Key to Markets Review

Key to Markets is a global broker offering forex and CFD trading with access to ECN pricing giving traders an innovative trading experience. It provides traders with competitive spreads, no dealing desk intervention, and transparency in fees. The platform supports MetaTrader 4, a popular choice among traders for its tools and ease of use.

The broker ensures a secure trading environment with regulatory compliance under the Financial Services Authority (FSA) of Seychelles. Traders can access a range of instruments, including forex, indices, and commodities, catering to both novice and experienced users. Key to Markets also offers tailored account types to suit different trading needs.

What is Key to Markets?

Key to Markets is an independent brokerage firm that provides a diverse range of financial instruments for professional and retail traders. The company offers trading platforms like MetaTrader 4, which supports automated trading systems and preferred trading systems. With its free demo account and educational resources, traders of all experience levels can explore the forex market and other financial markets effectively.

The markets website highlights multiple account types, including standard accounts and pro accounts with raw spreads and no commission on traded lot round turn. The firm’s minimum deposit is competitive, allowing traders to start trading with ease. Offering various payment methods, including bank wire, Key to Markets ensures smooth funding and withdrawal processes. Its efficient trading tools and free VPS service make it suitable for active trading and news trading, while customer support team is available during business hours to assist.

With regulatory oversight from the Financial Services Commission, Key to Markets prioritizes transparency and security for retail investor accounts and professional traders. The broker supports a wide range of trading styles, from trading CFDs to soft commodities and precious metals, catering to traders seeking flexibility and innovation in the financial markets.

Key to Markets Regulation and Safety

Key to Markets operates as a regulated broker, ensuring compliance with strict financial standards. It is overseen by the Financial Conduct Authority (FCA) in the UK, a highly respected regulator in the industry. This provides traders with assurance of transparency and fair practices.

The broker also follows guidelines to protect client funds, including maintaining segregated accounts. This ensures client money is not used for company operations, adding an extra layer of safety. Key to Markets prioritizes regulatory compliance to foster trust among its clients.

Key to Markets Pros and Cons

Pros

- Tight spreads

- ECN accounts

- MetaTrader 4

- Regulated

Cons

- No proprietary platform

- Limited education

- Withdrawal fees

- Seychelles regulation

Benefits of Trading with Key to Markets

Key to Markets offers traders several benefits that cater to diverse trading needs. Its ECN trading environment ensures direct market access with no dealing desk intervention, leading to faster execution and transparent pricing. The platform supports MetaTrader 4, a popular tool among traders for its user-friendly interface and advanced analytics.

Another advantage of trading with Key to Markets is its flexible account options, including standard and pro accounts with competitive spreads. Traders also benefit from zero restrictions on trading strategies, allowing scalping, hedging, and the use of expert advisors. Additionally, the broker emphasizes client funds’ safety by segregating accounts and offering robust regulatory compliance.

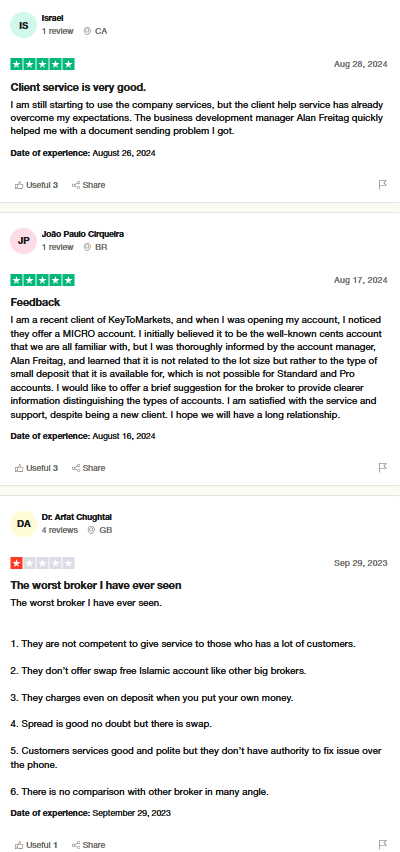

Key to Markets Customer Reviews

Key to Markets Customer Reviews highlight a mix of positive and negative experiences. Many users praise the platform’s low spreads and fast order execution, which cater to traders seeking cost-efficient trading. The availability of a no-dealing desk execution model also appeals to those looking for a more transparent trading environment.

