Lirunex provides an additional security layer that traders, including myself, find reassuring. This rule gives consumers piece of mind by guaranteeing that the broker complies with strict financial requirements and upholds ethical trading standards.

Lirunex offers a wide range of assets in its Good Instrument Range, giving traders plenty of options to diversify their holdings. This spectrum enables traders such as myself to investigate a variety of markets and covers indices, cryptocurrencies, commodities, and FX.

Lirunex Pros and Cons

Pros

- 30-day demo account for practice

- Negative balance protection adds safety

- Fast execution for timely trades

- Well-regulated ensures reliability

- MetaTrader4 for user ease

Cons

- Commission fees add to the cost

- No US Traders limit user base

- Variable offerings based on entity

Lirunex Customer Reviews

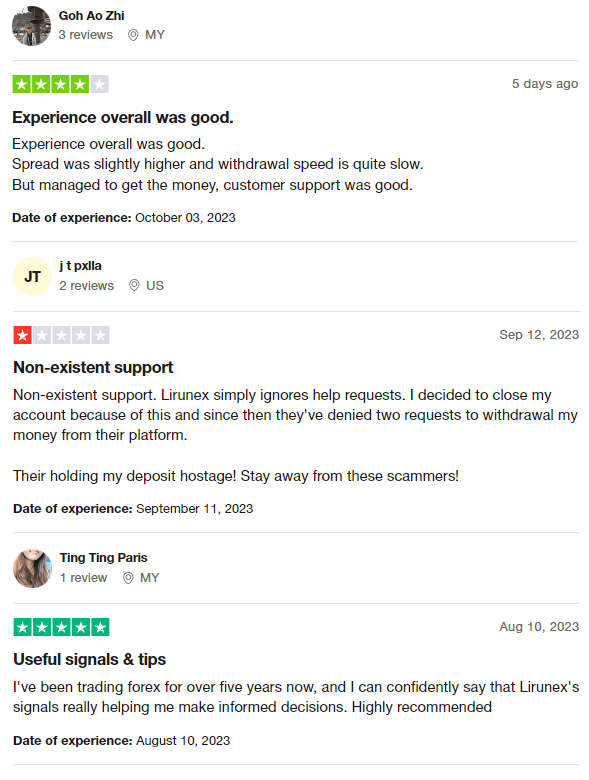

Lirunex’s current Trustpilot rating of 4.0 stars is based on a variety of user experiences. While some traders commend the platform for its useful trading signals and strong customer assistance, others are concerned about its slow withdrawal speed and unresponsive customer service. The inconsistent feedback indicates that although Lirunex excels in certain areas (such as trading signals and customer service), it still needs work in other areas (withdrawal processing and customer service consistency, for example).

Lirunex Spreads, Fees, and Commissions

Looking at the fee structure of Lirunex trading, I saw that the broker provides a combination of commission-based and spread-based models. The specific costs vary based on the kind of account you own. It is imperative to comprehend the entire fee landscape, which encompasses not only trading fees but also funding expenses and penalties for inactivity periods. For more information, I advise visiting the broker’s official website or getting in touch with them personally.

The Lirunex swap fee—also referred to as the overnight fee—is one expense to keep an eye on. This fluctuates based on your financial instrument and is included in the total trading costs. Therefore, if you intend to hold positions overnight, you must be aware of this.

