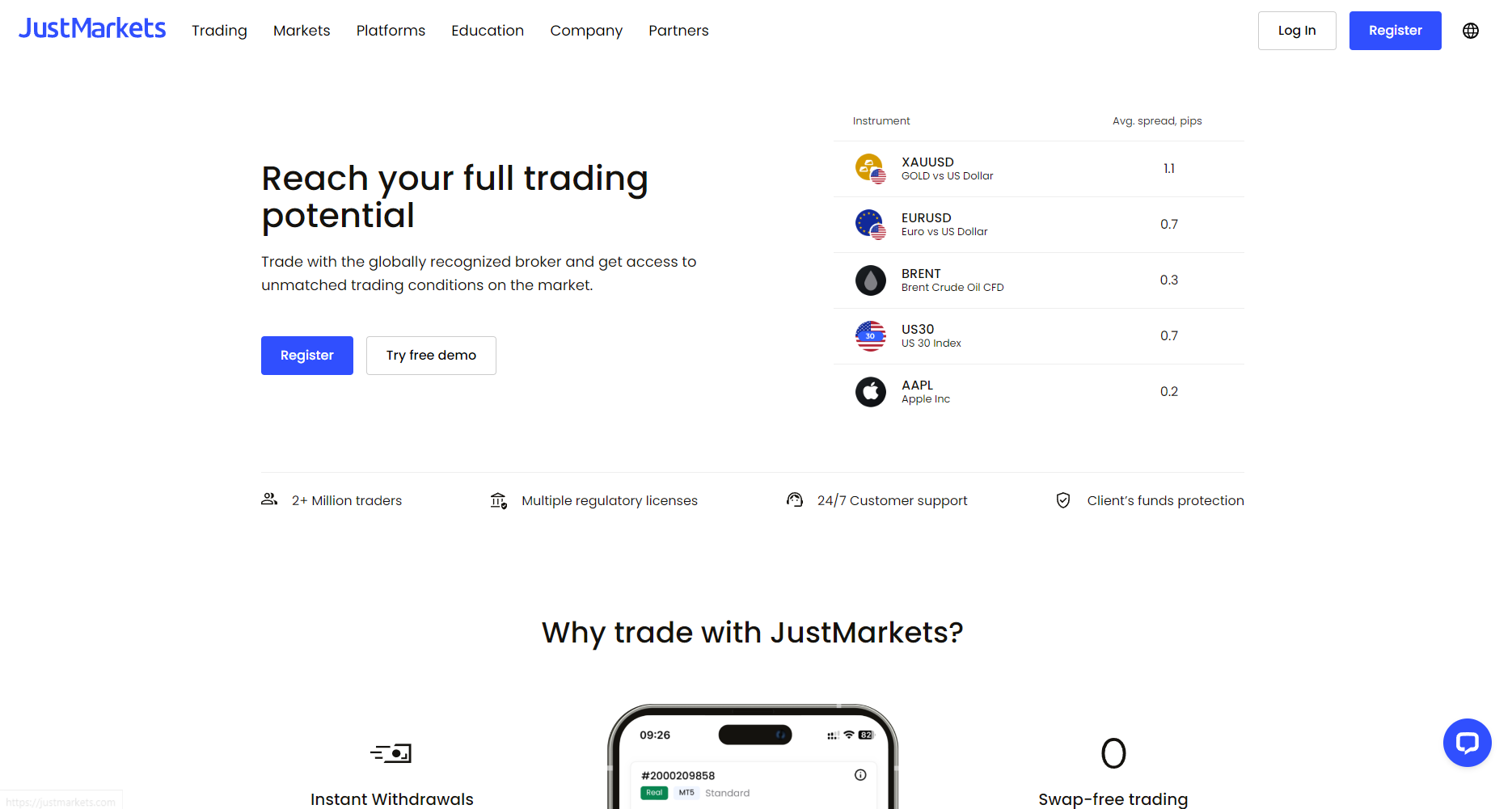

JustMarkets Review

JustMarkets is a brokerage known for providing a variety of trading assets, including forex, stocks, and cryptocurrencies. It offers multiple account types, each designed to meet specific trading needs, from beginners to experienced traders. JustMarkets’ platform is accessible, aiming to make trading straightforward for users at all experience levels.

