Kama Capital Review

Kama Capital is an investment firm and brokerage that provides a range of trading services across different asset classes, including forex, commodities, and equities in the financial markets. The firm aims to serve traders with diverse strategies and experience levels, offering both traditional and modern trading options.

Kama Capital focuses on transparency and user accessibility, with a straightforward fee structure that helps traders manage costs effectively. The broker also provides multiple account types to cater to varying trading needs, allowing users to choose options that best match their goals.

For trading platforms, Kama Capital offers MetaTrader 4 and a proprietary web-based platform, providing flexibility for traders to choose their preferred setup. Both platforms come equipped with essential tools and resources, making trading efficient and accessible from both desktop and mobile.

Kama Capital emphasizes client support and education, offering resources like market analysis and trading guides to help users make informed decisions. Its focus on customer assistance and transparent operations makes it a practical choice for traders looking for reliable trading services.

What is Kama Capital?

Kama Capital is an investment and brokerage firm offering access to a variety of trading assets, including forex, commodities, and equities. The firm provides services designed to meet the needs of traders with varying levels of experience, from beginners to seasoned investors, through competitive spreads and a range of account options.

Focused on transparency and accessibility, Kama Capital aims to provide a straightforward trading experience with a clear fee structure and reliable customer support. The broker supports trading through MetaTrader 4 and a proprietary web platform, making it a versatile choice for those seeking flexibility and user-friendly trading tools.

Kama Capital Regulation and Safety

Kama Capital regulators prioritizes regulation and safety to ensure a secure trading environment for its clients. The firm operates authorized and regulated by the Financial Services Commission (FSC) of Mauritius as an Investment Dealer, implementing strict compliance measures to protect client assets and data. This regulatory oversight promotes transparency and accountability, building trust with traders.

To enhance security, Kama Capital employs advanced encryption protocols and segregates client funds from company operational accounts, minimizing risks related to fund management. These practices demonstrate the firm’s commitment to safeguarding client information and assets, making it a reliable option for traders focused on security and compliance. Kama Capital also has a representative office in Dubai in the UAE, which it claims is “regulated by Dubai Economic Department.”

Kama Capital Pros and Cons

Pros

- Competitive spreads

- Multiple platforms

- Transparent fees

- Regulated

Cons

- Peak-hour delays

- Limited crypto options

- Swap fees

- Occasional wait times

Benefits of Trading with Kama Capital

Trading with Kama Capital offers several benefits that cater to different trading styles and goals. One key advantage is its range of asset options, including forex, commodities, and equities, allowing traders to diversify their portfolios effectively. This variety enables users to explore different markets and optimize their trading strategies.

Kama Capital also provides competitive spreads and a transparent fee structure, which helps traders manage their costs and maximize returns. With multiple account types, the firm tailors its offerings to suit both beginner and experienced traders, adding flexibility to meet specific trading needs.

Additionally, Kama Capital supports MetaTrader 4 and a proprietary platform, providing reliable and user-friendly tools for analysis and trade execution. The firm’s commitment to accessible trading platforms and responsive customer support enhances the overall trading experience, making it suitable for traders at all levels.

