LegacyFX Review

Forex brokers play a crucial role in the world of foreign exchange trading. They act as intermediaries between traders and the global currency market. Choosing the right Forex broker is essential for both new and experienced traders, as it directly impacts the effectiveness of your trading strategies, the security of your funds, and your overall trading experience.

LegacyFX, an international broker, has been a notable player in the Forex market since 2017. This broker distinguishes itself by catering to a diverse range of traders, from beginners to professionals. LegacyFX offers its clients the opportunity to trade in various markets, including currencies, metals, indices, and other assets, showcasing their versatility and commitment to providing a comprehensive trading experience.

What sets LegacyFX apart is its dedication to client satisfaction and adaptability. Whether you are just starting in Forex trading or you are a seasoned trader, LegacyFX provides a platform that evolves with your needs. In the upcoming sections, we will delve deeper into the features that make LegacyFX a standout choice for traders globally.

What is LegacyFX?

LegacyFX is a globally recognized Forex broker, established in 2017. It offers a wide range of financial services to a diverse client base, including both beginners and professional traders. This broker is known for its versatility, enabling clients to engage in trading activities across various markets.

One of the key features of LegacyFX is its ability to provide clients with the option to trade independently or through investment opportunities. This flexibility caters to different levels of experience and involvement in trading. The broker also offers trading signals and automated trading programs, which are significant tools for both new and seasoned traders.

LegacyFX stands out for its comprehensive approach to trading currencies, metals, indices, and other assets. This range of options is a testament to the broker’s commitment to providing an inclusive trading environment. Whether clients are looking to trade on their own or explore automated solutions, LegacyFX accommodates a variety of trading preferences and strategies.

Benefits of Trading with LegacyFX

Trading with LegacyFX has offered me several advantages that enhanced my trading experience. First and foremost, the fact that the broker covers the commission for account replenishment and withdrawal of funds is a significant financial benefit. This policy reduces the overall cost of trading, making it more accessible and less burdensome for traders like me.

LegacyFX also excels in providing educational resources. These materials, available in a range of difficulty levels, have been instrumental in sharpening my trading skills and understanding of the market. Whether you’re a beginner or a seasoned trader, LegacyFX’s comprehensive educational tools cater to all levels of expertise.

Another notable benefit is the convenience in conducting financial transactions. The process is straightforward and user-friendly, which simplifies managing my trading funds. Additionally, LegacyFX’s investment programs, trading signals, and auxiliary tools have been invaluable. These resources have not only enhanced my trading strategy but also provided me with various options to diversify my trading activities. This comprehensive support system is a key aspect of why I find trading with LegacyFX beneficial.

LegacyFX Regulation and Safety

Understanding the regulation and safety aspects of LegacyFX is crucial, especially for someone like me who has been actively trading with this broker. The first point to note is that LegacyFX is regulated by two authoritative bodies: the VFSC (Vanuatu Financial Services Commission) under license number 14579, and the CySEC (Cyprus Securities and Exchange Commission) with license number 344/17. This dual regulation is a significant factor in ensuring that LegacyFX operates within strict financial standards, providing traders with a secure and reliable trading environment.

From my experience, an impressive safety feature provided by LegacyFX is the blacklist on their website. This list includes organizations, individuals, and sites identified as potential scammers posing as LegacyFX employees. This proactive approach helps me and other traders avoid fraudulent schemes and enhances our overall trading security. However, it’s important to note that while LegacyFX takes steps to protect clients, it does not take responsibility for accounts where clients have given third-party access. This emphasizes the need for personal vigilance in managing account security.

Another layer of safety is the way LegacyFX handles client funds. They are kept in segregated accounts, which is a crucial aspect of financial safety, ensuring that our funds are separate from the company’s operating funds. Additionally, the broker’s initiative to provide a list of known cybercriminals and fraudulent organizations is an invaluable resource. This list helps me stay informed and vigilant against potential hacking and fraudulent activities, further securing my trading activities. These regulations and safety measures are pivotal in my decision to trade with LegacyFX and should be a key consideration for any trader looking for a secure Forex trading platform.