One of the standout features is its competitive spreads and flexible leverage options, especially appealing for forex traders. With leverage of up to 1:3000, JustMarkets gives traders more control over their trading strategies. The broker supports popular platforms like MetaTrader 4 and MetaTrader 5, ensuring reliable, high-speed trading.

JustMarkets also prioritizes customer support and provides resources like market analysis and educational materials to assist traders. The broker is regulated by reputable financial authorities, which adds a layer of trustworthiness. This combination of tools, support, and regulatory oversight makes JustMarkets a practical option for traders looking to diversify their portfolios with ease.

What is JustMarkets?

JustMarkets is a global online brokerage offering a range of trading services across multiple assets like forex, stocks, commodities, and cryptocurrencies. Established to serve both beginners and experienced traders, the platform provides flexible account options and supports popular trading tools like MetaTrader 4 and MetaTrader 5.

Known for its high leverage options (up to 1:3000) and competitive spreads, JustMarkets aims to give traders better control over their strategies. Additionally, the broker offers resources like market analysis and educational materials, helping users stay informed and make better trading decisions.

In the forex market, JustMarkets offers demo accounts to gain currency pairs with minimal trading fees. The broker states that investors’ deposits are safely kept in segregated bank accounts. It has also deployed multiple servers, complex backup systems, and SSL encryption. These are to ensure the speed and security of all transactions.

JustMarkets Regulation and Safety

JustMarkets takes regulation and safety seriously to ensure a secure trading environment for its users. It operates under the regulation of trusted financial authorities like the Cyprus Securities and Exchange Commission (CySec) and in Seychelles by the Seychelles Financial Services Authority (FSA)., which establishes a foundation of trust and transparency in its operations. This regulatory oversight helps protect clients’ funds and maintains compliance with financial standards.

The broker also employs advanced security protocols, including data encryption and segregation of client funds, to protect against potential breaches. JustMarkets’ commitment to safety and compliance gives traders added confidence in using the platform, especially those concerned with safeguarding their assets and information.

JustMarkets Pros and Cons

Pros

- High leverage

- Competitive spreads

- 24/7 support

- Multiple assets

Cons

- Withdrawal delays

- Occasional fees

- Limited regulation

- Support wait times

Benefits of Trading with JustMarkets

Trading with JustMarkets offers several advantages that cater to both new and experienced traders. One major benefit is the high leverage of up to 1:3000, allowing traders to maximize their potential returns with lower capital. This flexibility makes JustMarkets attractive to those looking to manage their trading strategies more effectively.

The platform also provides competitive spreads, helping traders minimize their costs, especially in high-frequency trading. JustMarkets supports popular trading platforms like MetaTrader 4 and MetaTrader 5, giving users access to a familiar, reliable trading environment.

Additionally, JustMarkets offers educational resources and market insights to help traders make informed decisions. The platform’s customer support is responsive and available to assist users, enhancing the overall trading experience and support system for all levels of traders.