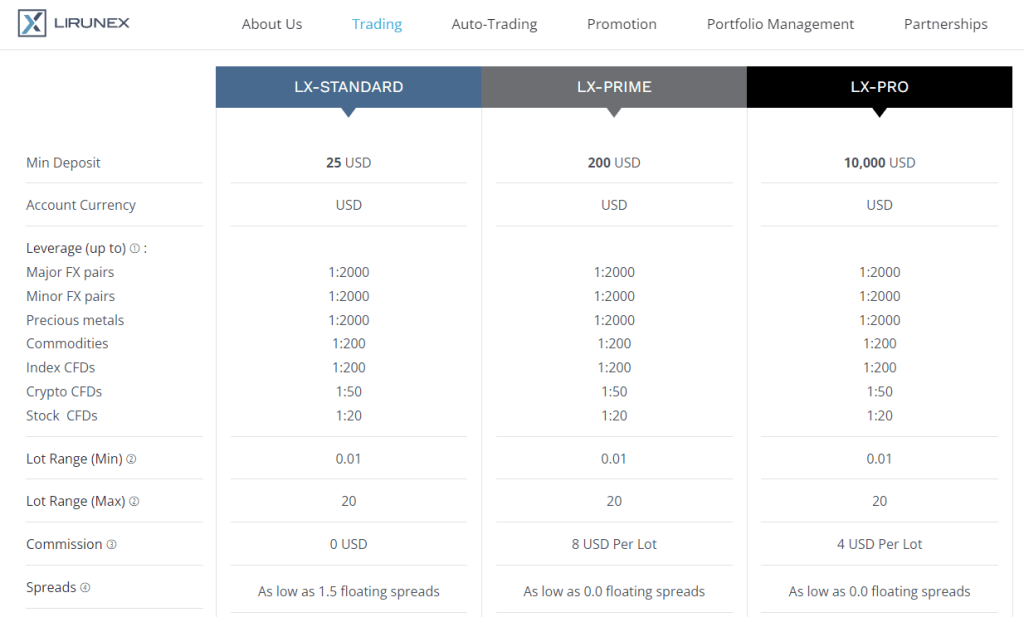

Depending on the type of account you have, Lirunex offers several spread rules for spreads. Better trading conditions are available to higher-grade accounts. Crucially, variable spreads are available on all account types without extra commission fees. For example, spreads for the Standard account begin at 1.5 pip. Prime and Pro accounts, on the other hand, start with spreads as low as 0.0 pips. These numbers, however, are subject to alteration in light of market dynamics and volatility. Effective trading requires an understanding of how spreads operate in this situation.

Account Types

After testing the different account types, I can confirm that Lirunex caters to a wide range of traders by offering three live trading accounts: LX-Standard, LX-Prime, and LX-Pro.

LX-Standard

The LX-Standard account is a great starting point for beginners. With a modest minimum deposit of $25, it offers a broad package of trading instruments and educational resources. This account provides essential customer support, making it easier for those new to trading to start.

LX-Prime

The LX-Prime account is more suited for those who have some trading experience. It requires a higher minimum deposit of $200 but comes with benefits like tighter spreads and lower commissions. Additionally, it offers exclusive trading signals and faster withdrawal processes, setting you up for potentially profitable trading.

LX-Pro

For the seasoned traders, the LX-Pro account is the top-tier option. With a substantial minimum deposit of $10,000, this account offers advanced trading tools, priority customer support, and dedicated account managers. The LX-Pro is designed for those serious about trading and looking for competitive market conditions.

How to Open Your Account

- Visit the Lirunex website.

- Locate and click the “Create Account” button at the top.

- Complete the online registration form with personal and contact information.

- Provide any additional identification if asked for verification purposes.

- Submit the registration form.

- Go to your email inbox.

- Find the activation or confirmation email from Lirunex.

- Click the link in the email to activate your Lirunex account.

What Can You Trade on Lirunex

Regarding the range of trading instruments, Lirunex doesn’t disappoint. The broker offers a variety of FX pairs, CFDs on metals, and commodities, all of which come with instant STP order execution. This variety allows traders to diversify their portfolios effectively.

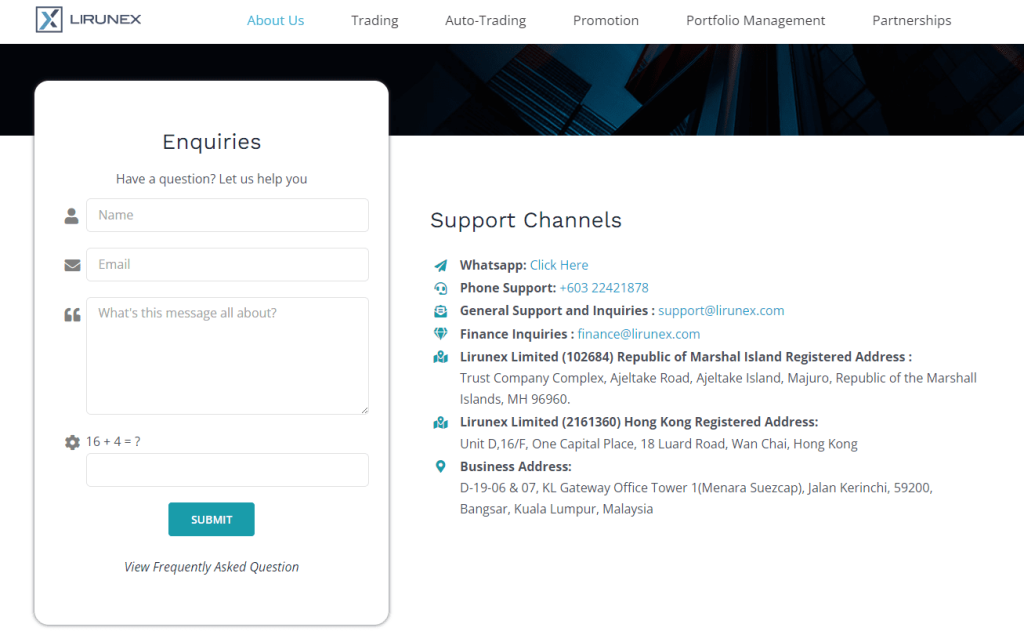

Lirunex Customer Support

Based on my experience, Lirunex’s customer support is designed to be both comprehensive and accessible. They offer support during market hours, and there are multiple ways to get in touch, catering to the diverse needs of traders.