LegacyFX Pros and Cons

Pros

- Protection against negative balance

- Broker covers replenishment and withdrawal fees

- Access to a variety of investment programs and tools

- Comprehensive educational resources

- Multiple customer support contact methods

- Easy financial transactions

- Segregated accounts for client funds

Cons

- Limited stock trading for Standard and Bronze accounts

- High initial deposit requirement

- Customer support not available during nights and weekends

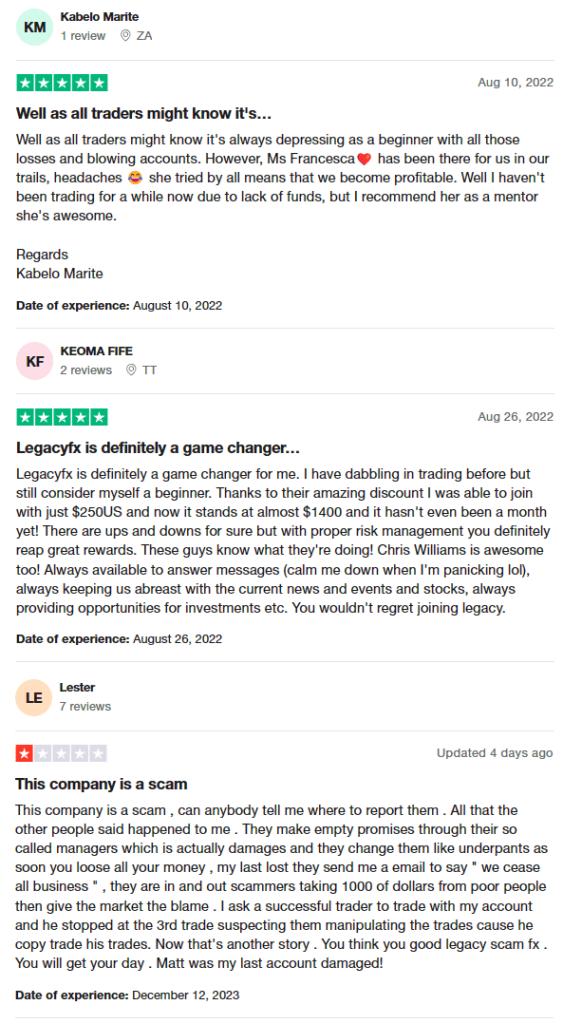

LegacyFX Customer Reviews

Trading with LegacyFX has given me insight into their approach to spreads, fees, and commissions. What stands out is their policy of not charging a separate fee for trade execution. Instead, this cost is incorporated into the spread, making the fee structure more straightforward. I appreciate that maintaining a trading account, using the trading platform, and accessing educational materials are all free of charge.

Another significant aspect is that LegacyFX covers the commission for both deposit replenishment and fund withdrawal. This is a rare and valuable benefit that reduces overall trading costs. The broker offers a choice between fixed or variable spreads, catering to different trading styles. For example, the spreads on EUR/USD start at 1.6 pips for the Silver account and can go as low as 0.6 pips for Gold and Platinum accounts, which is quite competitive.

While all assets are commission-free, there is an exception for stock trades. These incur charges ranging from 0.15% to 0.45%, varying based on the account type. This information is crucial for traders who focus on stock trading. Lastly, LegacyFX does not charge rollover fees on long-term positions. This policy is particularly beneficial for traders like me who are interested in long-term trading and investment, as it minimizes the costs associated with holding positions over an extended period.

LegacyFX Spreads, Fees, and Commissions

Trading with LegacyFX has given me insight into their approach to spreads, fees, and commissions. What stands out is their policy of not charging a separate fee for trade execution. Instead, this cost is incorporated into the spread, making the fee structure more straightforward. I appreciate that maintaining a trading account, using the trading platform, and accessing educational materials are all free of charge.

Another significant aspect is that LegacyFX covers the commission for both deposit replenishment and fund withdrawal. This is a rare and valuable benefit that reduces overall trading costs. The broker offers a choice between fixed or variable spreads, catering to different trading styles. For example, the spreads on EUR/USD start at 1.6 pips for the Silver account and can go as low as 0.6 pips for Gold and Platinum accounts, which is quite competitive.

While all assets are commission-free, there is an exception for stock trades. These incur charges ranging from 0.15% to 0.45%, varying based on the account type. This information is crucial for traders who focus on stock trading. Lastly, LegacyFX does not charge rollover fees on long-term positions. This policy is particularly beneficial for traders like me who are interested in long-term trading and investment, as it minimizes the costs associated with holding positions over an extended period.

