Leeloo Trading Review

Trading experts can gain access to capital and technology resources through a proprietary trading firm, sometimes known as “prop firms,” allowing them to trade in the financial markets. These companies profit by keeping a portion of the trade gains. Leeloo Trading is one such prop firm that offers financed accounts to skilled futures traders.

I am an experienced trader with firsthand knowledge of the trading world’s complexities. In this article, I’ll present a full review of Leeloo Trading by mixing my personal experience with customer reviews. We’ll go through everything, including the positives and drawbacks of trading with Leeloo, to help you make an informed decision.

What is Leeloo Trading?

Leeloo Trading is a prop firm based in Montana, founded by Jody Dahl in 2020. Since foundation, Leeloo trading has evolved to become a key player in the prop trading industry, especially in the field of futures trading.

What sets Leeloo Trading apart is its exclusive focus on futures trading. Unlike other prop firms that might offer a broad array of assets, Leeloo narrows its scope. They give a futures trader a funded account to concentrate on one market, guided by a firm that’s an expert in the field.

Advantages and Disadvantages of Trading with Leeloo Trading

Benefits of Trading with Leeloo Trading

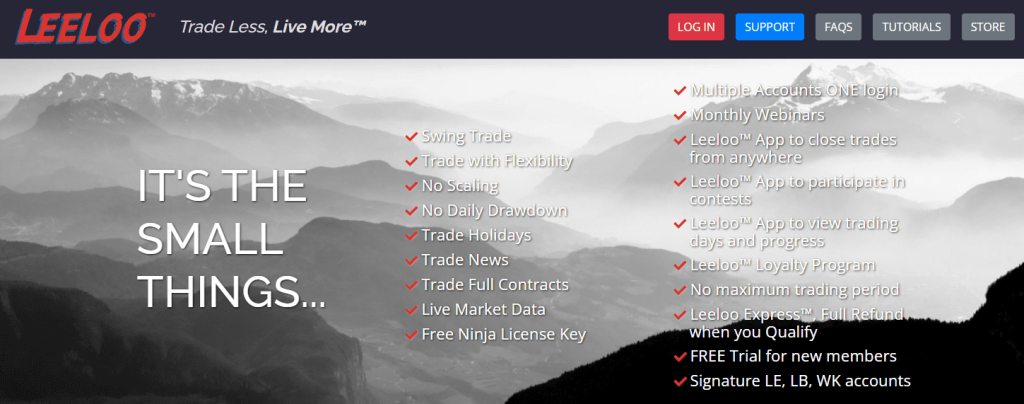

After trading with Leeloo Trading, I have noted several key points that I think is an essential benefit of trading with the prop firm. First, the prop firm wholly comprehends the challenges that traders might face. Usually, several capital and psychological hurdles affect traders. To address this, Leeloo has its own propriety software for its futures traders.

Moreover, their performance-based trading and contests should be noted too. Unlike the usual, Leeloo adds a twist by adding a competitive edge to their trading. The competition lets traders to put their trading knowledge into test while also reaping the benefits based on their performance payoff. will

Lastly, trust and legitimacy are crucial in choosing a trading platform. Leeloo has built a solid reputation as a reliable platform, attracting traders globally. The firm provides a fertile ground for traders to practice, explore various strategies, and ultimately enhance their trading skills.

Leeloo Trading Pros and Cons

Pros

- Fees for the service are reasonable

- Keep 100% of the first $8,000 you earn

- Allows for micro position sizes

- 90% profit share after one year

- Up to six funded accounts permitted

- Customer service is experienced

- Good range of account options.

Cons

- Some restrictions on taking out money.

- Limited to specific trading platforms.

- May be overwhelming for beginners.

Difficulties Met by the Traders Who Participated in the Brokers Challenge

Stringent Time Limit

The challenge often comes with a tight time constraint. This can make traders feel rushed, leading to impulsive decisions and potential losses.

How to Overcome the Difficulty

The best way to handle this is through preparation and backtesting. Know your trading strategy inside and out. Have clear entry and exit points defined before you begin. The better you prepare, the less the time limit will impact your decision-making.

Complexity of Platform Interface

Many traders find themselves stumped by a complex platform interface. It’s crucial to be fluent in the platform’s functionalities to trade effectively.