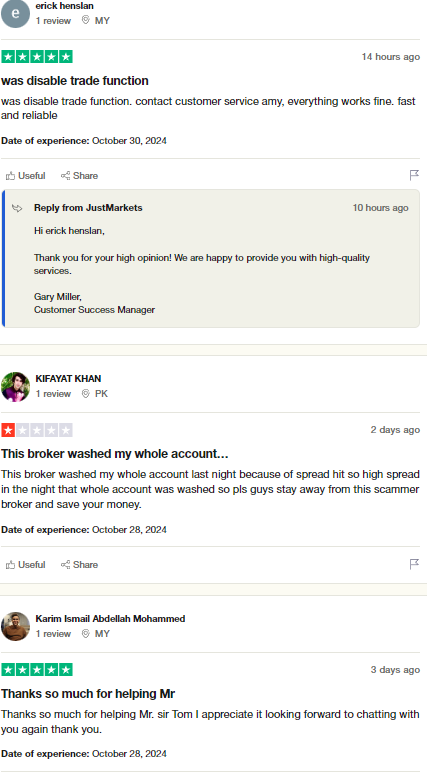

JustMarkets Customer Reviews

Customer reviews for JustMarkets generally highlight its user-friendly platform and wide range of trading options. Many users appreciate the broker’s high leverage and competitive spreads, noting that these features make trading more accessible and potentially profitable. For beginners, the platform’s educational resources and market insights receive positive feedback, helping new traders navigate the complexities of trading.

On the downside, some users report occasional delays in withdrawals or issues with customer support response times. However, JustMarkets has taken steps to address these concerns, continually working to improve its customer service experience. Overall, JustMarkets enjoys a solid reputation among traders for its flexibility, range of tools, and support, making it a preferred choice for many in the trading community.