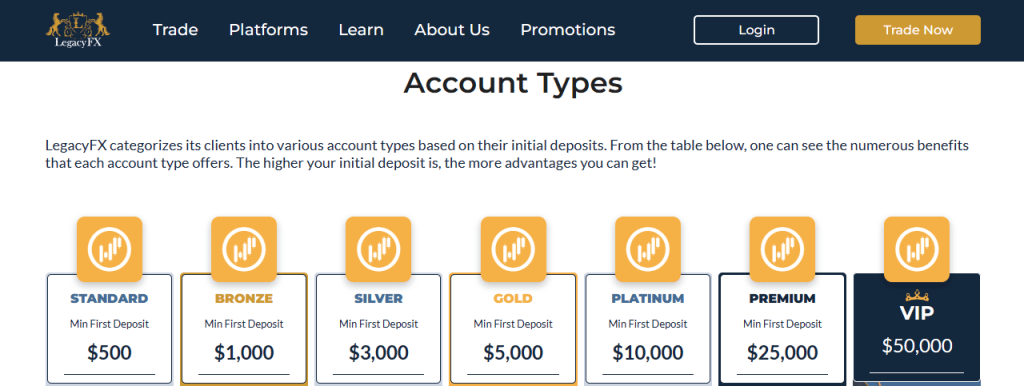

Account Types

Having tested various account types offered by LegacyFX, I’ve summarized my experience with each:

Standard Account

- Minimum Deposit: $250

- Features: Free access to the trading terminal, commodity trading, signals, live support, training materials, trading tips, and updates.

Bronze Account

- Minimum Deposit: $1,000

- Additional Features: Includes all Standard account features, plus 3 protected trades and automatic charting tools.

Silver Account

- Minimum Deposit: $3,000

- Additional Features: Builds on the Bronze account with access to stock trading, trading psychology materials, basic analytics, and mentoring.

Gold Account

- Minimum Deposit: $5,000

- Additional Features: Includes Silver account features, plus access to the Direct Dealing Desk, premium trading ideas, a personal trading goal plan, and a European VIP MasterCard.

Platinum Account

- Minimum Deposit: $10,000

- Additional Features: Offers all Gold account features, plus access to the Dealing Room Direct Line and a trading plan.

Premium Account

- Minimum Deposit: $25,000

- Additional Features: Encompasses all features of lower-tier accounts, with extended mentoring, and access to premium sessions and opportunities.

VIP Account

- Minimum Deposit: $50,000

- Unique Aspect: This account provides all the functionalities of the previous accounts but is tailored individually. Trading conditions are discussed separately with each client.

Each account type with LegacyFX offers a unique set of features designed to cater to varying levels of trading experience and investment capacity. The progression from Standard to VIP accounts reflects an increase in both the minimum deposit required and the range of services and tools available to the trader.