How to Overcome the Difficulty

Before you enter the challenge, get hands-on experience with the trading platform. Utilize free trials or demo accounts to familiarize yourself with the various tools and settings. This way, when you’re in the heat of the challenge, you’re not wasting time figuring out how to place a trade or set a stop-loss.

Emotional Stress

Trading can be a rollercoaster of emotions, especially in a competitive setting. Emotional decisions are often poor ones in trading.

How to Overcome the Difficulty

Emotional regulation is key here. Use stress management techniques like deep breathing exercises to keep a clear head. Keeping a trading journal can also help you understand your emotional triggers and make more calculated decisions.

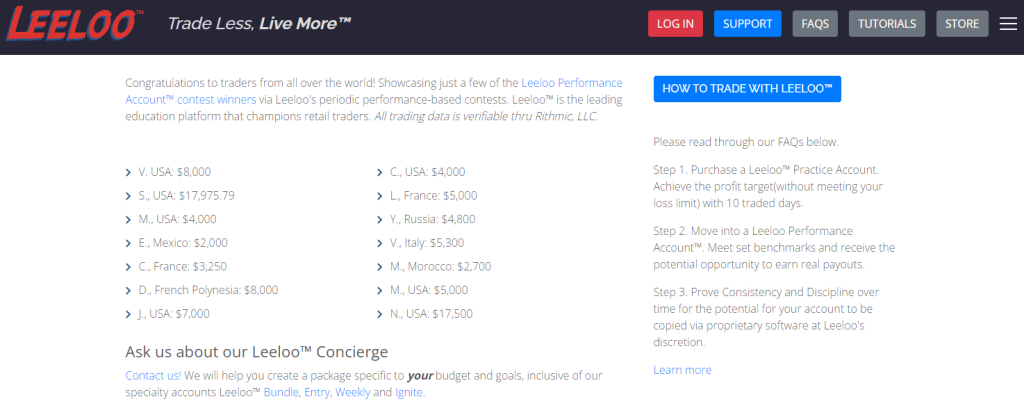

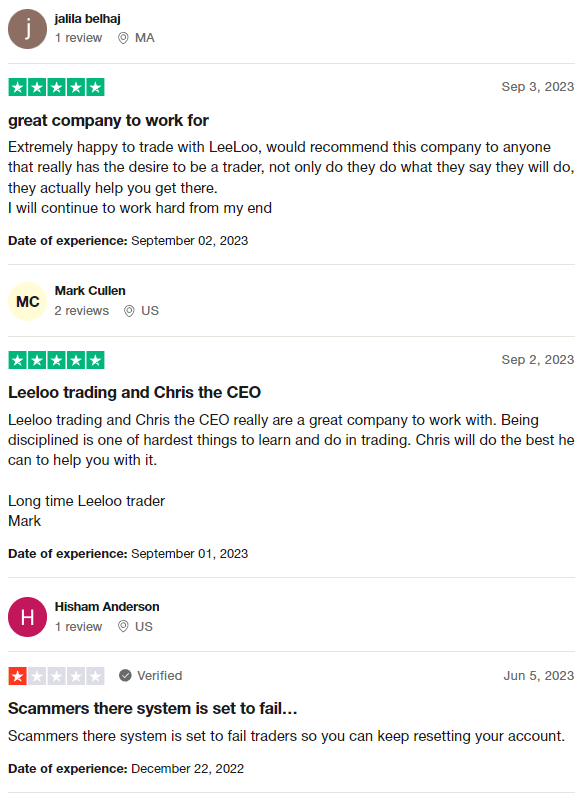

Leeloo Trading Customer Reviews

Based on customer reviews, Leeloo Trading seems to have garnered a mostly positive reputation. With a 4.9-star rating on Trustpilot, the firm is frequently praised for its support and educational tools designed to help traders succeed. Customers appreciate the company’s commitment to their growth, highlighting the hands-on help they receive. However, it’s worth noting that not all feedback is glowing; there are occasional mentions of system limitations leading to account resets.

Leeloo Trading Fees and Commissions

When you trade with Leeloo Trading, you have the option to upgrade to a Performance Account. This comes with its own set of fees and benefits tailored to different trading styles. You basically have two choices when it comes to fees for these specialized accounts.

