KVB Prime Review

KVB Prime is a forex broker founded in 2001 which provides a global access to trading instruments such as forex, commodities, indices, shares, and cryptocurrencies, catering to clients across 100+ countries. The platform supports web trading on MetaTrader 4 and the KVB Prime App, allowing users to trade both on desktop and mobile easily.

The trading platforms offers Classic and Plus accounts, giving traders options based on their needs and experience levels. Additionally, promotions like Deposit Bonuses and a Swap-Free Program add value, potentially increasing profitability and reducing costs.

KVB’s 24/5 multilingual support ensures accessible assistance for all users. The platform is regulated by the Anjouan Offshore Finance Authority, providing a level of compliance with global standards.

What is KVB Prime?

KVB is a financial markets company founded in 2001 that provides trading access to global markets in forex, commodities, indices, shares, and cryptocurrencies. The platform serves clients in over 100 countries, offering a range of brokerage services across these asset classes.

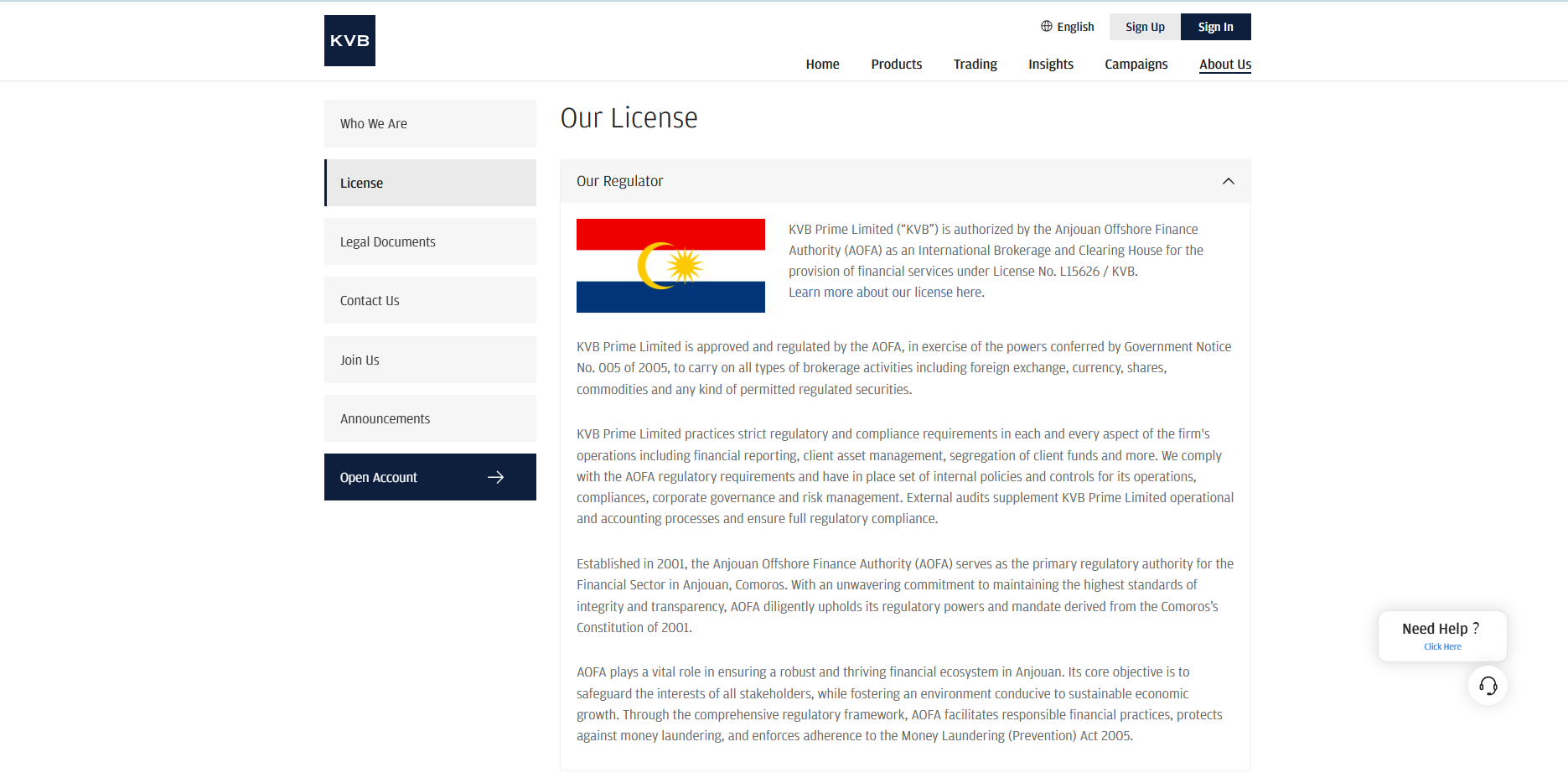

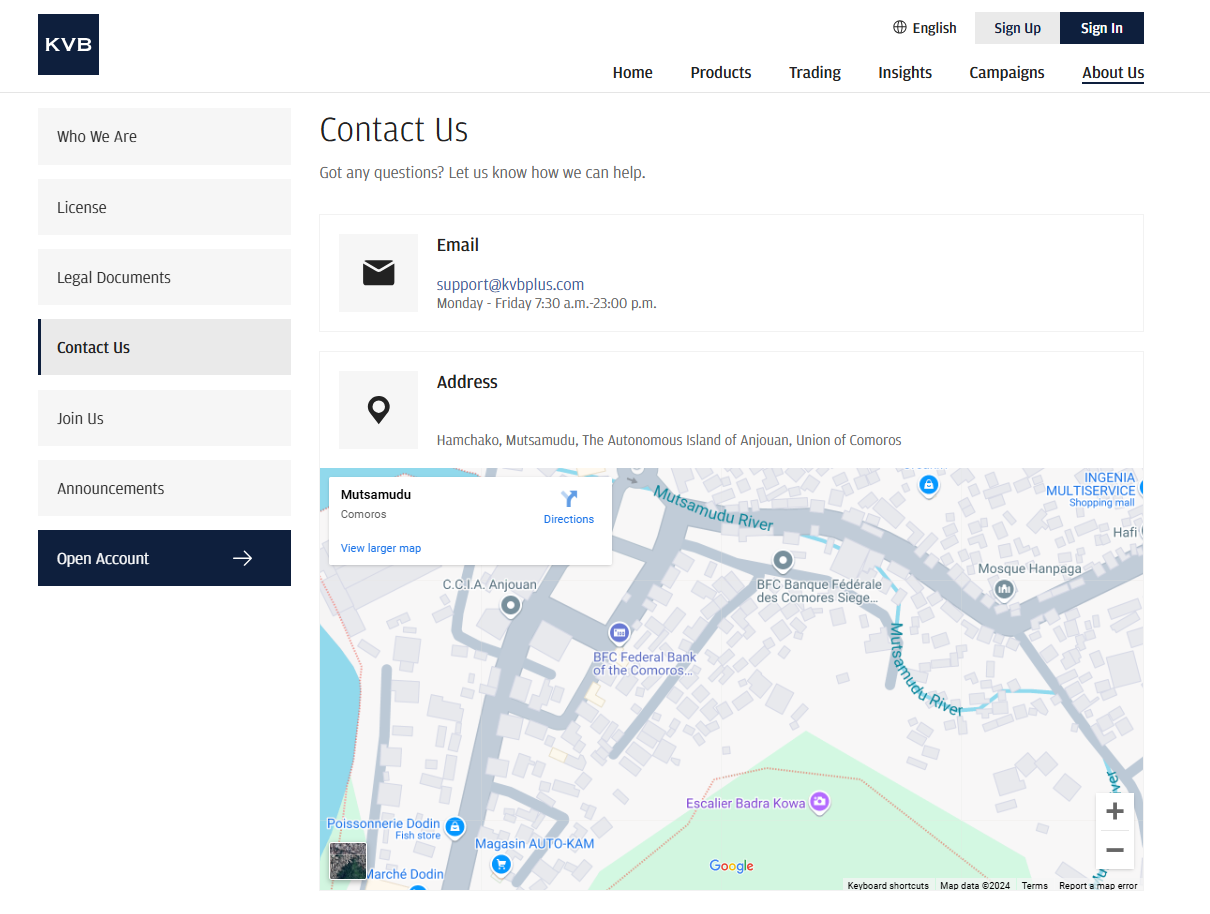

KVB Prime Regulations and Safety

KVB is regulated by financial authorities such as Anjouan Offshore Finance Authority (AOFA) in the Union of Comoros wherein it oversees its international brokerage activities across forex, shares, commodities, and other securities. On the other hand, while AOFA provides regulatory oversight, it does not offer the same investor protection as top-tier regulators like the UK’s Financial Conduct Authority (FCA) or Australia’s ASIC.

This means that while KVB operates under some regulatory standards, potential clients should be cautious and understand the limitations of AOFA’s protection compared to more established regulatory bodies. It’s essential for traders to evaluate KVB’s safety measures within this context before investing.

KVB Prime Pros and Cons

Pros:

- Global reach

- Diverse assets

- User-friendly

- Bonus options

Cons:

- Low-tier regulation

- Limited protection

- Basic account choices

- Standard support

Benefits of Trading with KVB Prime

KVB prime website offers access to forex trading, allowing traders to invest in diverse asset classes like forex, commodities, indices, shares, and cryptocurrencies. This range provides flexibility for traders looking to diversify their portfolios.

The platform supports MetaTrader 4 and a mobile app, making trading accessible from both desktop and mobile devices. This flexibility helps traders manage their investments conveniently, whether at home or on the go.

KVB offers two account types, Classic and Plus, catering to different trading preferences and levels of experience. This allows users to select an account that matches their strategy and trading goals.

Promotional options like Deposit Bonuses and a Swap-Free Program add value by potentially boosting profits and reducing trading costs. These benefits make KVB appealing to traders seeking cost-effective trading options with added rewards.

KVB Prime Customer Reviews

KVB prime limited users praise the platform for its user-friendly features, time-saving convenience, and efficient deposit/withdrawal processes. Many express trusts in its reliability, appreciating how it enhances productivity and integrates useful tools in a single platform.