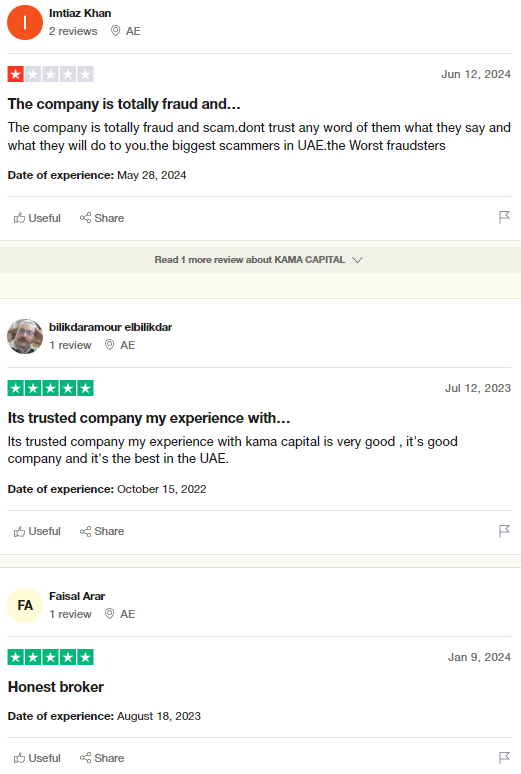

Kama Capital Customer Reviews

Customer reviews of Kama Capital often highlight the firm’s user-friendly platforms and transparent pricing structure. Many traders appreciate the competitive spreads and range of account types, which allow them to find options tailored to their trading style and budget. This flexibility is noted as a positive feature, especially among newer traders looking for accessible entry points.

Positive feedback also emphasizes the responsive customer support, with users reporting helpful assistance in resolving issues or answering queries. However, some customers mention occasional delays during high-traffic periods, though the firm has reportedly been working to improve service response times.

Overall, Kama Capital receives a favorable reputation for its reliable trading environment, range of tools, and transparent operations, making it a preferred choice among those looking for a straightforward, supportive brokerage.

Kama Capital Spreads, Fees, and Commissions

Kama Capital offers competitive spreads and a clear, transparent fee structure, allowing traders to manage costs effectively. The spreads vary depending on the account type, with lower spreads available on premium accounts, which appeals to traders focused on minimizing trading costs. These competitive spreads make it an attractive option for forex and high-frequency traders.

In terms of fees, Kama Capital uses a low or no-commission structure on certain accounts, making it cost-effective for those who prefer a spread-only model. However, some account types with reduced spreads may involve a commission, allowing traders to choose the setup that best aligns with their trading style.

For overnight positions, Kama Capital LTD charges swap fees, a common practice across the industry. The firm maintains transparency by clearly disclosing all fees, helping traders plan their costs upfront and avoid unexpected charges.