The first option is a Monthly Subscription, which costs $88 per month for each Performance Account. This is a good fit if you plan on trading regularly but don’t want to be locked into a long-term commitment. You pay every month and can stop whenever you want.

The second option is a One-Time Fee of $250 per Performance Account. This is geared towards active traders who commit to trading for at least 12 days each calendar month. But beware, this isn’t for those looking to place a few trades just to keep the account active; that’s against the rules.

Account Types

After hands-on testing of Leeloo trading accounts, I’ve compiled a straightforward list to help you decide which one suits you best. This information is particularly beneficial for those looking to engage with Leeloo’s platform.

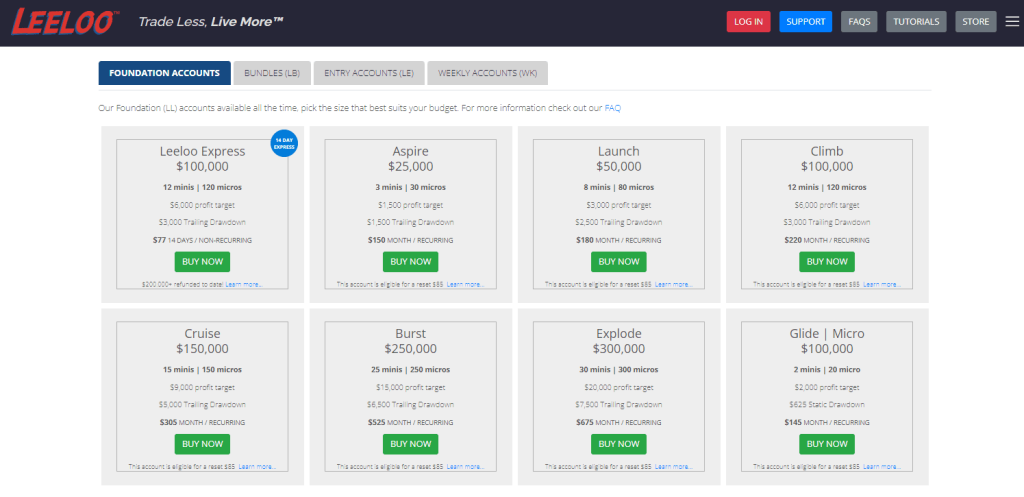

Foundation Accounts

Foundation Accounts are Leeloo Trading’s standard offerings. They range from $25,000 to $300,000 in capital. These accounts are suitable for different levels of traders and come with varying profit targets and trailing drawdowns. Fees for these accounts are mostly recurring monthly, except for Leeloo Express which is a 14-day non-recurring option.

Bundles

Bundle Accounts offer a unique mix of features from the Foundation Accounts but are available for non-recurring monthly fees. These accounts range from $25,000 to $300,000 in capital and come with specific minis, micros, profit targets, and trailing drawdowns.

Entry Accounts

If you’re on a tight budget, Entry Accounts are the go-to option. These accounts offer lower subscription costs with a limited payout structure. Ranging from $25,000 to $300,000 in capital, they offer various minis, micros, profit targets, and trailing drawdowns. All fees are recurring monthly.

Weekly Accounts

Designed for frequent traders, Weekly Accounts offer the flexibility to trade on a weekly cycle. These accounts come in $25,000 and $50,000 capital options. They offer specific minis, micros, profit targets, and trailing drawdowns with recurring monthly fees.

How to Open Your Account

- Start by picking a practice account that fits your trading goals. Leeloo has various options like $25k Aspire WK and $50k Leeloo Entry LE Launch.

- Find and click the “Buy Now” button for the account you chose.

- During sign-up, use your full legal name to comply with ID requirements.

- Follow the steps to finalize the account purchase.

- Leeloo Trading will create your account after payment.

- Look for an email with your account credentials, typically sent within 15 minutes.

- Leeloo offers a video guide to help you understand the platform.

- If you’re eligible for a Performance Account, provide government-issued identification.

Leeloo Trading Customer Support

In my experience, Leeloo Trading’s Customer Support interface could be more user-friendly for non-members. If you’re not yet part of their prop firm, your main point of contact is a blue box labeled “I DON’T HAVE A LEELOO,” which leads to a contact form.