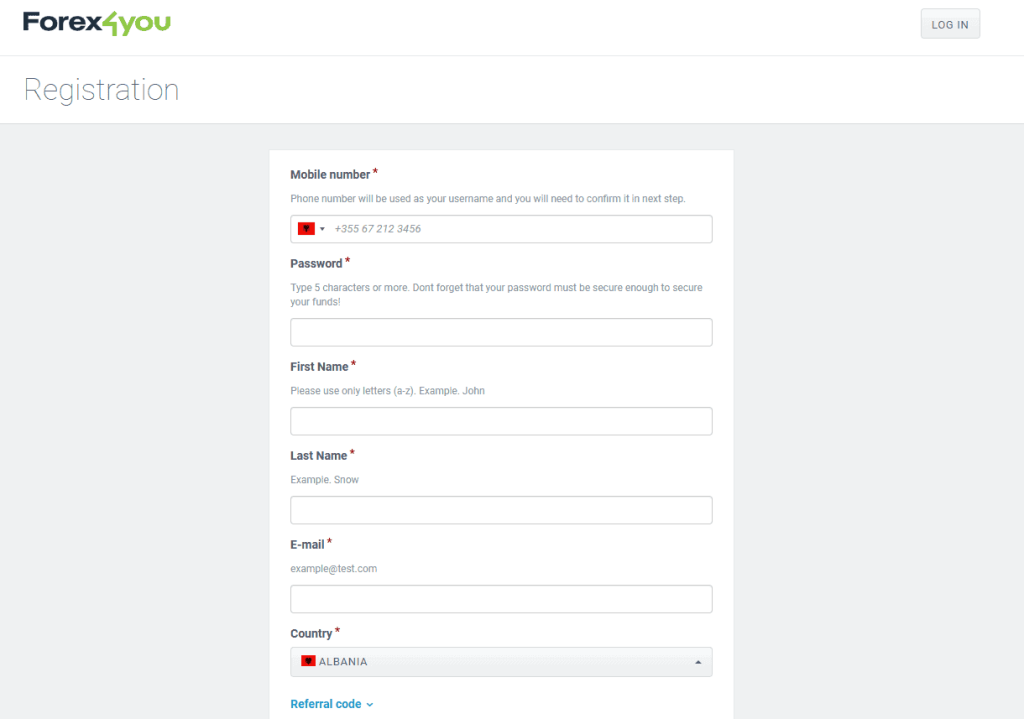

How to Open Your Account

- Visit the LegacyFX official website.

- Click on the menu button on the main page.

- Select “Open Account” for a live account or “Open Demo Account” for a demo.

- Choose between a personal or corporate account.

- Fill out the form with your name, surname, email, and phone number.

- Create and confirm your password, select your account currency, and complete the captcha and electronic signature.

- In your personal account, start by uploading your identity documents.

- Provide your credit/debit card details to complete the setup.

LegacyFX Trading Platforms

My experience with LegacyFX’s trading platforms has been quite comprehensive, covering various devices and needs.

The LegacyFX MT5 Web Platform offers a convenient way to trade Forex and CFDs. I found it especially useful because it doesn’t require any software installation or downloads. All you need is a web browser and an internet connection, and you can access your trading account. This platform is ideal for those who prefer trading directly from the web on different operating systems.

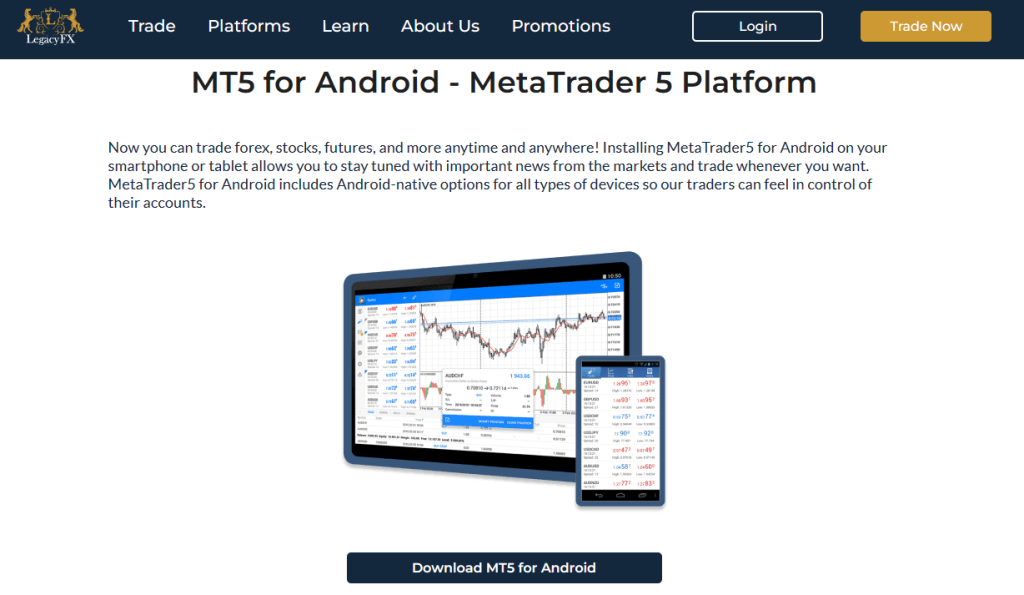

For a more robust trading experience, the LegacyFX MT5 Desktop Platform is a great choice. It’s designed to enhance the entire trading process, offering a wide range of functionalities. The platform supports advanced technical analysis tools and provides a comprehensive trading experience. MetaTrader5’s latest version, offered by LegacyFX, brings cutting-edge features, making it suitable for traders looking for a more institutional-grade platform.