KVB Prime Spreads, Fees and Commissions

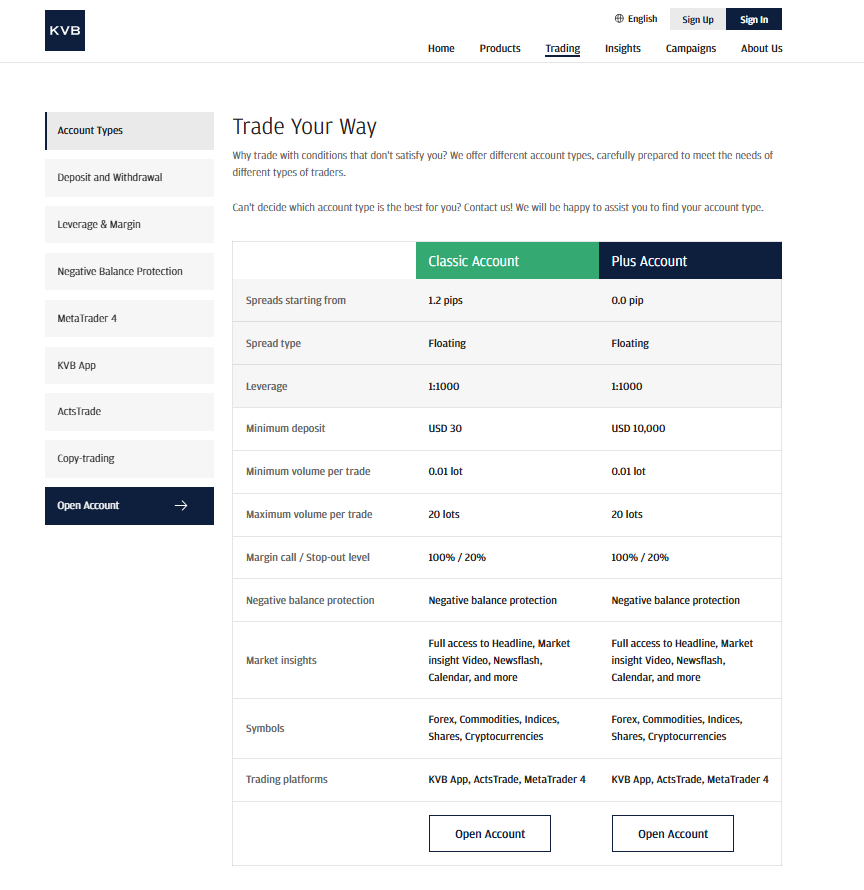

The Classic Account has spreads starting from 1.2 pips and a minimum deposit of $30, making it accessible for traders with smaller budgets.

The Plus Account, designed for higher-volume traders, offers tighter spreads starting from 0.0 pips but requires a minimum deposit of $10,000. Both accounts provide floating spreads and leverage up to 1:1000, along with negative balance protection to prevent losses beyond the account balance.

Both account types also include full access to market insights, including news and analysis, and are available on the KVB App, ActsTrade, and MetaTrader 4. For exact fees and any additional charges, it’s best to consult KVB’s official resources or reach out to their support team.

Account Types

KVB offers two main trading account types tailored to different trading needs: the Classic and Plus accounts. Each KVB Prime account provides flexible options with varying deposit requirements, spreads, and features to suit both beginner and experienced traders.

Classic Account

The Classic Account is designed for traders with a smaller budget, requiring a minimum deposit of $30. It offers floating spreads starting from 1.2 pips and allows leverage up to 1:1000. This account type is suitable for beginners or those looking for lower entry requirements.

Plus Account

The Plus Account is targeted at high-volume traders, with a minimum deposit requirement of $10,000. It provides floating spreads starting from 0.0 pips and also offers leverage up to 1:1000. This account is ideal for experienced traders seeking lower transaction capabilities costs and tighter spreads.

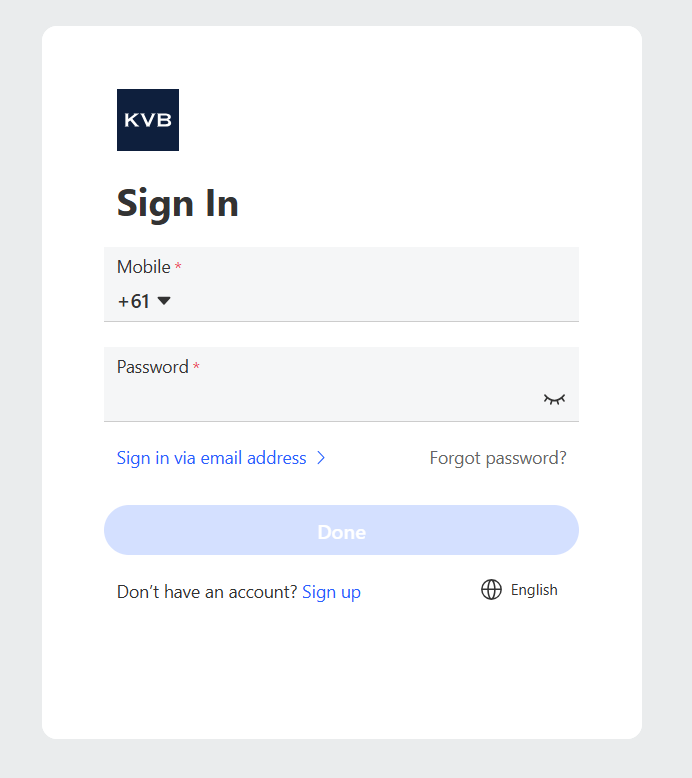

How to Open Your Account

KVB’s account opening procedure is simple and intended to get traders up and running as soon as possible. This is a detailed step-by-step procedure to assist new users to create account:

Step 1: Visit the KVB Prime’s Official Website

To start, users should go to the official KVB website and select the “Sign in” option. This will direct them to a registration page where they can begin the sign-up process.

Step 2: Fill Out the Registration Form

On the registration page, users need to provide basic information, including their contact details and Password, Users also has an option to sign via email address. This step is essential to create a unique account profile for each trader.