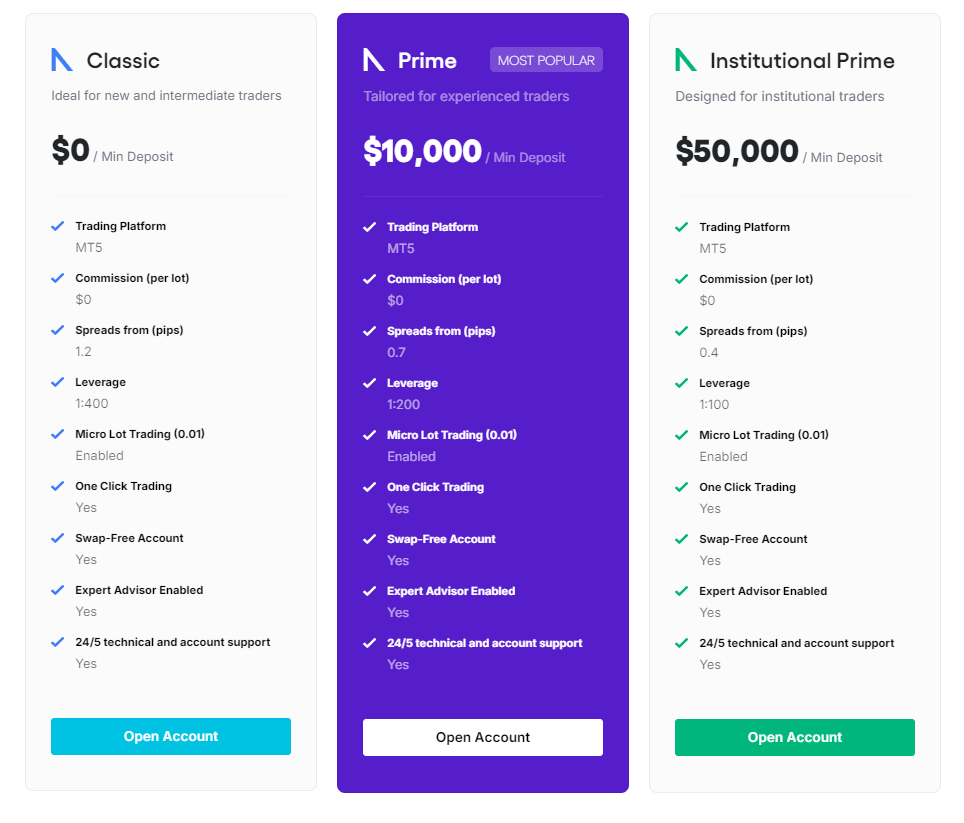

Account Types

Kama Capital offers a range of trading accounts tailored to accommodate different trading needs, whether a trader is new to the market or has advanced experience. Each account type provides distinct features, helping users select the one that best aligns with their strategies and goals. Here’s a closer look at the available account options.

Classic Account

The Classic Account is ideal for beginner traders looking for a straightforward trading experience. It provides competitive spreads with no commissions, making it an accessible choice for those starting in the market. This account type supports basic trading features, allowing users to get comfortable with the platform.

Prime Account

The Prime Account caters to more experienced traders who require tighter spreads and additional flexibility. It operates on a commission-based structure, allowing traders to benefit from lower spreads and higher leverage options. This account type is well-suited for advanced trading strategies.

Institutional Prime Account

Kama Capital’s Institutional Prime Account is designed for high-volume and professional traders who seek the best trading conditions. It offers ultra-low spreads, priority support, and exclusive features, giving traders an optimal setup for executing large trades. This account type is ideal for those who demand premium service and enhanced trading tools.

Demo Account

The Demo Account provides a risk-free environment for traders to practice and develop strategies without using real funds. It mirrors live market conditions, making it suitable for beginners wanting to learn or for experienced traders testing new techniques. This account type is accessible on both MetaTrader 4 and the proprietary web platform.

All of these accounts has required minimum deposit except demo accounts. Trading Forex and Leveraged Financial Instruments involves significant risk and can result in the loss of invested capital. Traders should not invest more than what can afford to lose and should ensure that fully understand the risks involved.

How to Open Your Account

Opening an account with Kama Capital is straightforward and user-friendly. Follow these steps to get started:

Step 1: Visit the Kama Capital Website

Go to the official Kama Capital’s website and click on the “Open Account” button on the homepage. This will direct you to the registration page where you can begin your account setup.

Step 2: Complete the Registration Form

Fill out the registration form with your basic information, such as name, email address, phone number, and country of residence. You’ll also select the account type that aligns with your trading needs and goals.

Step 3: Verify Your Identity

To comply with regulations, Kama Capital requires identity verification. Upload a government-issued ID, such as a passport or driver’s license, along with proof of address (like a utility bill) to complete this step.

Step 4: Fund Your Account

After verification, you can deposit funds using one of the payment methods supported by Kama Capital. Funding your account will allow you to start trading as soon as the deposit is confirmed.

Step 5: Start Trading

Once your account is funded, you’re ready to start trading. Access your chosen trading platform, either MetaTrader 4 or the proprietary web platform, and begin exploring the available markets.

Kama Capital Trading Platforms

Kama Capital provides access to multiple trading platforms, designed to accommodate various trading styles and preferences. The firm supports MetaTrader 4 (MT4), a popular platform known for its user-friendly interface, advanced charting tools, and fast trade execution. MT4 is ideal for traders of all experience levels, offering a range of features such as customizable indicators and automated trading options.

In addition to MT4, Kama Capital offers its own proprietary web-based platform. This platform is optimized for flexibility, allowing traders to access their accounts and monitor markets directly from any web browser. It provides essential tools for market analysis and trade management, making it a practical choice for those looking for a straightforward, accessible trading experience.