However, the customer support team is quite prompt in handling queries. The downside is that they’re only reachable via email. They also offer a knowledge-based FAQs section on their website to help you with common questions. Overall, their support is quick but could be more accessible for those who aren’t members yet.

Advantages and Disadvantages of Leeloo Trading Customer Support

Contact Table

Security for Investors

Withdrawal Options and Fees

When it comes to Leeloo Trading Withdrawal Options and Fees, the process is straightforward. Withdrawals are processed only once per month. To initiate the process, you have to place your request on the last Monday of each month.

One crucial point to note is that you should not trade after making your withdrawal request. Continue to refrain from trading until the withdrawal is taken from your account. This ensures a smooth transaction process.

You don’t have to wait long to receive your funds. You’ll be paid the same week that you place your withdrawal request. This adds a level of convenience to the Leeloo Trading experience.

What Makes Leeloo Trading Different from Other Prop Firms

In my experience, one thing that sets Leeloo Trading apart from other prop firms is its diverse range of account types. Whether you’re a novice or an expert, Leeloo offers accounts tailored to various trading needs and risk appetites. This includes Foundation, Bundle, Entry, and even Weekly Accounts.

Another noteworthy feature is the monthly withdrawal option. Many prop firms don’t offer such frequent withdrawal schedules, but with Leeloo, you can initiate a withdrawal request every last Monday of the month and get paid the same week.

How Can Asia Forex Mentor Help You Pass Leeloo Trading’s Evaluation?

As the founder of Asia Forex Mentor, I’ve dedicated years to refining the art of forex trading. Established in 2008 in Singapore, my small community of traders has rapidly grown into a full-fledged educational platform. Corporate trading firms and banks have even sought my expertise to train their teams.

One of my most prized offerings is the AFM Proprietary One Core Program. This comprehensive course equips traders with the tools they need to succeed in forex markets. It’s a complete package, consisting of 26 detailed lessons and over 60 subtopics, each paired with high-quality instructional videos. These lessons incorporate my handpicked trading examples and interpretations, making the program incredibly beginner-friendly.

So, how can Asia Forex Mentor help you pass Leeloo Trading’s evaluation? Simple. The One Core Program focuses on building a robust trading system, offers precise market analysis techniques, and teaches steady account management. By mastering these essential skills, you’ll be well-equipped to meet and exceed Leeloo Trading’s evaluation criteria, paving your way to a successful trading career.

Our Journey at Asia Forex Mentor

Here at Asia Forex Mentor, it’s been an incredible journey of shaping successful traders. My students come from various backgrounds: retail traders, bank professionals, and even those in investment firms. Many have started as novices and transitioned into full-time forex traders or esteemed fund managers.

The core of this transformation lies in our One Core Program. This comprehensive course encapsulates everything from bar-by-bar backtesting to trading psychology. Not only do I share how to maintain a trading diary, but I also dive into the keys to forex trading success. Unique strategies like the ‘set-and-forget’ method, an exclusive auto stop-loss tool, and the concept of free trade are all covered. I even explain the differences between large and small stop loss levels in-depth.

When it comes to pricing, the One Core Program offers excellent value. A seven-day free trial lets you test the waters. The program is available at a one-time fee of $997. But for those who are already convinced and eager to jump in, I offer a direct price of $940, bypassing the trial phase. This provides an excellent opportunity for anyone serious about excelling in forex trading.

Also Read: Fidelcrest Review 2024

Conclusion: Leeloo Trading Review

Different account types are available from Leeloo Trading to accommodate varying trading styles and skill levels. They have acceptable profit targets and drawdown restrictions based on user feedback and my testing. They are therefore a fantastic choice for anyone wishing to get into prop trading.

However, it’s important to note a couple of downsides. First, their customer support interface can be a bit cumbersome if you’re not already a member. Also, they don’t offer phone support, just email.

Another point to consider is the security for investors. While Leeloo Trading has garnered many positive reviews, the company doesn’t provide insurance for deposited funds. This is something potential users should be aware of before making any commitments.

Leeloo Trading Review FAQs

Is Leeloo Trading secure?

Generally yes, but they don’t offer insurance for your deposits.

How are withdrawals processed?

Once a month, and you need to avoid trading after making a request until the withdrawal is processed.

Is there a trial or practice account?

Yes, Leeloo offers practice accounts to help you get started.