The LegacyFX MT5 Android Platform is perfect for trading on the go. By installing MetaTrader5 on my Android smartphone, I could stay updated with market news and trade whenever and wherever I wanted. The platform is tailored for Android devices, ensuring seamless operation and control over my trading account. This mobile platform is ideal for traders who need the flexibility to trade from anywhere, at any time.

What Can You Trade on LegacyFX

Based on my experience with LegacyFX, I’ve found a diverse range of trading instruments available on their platform. This variety caters to different trading preferences and strategies.

One of the primary offerings is currency pairs, which includes major, minor, and exotic pairs. This variety allows traders to engage in the dynamic Forex market with a range of options. Cryptocurrencies are also available, providing an opportunity to trade in this modern and rapidly evolving market.

Stocks and indices trading are another key aspect of LegacyFX. The platform provides access to major stock markets, allowing traders to invest in well-known companies. Trading CFDs (Contract for Differences) on LegacyFX is another option, offering the flexibility to speculate on price movements without owning the underlying asset.

Additionally, the platform includes precious metals like gold and silver, popular among traders looking for safe-haven assets. Lastly, trading in various commodities broadens the investment horizon, including options like oil and agricultural products. This wide array of instruments makes LegacyFX a versatile platform for traders looking for multiple trading opportunities.

LegacyFX Customer Support

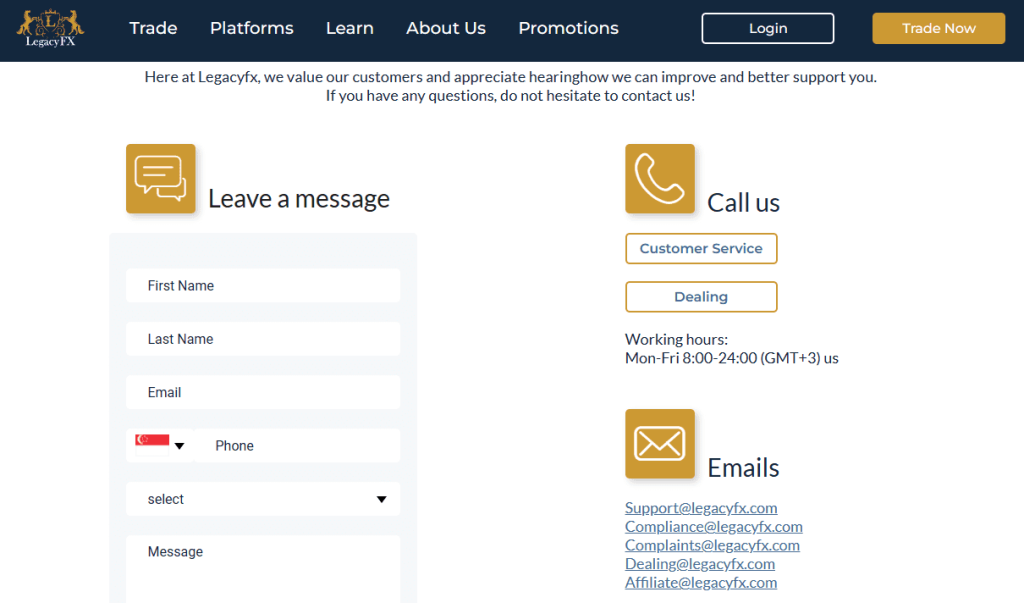

In my experience with LegacyFX, their customer support has been quite accessible and versatile. The broker offers multiple communication channels, catering to various preferences and needs.

For immediate assistance, I found the online chat on the LegacyFX website to be very convenient. It allows for real-time communication, which is great for quick queries. Alternatively, there’s the option to fill out a feedback form on their website, which is useful for less urgent or more detailed inquiries.

For those who prefer direct conversation, calling the number provided on the website is a good option. This method offers a personal touch and is helpful for complex or specific issues. Email communication is also available, and LegacyFX provides different mailing addresses for different departments, ensuring that queries are directed to the right place.

Visiting the broker’s physical office is another option, though it’s more suited for local clients or those who prefer face-to-face interactions. Additionally, LegacyFX is active on social networks like Twitter, Facebook, LinkedIn, YouTube, and Instagram, offering updates and another layer of engagement with their clients. This wide range of customer support options reflects LegacyFX’s commitment to providing comprehensive and accessible support to their clients.