Whether you’re a phone or email communication fan, Lirunex has you covered. Their team is responsive and committed to resolving issues and answering questions promptly. This enhances the overall customer experience.

For those who prefer immediate, real-time solutions, Lirunex also offers live chat. This feature allows for quick problem-solving and adds more convenience to customer support services.

In addition to these contact methods, Lirunex has a resource-rich online platform. It features a wide range of FAQs and educational materials that enable clients to find answers independently, adding another layer to their robust customer support system.

Advantages and Disadvantages of Lirunex Customer Support

Security for Investors

Withdrawal Options and Fees

Lirunex offers a variety of payment options for both deposits and withdrawals. You can choose from Global, SEPA, Global Transfer, VISA, Mastercard, credit, debit cards, and ePay.bg, GiroPay, Sofort, and Webmoney. The minimum deposit varies from $25 to $2000, depending on your chosen method.

The time it takes to process withdrawals can differ based on your chosen payment option. For instance, Visa and Mastercard can take up to 10 business days due to security checks and verification processes.

When it comes to fees, Lirunex does provide some fee-free withdrawal options like bank wire transfers. But, if you opt for card payments, you’ll face a 1.5% fee. Always be aware of potential additional charges from payment providers or institutions, especially when dealing with international transfers.

Lirunex Vs Other Brokers

#1. Lirunex vs AvaTrade

AvaTrade is a well-established broker founded in 2006 focusing on Forex and CFD trading. It serves an extensive global clientele and is heavily regulated. In contrast, Lirunex also provides various trading options but operates under a different regulatory framework. Both brokers offer diverse payment methods and comprehensive trading platforms. However, AvaTrade’s extensive experience and multiple global jurisdictions make it more appealing for risk-averse traders.

Verdict: AvaTrade is better for those prioritizing long-standing reputation and heavy regulation.

Also Read: AvaTrade Review – Expert Trader Insights

#2. Lirunex vs RoboForex

RoboForex has been in the industry since 2009 and offers many trading options. Lirunex, on the other hand, focuses on providing more tailored trading conditions. RoboForex offers multiple trading platforms and runs unique trading contests, setting it apart from Lirunex. Both brokers offer variable spreads, but Lirunex benefits from no commission charges.

Verdict: RoboForex is better for traders seeking various trading options and platforms.

#3. Lirunex vs Exness

Exness is known for low commissions and immediate order execution. It has been around since 2008 and offers a broad spectrum of CFDs and currency pairings. Lirunex also provides various trading instruments but needs a more extensive range than Exness. Exness also gives infinite leverage to small deposits, making it more flexible for different trading styles.

Verdict: Exness is better for those prioritizing low commissions and a wide range of trading options.

Conclusion: Lirunex Review

In summary, Lirunex offers a solid range of account types catering to new and experienced traders. Its LX-Standard account is excellent for beginners, while the LX-Prime and LX-Pro accounts offer advanced features for more seasoned traders. The platform also provides a variety of trading instruments, including FX pairs and CFDs, enhancing the trading experience.

However, it’s worth noting that customer support is not 24/7, and some users have reported delays in response times. While the platform offers various withdrawal options, fees can vary. Depending on the chosen method, they may take up to 10 business days. It’s crucial to understand these points before diving in.

The broker operates under multiple regulations, adding a layer of security for investors. But remember, protections may vary depending on the regulatory entity under which you’re registered. Given these insights and user feedback, Lirunex presents a balanced offering, making it a viable choice for many. Still, weighing the pros and cons is essential based on your individual needs.

Also Read: Charterprime Review 2024 – Expert Trader Insights

Lirunex Review: FAQs

What trading instruments does Lirunex offer?

Lirunex provides a variety of trading instruments, including FX pairs, CFDs on metals, and commodities.

Are there any fees for withdrawals?

Yes, withdrawal fees vary. For example, card payments involve a 1.5% fee, and the processing time can take up to 10 business days.

Is Lirunex a secure platform for trading?

Yes, Lirunex is a regulated broker that operates under multiple regulations, offering a layer of security for traders. However, protections can vary depending on the regulatory entity.