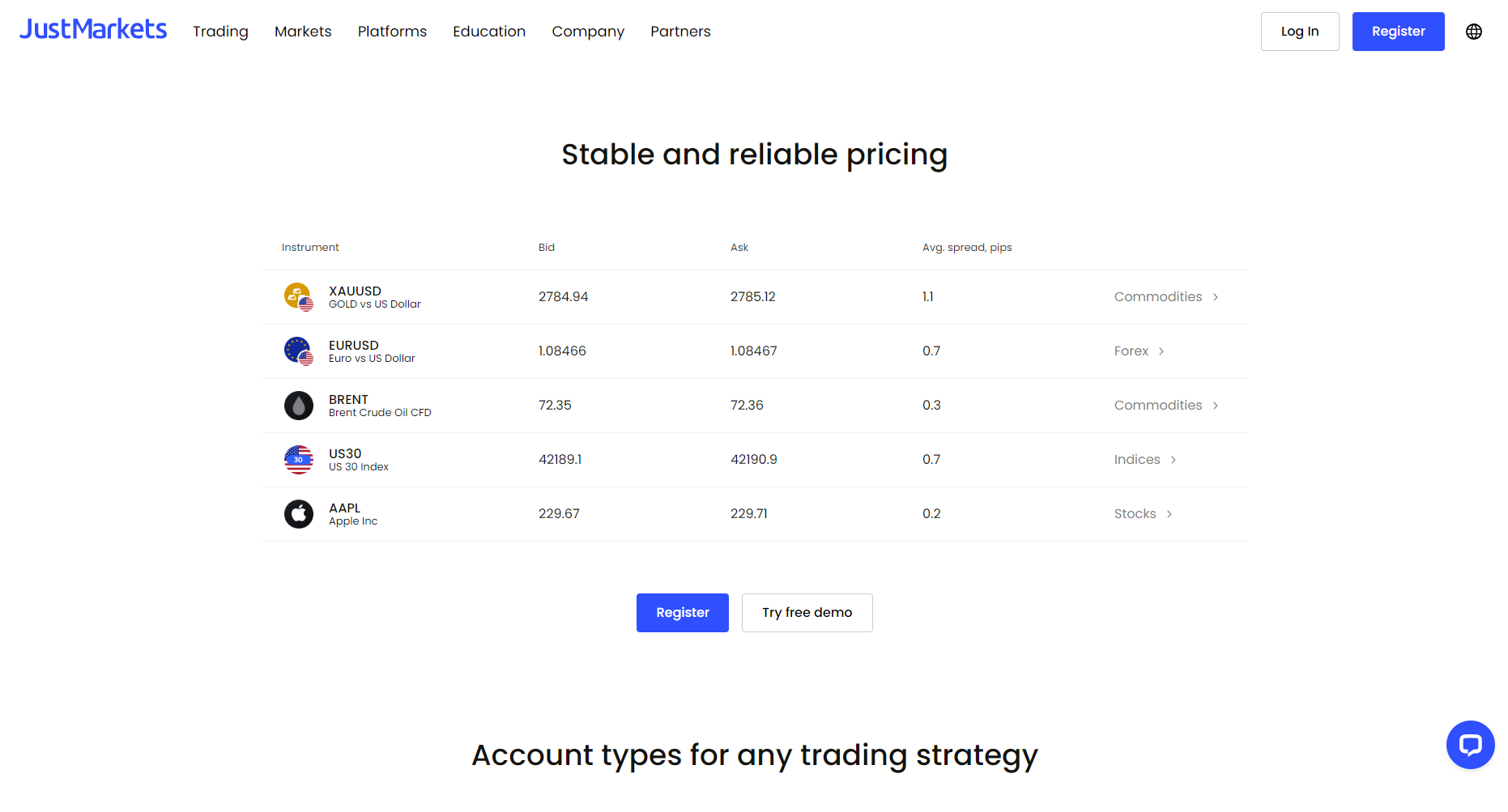

JustMarkets Spreads, Fees, and Commissions

JustMarkets offers competitive spreads and a transparent fee structure that appeals to cost-conscious traders. Spreads vary depending on the account type, with lower spreads available on premium accounts, making it ideal for traders looking to minimize costs on high-volume trades. The broker’s spreads are generally favorable for forex trading, keeping trading costs manageable across different strategies.

JustMarkets has a low or no-commission structure for some account types, which is an advantage for traders aiming to reduce overhead costs. However, specific accounts with lower spreads might include commissions, so it’s important for traders to choose an account that best aligns with their trading style.

There are also other fees, such as overnight or swap fees for holding positions beyond a trading day, but JustMarkets provides clear information on these charges. This transparency allows traders to plan their trades effectively, understanding the costs associated with each trade.