Both platforms are accessible on desktop, web, and mobile devices, enabling traders to stay connected and manage trades on the go. Kama Capital’s platform variety gives traders the flexibility to choose the setup that best suits their needs and trading approach.

What Can You Trade on Kama Capital

Kama Capital offers a diverse range of trading assets, allowing traders to explore various markets and diversify their portfolios. From forex to commodities, Kama Capital provides options to suit different trading strategies and goals. Here’s an overview of the available assets.

Forex

Kama Capital provides access to major, minor, and exotic currency pairs, catering to both new and experienced forex traders. The high liquidity and round-the-clock trading make forex a popular choice for those looking to capitalize on currency movements.

Commodities

For those interested in tangible assets, Kama Capital offers popular commodities such as gold, silver, oil, and natural gas. These options allow traders to hedge against inflation or economic shifts, adding a layer of stability to their portfolios.

Equities

Kama Capital also supports trading in equities from global markets, enabling traders to invest in individual companies. Equities trading is ideal for traders focused on company performance and stock market trends.

Indices

Indices trading on Kama Capital includes major global indices like the S&P 500, NASDAQ, and FTSE 100. This option allows traders to speculate on broader market movements rather than individual stocks, appealing to those interested in market-wide trends.

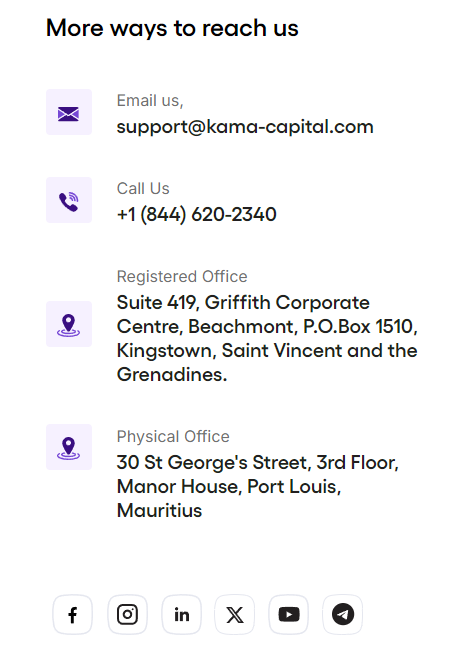

Kama Capital Customer Support

Kama Capital offers customer support available 24/5, providing assistance during market hours to address traders’ questions and issues. Support is accessible through live chat, email, and phone, ensuring traders can reach out through their preferred channel for quick resolutions. This multi-channel approach enhances the convenience and responsiveness of the support experience.

The support team is known for being knowledgeable and responsive, particularly in helping new traders with platform navigation and account-related inquiries. Additionally, Kama Capital offers a comprehensive FAQ section on its website, allowing users to find answers to common questions independently. While most users report positive experiences, some note minor delays during peak hours, though the firm continues to optimize its support response times.

Advantages and Disadvantages of Kama Capital Customer Support

Withdrawal Options and Fees

Kama Capital provides several withdrawal options to cater to traders’ convenience, with fees and processing times varying by method. Here’s an overview of the available withdrawal options and their fees.

Bank Transfer

Bank transfers are secure but may have higher fees and longer processing times, typically up to 5 business days. This method is suited for larger withdrawals.

Credit/Debit Cards

Kama Capital supports credit and debit card withdrawals, which usually come with lower fees and processing times of 1-3 business days. This option provides a quick and convenient way to access funds.

E-Wallets

E-wallet options like Skrill and Neteller offer fast processing, typically within 24 hours, and often have minimal fees. This makes them a preferred choice for traders seeking quick access to their funds.

Cryptocurrency

Kama Capital also allows withdrawals via cryptocurrencies such as Bitcoin. These transactions are generally processed quickly, but network fees may apply, depending on blockchain traffic.