However, some reviews point out concerns regarding limited research tools and the lack of in-depth educational resources. While customer support is generally responsive, a few users report delays in resolving technical issues. Overall, Key to Markets is valued for its competitive trading features but could improve in providing more robust trader support.

Key to Markets Spreads, Fees, and Commissions

Key to Markets offers competitive trading conditions with spreads starting from 0.0 pips on the ECN account, catering to traders looking for tight cost control. Standard accounts feature slightly higher spreads but come without additional commissions, ideal for beginners or lower-volume traders.

For ECN accounts, a commission of $6 per standard lot round trip is charged, providing transparency in trading costs. The broker does not impose deposit or withdrawal fees, but third-party charges may apply. Overall, Key to Markets ensures flexibility in pricing for diverse trading needs.

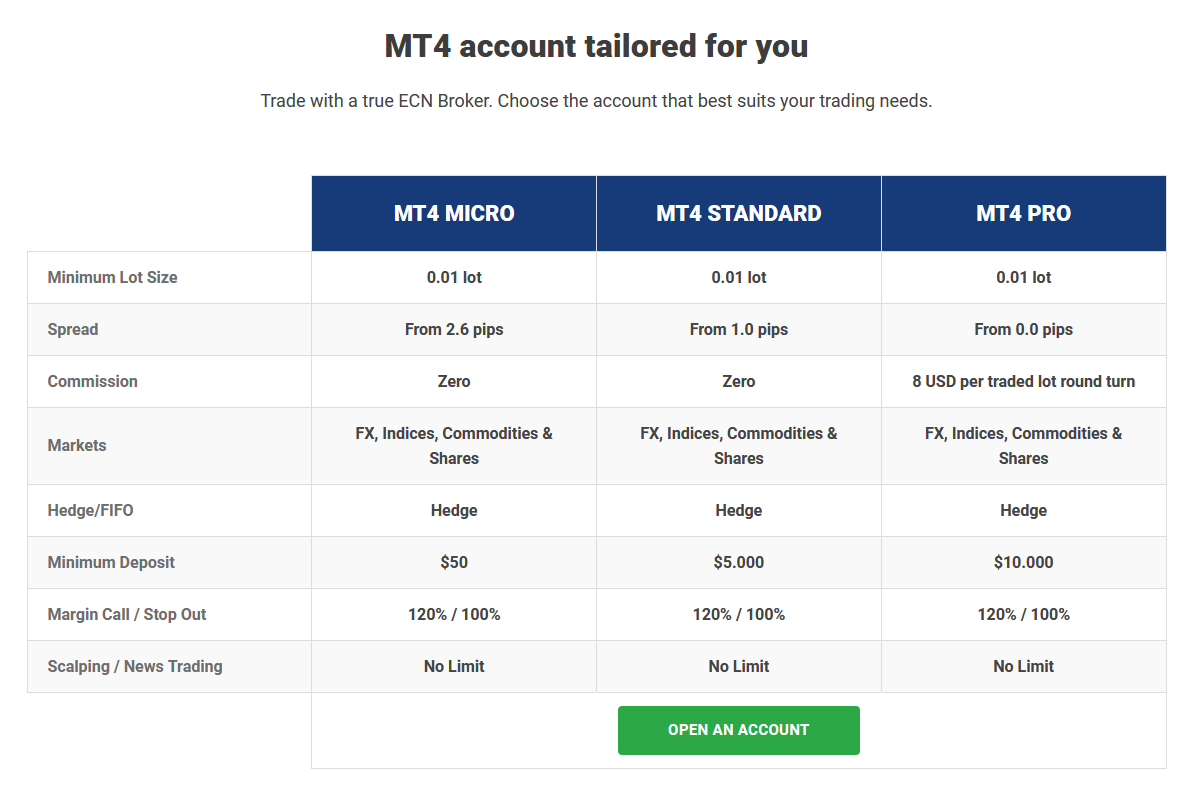

Account Types

Key to Markets offers a variety of trading accounts to cater to different trader preferences and experience levels. Each account type provides unique features, allowing traders to select the option that best aligns with their trading strategies and goals.