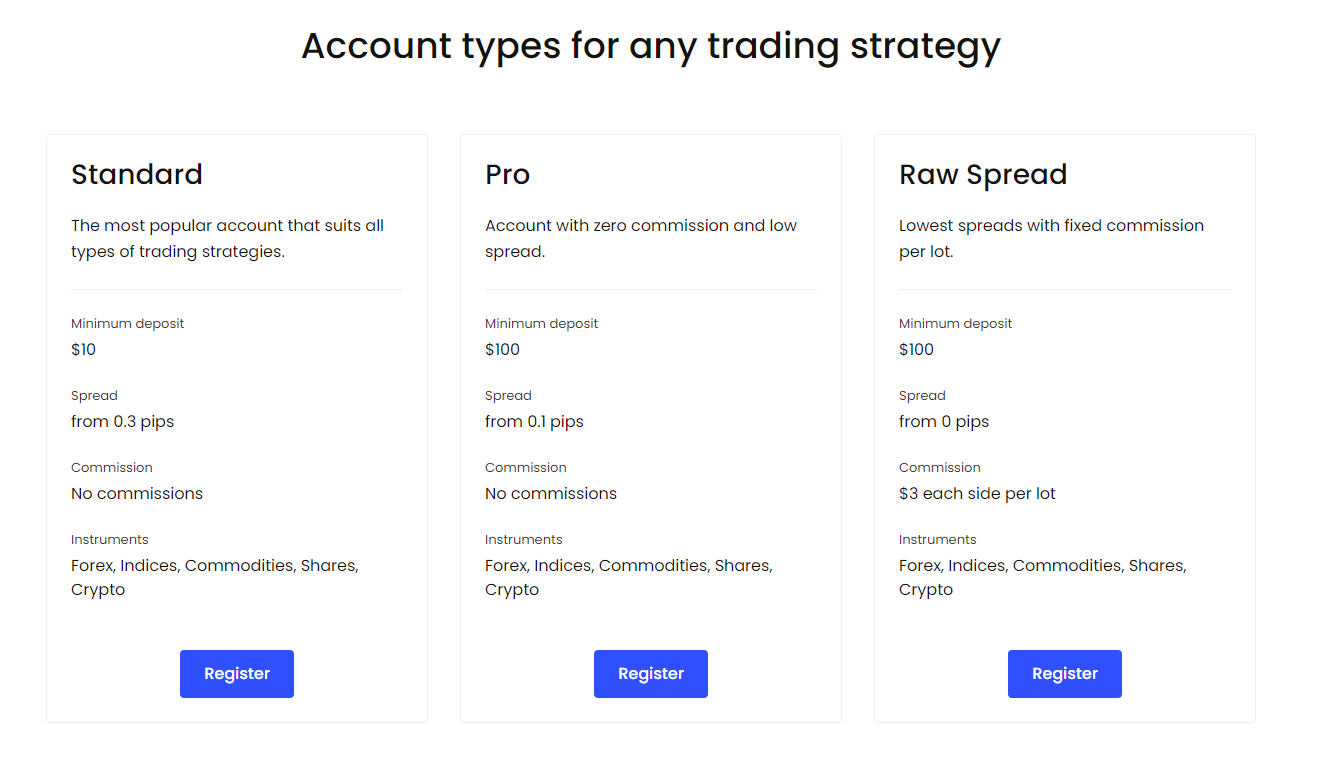

Account Types

JustMarkets offers a selection of trading account types tailored to accommodate different trading preferences and experience levels. Each account type has distinct features that cater to both beginners and experienced traders, enabling users to select an account that best fits their trading style and financial goals.

Standard Account

The Standard Account is designed for beginner traders or those looking for a straightforward, cost-effective trading experience. It offers competitive spreads with no commissions, making it an ideal choice for those starting out. This account is available on both MetaTrader 4 and MetaTrader 5, ensuring a familiar trading interface.

Pro Account

The Pro Account is suited for experienced traders who require more advanced features. It provides lower spreads and higher leverage, along with a commission-based structure that supports more intricate trading strategies. This account type is also compatible with MT4 and MT5, offering versatility for seasoned traders.

Raw Spread Account

The Raw Spread Account is designed for traders focused on minimizing costs. It offers spreads starting from 0.0 pips, with a small commission per trade, appealing to high-frequency and scalping traders. Available on both MT4 and MT5, this account allows for efficient, cost-effective trading.

Every account is offering good trading instruments for new and professional traders. Using the minimum deposit requirement depending on the account, Just global markets ltd is ready to give the best experience for every traders who wants to avail this forex broker benefits and unique trading styles.

How to Open Your Account

Opening an account with JustMarkets is straightforward and designed to be accessible for all levels of traders. The process involves a few easy steps, from registration to verification, allowing traders to quickly get started on the platform. Here’s a step-by-step guide to open your account on JustMarkets.

Step 1: Visit the JustMarkets Website

To begin, head to the official JustMarkets website and locate the “Open Account” button on the homepage. This will take you to the registration page where you can start the account setup process.

Step 2: Complete the Registration Form

Fill out the registration form with your personal details, including your full name, email, and phone number. Here, you’ll also select your preferred account type, which should align with your trading needs and experience level.

Step 3: Verify Your Identity

JustMarkets requires identity verification as part of its compliance with financial regulations. Upload a government-issued ID, such as a passport or driver’s license, along with proof of address (e.g., utility bill or bank statement) to verify your information.

Step 4: Fund Your Account

Once your identity is verified, you can proceed to fund your account using any of the payment methods supported by JustMarkets for minimum deposit. Deposits are typically quick, allowing you to start trading shortly after funding your account.

Step 5: Start Trading

With your account funded, you’re ready to begin trading on the JustMarkets platform. Access your chosen trading platform (MetaTrader 4 or MetaTrader 5) and explore the available tools and resources to start executing trades.

JustMarkets Trading Platforms

JustMarkets supports two of the most popular trading platforms, MetaTrader 4 (MT4) and MetaTrader 5 (MT5), catering to a wide range of traders. MT4 is favored for its user-friendly interface and robust charting tools, making it ideal for beginners and those focused on forex trading. It includes essential features like customizable indicators, one-click trading, and a variety of technical analysis tools.

MetaTrader 5, on the other hand, offers more advanced features and is designed for traders looking to diversify beyond forex, with additional support for assets like stocks and commodities. MT5 includes enhanced charting options, more timeframes, and an economic calendar, which appeals to seasoned traders needing more in-depth analysis.