Step 3: Select Your Account Type

After completing the form, users choose between the Classic and Plus account types based on their trading preferences and budget. Each account type has different features, so selecting the right one is key.

Step 4: Verify Your Identity

KVB requires users to upload identification documents, such as a passport or driver’s license, to verify their identity. This step ensures compliance with regulatory standards and secures the account.

Step 5: Make Your Initial Deposit

Once the account is verified, users can proceed to fund their account by making the required minimum deposit. This deposit activates the account, allowing traders to start trading on the platform.

Step 6: Access the Trading Platform

After funding, users can download the KVB App, MetaTrader 4, or ActsTrade platform to begin trading. With the account fully set up, traders are now ready to access the markets and start their trading journey.

KVB Prime Trading Platform

KVB offers multiple trading platforms to cater to different user needs, including MetaTrader 4, the KVB App, and ActsTrade. Each platform is designed to provide easy access to global financial markets, allowing users to trade on various devices.

MetaTrader 4 is a widely recognized platform known for its user-friendly interface and advanced trading tools. It supports automated trading, custom indicators, and comprehensive charting options, making it suitable for both beginners and experienced traders.

The KVB App provides mobile access to the markets, enabling traders to monitor and manage their trades from anywhere. This app is ideal for traders who need flexibility and want to stay updated on market movements in real time.

ActsTrade is another platform offered by KVB, providing additional tools and features to support trading strategies. It’s a solid choice for users looking for alternative options and specific functionalities not available on other platforms.

What Can you Trade on KVB Prime

KVB prime offers access to various financial industry, enabling traders to diversify their investments across multiple asset types.

Forex

Major, minor, and exotic currency pairs, allowing for high liquidity and tight spreads in the global forex market.

Commodities

Access assets like gold, silver, and oil, providing options to hedge against inflation and diversify beyond traditional investments.

Indices

Popular indices, letting users speculate on the overall market performance without focusing on individual stocks.

Shares

Invest in shares of leading global companies, giving traders exposure to specific stocks within the equity market.

Cryptocurrencies

Digital assets like Bitcoin and Ethereum, ideal for those interested in the high volatility of the crypto market.

KVB Prime Customer Support

KVB provides 24/5 customer support, ensuring assistance during the main trading hours. Their support team is multilingual, helping clients across different regions to resolve issues and answer trading-related questions effectively.

The support team is available through multiple channels, including email, phone, and live chat, making it easy for users to reach out when needed. This accessibility is aimed at enhancing the user experience and ensuring timely responses for smoother trading.

Advantages and Disadvantages of KVB Prime Customer Support

Withdrawal Options and Fees

KVB provides several withdrawal options to give traders flexibility in accessing their funds. Here’s an overview of the available methods and associated fees.

Bank Transfer

Traders can withdraw funds directly to their bank accounts through wire transfers. This option is secure and suitable for larger withdrawals, but it may take a few business days to process, and fees can vary depending on the bank.

Credit/Debit Card

KVB supports withdrawals to credit or debit cards, which is convenient for traders who prefer quick access to funds. Processing times are usually faster than bank transfers, though fees may apply depending on the card issuer.

E-Wallets

KVB also offers e-wallet options such as Skrill and Neteller, allowing for fast and flexible withdrawals. E-wallets often have lower fees and quicker processing times, making them a popular choice for traders looking for speed and convenience.

Cryptocurrency

For users trading digital assets, KVB provides cryptocurrency withdrawal options. This method is fast and suitable for those preferring digital transactions, though fees and processing times can vary depending on the specific cryptocurrency network.

KVB Prime vs Other Brokers

#1. KVB Prime vs AvaTrade

KVB and AvaTrade both offer access to forex, commodities, indices, shares, and cryptocurrencies, but they differ in platform variety, regulation, and account options. KVB operates under the Anjouan Offshore Finance Authority, which provides limited oversight compared to AvaTrade’s regulation by top-tier authorities like the FCA and ASIC, ensuring stricter compliance standards. While KVB provides MetaTrader 4, the KVB App, and ActsTrade, AvaTrade supports MetaTrader 4, MetaTrader 5, AvaOptions, and AvaTradeGO, giving traders more choices in platforms. KVB offers two main accounts, Classic and Plus, designed for beginner to high-volume traders, whereas AvaTrade offers more account types, including an options-specific account, making it more versatile for advanced trading needs. KVB’s minimum deposit starts at $30 for the Classic Account, providing accessibility for smaller traders, while AvaTrade generally requires a $100 deposit, appealing to those with a moderate trading budget.