Advantages and Disadvantages of LegacyFX Customer Support

Withdrawal Options and Fees

In my experience with LegacyFX, the process for withdrawing and replenishing funds offers a range of options suitable for various preferences.

The broker supports multiple payment methods, including Visa and MasterCard, e-payment systems like Neteller, Skrill, and Load, as well as Bitcoin, Perfect Money, and Wire Transfer. Using cryptocurrency is also an option, adding flexibility for those who prefer digital currencies.

The timeframe for transactions varies depending on the payment method. Transactions through the Blockchain system are almost instant, crediting funds within a few hours. Bank transfers usually take 1-3 days, while Load can take 3-5 days. It’s important to consider these timeframes when planning fund management.

For withdrawals, the minimum amount differs based on the method: $50 for Blockchain and $150 for bank transfers. A key advantage is that LegacyFX doesn’t charge a commission on transactions and covers any fees set by the payment systems. This policy significantly reduces the cost of managing funds.

Finally, to ensure security and compliance, financial transactions require trader verification. This step is a standard practice in the industry to safeguard both the trader and the broker.

LegacyFX Vs Other Brokers

#1. LegacyFX vs AvaTrade

LegacyFX and AvaTrade are both prominent players in the Forex and CFD trading market. LegacyFX, established in 2017, is known for its no-commission policy on transactions and its range of payment methods including cryptocurrencies. AvaTrade, operating since 2006, has a larger global presence with over 300,000 registered customers and offers a wider range of financial instruments. AvaTrade is heavily regulated with multiple global jurisdictions, providing a sense of security and trust.

Verdict: For traders looking for a more established broker with a wider array of financial instruments and stronger regulatory backing, AvaTrade might be the better choice. However, for those prioritizing newer payment methods like cryptocurrencies and lower transaction costs, LegacyFX could be more suitable.

#2. LegacyFX vs RoboForex

LegacyFX and RoboForex differ significantly in their trading offerings. LegacyFX offers a no-commission trading environment and various withdrawal options. RoboForex, operating since 2009, stands out with its vast range of over 12,000 trading options and multiple trading platforms like MetaTrader, cTrader, and RTrader. RoboForex also offers ContestFX for trading contests, adding an educational and competitive aspect to trading.

Verdict: If a trader is looking for a wide variety of trading instruments and platform choices, RoboForex is the better option. However, for those who prefer a simpler platform with a focus on reduced transaction costs, LegacyFX could be more appealing.

#3. LegacyFX vs Exness

LegacyFX and Exness offer different benefits for traders. LegacyFX is noted for its no-commission policy and diverse payment options. Exness, established in 2008, is renowned for its high monthly trading volume and offers an extensive range of CFDs for stocks, metals, energy, and over 120 currency pairings. Exness is unique for its offering of unlimited leverage on small deposits up to $999, a feature appealing to traders with lower capital.

Verdict: Traders looking for a broker with a high trading volume, diverse trading options, and the unique feature of unlimited leverage on small deposits would find Exness more suitable. On the other hand, for those prioritizing a straightforward fee structure and diverse payment methods, LegacyFX could be the preferred choice.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

Conclusion: LegacyFX Review

LegacyFX presents itself as a versatile and accessible broker for a range of traders, from beginners to professionals. Its no-commission policy on transactions and coverage of fees for account replenishment and withdrawals stand out as significant benefits. The availability of various payment methods, including cryptocurrencies, adds to its appeal in the modern trading landscape. Moreover, the array of educational resources and trading tools makes it a suitable platform for those looking to enhance their trading skills.

However, potential traders should be aware of the mixed customer feedback. While many users appreciate the broker’s features and support, some have raised concerns about aspects such as customer service availability and the high minimum deposit requirements. Additionally, the limitations in stock trading options for certain account types may not suit all trading preferences.

LegacyFX Review: FAQs

What is the minimum deposit required to start trading with LegacyFX?

The minimum deposit to start trading with LegacyFX is $250 for the Standard account, which provides access to various trading tools and educational materials.

Does LegacyFX charge a commission on transactions?

No, LegacyFX does not charge a commission on transactions. They cover the fees for account replenishment and withdrawal, making it cost-effective for traders.

Can I trade cryptocurrencies with LegacyFX?

Yes, LegacyFX offers cryptocurrency trading among its range of trading instruments, allowing traders to engage in the modern and evolving digital currency market.