Both platforms are available on desktop, web, and mobile, providing flexibility for traders to access their accounts and trade from anywhere. JustMarkets’ platform support enables a seamless experience across devices, allowing traders to execute strategies efficiently in a familiar trading environment.

What Can You Trade on JustMarkets

JustMarkets offers a diverse selection of trading assets, giving traders the opportunity to explore multiple markets. Whether a trader is focused on forex, commodities, or stocks, JustMarkets provides flexibility and options to build a well-rounded trading portfolio. Here’s an overview of what you can trade on JustMarkets.

Forex

Forex trading is a major focus on JustMarkets, with access to over 50 currency pairs including major, minor, and exotic pairs. This allows traders to capitalize on currency fluctuations around the clock. The forex market’s high liquidity and flexible trading hours make it ideal for both new and experienced traders.

Stocks

JustMarkets provides a selection of global stocks from major companies, allowing traders to invest in individual companies. Trading stocks on JustMarkets gives users access to the performance of top brands and industries, making it a great option for those interested in equity markets.

Commodities

With commodities trading, JustMarkets offers popular choices like gold, silver, oil, and natural gas. These assets allow traders to hedge against market volatility or diversify their portfolios with tangible resources. Commodities trading is favored by traders looking to balance their exposure in traditional markets.

Indices

Indices trading on JustMarkets includes access to major indices like the S&P 500, NASDAQ, and FTSE 100. This option allows traders to speculate on the broader market performance rather than individual stocks, making it a practical choice for those looking to trade overall market trends.

Cryptocurrencies

JustMarkets supports popular cryptocurrencies like Bitcoin, Ethereum, and Ripple, catering to traders interested in digital assets. Cryptocurrency trading offers the potential for high returns due to market volatility, appealing to those looking for alternative investment options outside traditional markets.

JustMarkets Customer Support

JustMarkets provides 24/7 customer support to assist traders with any issues or questions they may have. Support is accessible via multiple channels, including live chat, email, and phone, ensuring traders can reach assistance quickly. This round-the-clock availability is especially valuable for international traders who may be in different time zones.

The support team at JustMarkets is known for being responsive and knowledgeable, helping traders with everything from account setup to technical platform issues. Additionally, JustMarkets offers an FAQ section and resources on its website to help users troubleshoot common issues on their own, further enhancing the customer support experience.

While most users report positive experiences, some feedback indicates occasional wait times during high-traffic periods. JustMarkets is actively working to address this by enhancing its support infrastructure to provide a smoother, more reliable experience for all users.

Advantages and Disadvantages of JustMarkets Customer Support

Withdrawal Options and Fees

JustMarkets provides a variety of withdrawal options to ensure flexibility for traders worldwide. These options come with associated fees, which vary depending on the method chosen. Here’s an overview of the available withdrawal options and their associated fees.

Bank Transfer

Bank transfers are available for secure withdrawals but may incur higher fees and processing times, typically taking up to 5 business days. This method is reliable for larger withdrawals, though it may not be the fastest option.

Credit/Debit Cards

JustMarkets supports withdrawals to credit and debit cards, offering a convenient method for many users. Withdrawals through cards usually have lower fees and processing times of 1-3 business days, making it a practical option for quick access to funds.

E-Wallets

E-wallets like Skrill, Neteller, and Perfect Money are also available for withdrawals, providing a fast and often lower-cost solution. Processing times for e-wallets are typically instant to 24 hours, making this a popular choice for traders seeking swift transactions.

Cryptocurrency

JustMarkets allows withdrawals via cryptocurrencies such as Bitcoin, catering to users interested in digital asset transfers.