ECN MT4 MICRO

The MICRO trading account is designed for beginners entering live markets. Traders pay only the spread, with no per-lot commission. Spreads start from 2.6 pips, making it an affordable choice for new traders looking to gain experience.

ECN MT4 STANDARD

The STANDARD trading account emphasizes simplicity, charging no per-lot commission. Traders pay only the spread, which starts from 1.0 pips. This account is suitable for those seeking a straightforward trading structure with minimal costs.

ECN MT4 PRO

The PRO trading account offers raw market spreads, with a separate commission of $8 per traded lot round turn. This account is preferred by scalpers and traders seeking the tightest possible spreads. It is tailored for professionals who prioritize cost efficiency and precision.

Each account type provides true ECN execution through the MT4 platform, ensuring direct market access without dealing desk intervention. This structure reinforces Key to Markets‘ commitment to transparency and fair trading.

How to Open Your Account

Opening an account with Key to Markets is a straightforward process designed for both beginner and experienced traders. The platform ensures a seamless registration experience with clear instructions and quick approvals. Follow the steps below to get started.

Step 1: Visit the Website

Go to the official Key to Markets website and click on the “Open Account” button. You will be redirected to a registration page to start the process.

Step 2: Fill Out the Registration Form

Provide your personal information, including name, email address, and phone number. Ensure all details are accurate to avoid delays during verification.

Step 3: Verify Your Identity

Upload required documents such as a valid ID and proof of address. Key to Markets will review your submission, typically within 24 to 48 hours.

Step 4: Fund Your Account

Once approved, log in and deposit funds using your preferred payment method. Key to Markets supports multiple options, including bank transfers and online payment systems.

Step 5: Start Trading

After funding, access the trading platform, choose your asset, and begin trading. Key to Markets provides tools to help you navigate the market efficiently.

Key to Markets Trading Platforms

Key to Markets Trading Platforms offers access to reliable trading solutions for forex, commodities, indices, and stocks. The broker provides both MetaTrader 4 (MT4), known for its advanced charting, automated trading features, and compatibility with third-party tools. This platform cater to both beginner and advanced traders seeking efficiency and customization.

Users benefit from real-time market data, multiple order types, and expert advisor integration, ensuring a seamless trading experience. The platforms are accessible on desktop, web, and mobile, enabling traders to monitor and execute trades conveniently. This versatility positions Key to Markets as a dependable option for diverse trading needs.

What Can You Trade on Key to Markets

Key to Markets offers a diverse range of tradable assets, enabling traders to engage in various financial markets. This variety allows for portfolio diversification and the application of different trading strategies.

Forex

Trade major, minor, and exotic currency pairs with Key to Markets, benefiting from tight spreads and fast execution. The forex market operates 24/5, providing ample trading opportunities.

Commodities

Engage in trading commodities like gold, silver, and crude oil through Key to Markets. These assets can serve as hedges against inflation and offer diversification benefits.

Indices

Key to Markets provides access to global stock indices, including the S&P 500 and FTSE 100. Trading indices allows investors to speculate on the performance of entire markets rather than individual stocks.

Shares

Trade CFDs on shares of major companies with Key to Markets, enabling participation in the stock market without owning the underlying assets. This approach allows for both long and short positions.

By offering these asset classes, Key to Markets caters to a wide range of trading preferences and strategies.

Key to Markets Customer Support

Key to Markets offers reliable customer support aimed at ensuring a smooth trading experience. Their support team is available through email and live chat, providing assistance for technical issues, account queries, and trading-related concerns.

The response time is typically quick, and the team is knowledgeable in addressing trader needs. Key to Markets also provides a detailed FAQ section on their website, helping users find answers to common questions independently.