Verdict: AvaTrade offers more robust regulation and a wider choice of platforms, making it better suited for traders seeking advanced options and stricter compliance. KVB is a more accessible choice for beginners due to its lower minimum deposit and straightforward platform setup.

#2. KVB Prime vs RoboForex

KVB and RoboForex both provide access to major asset classes, including forex, commodities, indices, shares, and cryptocurrencies. KVB operates under the Anjouan Offshore Finance Authority, offering limited regulation, whereas RoboForex is regulated by the International Financial Services Commission (IFSC) in Belize, which provides a slightly higher but still moderate regulatory standard. KVB supports MetaTrader 4, the KVB App, and ActsTrade, while RoboForex offers a broader platform selection, including MetaTrader 4, MetaTrader 5, cTrader, and R StocksTrader, catering to both beginner and advanced trading needs. KVB’s two primary accounts (Classic and Plus) have accessible minimum deposits starting at $30, ideal for newer traders, while RoboForex offers multiple account types with varying features, including the ECN and Prime accounts with tighter spreads, appealing to experienced traders seeking lower transaction costs.

Verdict: RoboForex’s diverse platform and account options make it a better choice for advanced traders looking for specific trading conditions and tighter spreads. KVB, with its lower minimum deposit, is more suited for entry-level traders who prefer a simpler setup and straightforward options.

#3. KVB Prime vs Exness

KVB and Exness both provide access to key financial markets, including forex, commodities, indices, shares, and cryptocurrencies. However, KVB operates under the Anjouan Offshore Finance Authority, a lower-tier regulatory body, while Exness is regulated by multiple top-tier authorities, including the FCA and CySEC, which ensures higher regulatory compliance and client security. KVB offers MetaTrader 4, the KVB App, and ActsTrade, while Exness provides access to both MetaTrader 4 and MetaTrader 5, with a more comprehensive range of trading tools. KVB’s accounts start with a $30 minimum deposit for the Classic Account, accessible to beginners, while Exness offers an even lower barrier to entry with Standard accounts requiring just a $1 minimum deposit. Exness also provides advanced accounts, such as Raw Spread and Zero accounts, catering to experienced traders seeking ultra-low spreads and faster execution speeds.

Verdict: Exness stands out for its strong regulatory oversight, broader platform support, and flexible account options, making it a more secure and versatile choice for traders of all levels. KVB’s straightforward setup with accessible entry costs is suitable for beginners looking for a simpler, less costly starting point.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH KVB PRIME

Conclusion: KVB Prime Review

KVB provides a solid trading platform with access to global markets in forex, commodities, indices, shares, and cryptocurrencies. With user-friendly tools like MetaTrader 4 and the KVB App, it’s accessible to both new and experienced traders.

While the platform offers competitive spreads and flexible account options, its regulation under the Anjouan Offshore Finance Authority means it lacks the higher-tier protection offered by regulators like the FCA or ASIC. For traders prioritizing ease of use and low entry costs, KVB is a practical choice, though advanced users may seek platforms with stronger regulatory oversight.

KVB Prime Review: FAQs

How is KVB Prime’s customer support?

KVB provides multilingual, 24/5 customer support via email, phone, and live chat, aiming to assist clients during the main trading hours effectively.

Is KVB Prime regulated?

Yes, KVB is regulated by the Anjouan Offshore Finance Authority (AOFA) in the Union of Comoros. However, this is a lower-tier regulatory body, offering limited investor protection compared to top-tier regulators.

Does KVB Prime offer Demo accounts?

Yes, KVB offers demo accounts, allowing traders to practice and familiarize themselves with the platform’s features and trading conditions without risking real money.

OPEN AN ACCOUNT NOW WITH KVB PRIME AND GET YOUR BONUS