JustMarkets Vs Other Brokers

#1. JustMarkets vs AvaTrade

JustMarkets and AvaTrade are both popular brokers, yet they cater to different trading preferences. JustMarkets appeals to traders with its high leverage options of up to 1:3000 and supports both MetaTrader 4 and MetaTrader 5, offering flexibility across forex, stocks, and cryptocurrencies. AvaTrade, however, provides a broader range of trading platforms, including MetaTrader, AvaTradeGO, and WebTrader, alongside innovative tools like AvaProtect for risk management. AvaTrade also offers a more diverse selection of educational materials and is regulated in multiple regions, adding an additional layer of security, which may be appealing for those prioritizing regulated, globally recognized brokers. However, JustMarkets stands out for those seeking lower costs and higher leverage.

Verdict: AvaTrade is ideal for traders looking for broader platform options and a more globally regulated trading environment. JustMarkets, on the other hand, is a better fit for cost-conscious traders focused on high leverage and streamlined trading options.

#2. JustMarkets vs RoboForex

JustMarkets and RoboForex both provide a variety of trading options, but they differ in features and market approach. JustMarkets emphasizes high leverage up to 1:3000 and supports MetaTrader 4 and MetaTrader 5, appealing to traders interested in forex and cryptocurrency with straightforward options. RoboForex, on the other hand, offers a wider selection of trading platforms, including MetaTrader, cTrader, and its proprietary R Trader, and focuses on automation tools, such as CopyFX for social trading. Additionally, RoboForex provides various bonuses and cashback options, which may attract traders interested in added incentives, whereas JustMarkets’ appeal lies in its simplicity and focus on core trading needs.

Verdict: RoboForex is suitable for traders seeking diverse platforms and additional incentives like bonuses and social trading options. JustMarkets is ideal for those prioritizing high leverage, simplicity, and cost-effective trading.

#3. JustMarkets vs Exness

JustMarkets and Exness both attract forex and crypto traders, but they differ in leverage and trading conditions. JustMarkets offers high leverage up to 1:3000 and provides trading through MetaTrader 4 and MetaTrader 5, ideal for traders seeking flexibility in position sizes and cost-effective options. Exness, however, offers even higher leverage options (up to unlimited for certain accounts), along with zero spreads on select accounts, which can be advantageous for high-frequency and scalping traders. Both brokers emphasize regulatory compliance, but Exness is particularly well-regarded for its transparency, providing extensive market analytics and financial reports that give traders added confidence.

Verdict: Exness is a strong choice for traders focused on ultra-high leverage and transparent trading conditions. JustMarkets, by contrast, suits those looking for high leverage with simple, reliable trading setups and a more accessible cost structure.

Also Read: AvaTrade Review 2024 – Expert Trader Insights

OPEN AN ACCOUNT WITH JUSTMARKETS

Conclusion: JustMarkets Review

JustMarkets is a versatile and accessible broker offering a variety of trading options suitable for both beginners and experienced traders. With competitive spreads, high leverage, and support for popular platforms like MetaTrader 4 and MetaTrader 5, it provides a reliable environment for trading forex, stocks, and cryptocurrencies. JustMarkets’ regulatory oversight and security measures add to its appeal, ensuring a safe trading experience.

The platform’s 24/7 customer support and educational resources further enhance its user-friendly reputation, catering to traders’ needs around the clock. While some users have noted minor service delays, JustMarkets continually strives to improve its support and infrastructure. Overall, JustMarkets stands out for its flexibility, range of trading tools, and commitment to transparency, making it a strong choice for those looking to trade with confidence.

JustMarkets Review: FAQs

What assets can I trade with JustMarkets?

JustMarkets offers a wide range of assets, including forex, stocks, commodities, indices, and cryptocurrencies. This variety allows traders to diversify their portfolios according to their strategies and interests.

Is JustMarkets regulated?

Yes, JustMarkets operates under the oversight of reputable financial authorities, ensuring compliance with industry standards and adding an extra layer of security for traders.

What trading platforms does JustMarkets support?

JustMarkets supports MetaTrader 4 (MT4) and MetaTrader 5 (MT5), two of the most popular trading platforms. Both are available on desktop, web, and mobile, providing flexibility for traders to access their accounts anywhere.

OPEN AN ACCOUNT NOW WITH JUSTMARKETS AND GET YOUR BONUS