Advantages and Disadvantages of Key to Markets Customer Support

Withdrawal Options and Fees

Key to Markets provides a variety of withdrawal options to suit traders’ needs. While the broker ensures secure transactions, fees may vary depending on the method selected. It’s essential to review the details to choose the most cost-effective option.

Bank Transfer

Withdraw funds via bank transfer are available for all users. Processing times typically range from 1-3 business days, and fees may apply depending on the bank or region.

Credit/Debit Card

Using a credit or debit card for withdrawals is straightforward and faster, with funds usually credited within 1-2 business days. A small fee might be charged depending on the card issuer.

E-Wallets

E-wallets like Skrill and Neteller are supported for quicker transactions. These withdrawals are often processed within 24 hours, with nominal fees applied by the payment provider.

Cryptocurrency

Key to Markets also supports cryptocurrency withdrawals for users trading in digital assets. These transactions are fast, often completed within hours, but network fees may apply.

Key to Markets Vs Other Brokers

#1. Key to Markets vs AvaTrade

Key to Markets and AvaTrade both offer robust trading experiences but cater to different priorities. Key to Markets specializes in ECN accounts with tight spreads and advanced execution through MetaTrader 4, appealing to cost-conscious and professional traders. In contrast, AvaTrade provides a wider range of platforms, including AvaOptions and WebTrader, along with beginner-friendly features like comprehensive educational resources and fixed spreads. While Key to Markets focuses on transparency and low costs, AvaTrade stands out with its diverse trading tools and broader regulatory footprint.

Verdict: For experienced traders seeking low-cost ECN trading, Key to Markets is a stronger choice. AvaTrade is better suited for beginners and those valuing platform variety and fixed spreads.

#2. Key to Markets vs RoboForex

Key to Markets and RoboForex cater to different trading needs, with Key to Markets focusing on ECN accounts and transparent fee structures, while RoboForex offers a broader range of account types and platforms, including proprietary options. RoboForex provides higher leverage and more bonuses, appealing to risk-tolerant traders, but Key to Markets stands out with tighter spreads and a straightforward trading environment. Both brokers support MetaTrader platforms, but RoboForex includes additional tools like cTrader and CopyFX for social trading.

Verdict: For traders seeking low spreads and an ECN-focused approach, Key to Markets is the stronger choice. Those prioritizing platform variety and bonus offerings may prefer RoboForex.

#3. Key to Markets vs Exness

Key to Markets and Exness both offer competitive trading environments, but they cater to different trader priorities. Key to Markets focuses on ECN accounts with tight spreads and robust regulation, making it suitable for professional traders. Exness stands out with its proprietary platform, high leverage options, and a more extensive range of payment methods, appealing to those seeking flexibility. However, Exness’ offshore regulation in some jurisdictions may raise concerns compared to the stronger oversight of Key to Markets.

Verdict: For traders prioritizing transparency and ECN trading, Key to Markets is the better choice. Those seeking diverse tools and higher leverage might find Exness more appealing.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH KEY TO MARKETS

Conclusion: Key to Markets Review

Key to Markets is a reliable brokerage offering competitive spreads, ECN trading, and transparency. Its strong regulatory oversight and user-focused approach provide confidence for both new and experienced traders. However, the lack of a proprietary platform and limited educational resources may deter some users.

For traders prioritizing low costs and efficient execution, Key to Markets is a solid choice. Its clear focus on client satisfaction and robust trading environment make it a dependable option in the forex market.

Key to Markets Review: FAQs

Is Key to Markets regulated?

Yes, Key to Markets is regulated by the Financial Services Authority (FSA) of Seychelles, ensuring compliance with industry standards.

What trading platforms does Key to Markets offer?

Key to Markets supports the MetaTrader 4 platform, widely known for its user-friendly interface and advanced trading tools.

Are there any deposit or withdrawal fees?

Key to Markets does not charge fees for deposits, but withdrawal fees depend on the chosen payment method.

OPEN AN ACCOUNT NOW WITH KEY TO MARKETS AND GET YOUR BONUS