Kama Capital Vs Other Brokers

#1. Kama Capital vs AvaTrade

Kama Capital and AvaTrade both offer broad trading options, but they cater to different preferences in terms of platforms and account features. Kama Capital provides MetaTrader 4 and a proprietary web-based platform, with a focus on straightforward trading options in forex, commodities, and equities. AvaTrade, in contrast, delivers a wider variety of platforms, including MetaTrader, AvaTradeGO, and WebTrader, as well as unique tools like AvaProtect for risk management. AvaTrade also emphasizes a strong global presence with regulatory oversight in multiple regions, giving it a wider reach and added security appeal. Kama Capital focuses on transparent fees and competitive spreads, while AvaTrade attracts traders with its advanced risk management tools and broader platform selection.

Verdict: AvaTrade is a strong choice for traders who value diverse platforms and extra risk management tools like AvaProtect. Kama Capital suits those looking for straightforward, transparent trading and competitive spreads across key asset classes.

#2. Kama Capital vs RoboForex

Kama Capital and RoboForex both serve traders with versatile trading options, yet they differ in platform diversity and trading incentives. Kama Capital offers MetaTrader 4 and a proprietary web-based platform, focusing on simplicity and a transparent fee structure across forex, commodities, and equities. RoboForex, on the other hand, provides a broader selection of platforms, including MetaTrader, cTrader, and its proprietary R Trader, along with additional features like CopyFX for social trading. RoboForex also offers bonus programs and cashback options, making it appealing to traders looking for added incentives and community-based trading. While Kama Capital emphasizes competitive spreads and a clear, no-frills approach, RoboForex stands out for its platform variety and promotional incentives.

Verdict: RoboForex is ideal for traders interested in diverse platforms, bonuses, and social trading features. Kama Capital, in contrast, appeals to those seeking straightforward pricing, competitive spreads, and a simpler trading environment.

#3. Kama Capital vs Exness

Kama Capital and Exness both offer competitive trading services, but they cater to different needs in terms of leverage and market approach. Kama Capital supports MetaTrader 4 and a proprietary web-based platform with a focus on clear pricing and competitive spreads across forex, commodities, and equities. Exness, on the other hand, provides ultra-high leverage, even offering unlimited leverage on select accounts, which appeals to traders with high-risk appetites. Exness also offers extensive transparency with frequent financial reporting and access to detailed market analytics. While Kama Capital emphasizes a straightforward, secure trading experience with transparent fees, Exness attracts traders seeking maximum leverage and advanced financial reporting.

Verdict: Exness is ideal for traders interested in ultra-high leverage and comprehensive financial transparency. Kama Capital is a better fit for those who prioritize competitive spreads, clear pricing, and a simplified, secure trading experience.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH KAMA CAPITAL

Conclusion: Kama Capital Review

Kama Capital is a reliable brokerage offering a variety of trading options and platforms designed to meet the needs of both novice and experienced traders. With a strong emphasis on transparency, competitive spreads, and a clear fee structure, the firm makes it easier for traders to manage their costs effectively. Additionally, Kama Capital’s support for MetaTrader 4 and a proprietary web-based platform provides flexibility for those who prefer different trading setups.

The broker’s commitment to regulation and security ensures a safe trading environment, while responsive customer support adds an extra layer of reliability. Overall, Kama Capital stands out for its user-friendly experience, diverse account types, and focus on transparent operations, making it a strong choice for traders seeking a straightforward, secure trading solution.

Kama Capital Review: FAQs

What assets can I trade with Kama Capital?

Kama Capital offers a range of assets, including forex, commodities, and equities, allowing traders to diversify their portfolios across different markets.

What trading platforms does Kama Capital support?

Kama Capital provides access to MetaTrader 4 (MT4) and its proprietary web-based platform, both accessible on desktop, web, and mobile devices.

Are there any fees for trading with Kama Capital?

Kama Capital has a competitive spread structure and low or no commissions on certain accounts. Some accounts may have a commission fee, and swap fees apply for overnight positions.

OPEN AN ACCOUNT NOW WITH KAMA CAPITAL AND GET YOUR BONUS